- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

Open Account

CFD trading

Trade CFDs on forex, commodities, indices, and more.

Open accountTo open a CFD trading account as a Company, Trust, or SMSF, apply here.

Share trading

Invest in shares and ETFs on the Australian share market.

Open accountOpen a Personal or Company/Trust/SMSF share trading account.

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Economic Updates

- The Week ahead – US retail sales, jobs data from UK and Australia, RBA minutes.

- Home

- News & analysis

- Economic Updates

- The Week ahead – US retail sales, jobs data from UK and Australia, RBA minutes.

News & analysisNews & analysis

News & analysisNews & analysisThe Week ahead – US retail sales, jobs data from UK and Australia, RBA minutes.

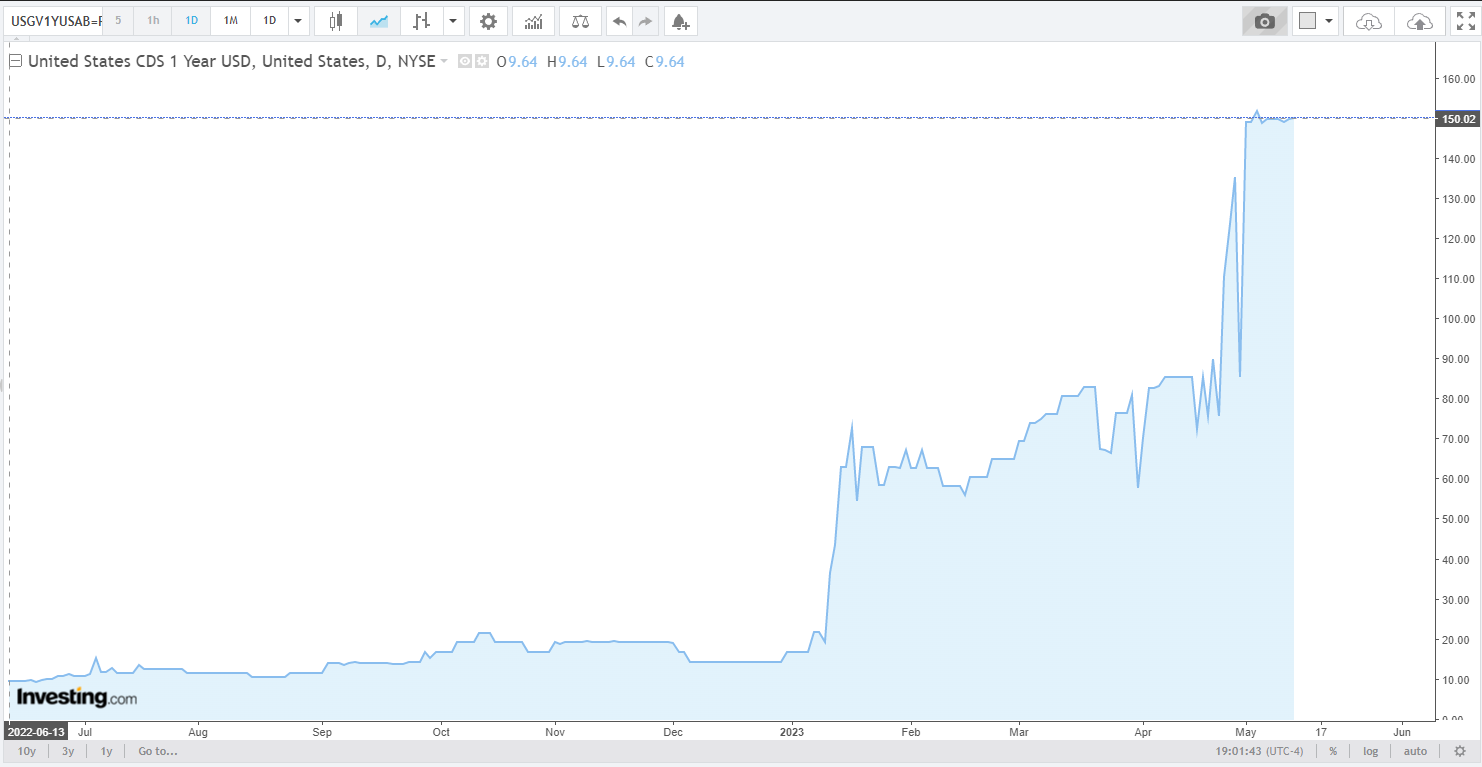

15 May 2023 By Lachlan MeakinGlobal markets enter the 3rd week of May against the backdrop of rising market concern regarding the ongoing US debt ceiling impasse as well as ongoing risks in the US banking system, both of which dampening risk sentiment and seeing markets rangebound as they await a solid catalyst to get moving.

US 1 year Credit Default Swap price spiking on debt ceiling fears.

RBA MINUTES (TUE): The RBA minutes will largely focus on the reasoning behind the Board blindsiding markets when it delivered a surprise 25bps hike at their May meeting. The Board noted inflation in Australia has passed its peak but is still too high at 7% and it will be some time yet before it is back within the target range. Judging by comments from Governor Lowe shortly after the May meeting, the RBA seems deadly serious about fulfilling its aim to lower inflation in a timely manner, expect the minutes to reflect this and give some possible support to the AUD.

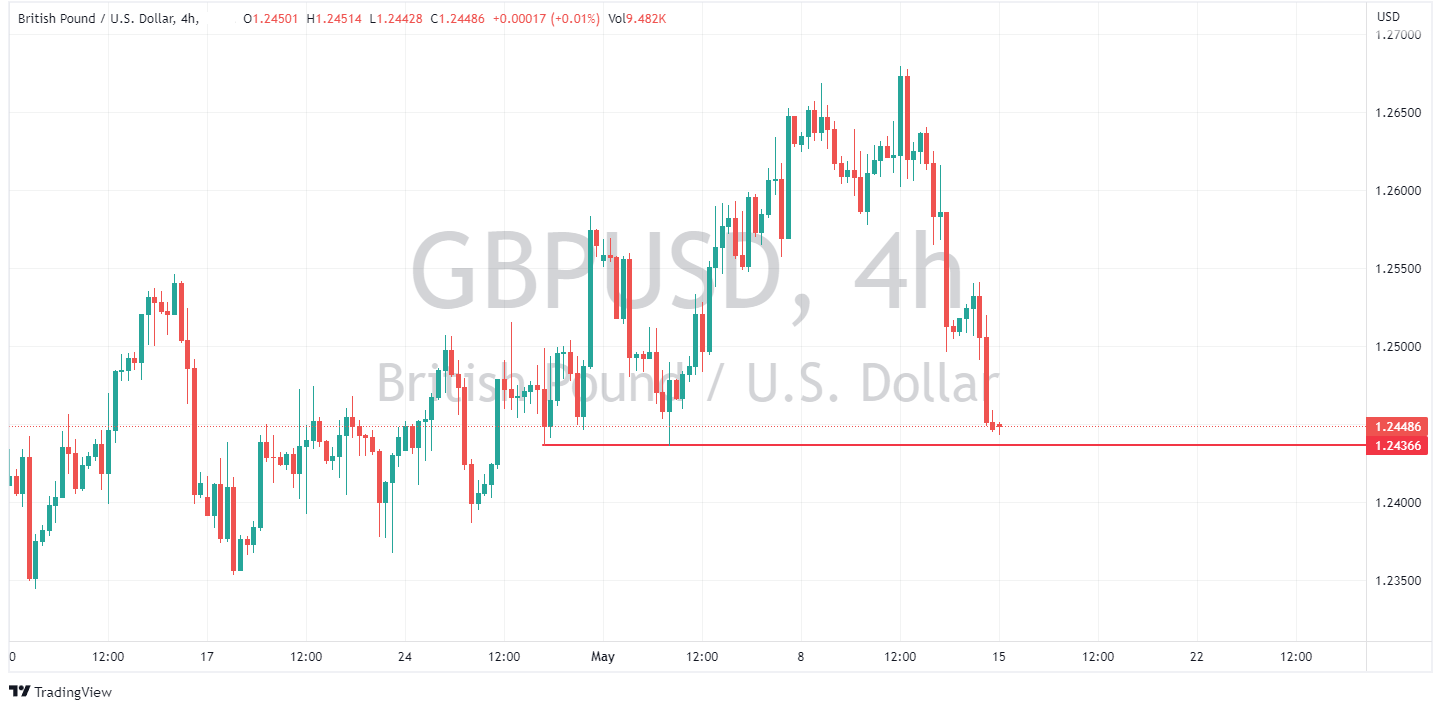

UK LABOUR MARKET REPORT (TUE): Expectations are for the unemployment rate to hold steady at 3.8%, employment change to fall to 50k and headline earnings growth to slow to 5.1% from 5.9%. The previous report showed a sharp rise in pay growth which was cited as being a major factor in the BoE’s decision to deliver another 25bps hike at their May meeting. Markets are currently showing a 25bps hike in June from the BoE is priced at around 62%, a hot labour market report could prompt a further increase in pricing for an additional hike and putting a tailwind under the GBP which saw a sharp drop late last week.

GBPUSD approaching May lows

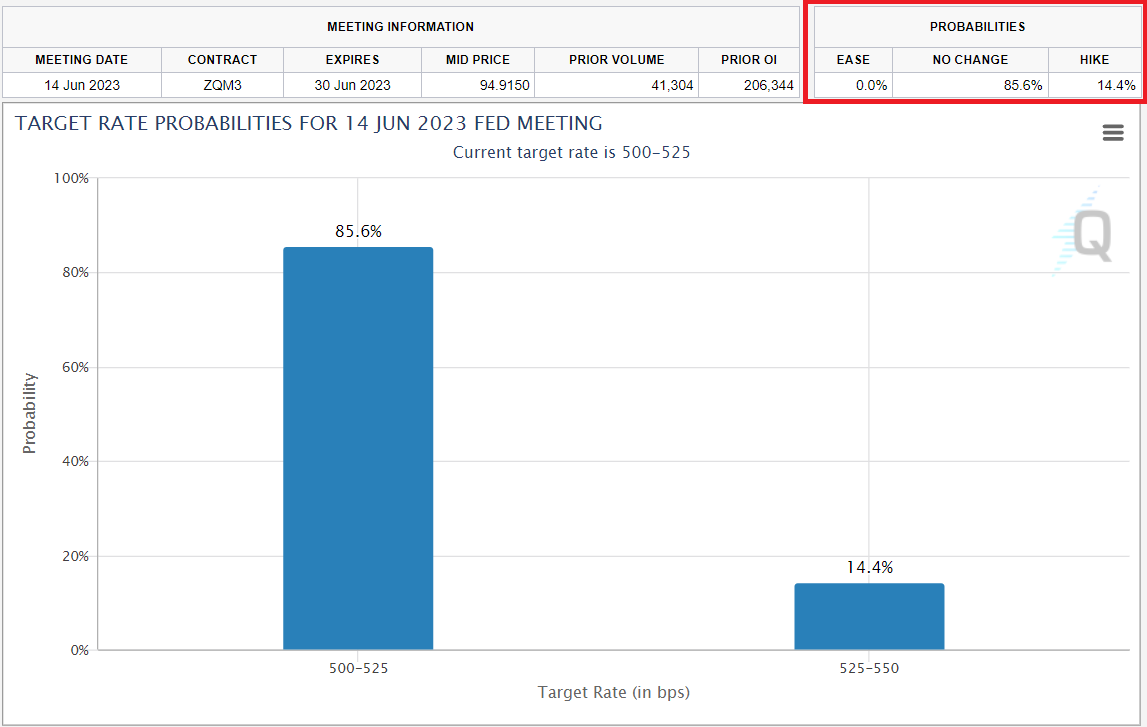

US RETAIL SALES (TUE): Headline retail sales are seen rising 0.7% M/M in April, offsetting some of the 1.0% M/M decline in March. Retail sales data will be an important indicator of how the US consumer is tracking in the face of an aggressive Fed rate hiking cycle, and with the Fed in “data dependent” mode we could see some repricing of June Fed rate hike odds if there is a big miss , seeing volatility in USD FX and equity markets.

Currently the market is pricing in a 14% chance of a hike, 85% hold at the FOMC June meeting.

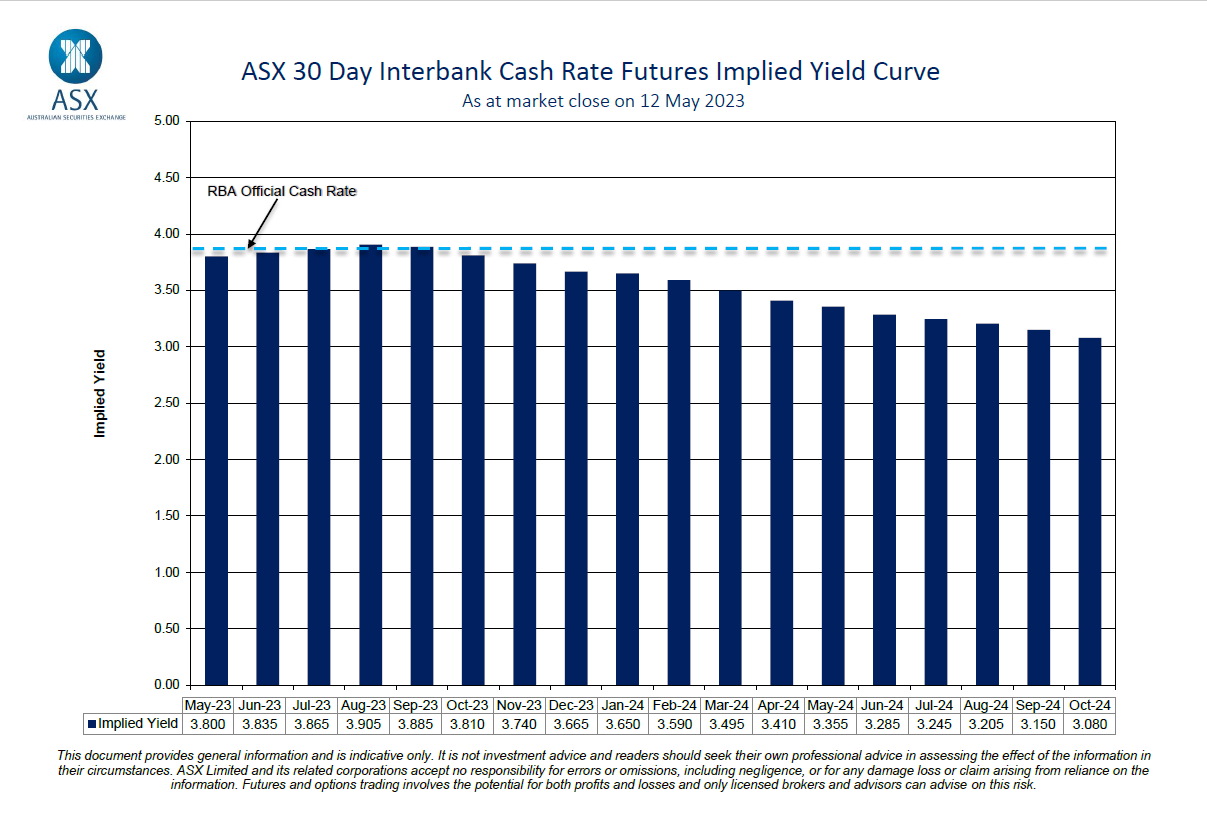

AUSTRALIAN LABOUR MARKET REPORT (THU): The employment change is expected to show the addition of 25k jobs in April, with the unemployment rate seen steady at 3.5% .The most recent RBA meeting, which saw a surprise 25bp hike , suggested “The recent Australian data also confirmed that the labour market remains very tight, with the unemployment rate at a near 50-year low.” The RBA is again expected to hold rates at their June 6th meeting, but with this month’s surprise hike and their obvious determination to rein in inflation, a big beat on this figure could see market participants start to price in a surprise hike form the RBA, which would be AUD positive.

Implied future yield on official Australian cash rate

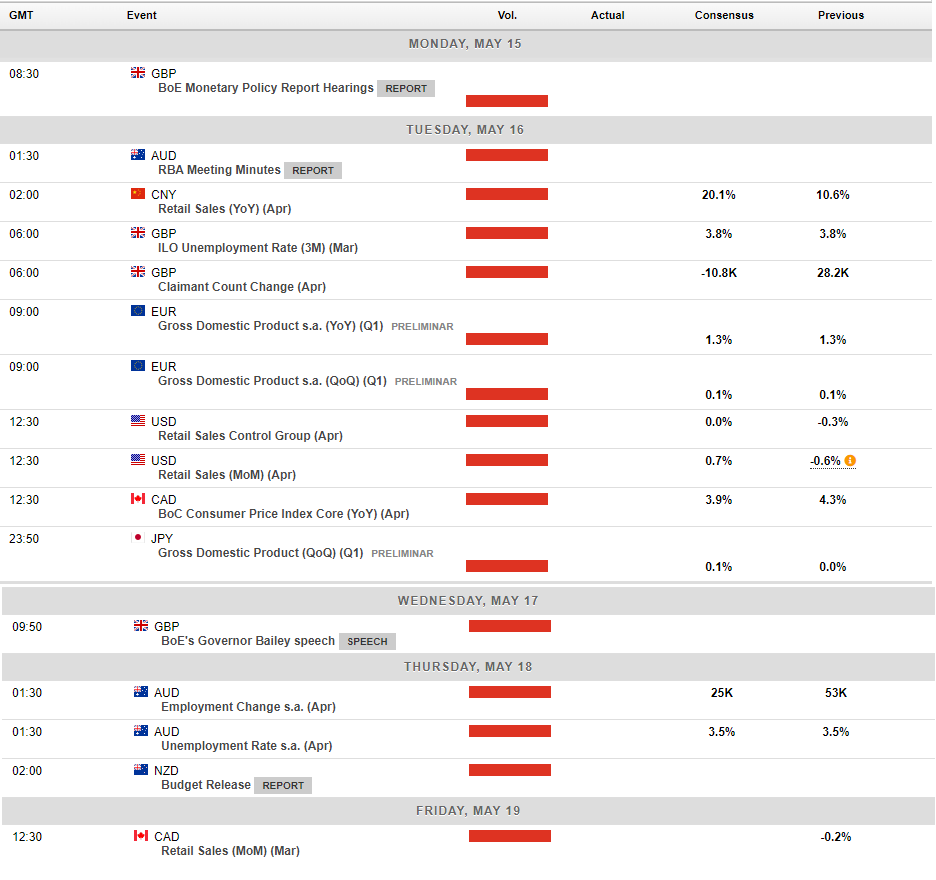

Full weekly calendar of the main risk events below:

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

US stocks finish in the green on weak data and regional bank short squeeze

Major US indices finished broadly higher after weak Empire State manufacturing figures fed into the “bad news is good news” for equities narrative, and a surge higher in regional bank stocks allayed fears of further crises in that sector in the short term. The Russell 2000, being the home of most of these mid-sized banks outperformed, finishing...

May 16, 2023Read More >Previous Article

US stocks mostly lower as bank woes sour risk sentiment, BoE hikes rates

US indices closed the session mixed with outperformance in Nasdaq, propped up by Google(GOOG) as their continuing I/O event bolstered their stock pric...

May 12, 2023Read More >Please share your location to continue.

Check our help guide for more info.