- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Shares and Indices

- Accenture latest results announced

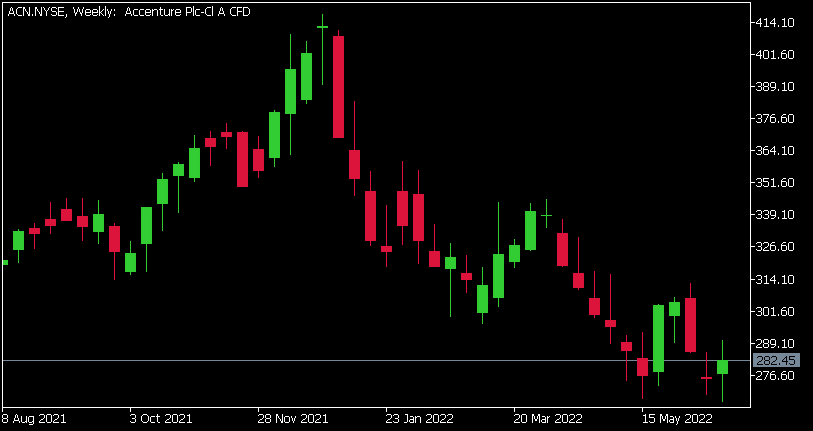

- 1 Month -3.00%

- 3 Month -13.07%

- Year-to-date -31.78%

- 1 Year -3.01%

- Deutsche Bank $364

- Cowen & Co. $330

- Baird $340

- Morgan Stanley $390

- RBC Capital $435

- Goldman Sachs $386

- Barclays $455

News & analysisAccenture (ACN) reported its latest financial results before the market open in the US on Thursday.

The Irish-American professional services company reported revenue of $16.159 billion for the third quarter of fiscal 2022 vs. $16.04 billion expected.

Earnings per share missed analyst expectations for the quarter at $2.79 per share vs. $2.86 per share estimate.

”Our very strong financial results for the third quarter reflect continued broad-based demand across markets, services, and industries, and the continued recognition of the outstanding talent of our 710,000 people. We continue to gain significant market share, and our services have never been more relevant as our clients turn to us as the trusted partner for the solutions they need to accelerate growth and become more resilient and efficient,” Julie Sweet, CEO of the company said in a press release after the earnings announcement.

Accenture (ACN) chart

Shares of Accenture were down by around 1% during the trading day on Thursday at $282.45 per share.

Here is how the stock has performed in the past year:

Accenture price targets

Accenture is the 52nd largest company in the world with a market cap of $179.21 billion.

You can trade Accenture (ACN) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Accenture, TradingView, MarketWatch, Benzinga, CompaniesMarketCap

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

Lithium darlings fall to 6 months lows.

Two junior lithium companies, Core Lithium, (CXO) and Lake Resources, (LKE) have seen aggressive sell offs after motoric rises in the last few years. The Backstory Lithium stocks companies had seen a momentous rise in the past 3 years largely on the back of the push towards renewable energy and electric vehicles which require lithium for th...

June 24, 2022Read More >Previous Article

Bitcoin teetering above key $20,000 level

Bitcoin and other cryptocurrencies have seen their prices decline rapidly in recent times as inflation has wreaked havoc across the market. The capitu...

June 22, 2022Read More >Please share your location to continue.

Check our help guide for more info.