- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Central Banks

- Federal Budget – “Back in the Black”

- The housing sector remains a concern

- Weak Wage growth persists

- Retail Sales is sluggish

- Global Growth is slowing

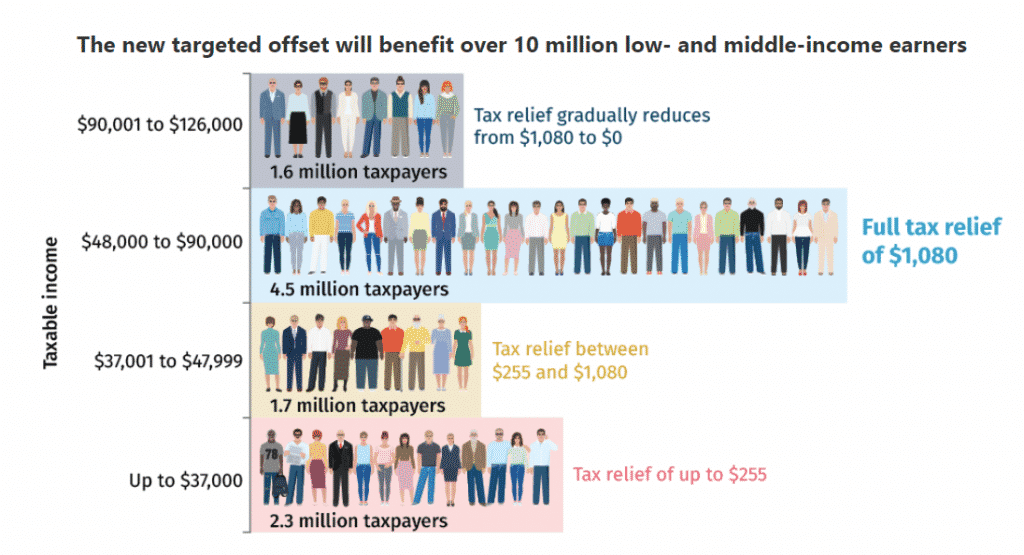

- Immediate tax relief of up to $1,080 for singles or up to $2,160 for dual income families of low-and-middle-income earners to ease the cost of living.

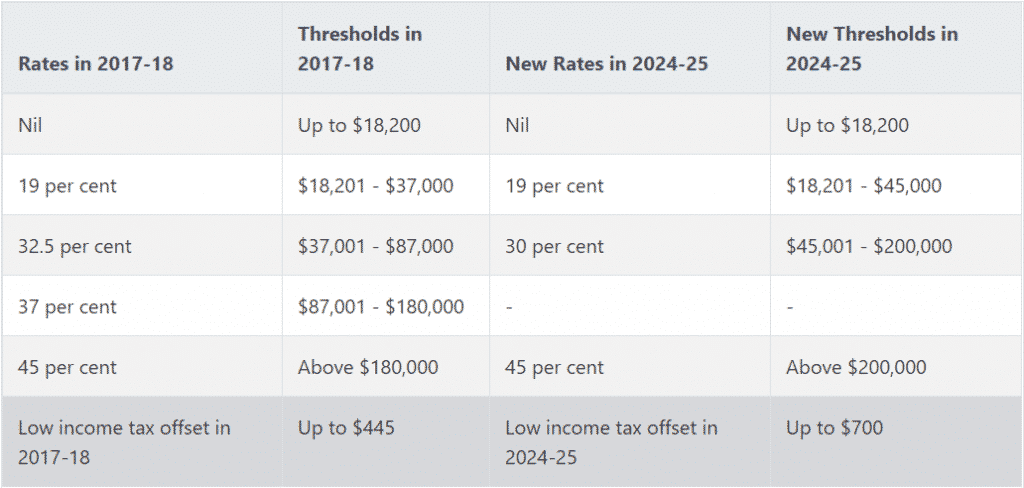

- Lowering the 32.5 per cent rate to 30 per cent in 2024-25

News & analysisFederal Budget – “Back in the Black”

“Returning the budget to surplus, delivering more jobs, providing lower taxes, guaranteeing essential services.”

We are in the election year, and the government needed a budget that will please voters. Treasurer Josh Frydenberg delivered his first federal budget and conveyed his plans for a stronger economy. The two dominant headlines surrounding the budget are:

“Budget in Black, Australia back on track”

&

“A Tax System that rewards effort and underpins a strong economy”

Returning the Budget to Surplus

Despite downgrades to domestic economic forecasts and heightened global growth concerns, the Treasurer announced the first budget surplus of $7.1 billion in 2019-20 in over a decade. However, the budget surplus does not come without a catch. It is conditional upon the Coalition winning the election.

The Budget Surplus is also based on optimistic economic forecasts, and if the rosy predictions are softer than expected, the actual revenue flows will be undermined and the surplus will not materialise.

It should be highlighted that the outcome of the 2019-2020 budget will not be known until September 2020, and Australia is facing a softening economy which can make “Budget in Black, Australia back on track” challenging to achieve:

Tax Cuts

The Australian Government is keen to build a simpler and more competitive tax system for the hard-working taxpayers and small businesses. There are three main themes to consider in the Government’s plans to build a better tax system:

Lower taxes for hard-working Australians

Source: www.budget.gov.au

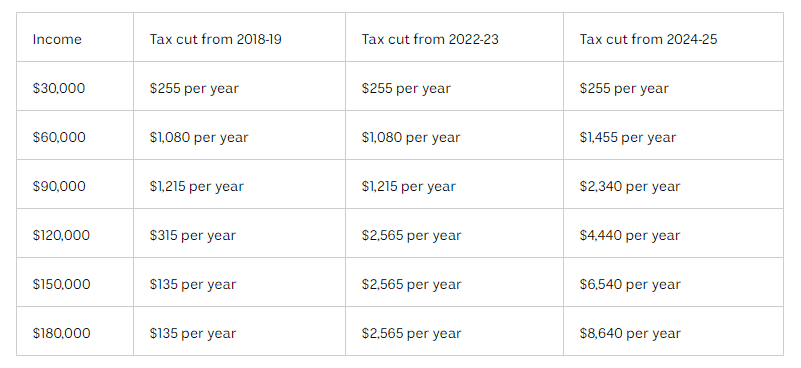

From 2018-19, the Government will provide immediate tax relief for the low- and middle-income earners and larger tax benefits will be mapped out over the next couple of years through the Government’s enhanced plan should the Coalition party win the election.

Source: abc.net.au

As from 2024-25, the Government will adopt further structural changes to the tax system and improve incentives for working Australians to rewards efforts.

Source: www.budget.gov.au

Backing small business

The Government will be lowering the small business tax rate and will also increase and expand access to the instant asset write-off:

“Increasing the instant asset write-off threshold to $30,000 and expanding access to medium‑sized businesses with an annual turnover of less than $50 million to help them reinvest in their business, employ more workers and grow. Around 3.4 million businesses will be eligible to benefit.

Fast-tracking the company tax rate cut to 25 per cent for small and medium‑sized companies with an annual turnover of less than $50 million and increases to the unincorporated small business tax discount rate.”

Making Multinationals and big business pay their fair share

The Government also want to make multinationals and big business pay their fair share.

“$12.9 billion in tax liabilities raised from tax compliance activities since July 2016.

New funding for the ATO to target tax avoidance by multinationals, big business and high‑wealth individuals.”

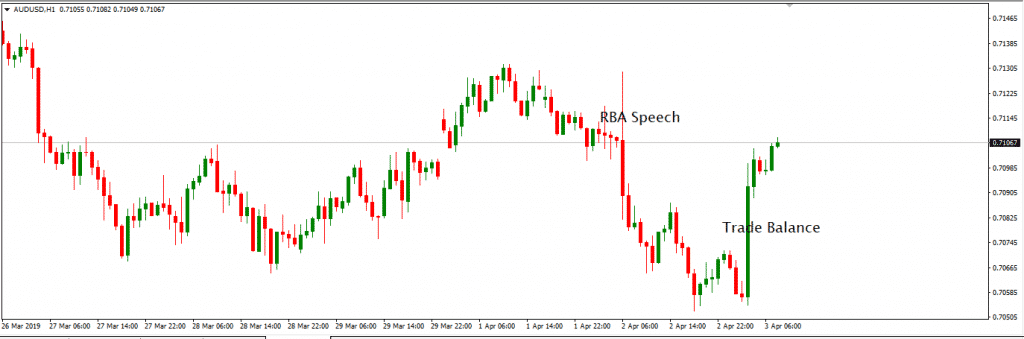

The reaction following the release of the budget in the financial markets was subdued. The Reserve Bank of Australia was the main event that moved the AUD pairs yesterday. Trade balance, and Retal Sales figures came in better than expected this morning and helped the Australian dollar to pare the losses made yesterday after Governor Lowe’s Rate Statement.

AUDUSD (Hourly Chart)

Source: GO MT4Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Interest #Rates #Fed #InterestRates #Banks #Banking #FinTechNext Article

Accumulating into a Profitable FX Position: Opportunities and Risk Management

Position accumulation is to increase exposure to a currency pair, by adding a second (or more) position in the same trading direction. Although on the surface the opportunity to increase potential return is attractive, there are also risks that MUST be at the forefront of your thinking. Are you ready to accumulate? Before considering position accu...

April 9, 2019Read More >Previous Article

Your Trading Journal Blueprint – Free Download

Those of you who have attended any of our LIVE Inner Circle education sessions, or participated in our courses, will know that a regular the...

March 29, 2019Read More >Please share your location to continue.

Check our help guide for more info.