- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- What just happened to Mark Zuckerberg’s Facebook and Meta?

- Home

- News & analysis

- Economic Updates

- What just happened to Mark Zuckerberg’s Facebook and Meta?

News & analysisNews & analysis

News & analysisNews & analysisMark Zuckerberg and his company Meta Platform Inc (formerly known as Facebook) have been in the news recently, and it is often not good news. They might be able to attract some positive attention through their futuristic demonstrations of the Metaverse, but it is often the controversial news that gets the most attention. For example, how Instagram (one of Meta’s companies) is having a negative effect on young girls and the working conditions of Instagram’s moderators.

This chart below will show that despite the frequent bad press the company’s share prices have shown exceptional growth and resilience throughout the years, that was until this month.

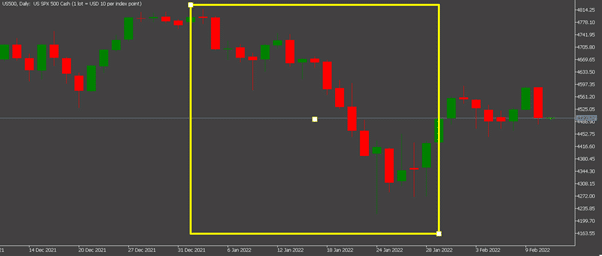

In January, the S&P500 has fallen by 11%. The month high was 4,800 and low was 4,220. This would make last January the worst month since the start of the Covid-19 pandemic and it is the worst January since 2009. The Nasdaq has also fallen by 16% during January, with a month high of 16,564 and low of 13,711. These fall in prices has essentially affected every sector with the exception of oil and gas companies (this is due to the rising price of energy).

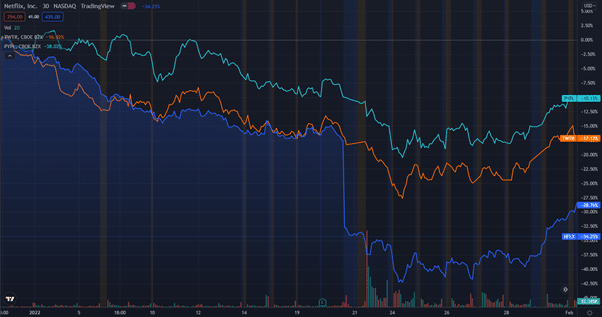

Unsurprisingly, this market crash in January has affected a lot of the big tech firms in America. For example, Netflix has lost 40% of their value last month. This is due to investors being spooked from figures showing they have a declining number of new subscribers and last year’s financial performance ($159 million losses on $30 billion revenue). Twitter’s value has also declined by 50% in the last six months, in part due to ex-CEO Jack Dorsey’s resignation. Paypal is also down 60% during this timeframe

Meta was one of the companies that relatively held their value throughout January. However, during the first week of February, Meta’s share price had a massive slump of 26% which had wiped $240 billion off its market cap. This has resulted in the largest one day drop of any publicly traded US company in history. Mark, who owns 12.8% of Meta, personally lost $29 billion worth of value.

Meta’s End of Year 2021 Earnings Report

The Securities and Exchange Commission (SEC), who oversees the US stock markets, requires companies to file four reports, three of which are quarterly reports and one end of year report. These earnings reports are often used to see if a company is meeting their expectations. These expectations are often set by analysts and banks. If companies do not meet these targets, their share value will usually fall as a result.

On Wednesday, 2nd of February, Meta published their end of year earnings report. This report had three pieces of bad news for Meta.

Firstly, the report shows that Meta did not meet its expectations. The projected revenue was $30 billion; however, the actual revenue was roughly $28 billion. The earning per share was also short of expectation, projected at $3.84 however, it was actually $3.67.

Secondly, the report has also shown that for the first time in Facebook’s history, it had lost daily active users (DAU); going from 1.930 billion in Q3 to 1.929 billion in Q4 of 2021. The DAU has been used as a key metric to track Facebook’s growth for years. With this decline, it shows that people are using Facebook services less than before.

Lastly, the ad revenue has started to decline due to Apple’s recent changes to their privacy policy. Previously, Apple would work with Facebook to help provide targeted ads by allowing Identifier For Advertisers (IDFA). This would give Facebook a way to track Apple devices users’ behaviour. There has always been an option to disable IDFA from your devices, however, the recent change by Apple was to disable the IDFA by default. This means companies like Facebook, would require the user’s explicit permission to be tracked. As expected, a lot of users declined such a request. Facebook has estimated a loss of $10 billion per year. This is because the recent changes will hinder Facebook’s ability to offer targeted ads and thus, advertisers would not be paying as much for lesser quality ads. This problem can also get worse as Google (Android provider) is looking to follow Apple in terms of privacy changes.

All in all, Meta’s end of year earnings report did not go down well with investors. There might be other factors that cause Meta’s value to drop, such as Meta’s shares possibly being overvalued or US share investors’ confidences being at a new low, but this report was the main catalyst in creating history earlier this month.

If you would like to trade Facebook shares and don’t already have a trading account, you can register for a Shares CFD trading account at GO Markets.

Source: GO Markets MT5, TradingView, https://investor.fb.com/

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Cisco tops Wall Street expectations

Cisco Systems Inc. reported its second quarter results for the period ended January 29, 2022, after the closing bell on Wall Street today. The company topped both revenue and earnings per share estimates. Let’s take a closer look at the key numbers. Total revenue reported at $12.72 billion (up 6% year-over-year) vs. $12.664 billion expected. ...

February 17, 2022Read More >Previous Article

Disney tops Wall Street expectations

The Walt Disney Company (DIS) reported its first fiscal quarter ended January 1, 2022 after the closing bell on Wednesday. The US media giant repor...

February 11, 2022Read More >Please share your location to continue.

Check our help guide for more info.