- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Forex

- FX Analysis – EUR and GBP rally on PMIs, USDJPY tests key level.

- Home

- News & analysis

- Forex

- FX Analysis – EUR and GBP rally on PMIs, USDJPY tests key level.

News & analysisNews & analysis

News & analysisNews & analysisFX Analysis – EUR and GBP rally on PMIs, USDJPY tests key level.

24 November 2023 By Lachlan MeakinMarkets were predictably quite due to holidays in the US and Japan on Thursday.

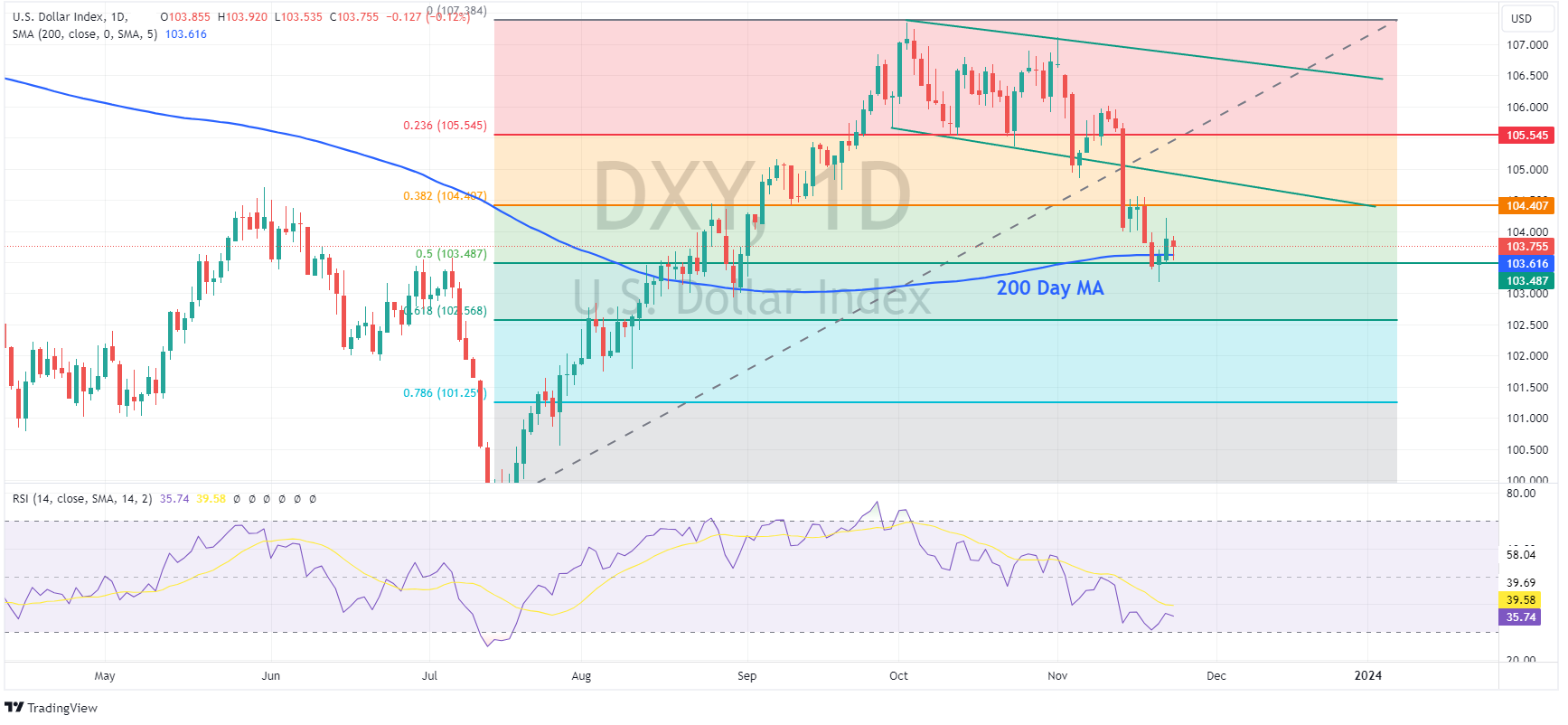

USD was marginally softer overall with DXY dropping to test the support at the 200-day MA before recovering modestly amid the holiday lull for Thanksgiving.

Source:TradingView.com

EURUSD managed mild gains with price action choppy around the 1.0900 level but eventually managed to hold that key level. There were several hawkish leaning comments from ECB officials and ECB Minutes noting that members argued in favour of keeping the door open for a possible further rate.

Source:TradingView.com

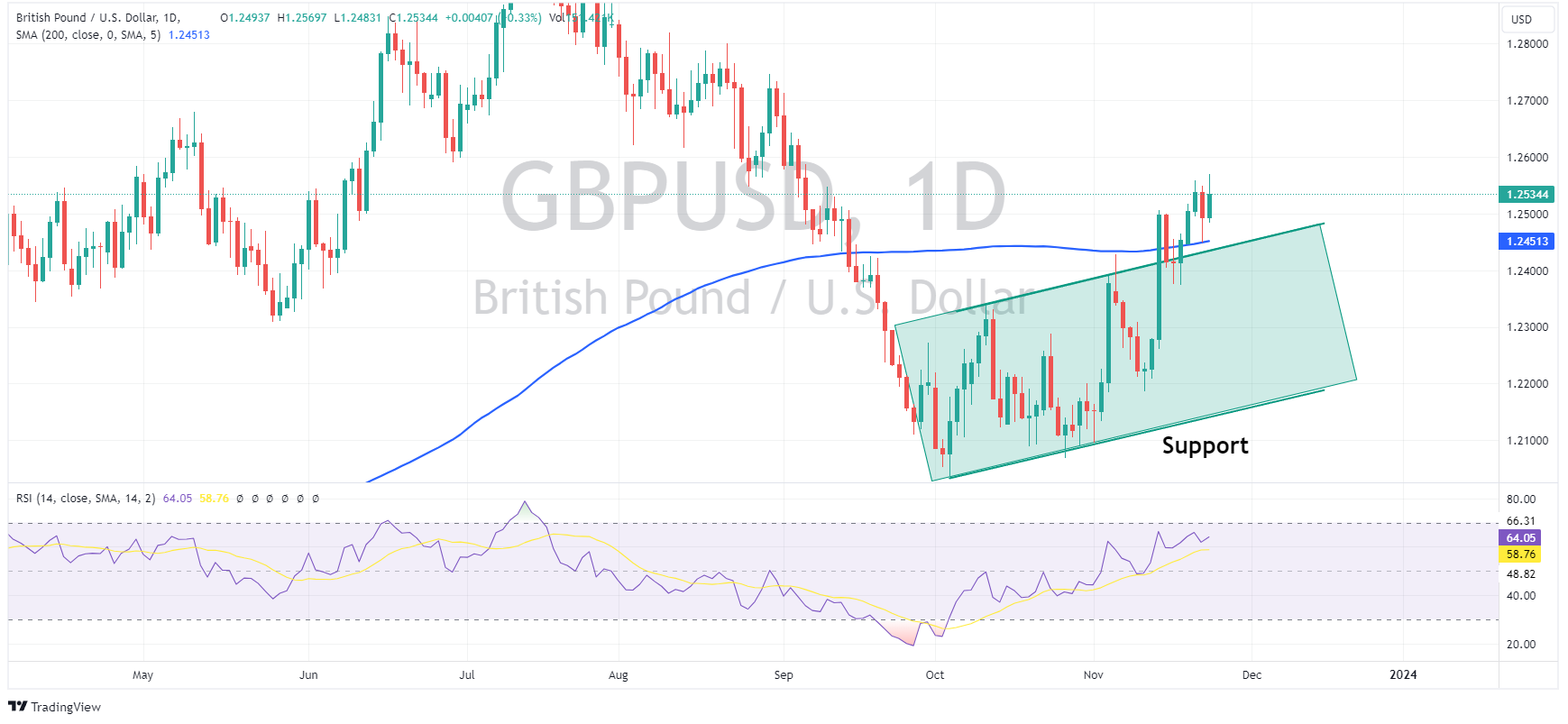

GBPUSD extended on its mid-week bounce and made further progress above 1.2500 after UK manufacturing and services PMI figures beat forecasts.

Source:TradingView.com

USDJPY ended flat for the session but not before a sharp dip reversed following a bounce off support at 149.00 and seeing the pair again settle above 149.50.

Source:TradingView.com

Ahead on Fridays , US traders will be mostly offline meaning another likely low volume session, we do have Manufacturing and Services PMI figures out of the US later today though.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

The Week Ahead – Charts to watch EURUSD, Crude Oil, Gold

Global markets enter the new week in a risk on tone with as market participants are positioning for no more rate hikes out of the Federal Reserve and pricing in cuts from Q2 2024. In last week’s low volatility, holiday shortened week this translated to a steady rise in equities (DOW hitting 3-month highs), a steady decline in the US dollar (DXY h...

November 27, 2023Read More >Previous Article

APAC Open – Equites and USD up, Gold down, Oil takes a wild ride.

US equities continued to climb in a broad rally ahead of the Thanksgiving break I Wednesdays session with the Dow Jones index up almost 200 points...

November 23, 2023Read More >Please share your location to continue.

Check our help guide for more info.