- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Forex

- AUD and NZD under pressure on rising US and EU yield expectations

- Home

- News & analysis

- Forex

- AUD and NZD under pressure on rising US and EU yield expectations

News & analysisNews & analysis

News & analysisNews & analysisAUD and NZD under pressure on rising US and EU yield expectations

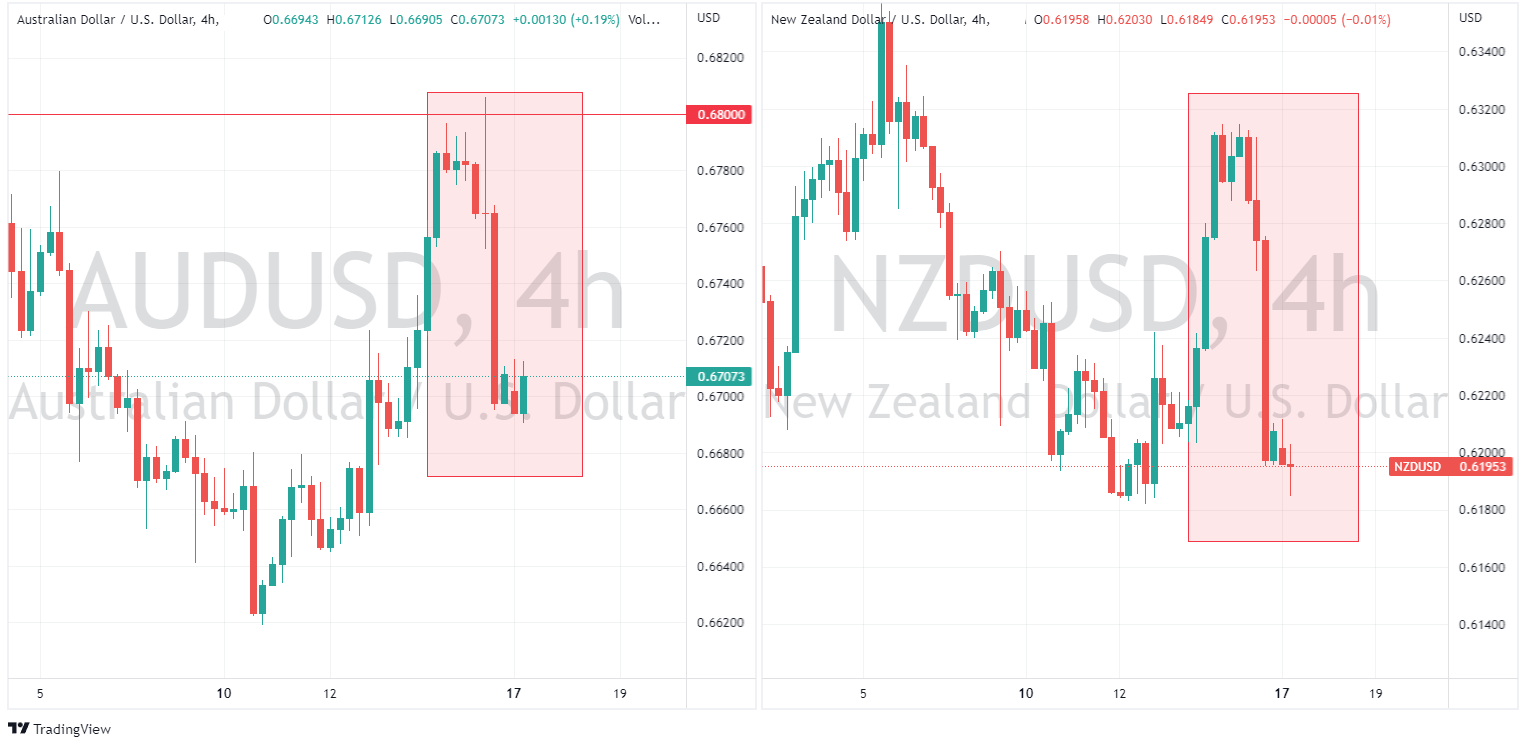

17 April 2023 By Lachlan MeakinAUD and NZD, being cyclical currencies (cyclical currencies being ones that are extra sensitive to global risk sentiment) took a big hit in Fridays session , dropping 1.1% and 1.3% respectively against the USD and remain under pressure today.

Weak retail sales out of the US on Friday didn’t help risk sentiment, but the rout really started when the USD soared on hawkish comments from Fed governors, (Waller being the most forceful) which saw rate hike odds at the next Fed meeting push significantly higher.

Both the Aussie and Kiwi dollars have suffered from a shift in market pricing for continuing rate hikes in the United States and Europe, with Fed Funds futures now showing an 80% chance of another Fed hike in May and flirting with the risk of a 50bp hike from the ECB as both banks Governors continue to talk tough on inflation.

AUDUSD

AUDUSD is technically still in an uptrend with an upward sloping trend line still in place, AUD was helped along by stellar employment figures out of Australia last week, though the forcefulness of the rejection at the 0.68 USD resistance zone on Friday does put into question how much legs this short-term uptrend has. Traders looking to enter the AUDUSD need to keep these levels in mind, a break and hold of the major 0.68 resistance could signal a push higher and resumption of the uptrend, a solid break through the short term trend would likely see the AUDUSD test 2023 lows before finding much buying.

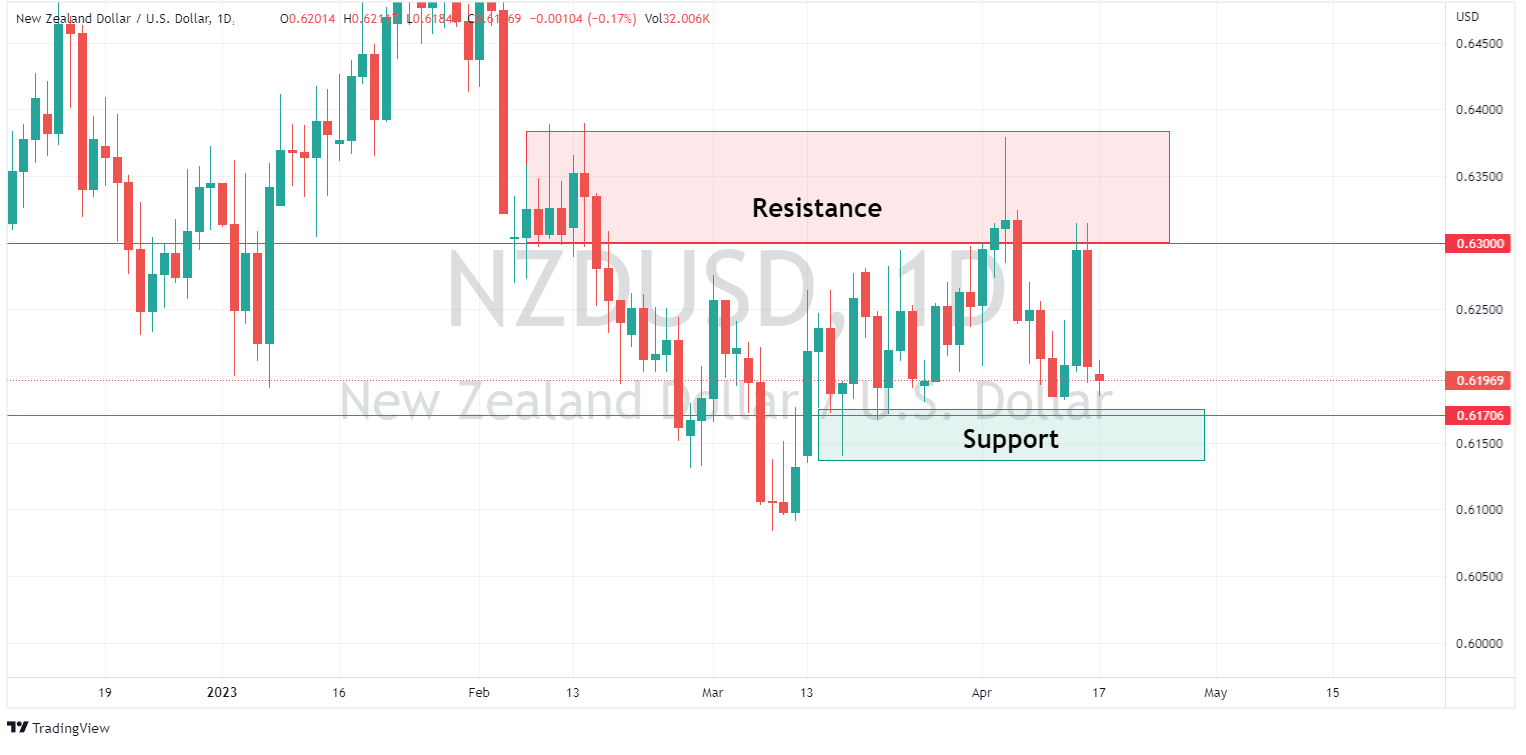

NZDUSD

The Kiwi is showing similar price action to AUDUSD, with its major resistance and an area of a real battle between the Bulls and the Bears just above the psychological 0.63 level, with some short term support around the 0.6170 level. There was a major rejection of the 0.63 level on Friday , in similar price action to the AUD, this also pushed NZDUSD below its 100 Day SMA (which has now turned on a downward trajectory) and just holding above its support zone. Like the AUD, a break below this support zone could see the Kiwi test the 2023 lows around 0.6080 before seeing buyers come back in, any push above 0.63 is likely to see some pushback and volatility in the NZDUSD pair.

AUDNZD

Despite higher yields in New Zealand the AUDNZD pair has rallied strongly in recent days, helped along by some small pricing in of a RBA hike next month after the strong jobs report. The pair has now risen well into the 1.08’s after pushing below its 10-year median of 1.07 earlier in the month, showing that AUDNZD continues to be a good buy under this level.

In economic news out of Australia, the RBA Minutes form the last RBA meeting will be released tomorrow, which could give clues as to whether the hold is temporary or not, plus NZ CPI figures will be released on Thursday. Inflation figures have been very important in recent times as indicators of Central Bank actions, so we could see some excitement on this figure.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Charles Schwab posts mixed Q1 results

Charles Schwab Corporation (NYSE: SCHW) announced the latest financial results for the first three months of 2023 ended March 31, before the opening bell on Wall Street on Monday. Company overview Founded: 1971 Headquarters: Westlake, Texas, United States Number of branches: 400 Number of employees: 35,300 (as of December 2022) ...

April 18, 2023Read More >Previous Article

GO Markets named as Compare Forex Brokers’ Best Liquidity Broker, Lowest Commission Forex Broker and Best Forex Broker in Singapore 2023

A 2023 Compare Forex Brokers’ comparison of the top global forex brokers named GO Markets as the top broker in multiple categories, including: ...

April 17, 2023Read More >Please share your location to continue.

Check our help guide for more info.