- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Forex

- FX Analysis – Yen surges on hawkish BoJ, Gold holds key level, AUDUSD bounces off key support

- Home

- News & analysis

- Forex

- FX Analysis – Yen surges on hawkish BoJ, Gold holds key level, AUDUSD bounces off key support

News & analysisNews & analysis

News & analysisNews & analysisFX Analysis – Yen surges on hawkish BoJ, Gold holds key level, AUDUSD bounces off key support

8 December 2023 By Lachlan MeakinEquities were green across the board in Thursday’s session, led by the Nasdaq which was up almost 200 points on renewed AI optimism after Google unveiled its newest AI model, Gemini. But it was the FX space where the big moves happened.

JPY surged to have its best day of 2023 on the back of hawkish commentary from Bank of Japan Governor Ueda hinted at the end of the Central banks easy money policies, this saw a flash crash in USDJPY to 141.60 before the pair found some support at the 200 Day MA. A big driver of this pair has been the carry trade, traders cashing in the difference between US and Japanese yields, so talk of a hike in rates in Japan will be a big factor in where this pair goes next.

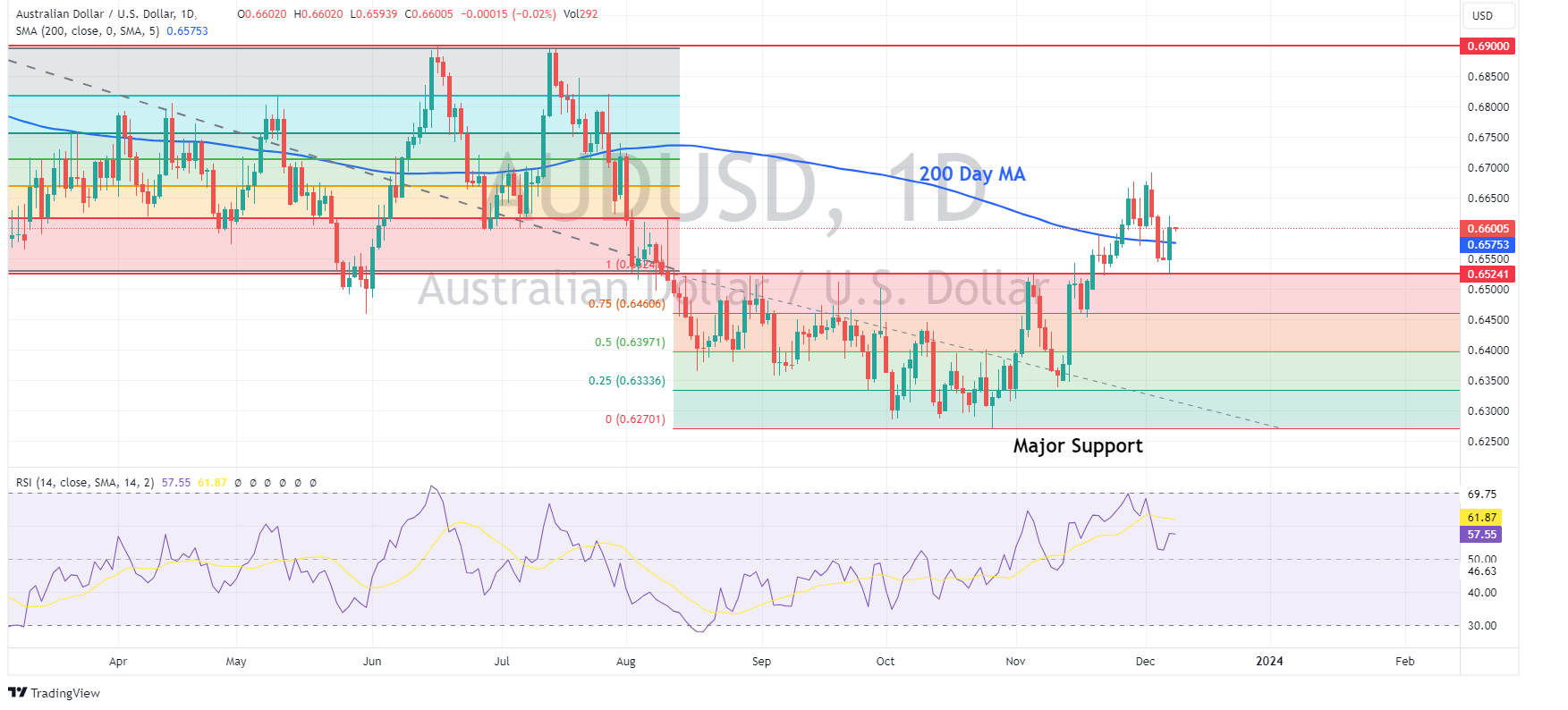

The move in USDJPY also rippled across other USD crosses with AUDUSD performing particularly well on the Dollar dip, a risk on market sentiment and a rise in Iron ore prices. AUDUSD tested the major support at the top of its Sep-Nov range before bouncing strongly through its 200 day MA to reclaim a 66 handle.

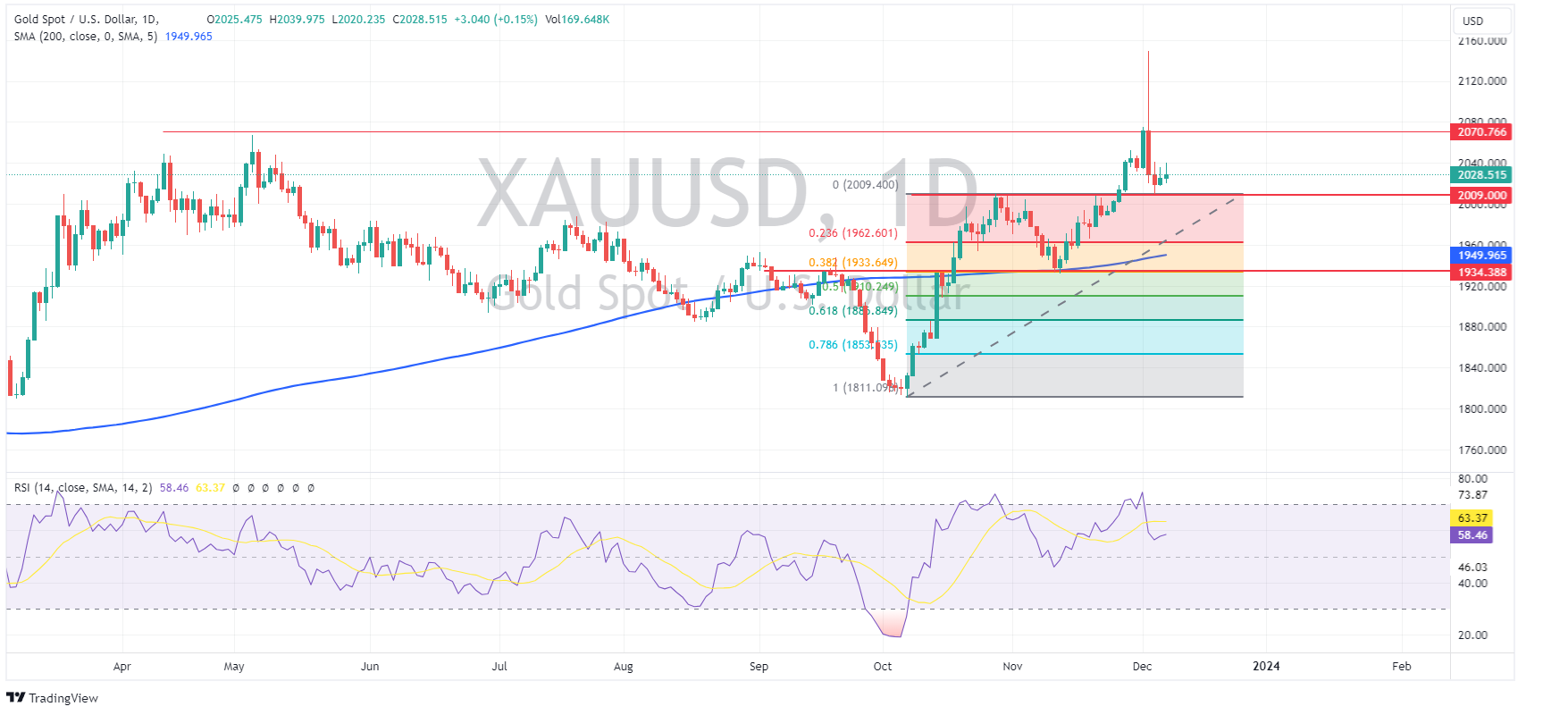

Gold continued to hold the key 2009 USD an ounce support level after a modest up session. The gold bulls may be a little disappointed with the gains though considering the drop in the USD on Thursday and will be watching this key level closely coming into today’s non-farm payroll report.

Todays NFP will be the last big figure before next weeks FOMC so expect some volatility if we get a number outside of the expected range.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Broadcom fourth quarter and full-year results are here

US technology giant and one of the largest semiconductor companies in the world, Broadcom Inc. (NASDAQ: AVGO), announced fourth quarter and fiscal year 2023 results after the market close in the US on Thursday. Company overview Founded: 1961 Headquarters: San Jose, California, United States Number of employees: 20,000 (2023) Indust...

December 8, 2023Read More >Previous Article

Up next: Non-Farm Payrolls announcement

It’s the beginning of a new month which means that the US Non-Farm Payrolls figures will be released by the US Bureau of Labor Statistics. The la...

December 7, 2023Read More >Please share your location to continue.

Check our help guide for more info.