- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Geopolitical Events

- The Dalian Port – “China’s Coal Ban”

- The port would cap the overall coal imports for 2019.

- Other major ports elsewhere in China have delayed clearing times.

- The delayed cargoes would not be included in the 12 million tonnes under the 2019 quota.

- Dalian, Bayuquan, Panjin, Dandong and Beiliang are the five harbours overseen by Dalian customs which will not allow Australian coal to clear through customs.

- Imports from Russia and Indonesia will not be affected.

- The goals are to better safeguard the legal rights and interests of Chinese importers and to protect the environment.

- Customs were inspecting and testing coal imports for safety and quality

- Beijing has been trying to restrict imports of coal more generally to support domestic prices.

News & analysis

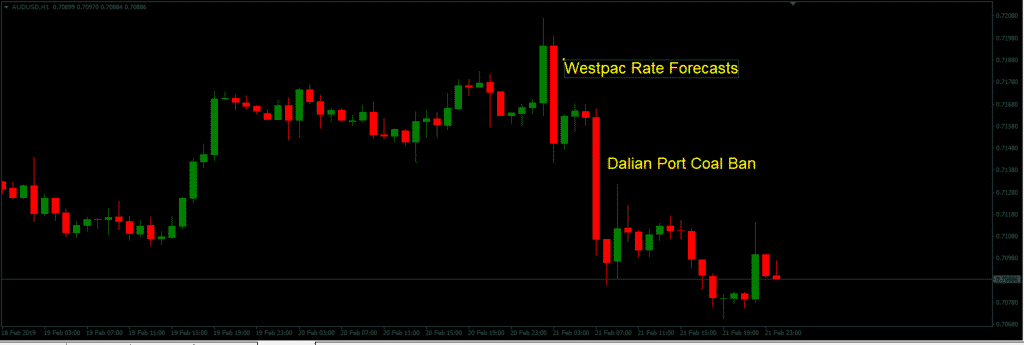

Wednesday was the bearer of bad news for Australia. Despite the buoyant employment report which briefly lifted its local currency, the Australian dollar plummeted on Westpac’s rate cut forecasts and the news of China’s Coal Ban.

Simmering diplomatic tensions could be the trigger behind the ban. The news that the Dalian port in China has blocked imports from Australia emerged on Wednesday. It was also reported:

Beijing and Canberra’s clash back in 2017 over cybersecurity and China’s influence in Pacific Island nations were already showing signs of Australia’s deteriorating ties with China. However, tensions increased again last month when Australia withdrew the visa of a prominent Chinese businessman, just months after barring Huawei from supplying equipment to its 5G broadband network.

At the moment, the comments from China are:

The coal ban put additional pressure on the Australian dollar which plummeted against major currencies. The AUDUSD pair lost its recent bullish momentum and dropped to 0.70 level.

AUDUSD (Hourly Chart)

Source: GO MT4Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#GeoPolitical #GeoPolitics #Markets #CurrenciesNext Article

Trade Deadline Delayed – “Substantial Progress”

Monday started on a buoyant note as the weekend negotiations between the US and the Chinese officials on structural issues, including intellectual property protection, technology transfer, agriculture among others were productive which encouraged President Trump to extend the 1st March deadline. Asian stocks and trade-sensitive currencies l...

February 25, 2019Read More >Previous Article

Updated Product Disclosure Statement (PDS)

GO Markets Pty Ltd updated its Product Disclosure Statement (PDS). View our updated Product Disclosure Statement. The changes made to the PDS mainly ...

February 20, 2019Read More >Please share your location to continue.

Check our help guide for more info.