- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Forex

- FX Analysis – AUDUSD, XAUUSD – Testing Key Levels

News & analysisThe US Dollar has continued its year end decline after the holiday break in thin volume. Traders still holding onto the view of a dovish Fed come 2024 seeing yields also drop creating a headwind for the Greenback.

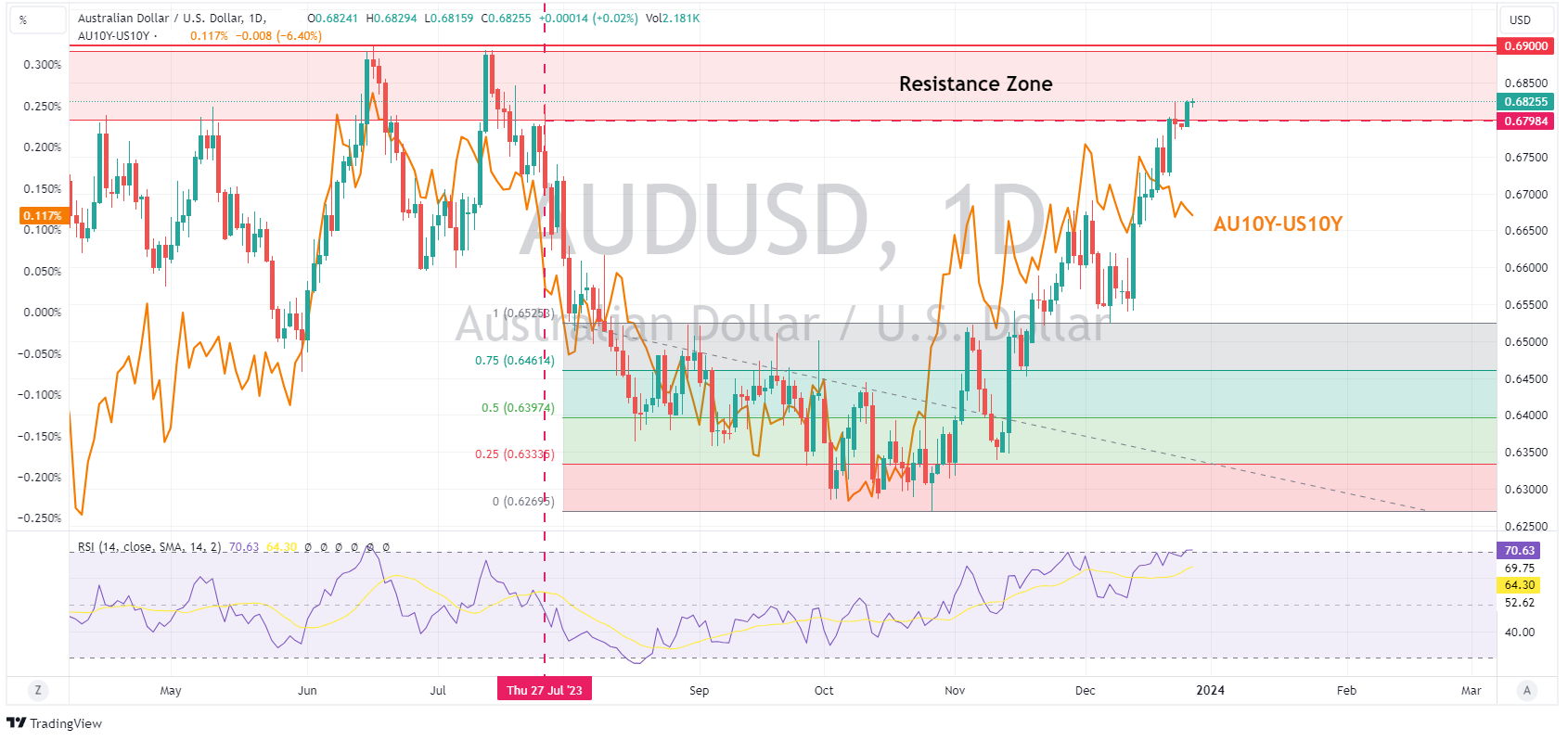

AUDUSD

The Aussie pushed has pushed higher this week, taking advantage of a weak USD and a risk on environment. AUDUSD breaking the resistance and key psychological level of 0.68 in Tuesday’s session and entering the Resistance zone from 0.6800 -0.6900 where rallies have faltered previously in 2023. The AU 10 and US 10 yield differential has also found some resistance at its current level and could temper further gains in this pair, AUDUSD looking like it has got a little ahead of itself at these levels.

XAUUSD

Gold also continued to grind higher in thin holiday volume, a weak USD and falling yields making the non-yielding asset look more attractive to speculators. XAUUSD trading at the key level of 2070 USD an ounce that gold traders should be keeping a close eye on. The last time XAUUSD broke this level was December 4 when a surge in price saw gold hit all-time highs. Currently XAUUSD has found resistance here and attempts to breach have been rejected, a push through could see another run to re-test those highs, a hold of the resistance and a leg lower in XAUUSD looks likely.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Market Analysis – Gold, USDCHF, Crude Oil

Wednesday’s session saw another drift higher in equities with volumes still in holiday mode and few major catalysts to drive market action. There were some big moves in safe haven assets with USDCHF tanking and Gold breaking a key resistance level, a big build in inventories also saw Crude Oil take a tumble. USDCHF The Swiss Franc surged...

December 28, 2023Read More >Previous Article

Market Analysis – USD slides, AUD hits key level, Gold rallies

Risk on returned to global markets in Thursdays session with equities rebounding strongly on weak US data that refuelled hopes of a faster pace to the...

December 22, 2023Read More >Please share your location to continue.

Check our help guide for more info.