- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Forex

- EU / UK open FX analysis – AUD, JPY, USD, EUR

News & analysisEU and UK indices are looking to open slightly stronger despite a weak lead from the Asian session. Aussie and Asian indices finish in the red after US-China tech-related frictions and disappointing Japanese GDP revisions weighed on risk sentiment.

Asian session wrap – FX Markets

The USD was softer with DXY retreating from extreme RSI overbought levels to push below the key 105.00 level. Dovish commentary from the Fed’s Logan ahead of the Fed blackout window and strength in the Dollars major counterparts outweighing the sour risk sentiment which would normally see the Dollar benefit from haven flows.

EUR bounced back after a sell-off on Yesterday’s dismal German data. EURUSD pushing back above the 1.0700 level after finding support at the June lows.

USDJPY was choppy with early drop due to the risk-off mood and MoF jawboning saw the pair test the S/R level at 146.63 before bouncing back as the Asian session progressed. Japanese Finance Minister Suzuki stating in comments that rapid FX moves are undesirable and warned the Japanese MoF won’t rule out any options (intervention?)

AUDUSD rallied to test the key 0.6400 S/R level, despite the risk-off tone and recent commodity pressure. A weaker USD and some technical support from the daily trendline seeming to be the key drivers.

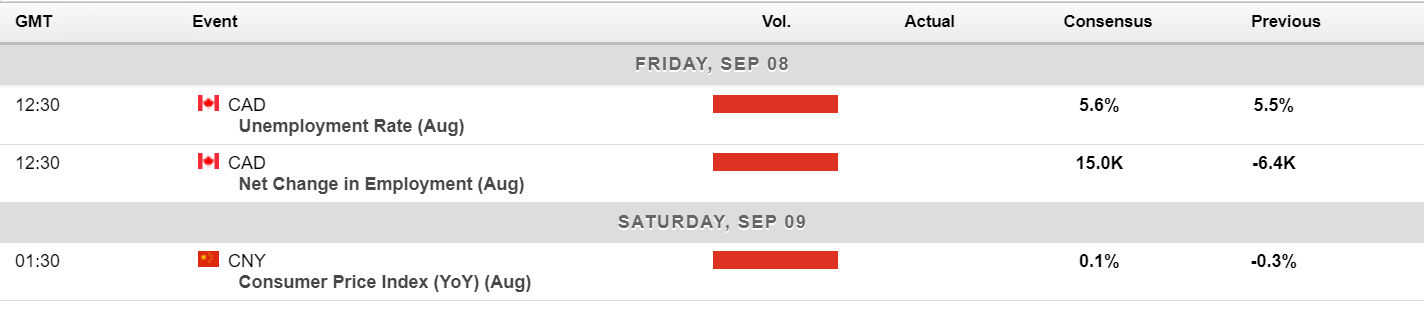

Looking ahead, the main risk events data wise will be Canadian jobs figures later today and Chinese CPI released on Saturday.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

EURUSD Faces Key Support Ahead of US CPI Data Release

The EURUSD pair has been navigating challenging waters in recent weeks, experiencing a decline of more than 5% since mid-July. This decline has primarily been due to the USD's strength, as the Federal Reserve remains firm in its commitment to maintaining higher interest rates for longer to bring down inflation. Last week marked a critical tu...

September 11, 2023Read More >Previous Article

Apple breaks down below key level in pre-market on China iPhone ban woes

A -3.5% slide in AAPL stock price pre-market is seeing the tech giant looking to continue this weeks sell-off after a Bloomberg report that Chinese au...

September 7, 2023Read More >Please share your location to continue.

Check our help guide for more info.