- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Shares and Indices

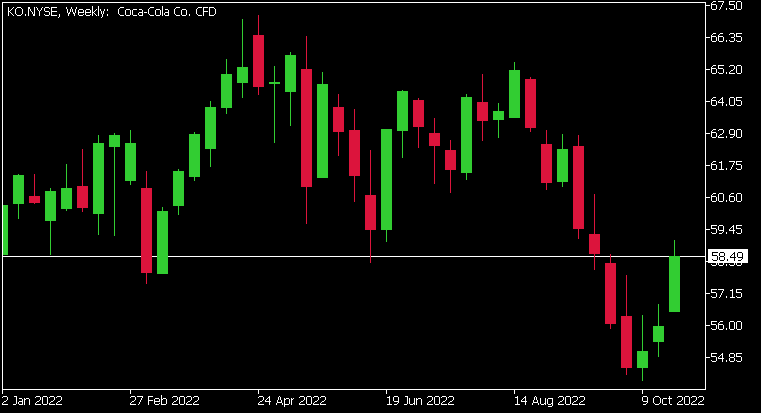

- Coca-Cola tops Wall Street Q3 estimates

- 1 month: +3.39%

- 3 months: -7.78%

- Year-to-date: -1.55%

- 1 year: +7.01%

- Deutsche Bank: $59

- Wedbush: $63

- Morgan Stanley: $68

- Credit Suisse: $64

- Wells Fargo: $66

- HSBC: $76

- UBS: $72

- JP Morgan: $70

News & analysisCoca-Cola tops Wall Street Q3 estimates

The Coca-Cola Company (NYSE:KO) reported Q3 financial results before the market open on Tuesday.

The US beverage company posted solid results for the quarter, beating Wall Street analyst estimates for both revenue and earnings per share (EPS).

Revenue reported at $11.063 billion (up by 10% year-over-year) vs. $10.52 billion expected.

EPS at $0.69 per share (up by 7% year-over-year) vs. $0.637 per share estimate.

”Our strong capabilities and consumer insights continue to help us win in the marketplace,” Coca-Cola CEO, James Quincey said in a press release.

”Our business is resilient amidst a dynamic operating and macroeconomic environment. We are investing in our strong portfolio of brands, which is a cornerstone of our ability to deliver long-term value for our stakeholders,” Quincey added.

Shares of Coca-Cola were up by around 1% on Tuesday, trading at $58.49 a share.

Stock performance

Coca-Cola price targets

Coca-Cola is the 30th largest company in the world with a market cap of $251.88 billion.

You can trade The Coca-Cola Company (NYSE:KO) and many other stocks from the NYSE, NASDAQ, HKEX, ASX, LSE and DE with GO Markets as a Share CFD.

Sources: The Coca-Cola Company, TradingView, MetaTrader 5, Benzinga, CompaniesMarketCap

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

US stocks rally during cash session, futures down after market as Microsoft and Alphabet earnings disappoint.

US equities markets had another strong session as a flurry of weaker than expected housing and consumer confidence figures kept the Fed pivot dream alive. Growth and tech stocks outperformed with all major US indices finishing well in the green ahead of major earnings releases after the bell. The big movers after hours are Microsoft (MSFT) a...

October 26, 2022Read More >Previous Article

Pound gearing up for a reversal?

The UK has had to deal with recessionary fears, sky high energy prices, a cost-of-living crisis, and a breakdown in political leadership. This has cau...

October 25, 2022Read More >Please share your location to continue.

Check our help guide for more info.