- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Forex

- Eyes on EURUSD going into European inflation data

News & analysisAfter surging close to 4% since early July off the back of a weakening USD, the EURUSD pair has stabilised around $1.123. With very little volatility seen this week in the pair, eyes now turn to the euro, as the European inflation data is set to be released today.

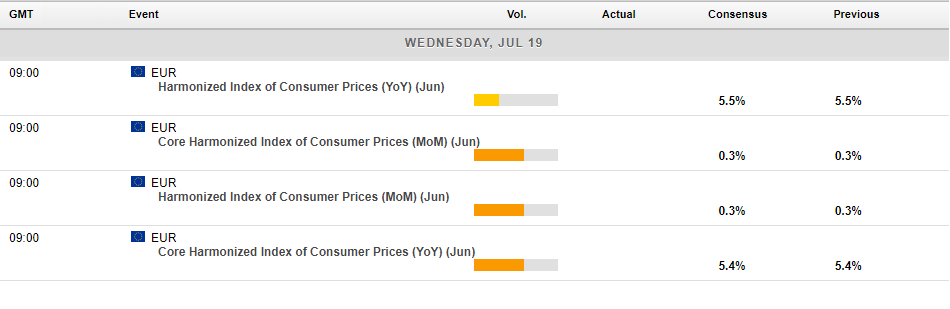

Analysts are predicting a continued downward trend in inflation, with a Year-on-Year forecast of 5.50%, which is below May’s figure of 6.1%. If the inflation data comes in above forecasts, we may see a further increase in the EUR as investors move towards the potentially higher yields.

On the technical front, the tightening of Bollinger Bands on the 4-hour chart is something to watch. The lack of movement in the EURUSD pair throughout this week has led to exceptionally tight Bollinger Bands, with levels not observed on this timeframe since 2021. When Bollinger Bands contract significantly, it typically signifies a period of low volatility and suggests that a breakout or significant price movement may be on the horizon.

The Relative Strength Index (RSI) is also in overbought territory on multiple timeframes, including the daily. This might suggest there is room for a cool-off before a further continuation higher. However, with the European inflation data due today, the fundamental data might cancel out any technical signals.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

FX Analysis – Treasury Yield surge Pushes USD Higher, AUD Outperforms on Hot Jobs Report

The US Dollar was firmer Thursday, continuing its bounce from extreme oversold levels, the DXY peaking at 100.97, just short of the major resistance at the big 101 figure. A much lower than expected initial jobless claims figure saw a jump in US treasury yields, propelling the USD higher with the DXY having it biggest up day since May. AUD w...

July 21, 2023Read More >Previous Article

The Rally on Wall St continues – Tech leads on soft US data, FX markets choppy – range bound

US equities pushed higher again in Monday’s session with soft US manufacturing data (lowering rate expectations from the Fed) counteracting weak Chi...

July 18, 2023Read More >Please share your location to continue.

Check our help guide for more info.