- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Shares and Indices

- The Week Ahead – Stock Markets

News & analysisAfter weeks of relentless selling the market provided a decent rally to end the week. The S&P 500 saw a nice jump rising 3.44% during Friday’s trading session. This may provide investors and traders some positive momentum for the beginning of the week. Whilst the market is still holding a down trend, it was able to bounce of the bottom of the downward channel. Similar moves were seen on the NASDAQ and the Dow Jones as well as other global indices.

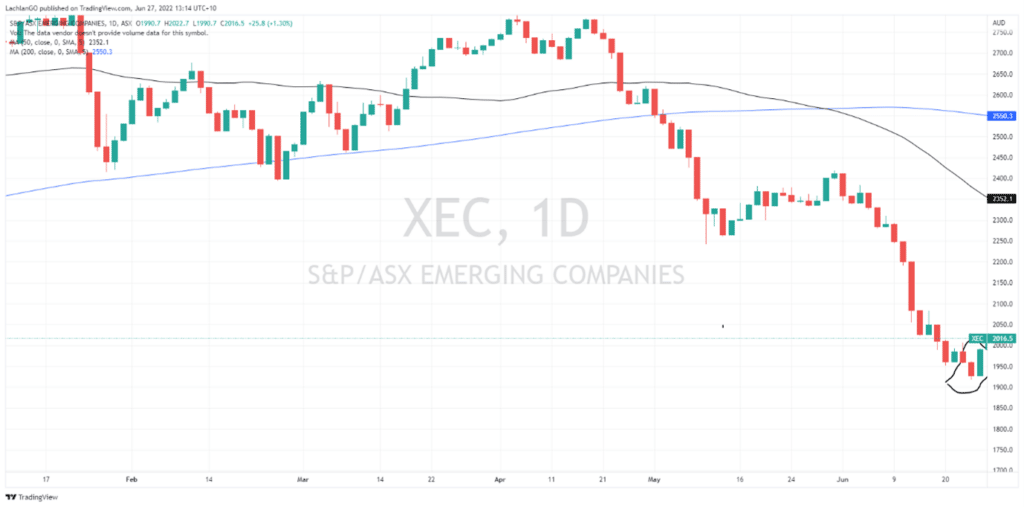

In Australia, the ASX 200 was not quite as productive as the American indices in its Friday session. The Aussie market may catch some of the gains from the Friday US session in the early part of the week. Inflationary pressures have eased somewhat with hard commodities such as Oil and Natural Gas have pulled back from their recent highs. This has also supported leading to money flowing back into growth markets. Small Cap companies had an important day as the market rallied, lifting 3.31%. This marks the strongest day since July 2020 and some much-needed relief after a brutal sell off.

As the end of the financial year approaches, tax selling should be expected on the market. Furthermore, it is a time where funds and fixed weight portfolios rebalance their assets.

Stocks in the spotlight

Anteris Technologies, (AVR)

The Bio/Medi Tech company saw great growth in its share price during the last week as it climbed more than 33%. The company announced a 6-month update of its first cohort of 5 patients using its DurAVR 3D Single piece aortic valve. The results showed an 86% improvement in Haemodynamic/normal blood flows since the product was implanted into patients. The company’s share price rose to $28.30 its highest level since 2019 om the back of these results. With a relatively small float the share price can be quite volatile and have a high daily range.

BlueScope Steel (BSL)

Blue Scope Steele has seen a large drop in its share price sitting just above its long-term support. The large Steele manufacturer has seen as the market reacts to an increase in costs for the manufacturing and construction sectors. The share price has been trending downward after peaking in August 2021.

Woolworths (WOW)

Consumer staple Woolworth’s had a strong rally as its share price rose 7.26% to $35.46 after slipping to as low as $32.60 in the middle of June. The company’s share price has held up relatively well during the recent volatility as inflation and geopolitical pressure have seen much of the market slip.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

Nike tops Wall Street estimates

Nike Inc. (NKE) reported its latest financial results for its fiscal 2022 fourth quarter after the closing bell in the US on Monday. World’s largest sporting goods company topped both revenue and earnings per share estimates. The company reported revenue of $12.234 billion for the quarter vs. $12.061 billion expected. Earnings per share rep...

June 28, 2022Read More >Previous Article

Lithium darlings fall to 6 months lows.

Two junior lithium companies, Core Lithium, (CXO) and Lake Resources, (LKE) have seen aggressive sell offs after motoric rises in the last few years...

June 24, 2022Read More >Please share your location to continue.

Check our help guide for more info.