- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Oil, Metals, Soft Commodities

- Oil – Can Basic Economics Be Responsible For An 11% Decline?

- Home

- News & analysis

- Oil, Metals, Soft Commodities

- Oil – Can Basic Economics Be Responsible For An 11% Decline?

News & analysisNews & analysis

News & analysisNews & analysis

On the back of what has been a pretty punishing month for Oil, now trading below $70 a barrel for WTI crude, we’re going to take a look at Oil, the fundamental drivers behind the price swings and what the future could hold for the Oil markets. For the sake of clarity, this article will be looking exclusively at WTI Crude.

So what drove the close to 11% decline in Oil? What has stalled fund managers and market voices calling for oil to revisit $100 a barrel? Well, mostly it is a confluence of reasons, some rooted in basic economics and one fear-based reaction on the back of the “stock market rout” as it has been dubbed. Now although we are going to be focusing on some of the reasons for this decline, these are not specific to this sell-off alone, these are fundamental drivers in the price of Oil markets.

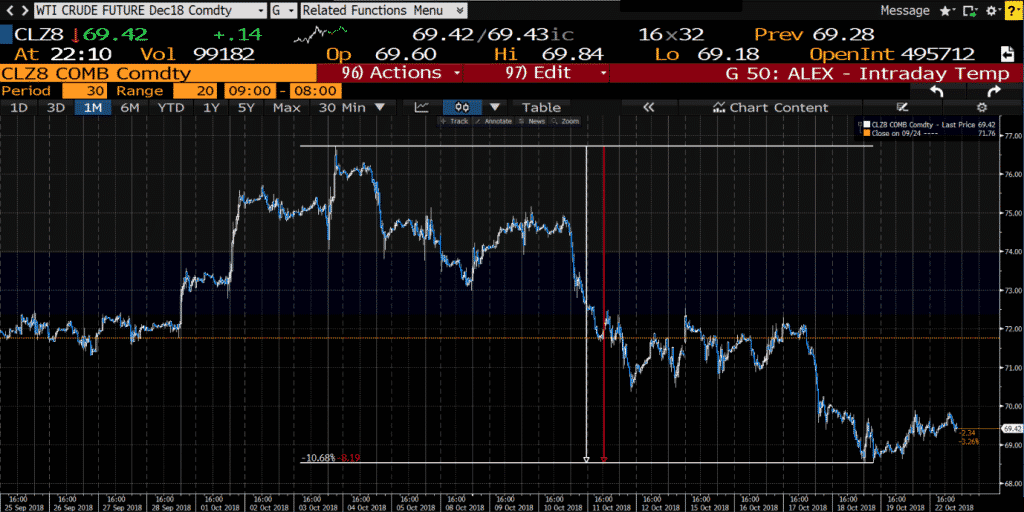

WTI Crude December Contract – October sell of from $76.72 to low of $68.53

One of the reasons for the sell-off is that of a supply jump. U.S. crude stockpiles rose by 22.3 million barrels, which is the most substantial increase since 2015. This factor comes down to basic economics. With a boost in supply and the more something is readily available; naturally, the associated value will be lower, and this is what is weighing here.

However, the story doesn’t end there. It can also provide an insight into how the general populous is leaning as an increase in stockpiles means that the current supply level is too much for current demand. For example, it could potentially be an indicator in sentiment, companies shifting to renewables, and more and more people moving to electric vehicles, etc. All of these factors would impact the appetite for oil which then leads to an oversupply, subsequently causing a tumble in price as we’ve seen of late.

One of the other factors for Crude also stems from this balancing act of supply and demand. With Crude spiking to highs not long seen, it sparked some fear that the high prices would weigh on demand for the asset, causing investors to be more cautious and to close out long positions. Since then both OPEC and the International Energy Agency have both revised down the oil growth forecasts.

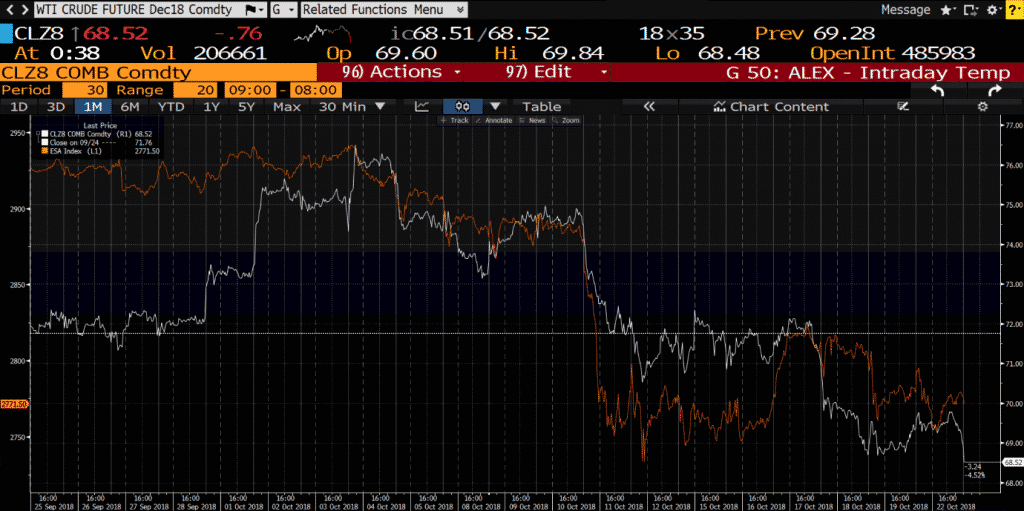

WTI December Contract and S&P Overlay – During the “stock rout”

The so-called “stock market rout” also took its toll on the Oil price, with investors dumping risk assets and moving into safe-haven assets, i.e., bonds, gold, etc. this helped to perpetuate Crude’s slide and saw it shed a further 5% of its value.

So, with WTI Crude oil currently, at the time or writing sitting at lows of $66.70 a barrel, what lies ahead for Oil? With continued sell-offs seen in equities markets and steadily more risk-off sentiment throughout the market, we could continue to see Oil slide. However, as markets tend to jump between risk-on & risk-off on a daily, sometimes more frequent basis, we can expect to see plenty of activity in the Oil market, and this will undoubtedly be one of our watchlist staples.

For more information or any questions feel free to reach out to me on twitter

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives, including Oil Commodity trading, carries a high level of risk.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#SpotGold #SpotSilver #GoldTrading #SilverTrading #SpotWTICrudeOil #WTICrudeOil #SpotBrentCrudeOil #BrentCrudeOil #OilTrading #Commodities #CommoditiesTrading #CommodityMarket #CommodityTradingNext Article

Monthly Updates

Stock Markets: Wall Street Bleeds This Year’s Gains October took the equities markets on a rollercoaster ride. Investors’ sentiment is vulnerable as a series of bearish facts engulfed the markets. Various headwinds are hitting the stock markets and reviving fears creating some panic-selling. The presumption that a correction is due soon is ...

October 31, 2018Read More >Previous Article

Gold Making Waves – Where Will Price Settle?

Creating New Monthly Highs Yesterday gold reached a three-month high of $1,239.68 which, as we head into the final quarter of 2018, is once again sti...

October 24, 2018Read More >Please share your location to continue.

Check our help guide for more info.