- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Shares and Indices

- Tesla sets a new record

- 18,672 Model S/X

- 325,158 Model 3/Y

- 1 month: -1.84%

- 3 month: +71%

- Year-to-date: -24.70%

- 1 year: +65%

- JP Morgan: $153

- Piper Sandler: $340

- Deutsche Bank: $400

- Wolfe Research: $360

- Jefferies: $350

- Morgan Stanley: $383

- Wedbush: $360

News & analysisTesla Inc. (NASDAQ: TSLA) reported its Q3 2022 delivery numbers on Sunday.

World’s largest automaker delivered a total of 343,830 cars (up by 42.49% year-over-year) in the third quarter – setting a new quarterly record.

The deliveries in Q3 consisted of:

The automaker produced 365,923 vehicles in Q3.

”Historically, our delivery volumes have skewed towards the end of each quarter due to regional batch building of cars. As our production volumes continue to grow, it is becoming increasingly challenging to secure vehicle transportation capacity and at a reasonable cost during these peak logistics weeks. In Q3, we began transitioning to a more even regional mix of vehicle builds each week, which led to an increase in cars in transit at the end of the quarter. These cars have been ordered and will be delivered to customers upon arrival at their destination,” the company said in the press release.

Tesla will report its Q3 financial results after the closing bell on Wednesday, October 19, 2022.

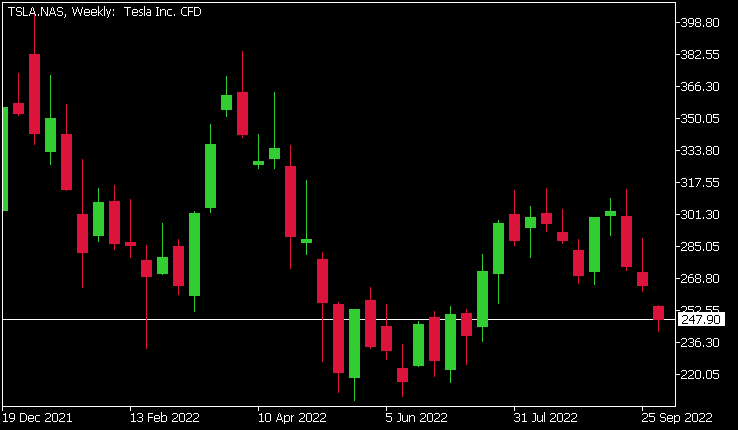

Tesla Inc. (NASDAQ: TSLA) chart

Shares of Tesla were down by around 6% on Monday at $247.90 per share.

Stock performance

Tesla price targets

Tesla is the 6th largest company in the world and with a total market cap of $825.19 billion.

You can trade Tesla Inc. (NASDAQ: TSLA) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Tesla Inc., GO Markets MT5, Benzinga, CompaniesMarketCap

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

Stocks begin Q4 with a bang as Fed pivot dreams see yields lower

US stocks started with a Q4 bounce after a dismal Q3 helped by softer PMI data and perhaps extreme oversold technical conditions. Bond yields drifting lower as the market priced in a possible and highly speculative Fed pivot also bolstered equities and other risk assets. One big exception was Tesla (TSLA) cratering over 8% on a big miss on de...

October 4, 2022Read More >Previous Article

Optimising trading strategies by using multiple timeframe analysis

Many trading strategies utilise technical analysis to predict price patterns and for entries and exits. These strategies revolve often begin with the ...

October 3, 2022Read More >Please share your location to continue.

Check our help guide for more info.