- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Forex

- FX Analysis – DXY, USDJPY, USDCAD, AUDUSD

News & analysisUSD was offered in Tuesdays session, with the US Dollar Index (DXY) printing a low of 102.060 ahead of the last major economic release for the year in Fridays Core PCE reading. Hawkish leaning comments from the Feds Bostic that he only sees two Fed rate cuts in 2024, less than the Fed median of three and well under the market pricing of six, failing to lend much support to the greenback.

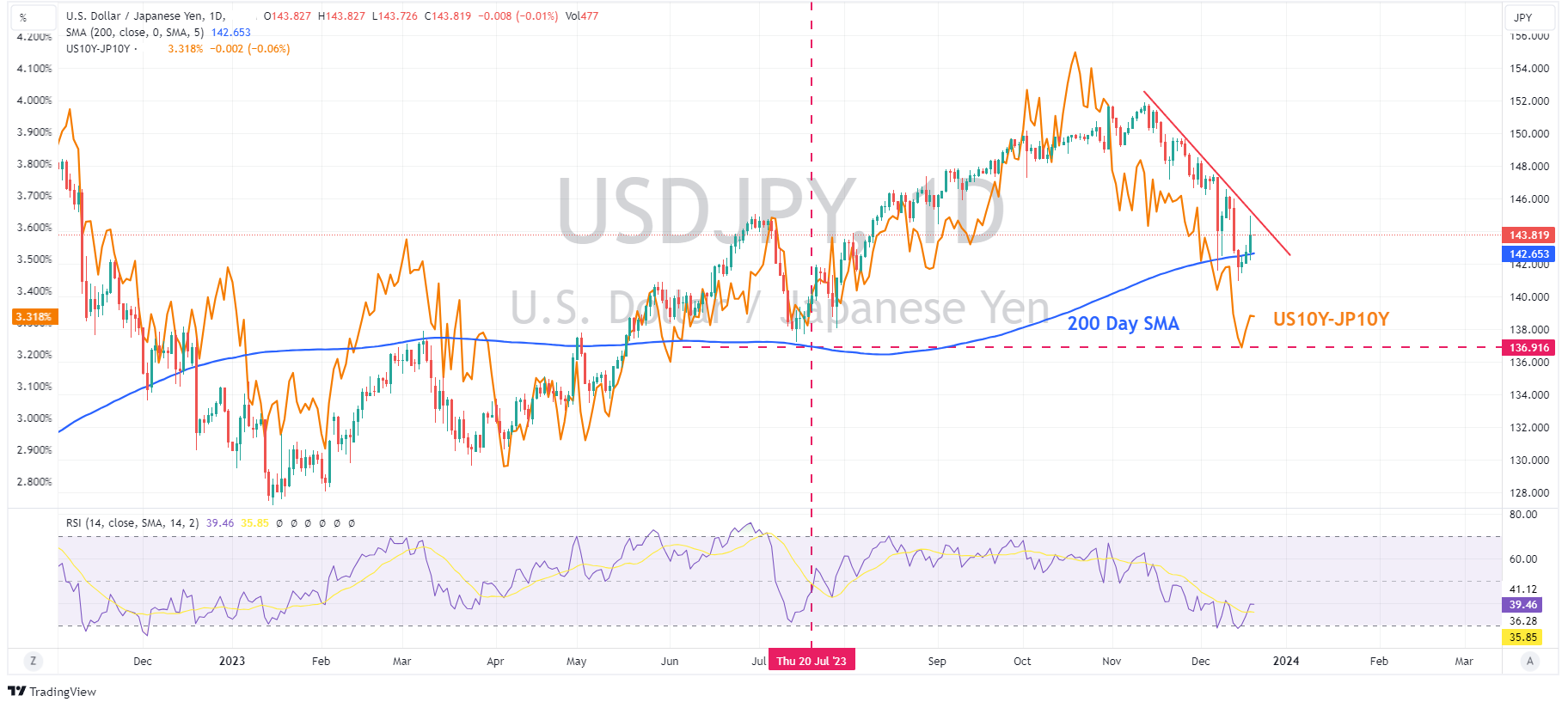

JPY was the obvious FX underperformer, seeing USDJPY hit a high of 144.95, just failing to breach the psychological 145.00 level before retracing somewhat. JPY took a hit on the BoJ meeting where the central bank stood pat and unanimously left its rates and YCC unchanged. There was some pricing in on this pair of a hawkish surprise from the BoJ which didn’t materialise.

AUD and NZD were the G10 outperformers. AUDUSD benefitting from improved risk sentiment and the December RBA Minutes which suggested the Board considered whether to hike by 25bps or keep rates steady, NZDUSD caught a tailwind from upbeat NZ trade data.

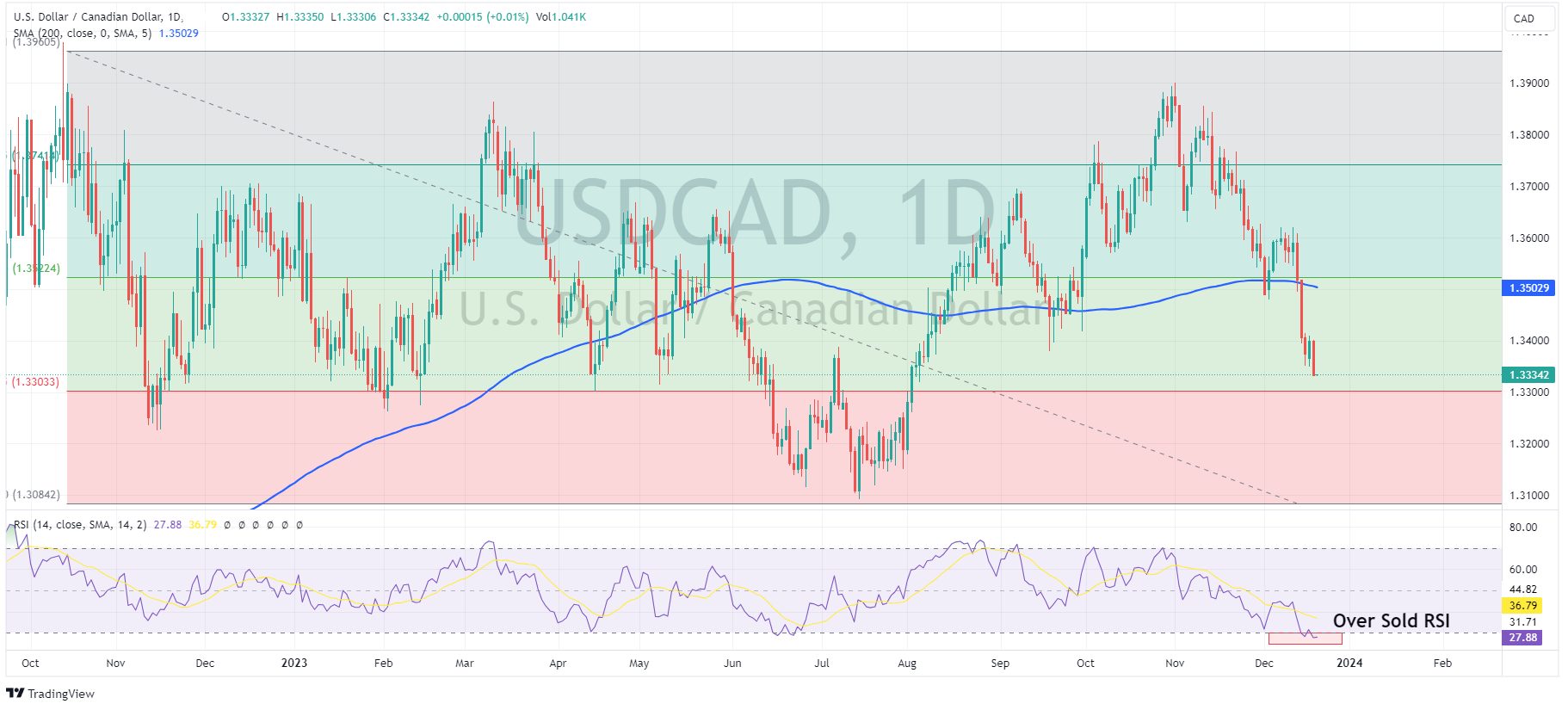

CAD strengthened on the hotter-than-expected inflation data, where the year on year figure came in at 3.4% a beat of the expected 3.3%. CAD also receiving support from a rally in crude oil prices on the back of Red Sea tensions affecting oil transportation. USDCAD dropping to 5-month lows and seeing the daily RSI move into extreme oversold territory.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Accenture results revealed

Irish-American professional services company, Accenture plc (NYSE: ACN), announced Q1 FY24 financial results before the opening bell in the US on Tuesday. The company reported revenue of $16.224 billion for the three months that ended on 30/11/23, which was narrowly above analyst estimate of $16.169 billion. Earnings per share (EPS) reached $...

December 20, 2023Read More >Previous Article

FX Analysis – USDCAD, USDJPY, AUDUSD

FX traders have some tier one data releases to look forward to today, including the last major central bank meeting in the form of the Bank of Japan. ...

December 19, 2023Read More >Please share your location to continue.

Check our help guide for more info.