- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Forex

- FX Analysis – Fed pivot bets to be tested this week

News & analysisFX markets enter the new year with a continuing backdrop of a weaker USD as traders bet on a Fed pivot in the first half of the year. That narrative could be tested later in the week with some key US manufacturing and employment data, including the monthly Non-farm payrolls.

Key levels look to be tested this week in different FX pairs with AUDUSD and Gold both being interesting examples.

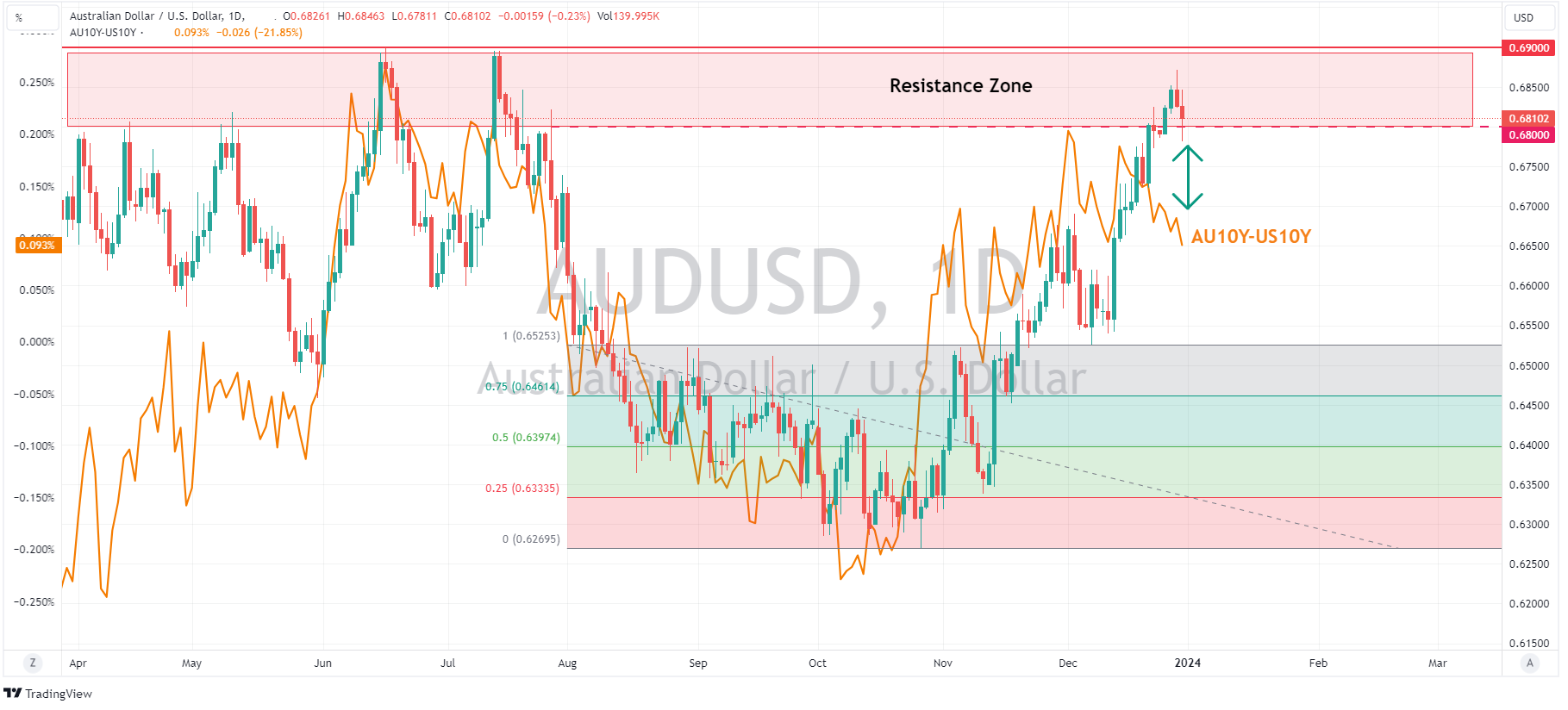

AUDUSD – Gone too far, too fast?

AUSUSD has had a stellar run since late October, benefitting from the risk-on environment and following equity markets higher. A weaker USD and falling US yields as traders’ position for a Fed pivot also being a strong tailwind. AUDUSD is now sitting in the 2023 “resistance zone” where upward momentum has faltered previously. Also of note is an extreme overbought signal from the daily RSI and a growing gap between the AUDUSD price and the AU 10-year – US 10-year yield differential. Combined, these three factors could see AUDUSD upside capped for now, this week’s Non-Farm payroll will be the main figure to watch, a strong report could see traders pare back somewhat on their Fed pivot bets, pushing this pair lower.

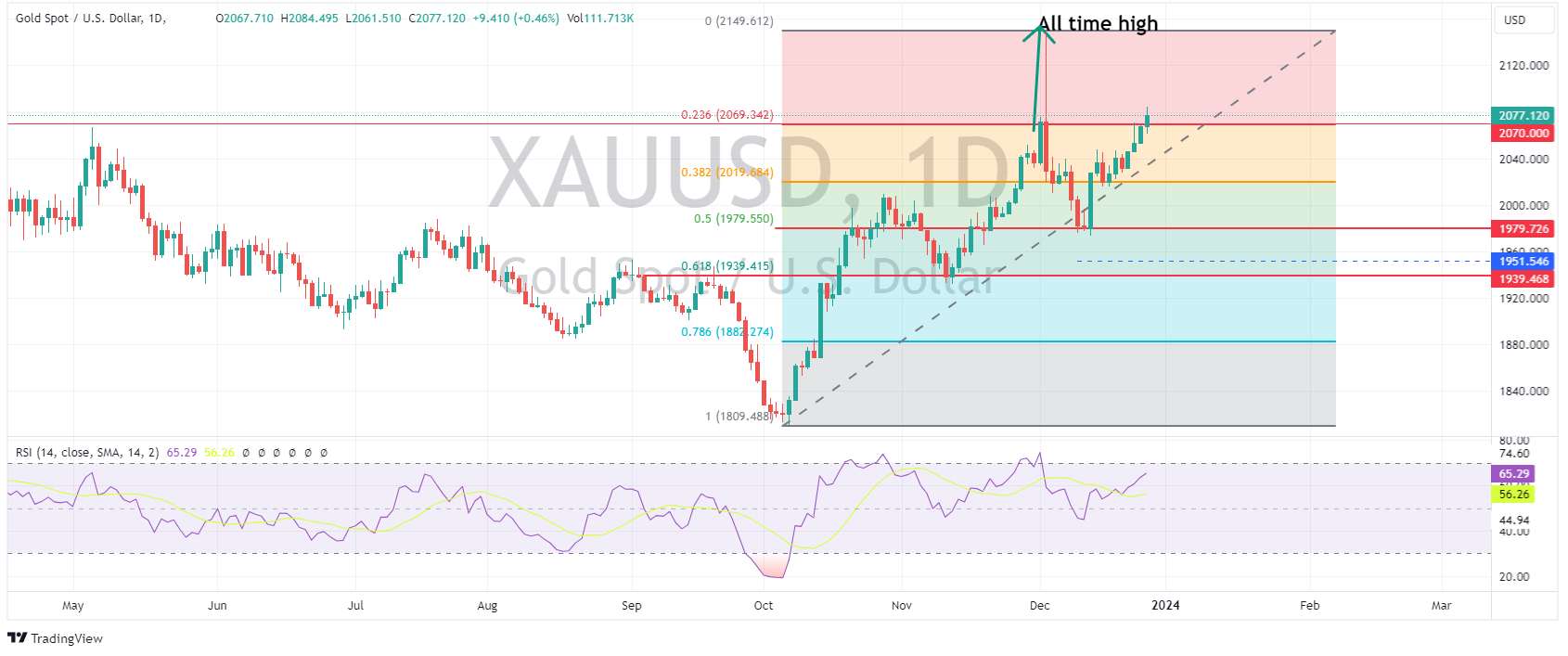

XAUUSD – Gold

XAUUSD broke the resistance level at 2070 USD an ounce, but the bulls were unable to establish it as support and the gold price quickly retraced back below. Currently XAUSD is again flirting with this key level, where the bulls and the bears have been fighting it out. 2070 remains the level to watch this week, with US data that could certainly move yields and the USD , another push through and a hold as support could see gold make another attempt at all-time highs, a hold as resistance and the gold bull run could be over for now.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Tesla announces Q4 2023 deliveries and confirms the date for earnings

Tesla Inc. (NASDAQ: TSLA) reported the latest delivery numbers for Q4 2023 on Tuesday. World’s largest electric vehicle company produced around 495k cars during the quarter. Deliveries reached 484k. The company produced a total of 1.85 million vehicles last year – up by 35% year-over-year. Total deliveries reached 1.81 million – up b...

January 3, 2024Read More >Previous Article

Market Analysis – Gold, USDCHF, Crude Oil

Wednesday’s session saw another drift higher in equities with volumes still in holiday mode and few major catalysts to drive market action. There...

December 28, 2023Read More >Please share your location to continue.

Check our help guide for more info.