- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- Technology sector facing cuts, but is it a good thing for investors and traders?

- Home

- News & analysis

- Economic Updates

- Technology sector facing cuts, but is it a good thing for investors and traders?

News & analysisNews & analysis

News & analysisNews & analysisTechnology sector facing cuts, but is it a good thing for investors and traders?

25 January 2023 By GO MarketsThe technology sector saw some of its worst losses in 2022 as inflation ramped up and Central Banks were tasked with increasing interest rates to fight the record high inflation. As the cost of borrowing has increased, start-ups and other small cap, growth sectors have suffered immensely. The current Federal Reserve funds rate is 4.25-4.50% which is a far cry from the almost 0% rates seen during Covid 19.

The technology sector in particular has seen the higher rates effect their operating costs and many companies have had to enact steep staff cuts. Most of the major technology players including Amazon, Microsoft and Google have all made large staff cuts. This includes firing 18,000,10,000 and 12,000 employees respectively. The cuts were blamed on a slowing economy and excessive hiring that has occurred in previous years. They have also coincided with large drops in the share prices in many of these companies.

The question now, is whether the bottom has been put in and is now a good time to enter into many of these stocks? All though these cuts have occurred, the recent trend for growth equities, especially in early 2023 has been extremely positive. With hopes that inflation has peaked and that the Federal Reserve pivoting the sector has recovered despite these cuts. Therefore, it is possible that the cuts and poor performance have already been prices into the market. Another factor that might support a rise in growth assets may be due to a potential rebound in China. As China awakes from its Covid 19 slumber, one theory is that an accelerated rebound will support growth assets and economies.

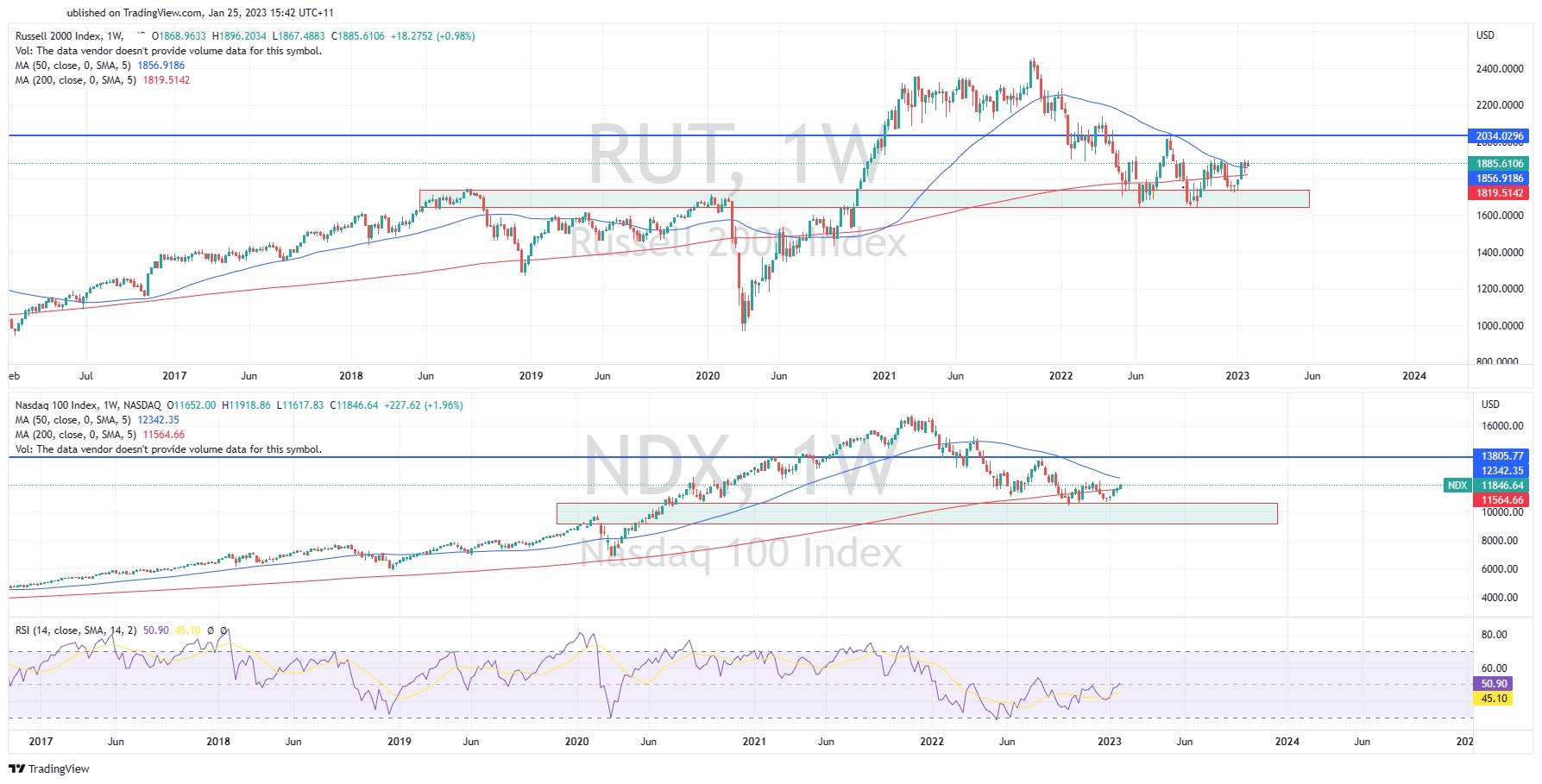

Looking at the weekly price chart of both the Russell 2000 and the Nasdaq as proxies for these sectors, the long term outlook shows that the price has bounced off the support zone. The price has bounced on the Russell three times and the Nasdaq twice. In addition, the 50 week and 200 week moving average are converging which indicates that the prices are bottoming out or at the very least consolidating. This indicates a potential a reversal in the short term future.

With more economic data to come out and the FOMC meeting next the Russell 2000 and the Nasdaq may find some fuel to continue to rise.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Tesla posts mixed Q4 results

Tesla Inc. (NASDAQ: TSLA) reported Q4 2022 financial results after the market close in the US on Wednesday. World’s largest automaker reported revenue that fell short of Wall Street expectations at $24.32 billion (up by 37% vs. Q4 2021) vs. $24.669 billion expected. The company beat earnings per share (EPS) estimates for Q4. EPS at $1.19 pe...

January 26, 2023Read More >Previous Article

Microsoft results announced – the stock jumps in the after-hours

Microsoft Corporation (NASDAQ: MSFT) reported the latest financial results on Wall Street after the market close on Tuesday. Let’s take a closer loo...

January 25, 2023Read More >Please share your location to continue.

Check our help guide for more info.