- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Forex

- EURUSD tests near term support

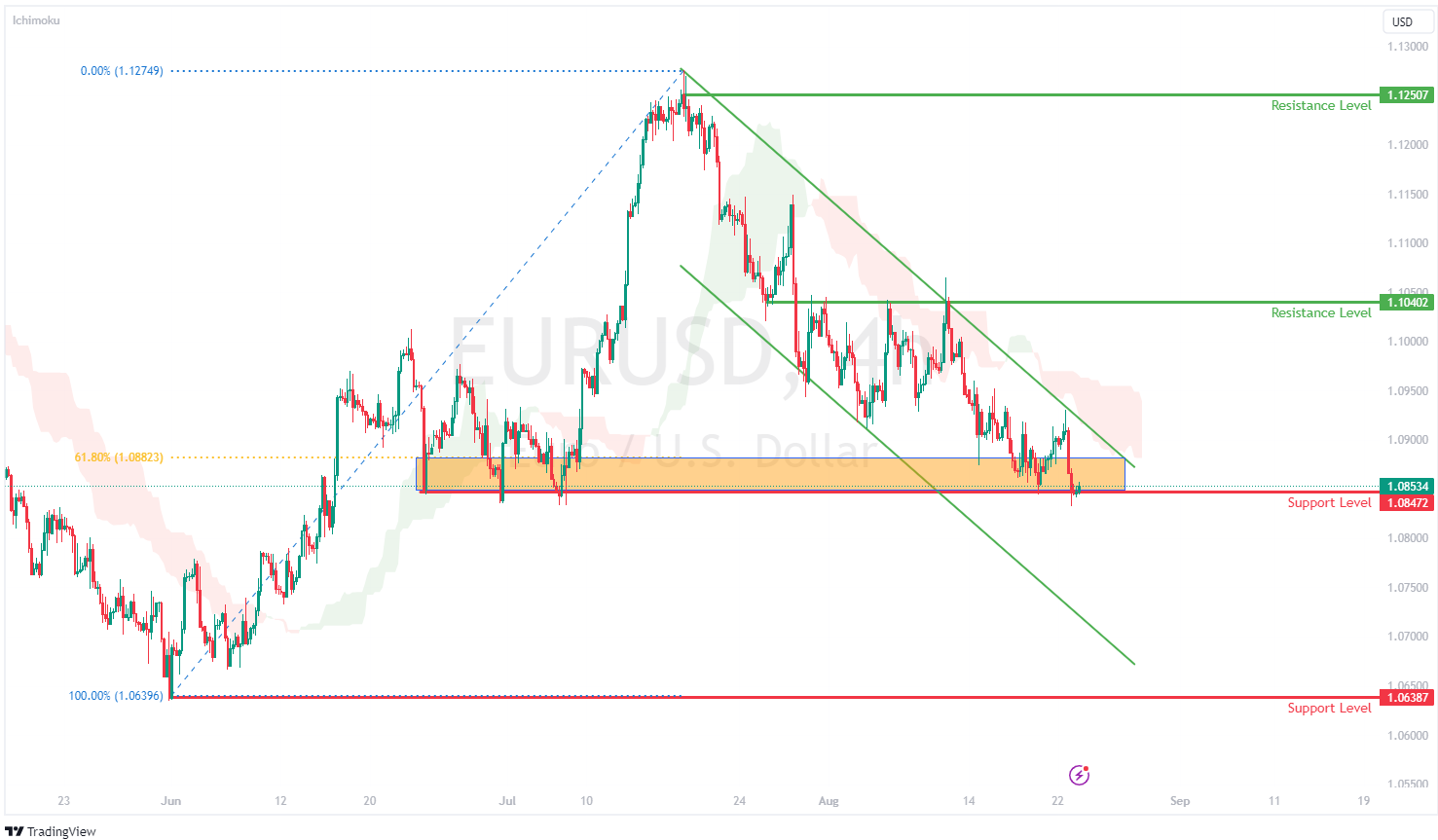

News & analysisAfter reaching the high of 1.1250, last tested in 2022, the EURUSD has been trading steadily lower and currently sits along the 1.0850 support level, formed by the 61.8% Fibonacci retracement level and the previous swing low from early July.

Looking at the technical aspects, the Ichimoku cloud indicates continued bearish pressures, with the top of the channel providing dynamic resistance, highlighting further downside potential for the EURUSD.

The current downtrend on the EURUSD has been driven by the European Central Bank’s (ECB) comments in July that there was no clear bias in favour of hiking or holding rates for the upcoming meeting in September. Coupled with the increasing likelihood of another rate hike to come from the US FOMC in September, as the Fed continues to fight inflation, strength in the DXY has led to the EURUSD trading lower.

While a brief retracement could be likely to retest the upper bound of the channel, look for the EURUSD to maintain within the bearish channel. If the price breaks below the support level of 1.0850, this could signal a confirmation of further downside, with the next key support level at the previous swing low, along the 1.0650 price level.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

USDJPY – Will the BoJ Intervene?

In 2022, it was believed that the Bank of Japan (BoJ) intervened three times, in September when the USDJPY was at 145.80, and in October and November when the USDJPY was at the 151.50 and 146.50 price levels respectively. For each of the 3 interventions, the USDJPY reversed strongly by more than 500pips. With the recent steady climb in the USDJP...

August 23, 2023Read More >Previous Article

FX analysis – Euro lower ahead of PMIs – AUD, JPY and Gold stumble higher

USD was mostly firmer in Tuesday’s session as a mixed equity markets saw some slight risk-off conditions. Also support USD was rates markets shiftin...

August 23, 2023Read More >Please share your location to continue.

Check our help guide for more info.