- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Forex

- The Week Ahead – Volatility set to return with FOMC, BoE and NFP ahead

- Home

- News & analysis

- Forex

- The Week Ahead – Volatility set to return with FOMC, BoE and NFP ahead

News & analysisNews & analysis

News & analysisNews & analysisThe Week Ahead – Volatility set to return with FOMC, BoE and NFP ahead

29 January 2024 By Lachlan MeakinFX traders have a bumper week of major economic announcements to navigate, with markets in a holding pattern awaiting the pivotal January Federal Reserve meeting, adding to that a Bank of England policy meeting, CPI readings out of Australia and Europe topped off by the US non-farm employment report.

The Charts to Watch:

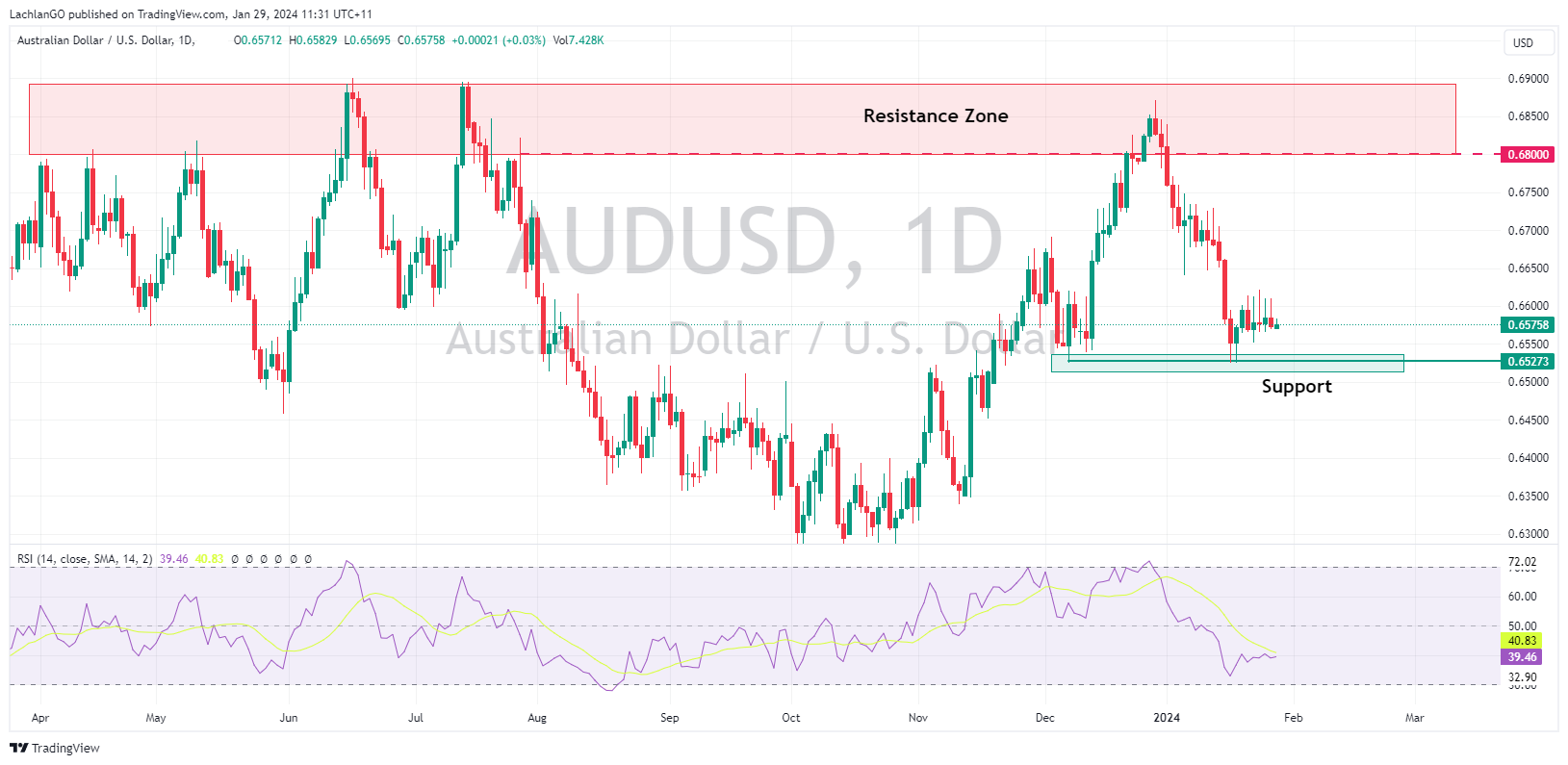

AUDUSD – Aussie CPI and Chinese manufacturing PMI

Since hitting a cycle low of 0.6525 and finding support at the December lows on January 17 AUDUSD has traded in a tight range between that support and 0.66 where multiple attempts to push higher have been rebuffed.

This week’s data looks set to test that range, starting with Aussie CPI and to a lesser extent a Chinese manufacturing PMI on Wednesday. 0.66 will be the level to watch if we get a hot CPI reading, the support at 0.6525 to the downside if there is a cooler than expected reading.

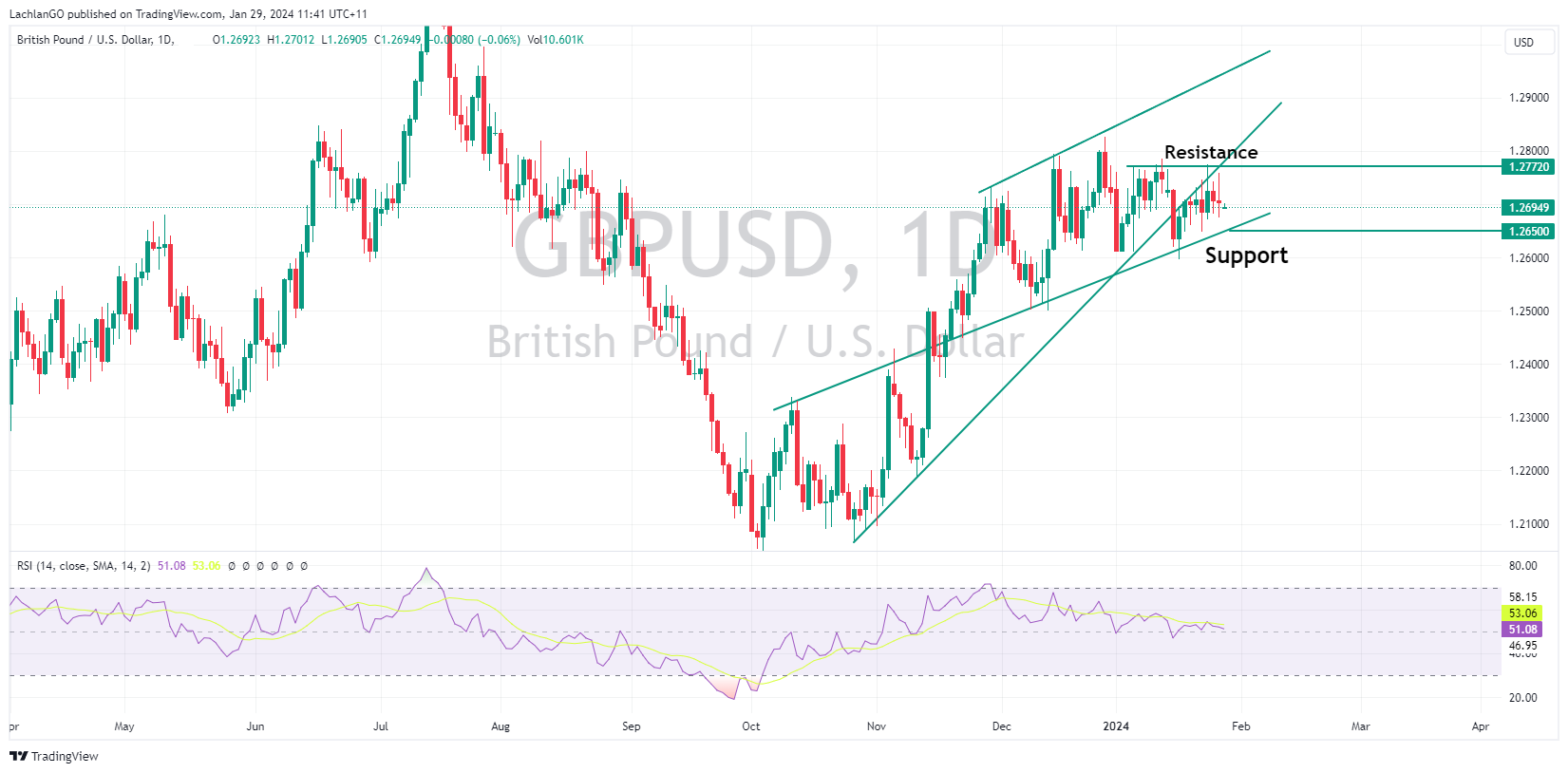

GBPUSD – Bank of England policy meeting

Cable has also spent the last week chopping around in a tight range, GBPUSD price action has been contained in a myriad of technical levels with resistance to the upside at 1.27720 and support at the lower 2024 trendline around 1.2650.

At this weeks Bank of England meeting, the central bank is expected to gold rates steady but is will be the accompanying statement and presser where traders will look for clues as to when the bank may start cutting rates that will see FX markets re-price.

US Dollar Index (DXY) – FOMC and NFP ahead

DXY comes off a choppy week with a pivotal FOMC meeting on Thursday and the always market moving NFP on Friday to get things moving.

The 2024 advance in DXY has been capped by resistance at the 200-day moving average along with the July lows-October highs 50% fib level at 103.55. The Fed is widely expected to hold rates steady at this meeting, with futures only pricing in a 2% chance of a cut, but it will be the messaging regarding the March meeting (where there is a 50-50 chance of a cut) that should see some volatility in the USD as markets re-price those odds. 103.55 will be the level to watch for the next move in DXY with a break above or below possibly signaling the next trend in DXY.

The weeks full calendar at the link below:

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Nucor Q4 2023 results exceed expectations

The largest steel producer company in the United States, Nucor Corporation (NYSE: NUE), announced the latest financial results after the market closed in Wall Street on Monday. The company achieved revenue of $7.705 billion in the fourth quarter of last year, above analyst estimate of $7.635 billion. Earnings per share was reported at $3.16, ...

January 30, 2024Read More >Previous Article

American Express sets a new full year revenue record, raises outlook – the stock is up

American Express Company (NYSE: AXP) announced fourth quarter of 2023 and full year financial results before the market opened in the US on Friday, en...

January 29, 2024Read More >Please share your location to continue.

Check our help guide for more info.