- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- Where to next for Magellan Financial?

News & analysisMagellan Financial Group (MFG) has seen a tumultuous 12 months in which the share price has seen a large fall from grace. The large Australian managed funds company has had a myriad of bad announcements and bad news. Resignation from key members of its leadership team and an exodus of cash outflows from investors have caused a large drop in price. The question remains, what happens next for the share price?

One of the key catalysts for the drop in share price was the resignation and exit of the former CEO Brett Cairns and MFG’s founder and Chief Investment Officer, Hamish Douglas. Douglas specifically, was the face and the brains behind MFG and its successful operations since its inception in 2006. His exit made the market very uncertain of the company’s next moves as it looks to recover.

Consequently, a large outflow of funds under management occurred as large institutional investors exited their positions in the managed fund. The largest of which was St James Place, which was also Magellan’s largest institutional contract worth $23 billion.

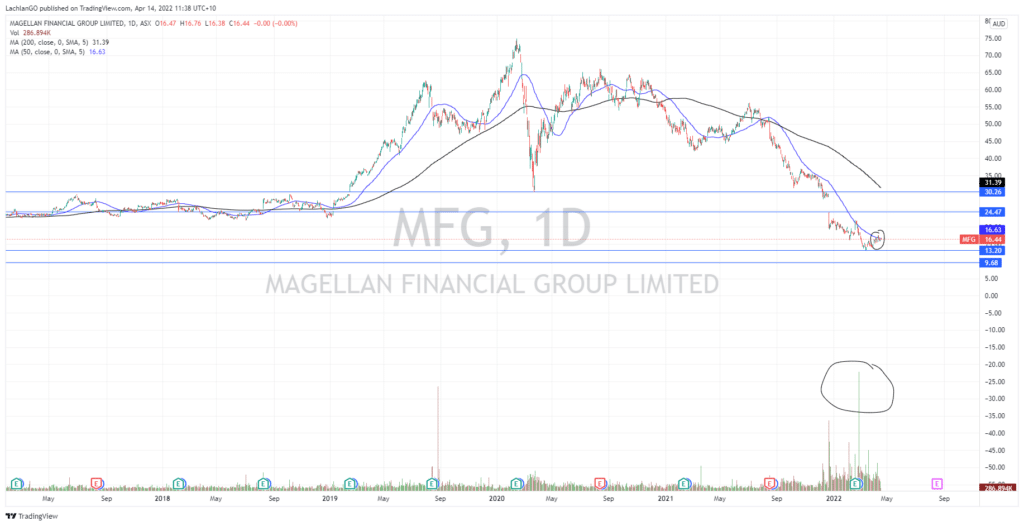

Therefore, the share price for MFG has nosedived from a high of $74.91 in early 2022 to sit at a measly $16.44 as of 14 April 2022, a drop of 82%. The question that remains is how much further it can fall before the market starts to see value again and sentiment starts to change.

Technical Analysis

On the daily chart, the price is showing signs that selling is beginning to slow down. The 50 Period moving average has begun to slightly plateau and the price has found some support after strong volume saw a bounce off $13.00. In addition, the selling volume has dried up and the price has moved into a small uptrend. A key test for the MFG share price will be whether it can break through the 50 Day Moving average and hold above that level. This would mark the first time since July 2021 that the price has been able to stay above the 50 – day Moving Average without falling back down.

If the move can be supported by a strong volume bar it may show a shift towards the buy – side at least in the short term. If this break occurs there is the potential for the price to reach $24.50 or even close the gap to $30.00.

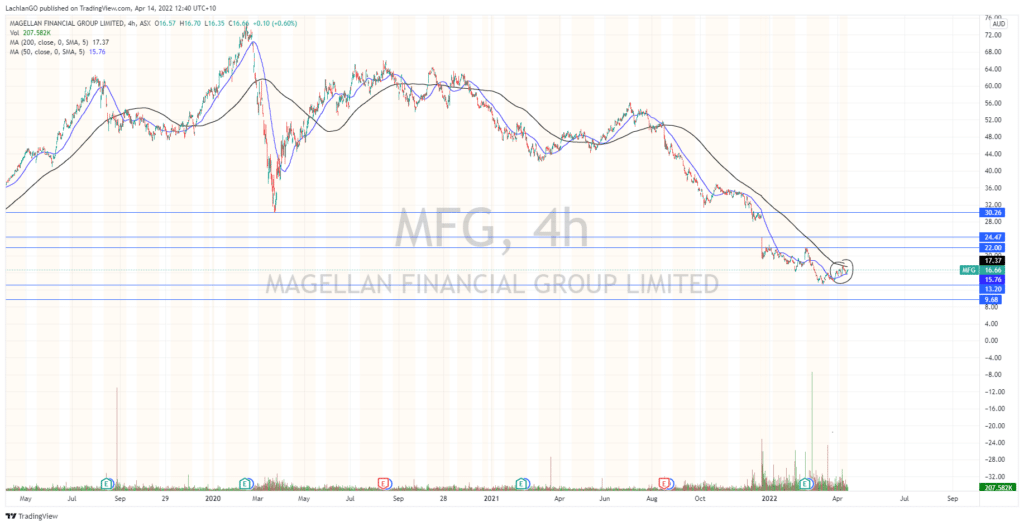

On the shorter 4-hour chart, it can be observed that the price has in recent times used the 50-period moving average as support. As the longer 200 – period MA is still on its way down the 50-period moving average is accelerating towards the upside. Furthermore, it does seem that for the first time since August 2021, a golden cross may occur at least for the short-term, signalling a short-term bullish move. Short – term targets of $22.00 and $24.47 may provide good opportunities on the long side. Conversely, if the price is not able to break through and continues to fall, a breakthrough $13.20 may prove disastrous for the share price offering short opportunities.

MFG has seen one of the largest falls from grace of any stock on the ASX. However, the time for the market to shift its sentiment may be coming soon. MFG is a tradable CFD on GO Markets’ Meta Trader 5 platforms.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Best-Performing Stocks: April 2022

It's been a volatile stretch for the stock market. From pandemic-induced sell-offs, record highs in 2021 and a bumpy start to 2022, the market has certainly tested investors' mettle. But when looking for the best stocks, investors should consider long-term performance, not short-term volatility. To help with that, we've compiled the best 5 stocks i...

April 19, 2022Read More >Previous Article

JPMorgan Q1 results announced

JPMorgan Chase & Co. reported its latest financial results for Q1 before the opening bell on Wall Street on Wednesday. World’s largest bank r...

April 14, 2022Read More >Please share your location to continue.

Check our help guide for more info.