- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

Open Account

CFD trading

Trade CFDs on forex, commodities, indices, and more.

Open accountTo open a CFD trading account as a Company, Trust, or SMSF, apply here.

Share trading

Invest in shares and ETFs on the Australian share market.

Open accountOpen a Personal or Company/Trust/SMSF share trading account.

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Economic Updates

- US stocks finished mixed – Nasdaq surges on NVDA earnings boost – Gold down again

- Home

- News & analysis

- Economic Updates

- US stocks finished mixed – Nasdaq surges on NVDA earnings boost – Gold down again

News & analysisNews & analysis

News & analysisNews & analysisUS stocks finished mixed – Nasdaq surges on NVDA earnings boost – Gold down again

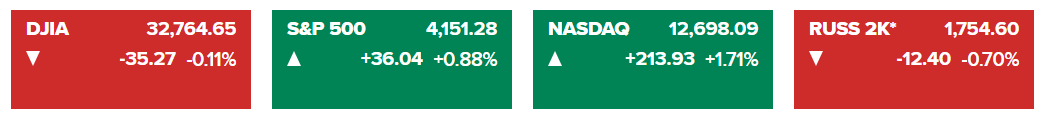

26 May 2023 By Lachlan MeakinUS indices finished mixed in Thursdays session two up, two down though with an overall positive bias on debt ceiling progress and strong economic data. The Nasdaq easily outperformed as a huge up day from Nvidia (NVDA + 24%) after a positive earnings report saw the tech heavy index surge over 200 points.

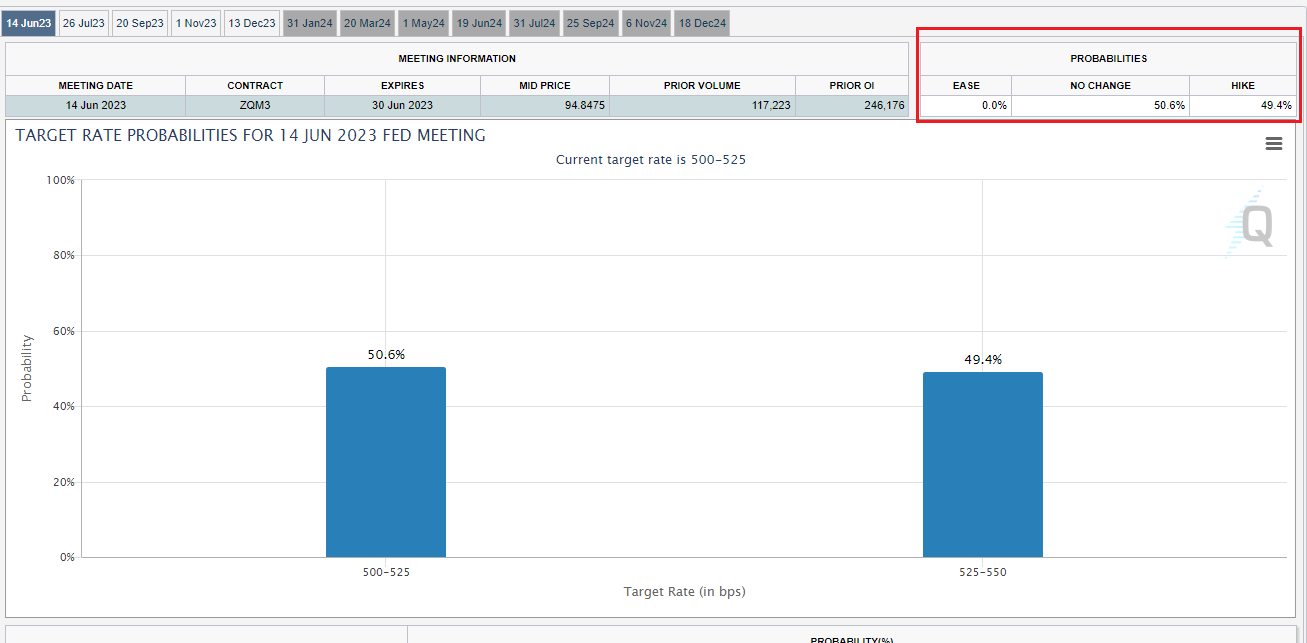

Strong data was also released easing US recession fears, jobless claims came in at 229k, 20k under forecast and preliminary GDP handily beat forecasts, coming in at 1.3% vs the expected 1.1%. These, coupled with seemingly positive progress in debt ceiling negotiations has see pressure put back on the Fed, with rate hike expectations in June surging to be a 50-50 bet, only a few days ago the market was giving little chance of another hike.

Source: CME Fedwatch tool

FX Markets

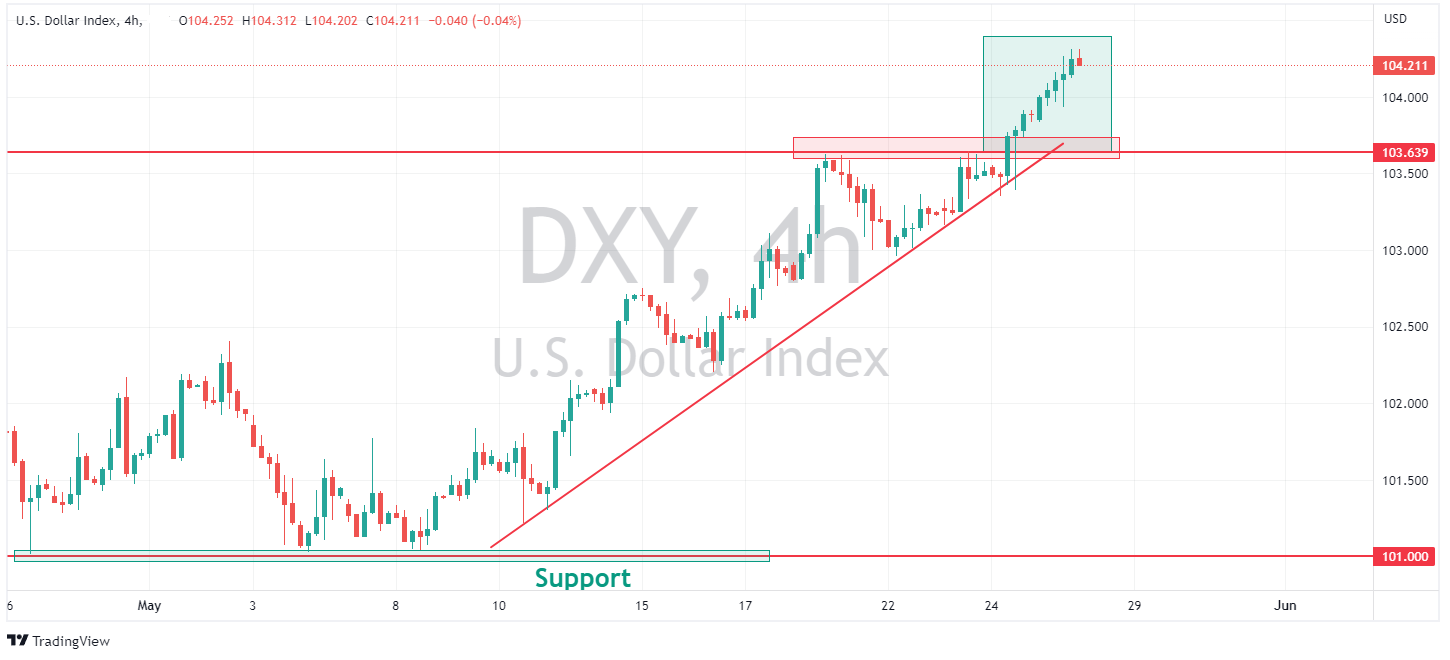

USD continued its run up on Thursday, with the Dollar Index breaking through resistance and hitting a two-and-a-half-month high of 104.310 after positive US data releases resulted in a hawkish shift in pricing of the next Fed decision in June.

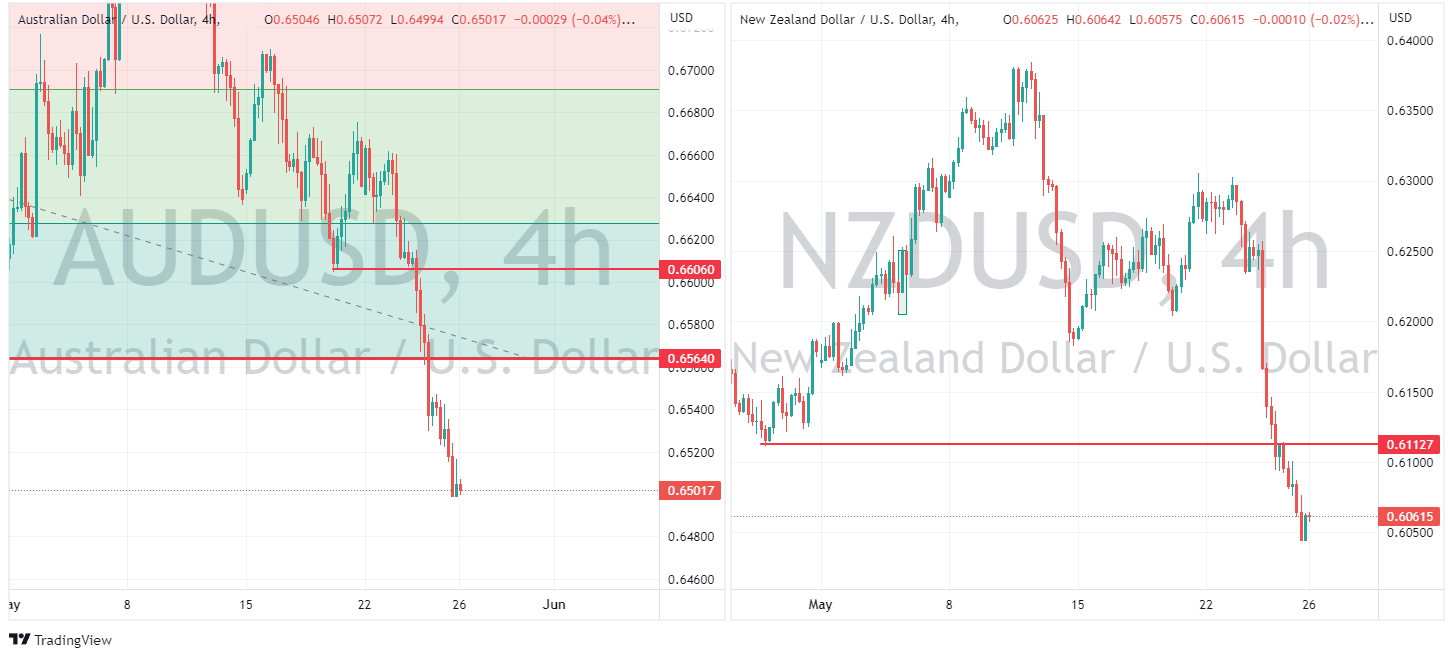

AUD and NZD were the G10 underperformers as the Kiwi continues to be hit after the dovish RBNZ 25 bp hike on Wednesday. Highlighting the weakness, AUDUSD and NZDUSD both breached key levels and hit six-month troughs of 0.6499 and 0.6045, respectively. A fall in commodity prices also weighing on the Aussie.

EUR was softer trading between 1.0708-56 after reports that Germany had officially entered a recession. However, EURUSD held just above 1.0700 finding support at the 24th March lows after ECB member Knot said that there was “no sign that underlying inflation is abating and ECB will hold rates at peak for significant time.”

Commodities

Gold again took a leg down, breaking the minor support at 1952 as improved risk sentiment and rising US yields on the back of strong US data saw the sellers take charge. The next real support for XAUUSD is at 1935, which it is looking likely to test in the near future going from recent price action.

Despite recession fears subsiding somewhat, Crude oil tumbled through the session on Thursday with the downside beginning in the European morning amid comments from Russian Deputy PM Novak downplaying the prospect of further OPEC+ production cuts at the June 4th meeting. A Strong USD also weighing on USOUSD.

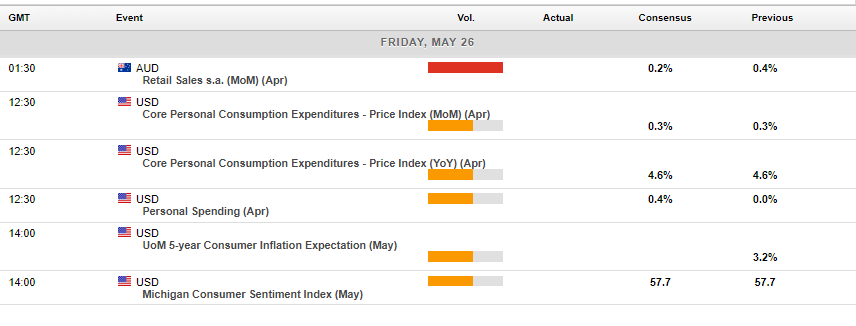

Today’s Economic calendar sees Aussie retail sales which will be one to watch for Aussie traders and later in the session the Feds “favoured” inflation gauge, the core PCE price index. With the Money markets pricing in 50-50 odds of a hike or hold at the next FOMC meeting, there should be some exciting market action on this release.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

The Week ahead – Debt ceiling deal, NFP and Aussie CPI – charts to watch

News over the weekend of a tentative debt ceiling deal had been achieved should see investors in the week ahead return to their usual programming of trying to predict the next move from the Federal Reserve, which this week’s jobs data will be a critical component. Late Saturday, the White House and Republican negotiators announced a debt ceili...

May 29, 2023Read More >Previous Article

US stocks sink as debt ceiling impasse continues to weigh on investors, RBNZ rate decision today

Major US indices were lower on Tuesday, extending to the downside through the session, as debt limit negotiations extend further to the edge after lit...

May 24, 2023Read More >Please share your location to continue.

Check our help guide for more info.