- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Articles

- Featured

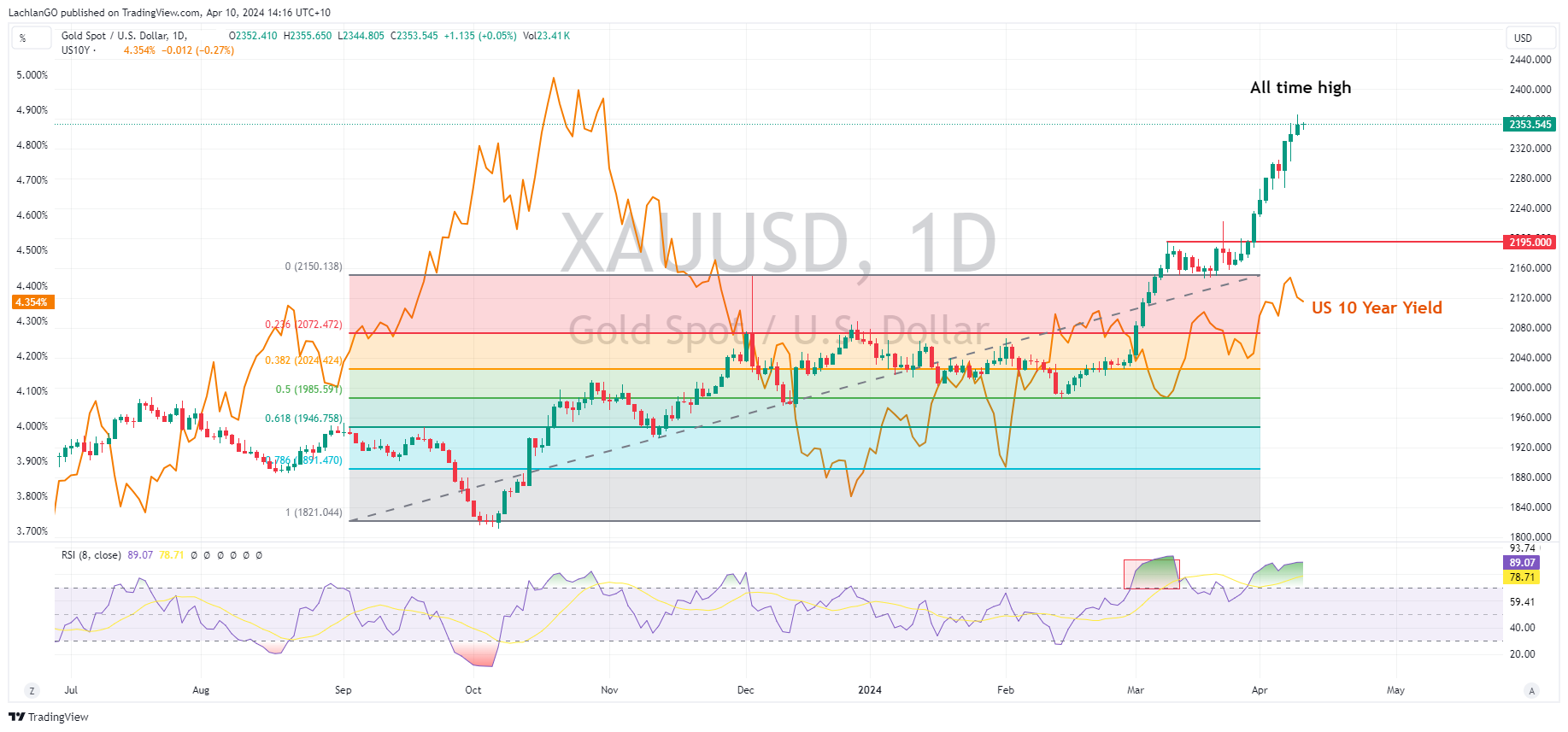

- FX analysis – Gold and USD eye key CPI figure

News & analysisAfter last week’s blockbuster NFP figure FX traders have a key US CPI reading to look forward to later today. Rates markets have seen see-sawing expectations on when the Fed will start cutting rates and today’s CPI will be another big part of that puzzle.

US CPI for March is expected to come in at a 0.3% increase, a slight cooling from Februarys 0.4% but still stubbornly holding the Year-on-Year rate at 3.4%, showing that not progress in the battle to bring down inflation is slow going and not over yet.

USD has been in a holding pattern during April with the US dollar Index range trading between the support at 104 and resistance at 105, the 104 support is certainly in play should a cooler than expected CPI reading come in, with the next support at the 200-day SMA at 103.81

Golds record run-up to all time highs has seen the precious metal take headlines during April. As an inflation hedge it should benefit from a hot CPI reading, but a cool reading would see yields and the USD drop which is also gold positive. It’s hard to predict how gold will react fundamentally to todays CPI, though from a chartist point of view XAUUSD is in serious overbought territory and a correction is overdue.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

FX analysis – USD rallies on hawkish Fed, JPY holds above 154

USD rallied in Tuesday’s session, with the US dollar Index hitting a 2024 high of 106.510 after hawkish Fed Chair Powell commentary where he noted recent data was showing a lack of further progress on inflation. Powell also added that if higher inflation persists the Fed can maintain current rate as long as needed. On data, building permits and h...

April 17, 2024Read More >Previous Article

ASIC shuts down nearly 3,500 scam websites, steps up surveillances in push to protect consumers

New data has revealed nearly 3,500 investment scam websites have been knocked out by ASIC's scam website takedown capability since it was launched in ...

April 4, 2024Read More >Please share your location to continue.

Check our help guide for more info.