市场资讯及洞察

Your complete day-by-day guide to Australian medal chances and market-moving moments during the Milano Cortina Winter Olympics.

Quick Facts

- Opening Ceremony: 6:00 am, 7 February AEDT (8:00 pm, 6 February Milan).

- Prime viewing window: 4:00 am to 2:00 pm AEDT daily coincides with pre-market and ASX trading hours.

- Medal ceremonies: Typically run from 6:00 am to 7:00 am AEDT. Perfect for pre-market position adjustments.

- 53 Australian athletes competing: The second-largest Australian Winter Olympic team ever, with 10 genuine medal contenders.

Opening Ceremony + first medals - Saturday, February 7

Opening Ceremony at breakfast time, then the first gold medal awarded in primetime on Saturday.

Harry Laidlaw represents Australia in the Men's Downhill, the Games' first Gold medal event, while cross-country skiers Rosie Fordham and Phoebe Cridland compete late Saturday night.

This same-day pairing of ceremony and first medals creates maximum media saturation, with a full weekend news cycle processing before Monday's ASX open.

Key events

- Opening Ceremony: 6:00 am AEDT

- Men's Downhill Final (first gold medal of the games): 9:30 pm AEDT

- Women's 10km + 10km Skiathlon: 11:00 pm AEDT

For traders

- NEC (Nine Entertainment): Double viewership event. Opening Ceremony 6:00 am Saturday, lines up for the peak morning TV audience. First medals at 9:30 pm are a primetime Saturday night.

- Italian equities (FTSE MIB): Historically underperform during domestic Olympics. Turin 2006 saw -2.1% during the Games.

- STLA (Stellantis): ESG headline risk if environmental groups target the ceremony.

- Apparel sponsor arbitrage: If a non-favourite wins Men's Downhill, their sponsor sees average +2.3% pop (PyeongChang 2018, Beijing 2022 data).

First medals continue - Sunday, February 8

The medal rush continues on Sunday as 19-year-old Valentino Guseli takes flight in Men's Snowboard Big Air, offering Australia an early podium chance in one of the Games' most visually spectacular events.

With the ceremony glow still fresh, Guseli's performance sets the tone for Australia's snowboard campaign and could influence Monday's ASX open positioning for action sports stocks.

Key events

- Men's Snowboard Big Air Final (Valentino Guseli): 5:30 am AEDT

- Women's Normal Hill Individual Final: 5:57 am AEDT

For traders

- MNST (Monster Beverage): Action sports sponsor, benefits from multi-athlete Olympic presence.

- FL (Foot Locker), ZUMZ (Zumiez): Youth retail action sports exposure. Guseli gold could create a temporary buzz.

Monday, February 9

A rare quiet day in Australia's Olympic calendar. No Australian medal events are scheduled, making this a pure observation day for traders.

Monitor how Guseli's weekend result is processed through Monday's ASX open, and position ahead of Tuesday's Coady showdown.

Tuesday, February 10

Tess Coady attempts to upgrade her 2022 bronze to gold in Women's Snowboard Big Air. The Tuesday morning timing offers traders a potential pre-market positioning window, though Coady's modest mainstream profile limits exposure compared to the moguls stars on the following day.

Key events

- Women's Snowboard Big Air Final: 5:30 am AEDT

For traders

- FL (Foot Locker), ZUMZ (Zumiez): Youth retail. Coady gold could create a temporary buzz.

- MNST (Monster Beverage): Less volatile, general action sports sponsor.

Wednesday, February 11

The calm before Jakara Anthony. No Australian events on Wednesday means traders spend the day positioning for the biggest moment of the Games: Anthony's moguls final just past midnight.

Moguls Finals - Thursday, February 12

The biggest moment of the Games for Australia arrives just after midnight on Wednesday with Jakara Anthony defending her Olympic crown in the Women's Moguls Final.

As the nation's brightest gold medal hope with 26 World Cup victories, Anthony's 12:15 am performance is the single highest-impact potential event for NEC and VFC stocks across the entire Olympic fortnight.

Matt Graham also chases his first Olympic gold at 10:15 pm Thursday night. Both events carry high NEC and VFC volatility potential.

Key events

- Women's Moguls Final (Jakara Anthony): 12:15 am AEDT

- Men's Moguls Final (Matt Graham): 10:15 pm AEDT

For traders

- NEC (Nine Entertainment): Monitor overnight results and viewership for Thursday open direction.

- VFC (VF Corp/North Face): Sponsors both athletes. A double medal could bring a larger impact.

- Defending champion volatility: An Anthony loss could create higher emotional swings.

- Social sentiment: Track Twitter/Google Trends Thursday morning to gauge the magnitude of Anthony’s performance.

Friday, February 13

Snowboard cross takes centre stage with two Australian medal chances bookending Friday's trading day.

Adam Lambert's overnight final sets the morning open, while Josie Baff's evening showdown takes the Aus prime time slot.

Key events

- Men's Snowboard Cross Finals: 12:56 am AEDT

- Women's Snowboard Cross Finals: 7:30 pm AEDT

For traders

- NEC sentiment gauge: If Lambert medals Fri morning and Graham medaled Thu night, it could create positive momentum.

Jakara Anthony competes - Saturday, February 14

Jakara Anthony goes for the double in Saturday night's Women's Dual Moguls Final.

If she claims gold Thursday and again here, the "double gold Jakara" narrative writes itself, offering geometric rather than linear media value.

Key events

- Women's Dual Moguls Final (Jakara Anthony): 9:46 pm AEDT

For traders

- NEC narrative power: "Double gold Jakara" could draw in more casual viewers.

- If Anthony silver/bronze Thu: Redemption story potential.

- Weekend timing: Saturday night result = Monday ASX gap.

- Format risk: Monitor qualifying rounds; if margins are greater than 1 second (blowouts), engagement could drop.

Sunday, February 15

A quiet Sunday offers redemption arcs and low-impact action. Brendan Corey's morning short track effort carries minimal stock relevance, while Matt Graham's late-night dual moguls final provides a second medal chance after Friday's traditional event.

Key events

- Short Track Speed Skating 1500m Final: 8:42 am AEDT

- Men's Dual Moguls Final: 9:46 pm AEDT

For traders

- VFC second opportunity: If Graham misses on Friday’s moguls, dual moguls redemption is possible.

Monday, February 16

Harry Laidlaw returns to the slopes for late Monday night slalom action, but alpine skiing holds minimal sway over Australian audiences.

This is a placeholder day in the trading calendar, with markets more focused on digesting the weekend moguls results and positioning for Tuesday's monobob final.

Key events

- Men's Slalom: 11:00 pm AEDT

Bree Walker competes - Tuesday, February 17

Bree Walker could make Olympic history as she competes in the Women's Monobob Final, chasing Australia's first-ever bobsleigh medal.

While the narrative is powerful, the commercial reality is that bobsleigh has no retail sponsor footprint, limiting direct stock plays.

Key events

- Pairs Figure Skating Final: 6:00 am AEDT

- Women's Monobob Final: 7:06 am AEDT

For traders

- NEC: Bobsleigh historically gets low ratings, but a Walker gold could provide value as an Australian-first.

Wednesday, February 18

Veterans Laura Peel and Danielle Scott take centre stage on Wednesday night in an event with proud Australian history (2 golds since 2002). However, aerials' niche appeal and late-night timing may limit market impact.

Key events

- Women's Aerials Final: 9:30 pm AEDT

- Women's Slalom Final: 11:30 pm AEDT

For traders

- NEC: If either medals, potential for a small sentiment boost.

- VFC exposure: Limited potential as aerials athletes are less commercially developed

Thursday, February 19

Thursday night aerials effort is a low-impact finale event with minimal medal expectation for Australian Reilly Flanagan, and even less market relevance.

Scotty James' Saturday halfpipe showdown is the real conversation as the games begin winding down, although a medal run from Flanagan could create an underdog narrative.

Key events

- Men's Aerials Final: 9:30 pm AEDT

Friday, February 20

The final calm before Scotty James' legacy-defining Saturday. Set up day for James' 5:30 am Saturday halfpipe final, the Games' last major potential volatility event for an Aussie athlete.

Scotty James competes - Saturday, February 21

Scotty James' legacy moment arrives Saturday morning. He’s represented Australia at five Olympics, with two medals and zero golds. This is his final chance and brings with it the Games' most emotionally charged event, and the last major trading catalyst before Monday's Closing Ceremony.

Key events

- Men's Snowboard Halfpipe Final (Scotty James): 5:30 am AEDT

- SkiMo Mixed Relay: 11:30 pm AEDT

For traders

- NEC: Potential weekend delays on price discovery. If James gold Saturday.

- NKE (Nike): Potential halo effect from gold via action sports lift.

- Guseli wildcard: Valentino is also competing (his second event after Big Air, Feb 8). A dual medal could create narrative amplification.

Sunday, February 22

Sixteen-year-old Indra Brown takes the Sunday morning spotlight in Women's Freeski Halfpipe, facing off against favourite Eileen Gu (CHN) in what could become a Gen-Z brand inflection point.

Key events

- Women's Freeski Halfpipe Final (Indra Brown): 5:30 am AEDT

- Two-Woman Bobsleigh Final: 7:05 am

For traders

- Mon-Tue watch: Monitor which brands announce Brown signings.

- MILN (Global X Millennials ETF): Action sports retailers, social platforms exposure for Gen Z.

Closing Ceremony - Monday, February 23

The curtain falls on Milano Cortina 2026 with Monday morning's Closing Ceremony, and history says this is where euphoria dies.

- Men's Ice Hockey Final (NHL Superstars): 12:10 am AEDT

- Closing Ceremony: 6:00 am AEDT

Markets to watch:

- French Alps 2030 rotation: Closing features handover to France.

- Australian medal count: If >4 medals (Beijing total), the government may increase 2030 winter sports funding.

- Ice Hockey Final: NHL players compete for the first time since 2014. Major US/Canada viewership means a potential CMCSA boost

%20(1).jpg)

声明:本文旨在整理公开市场信息、梳理逻辑框架,不构成任何投资建议、交易指引或收益承诺。所有引用数据均来自公开渠道,并已尽可能核实。请读者结合自身情况独立判断,审慎决策。

摘要:高位震荡新常态

进入2026年,黄金市场并未如部分预期般“冷却”,而是进入了高位、高波动的“再平衡”阶段。截至1月9日,现货黄金价格在4,454美元/盎司附近盘整,虽较2025年12月26日创下的历史高点(4,549.92美元/盎司)有约2.1%的回调,但仍稳固地站在历史性的价格高位 [1]。这一价格水平的背后,是2025年金价超过64%的惊人涨幅——这是自1979年以来最强劲的年度表现之一 [2]。

当前市场的核心特征并非单边趋势的延续,而是在多重因素交织下的剧烈波动。投资者正在同时交易三大核心主题:货币政策预期、地缘政治风险与市场资金流向。理解这三大驱动力,是把握当前黄金市场脉搏的关键。

货币政策与美元:预期比现实更重要

在高位区间,黄金对利率和美元的敏感度被显著放大。市场的焦点已从“美联储已经做了什么”转向“下一步可能做什么”。

美联储的微妙平衡:近期偏软的劳动力市场数据,一度点燃了市场对美联储提前或加速降息的预期,为黄金提供了支撑。然而,任何显示经济韧性的数据(如强劲的非农就业报告)都可能迅速逆转这一预期,导致金价承压。这种在“降息预期”与“更高更久利率”之间的快速切换,是当前市场高波动性的主要来源之一。

值得注意的是,美联储的领导层也将在2026年迎来变数。现任主席杰罗姆·鲍威尔的任期将于5月结束,市场普遍预期新任主席不太可能采取更为鹰派的政策立场,这为黄金的长期价值提供了潜在的政策底 [3]。

实际利率是理解这一逻辑的核心。作为一种无息资产,黄金的价格与实际利率(名义利率减去通胀预期)呈负相关。在当前降息周期的大背景下,即使降息步伐放缓,只要实际利率维持在低位,持有黄金的机会成本就相对较低,从而对其价格构成结构性支撑。

地缘政治与避险需求:风险溢价永久化

黄金作为“不确定性的定价工具”的角色在当前尤为凸显。牛津经济研究院的分析指出,地缘政治风险正从过去的“短暂冲击”演变为大宗商品定价的“永久性因素” [4]。

央行购金是这一趋势最直接的体现。中国人民银行已连续14个月增持黄金,截至2025年12月末,其黄金储备已达7,415万盎司 [5]。世界黄金协会的数据显示,全球央行在2025年持续净购入黄金,这股结构性的买盘力量为金价提供了坚实的底部支撑。

资金流向与市场结构:技术性因素的放大效应

除了宏观基本面,资金层面的技术性因素也在加剧市场波动。

指数再平衡:年初的彭博大宗商品指数(Bloomberg Commodity Index)年度权重调整,可能引发管理着数千亿美元的指数基金进行仓位调整,从而对包括黄金在内的贵金属价格造成短期扰动 [6]。

ETF持仓变化:全球最大的黄金ETF——SPDR Gold Trust(GLD)的持仓量变化是观察投资者情绪的重要窗口。数据显示,其持仓量在2025年底至2026年初维持在高位,表明投资者对黄金的配置需求依然旺盛 [7]。

高位获利了结:在经历了2025年的大幅上涨后,任何风吹草动都可能触发部分投资者的获利了结行为,这在短期内会放大价格的回调压力。

机构展望:谨慎乐观下的共识

尽管短期波动剧烈,但多家主流投行对2026年的黄金市场仍持谨慎乐观态度,普遍认为金价仍有上行空间,但高波动将是常态。

未来展望:两份关键数据与产业链传导

对于短期交易者而言,未来两周的两份美国经济数据将是关键的“波动性事件”:

美国12月非农就业报告 (NFP):1月9日(美东时间08:30)发布。市场将重点关注新增就业人数、失业率,以及更能反映通胀压力的平均时薪增速。数据的“喜忧参半”最容易引发市场剧烈震荡。

美国12月消费者价格指数 (CPI):1月13日(美东时间08:30)发布。除了总体CPI,市场将更关注剔除食品和能源的核心CPI以及服务业通胀,这些数据是判断美国通胀“粘性”和美联储降息空间的关键。

此外,金价的强势已经向上游产业链传导。以中国最大的黄金生产商紫金矿业为例,该公司预计2025年净利润将同比增长59%-62%,达到创纪录的51-52亿元人民币,其市值也跃升至全球矿业公司第二位 [8]。这表明,黄金的牛市不仅是金融市场的交易故事,也实实在在地影响着实体经济的盈利预期和资本开支。

风险提示与结语

综合来看,2026年的黄金市场正处在一个复杂的十字路口。一方面,宏观经济的不确定性、结构性的央行需求和持续的地缘政治风险,为金价提供了强有力的支撑。另一方面,历史高位的价格本身就意味着更高的波动性和回调风险。投资者在关注潜在上行空间的同时,也必须对市场的剧烈波动和潜在的下行风险保持高度警惕。

References

[1] Trading Economics. (2026). Gold | 1968-2026 Data | 2027-2028 Forecast. https://tradingeconomics.com/commodity/gold

[2] Sina Finance. (2026). Gold Prices Surge Over 64% in One Year: Reasons Explained. https://finance.sina.com.cn

[3] HSBC. (2026, January 8). Gold Could Hit $5,000 an Ounce in First Half of 2026. https://www.reuters.com/business/gold-could-hit-5000-an-ounce-first-half-2026-says-hsbc-2026-01-08/

[4] Cailian Press. (2026). Commodity Markets Enter New Era: Geopolitical Risks Become "Permanent Pricing Mechanism". https://www.cls.cn

[5] FastBull. (2026). Trump's Disruption: Dollar-Gold Safe Haven Logic Shifts. https://m.fastbull.com

[6] Beijing News. (2026). Central Bank Increases Gold Holdings for 14 Consecutive Months; Foreign Exchange Reserves Rise for 5 Consecutive Months. https://www.bjnews.com.cn

[7] Reuters. (2026). Gold Trading Alert: Price Crashes Nearly 1% at High Levels. https://finance.sina.com.cn

[8] Sina Finance. (2026). Global Largest Gold ETF Fund SPDR Holdings Data. https://quotes.sina.cn

[9] Sina Finance. (2026). HSBC: Spot Gold Expected to Reach $5,000 per Ounce in First Half of 2026. https://finance.sina.com.cn

[10] Sina Finance. (2026). Morgan Stanley Prediction: Gold to Rise to $4,800 in Fourth Quarter of 2026. https://finance.sina.com.cn

[11] Wall Street News. (2026). Goldman Sachs Commodities Outlook: Central Bank Gold Buying + Fed Rate Cuts, Bullish on Gold in 2026. https://wallstreetcn.com

[12] Sina Finance. (2025, December 31). Zijin Mining 2025 Net Profit Expected to Increase 59%-62%: Gold, Silver, and Copper Volume and Price All Rise. https://finance.sina.com.cn/roll/2025-12-31/doc-inhesnwn9157323.shtml

Global markets move into the new week with a number of potentially high-impact catalysts. Japan’s general election lands first on Sunday, followed by US inflation and labour market data that continue to shape interest-rate expectations.

- Japan election: Policy continuity and political stability are generally viewed as supportive for regional markets.

- US inflation and labour market: The consumer price index (CPI) and the Employment Situation report (nonfarm payrolls, NFP) are the immediate macro focal points for the week.

- Bitcoin risk gauge: Bitcoin is back near levels last seen in late 2024 and remains well below its October 2025 peak.

- Sector rotation watch: Technology has recently underperformed while value and defensive segments have stabilised, with earnings season continuing to influence flows.

Japan election

The general election in Japan is primarily viewed through the lens of policy certainty. Markets typically favour a clear outcome and continuity in fiscal and monetary settings.

Unexpected results or coalition uncertainty may increase short-term volatility in the JPY and regional indices at the start of the week.

Key dates

- General election (Japan): Sunday, 8 February

- Results through Asian trade on Monday

Market impact

- JPY may be sensitive to results uncertainty or potential changes in policy direction

- Asia equities may see early-week volatility until results are clear

US inflation and labour market

Inflation remains the most direct input into interest-rate expectations, while the monthly NFP report provides a broad read on employment conditions and wage pressures.

Treasury yields and the USD often react quickly to these releases, with knock-on effects across equities, gold and growth assets.

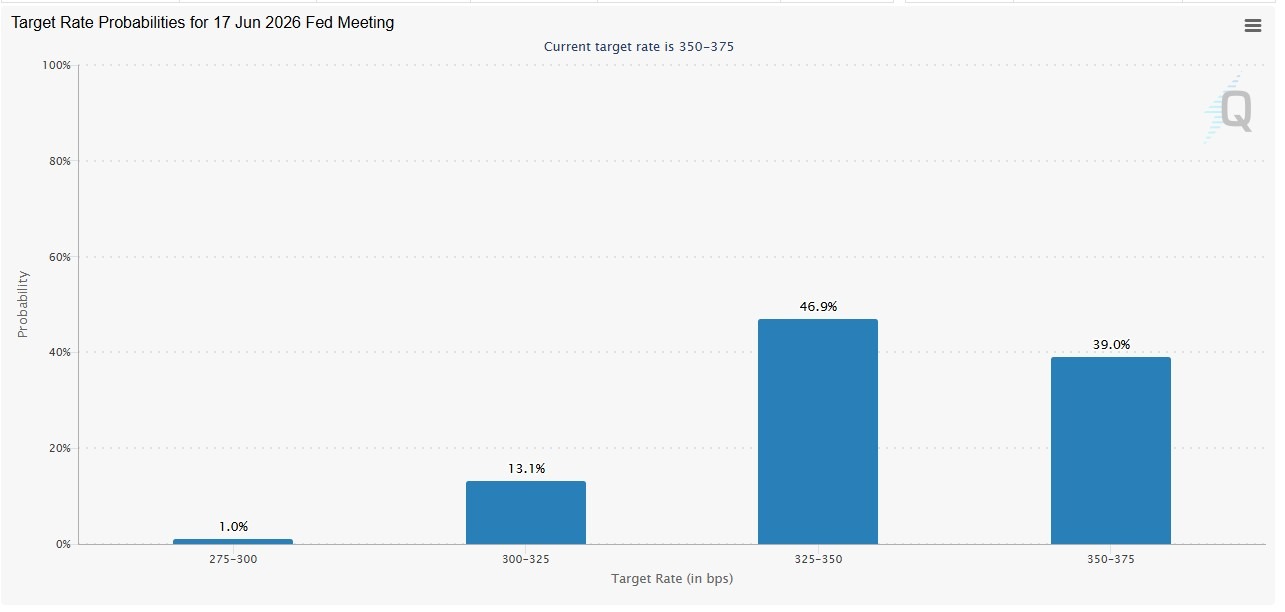

Current pricing indicates markets assign less than a 30% probability of a cut by the April meeting, with June meeting hike probabilities above 50%.

Key dates

- Employment Situation: Wednesday, 11 February 08:30 (ET) | Thursday, 12 February 00:30 (AEDT)

- CPI (January 2026): Friday, 13 February 08:30 (ET) Saturday, 14 February 00:30 (AEDT)

Market impact

- Yields often move first, followed by USD and then risk assets

- Expectations for rate-cut timing may adjust quickly

- Growth and technology shares remain more rate-sensitive

Bitcoin

Bitcoin has declined to levels last seen prior to the US elections in November 2024 and is close to 50% below its October 2025 peak.

While not a traditional macro indicator, crypto markets could be viewed as a real-time read on investor risk tolerance. Sustained weakness can coincide with more cautious positioning across higher-beta assets, including technology shares.

Market impact

- Softer crypto sentiment may coincide with reduced speculative flows

- Risk appetite may remain more selective

Sector rotation

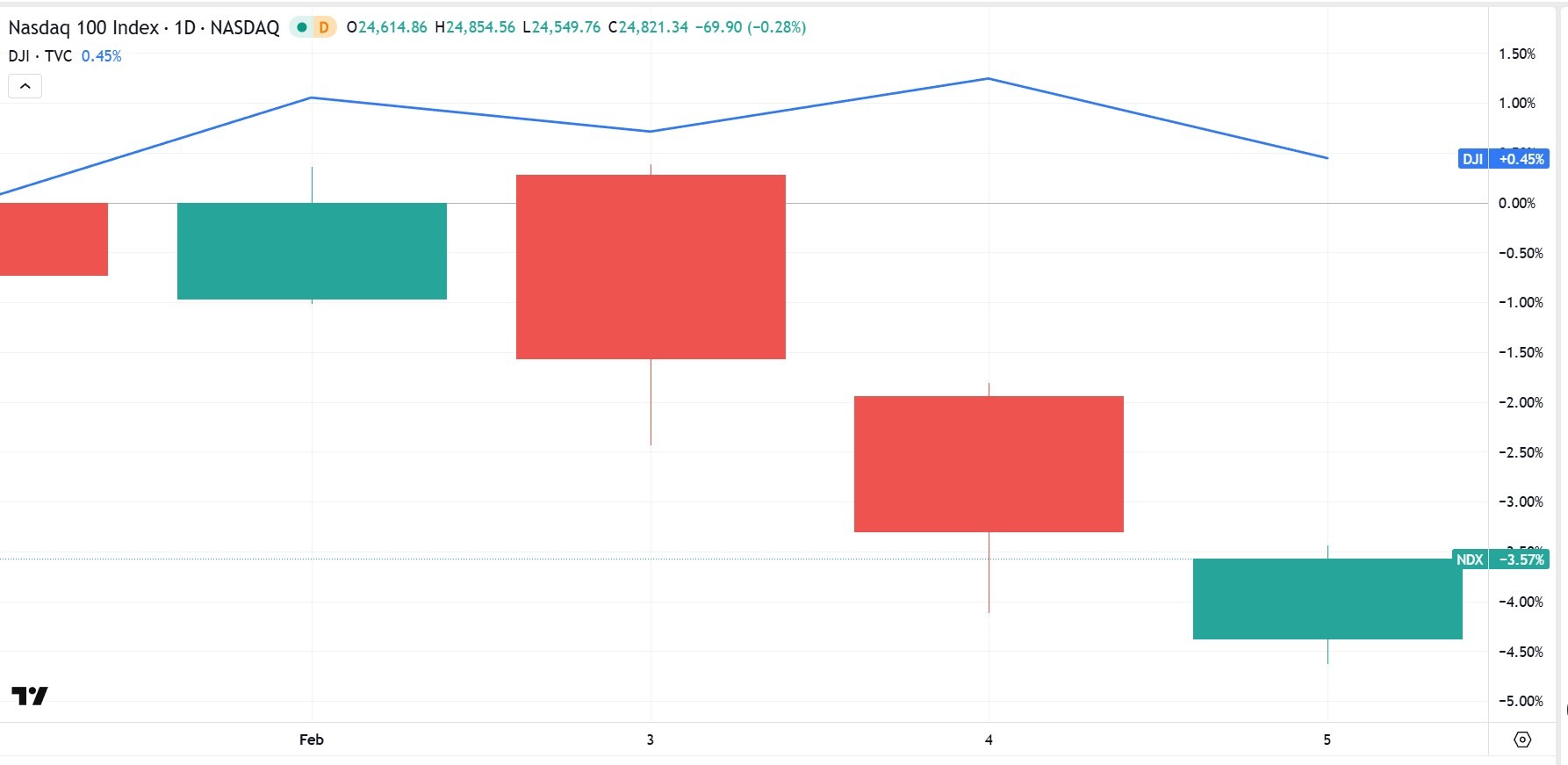

Over the past week, the Dow Jones Industrial Average has outperformed, trading just below neutral, while the Nasdaq-100 has declined more than 4%, reflecting sensitivity in large-cap technology to firmer yields.

What the move may reflect

- Rate-driven pressure on growth stocks

- Profit-taking after strong tech performance

- Earnings season favouring broader sector participation

- A generally more cautious tone across higher-beta assets

Markets typically look for sustained multi-week outperformance in financials, industrials or defensives before characterising the shift as structural rotation.

Market impact

- Tech remains more sensitive to yield moves

- Value and defensive sectors may see relative support

- Earnings guidance continues to influence leadership

2月份的外汇格局可能受通胀持续性、劳动力弹性和央行通信的推动。随着美国、欧洲、日本和澳大利亚发布了几份具有高影响力的数据,短期走势可能更多地以事件驱动和重定价为主导,而不是以趋势为导向。

事实速览

- 美元仍然是关键参考点,美国数据推动了收益率和整个外汇市场的重新定价。

- 欧元对欧洲央行(ECB)的消息以及传入的通货膨胀和活动信号的敏感度仍然很高。

- 日元仍然与国内数据和日本银行(BOJ)的沟通密切相关,美元/日元经常对收益率预期的变化做出强烈反应。

- 澳元仍然对政策敏感,国内通货膨胀和劳动力数据以及全球风险基调和金属可能最为重要。

美元 (USD)

关键事件

- 非农就业人数(NFP)和失业率: 美国东部时间 2 月 11 日上午 8:30 | 2 月 12 日上午 12:30(澳大利亚东部夏令时间)

- 消费者价格指数(CPI),总体和核心: 2月13日上午 8:30(美国东部时间)| 2月13日 12:30(澳大利亚东部夏令时间)

- 个人收入和支出(包括个人消费支出价格指数): 2月20日,8:30(美国东部时间)| 2月21日 12:30(澳大利亚东部夏令时间)

要看什么

美元可能仍将主要受通货膨胀和劳动力数据的变化及其对美联储利率预期的影响所驱动。最近的头条新闻 美联储的独立性 也增加了美元头寸的波动性。

更强的通货膨胀或劳动力弹性通常与通过更高的收益率预期获得更坚定的美元支撑有关。较软的结果可能会减少利率支撑,并允许欧元/美元和澳元/美元等货币对稳定。

关键图表:美元指数(DXY)周线图

欧元(欧元)

关键事件

- 欧洲央行的政策决定: 2 月 6 日上午 12:15(澳大利亚东部夏令时间)

- 欧洲央行新闻发布会: 2 月 6 日上午 12:45(澳大利亚东部夏令时间)

- 欧洲央行对国内生产总值和就业的初步估计: 2 月 13 日晚上 8:00(澳大利亚东部夏令时间)

要看什么

欧元的走势仍然与欧洲央行能否在活动出现实质性恶化的情况下维持其立场,或者通货膨胀和增长数据是否拉动宽松预期有关。

弹性增长和稳健的通货膨胀可以支持 “长期向上走高” 的定价偏见。增长疲软或通货膨胀疲软可能会打压该货币,特别是如果它们带来宽松预期。

关键图表:欧元/美元周线图

日元 (JPY)

关键事件

- 日本初步国内生产总值(2025年第四季度,首次初步数据): 2月15日下午 6:50(美国东部时间)| 2月16日上午10点50分(澳大利亚东部夏令时间)

- 全国消费者价格指数(日本): 2 月 20 日(日本)

要看什么

日元对国内收益率变化和日本央行的沟通仍然很敏感。即使对政策预期进行适度的调整也可能导致美元/日元的大幅波动。

稳健的增长或通胀结果可以通过提高国内收益率和改变日本央行预期来支撑日元。疲软的业绩或谨慎的政策信息可能会使美元/日元保持支撑。

关键图表:美元/日元日线图

澳元 (AUD)

关键事件

- 澳洲联储会议纪要: 2 月 17 日上午 11:30(澳大利亚东部夏令时间)

- 工资价格指数: 2 月 18 日上午 11:30(澳大利亚东部夏令时间)

- 劳动力调查: 2 月 19 日上午 11:30(澳大利亚东部夏令时间)

- 消费者价格指数(CPI): 2月25日上午11点30分(澳大利亚东部夏令时间)

要看什么

澳元对政策仍然敏感,对国内通货膨胀和劳动力数据以及全球风险情绪及其对金属定价的影响做出快速反应。

持续的工资或通货膨胀压力可以通过更坚定的政策预期来支撑澳元。数据疲软可能会减少利率支撑并打压澳元的表现,尤其是兑美元和日元的表现。

关键图表:欧元/澳元日线图

二月份,三个数据杠杆主导着美国市场:增长、劳动力和通货膨胀。除此之外,政策沟通、贸易头条和地缘政治仍然很重要,即使它们与预定的发布日期无关。

增长:商业活动和贸易

月初至中旬的指标为美国进入第一季度的势头是稳定还是减弱提供了依据。

关键日期

- 预付月度零售额: 2 月 10 日上午 8:30(美国东部时间)/2 月 11 日上午 12:30(澳大利亚东部夏令时间)

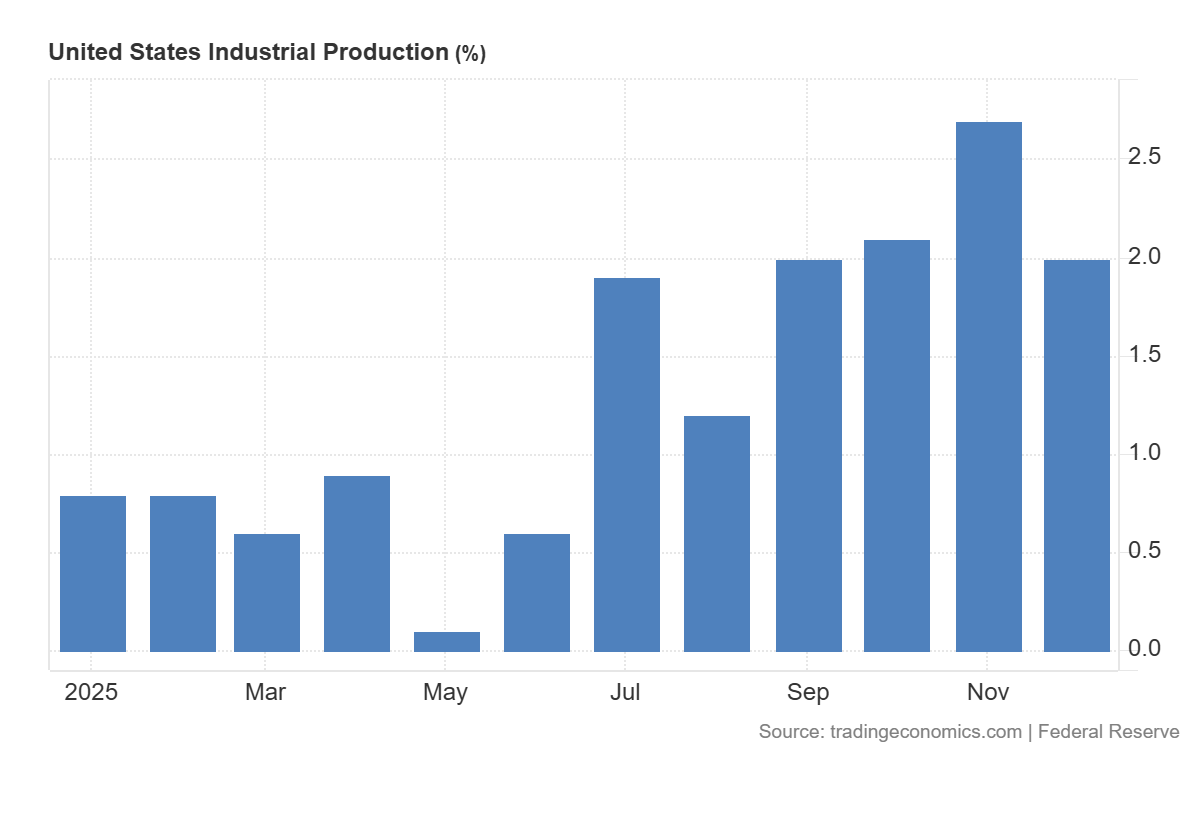

- 工业生产和产能利用率: 2 月 18 日上午 9:15(美国东部时间)/2 月 19 日凌晨 1:15(澳大利亚东部夏令时间)

- 国际商品和服务贸易: 2 月 19 日上午 8:30(美国东部时间)/2 月 20 日上午 12:30(澳大利亚东部夏令时间)

市场在寻找什么

市场将关注采购经理人指数的新订单和产出趋势,以评估潜在的需求势头。进出口数据将提供对全球贸易流动和国内消费模式的见解。交易者还将评估制造业和服务业是否仍处于扩张区间或显示出收缩迹象。

市场敏感度

- 尽管通货膨胀和政策预期通常在利率反应中占据主导地位,但更强劲的增长可能与更高的收益率和更坚挺的美元有关。

- 活动疲软可能与较低的收益率和风险偏好的改善有关,具体取决于通货膨胀、定位和更广泛的风险状况。

工资数据

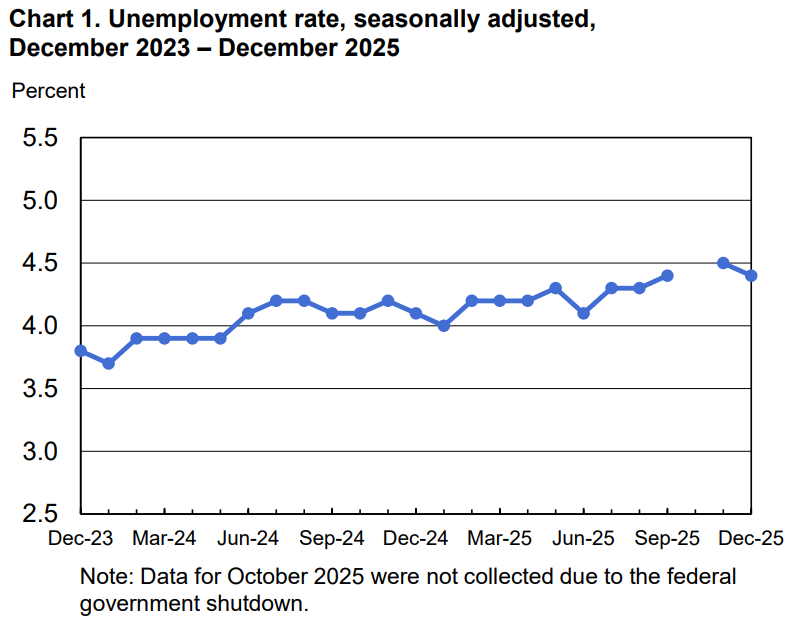

劳动条件仍然是利率预期的直接因素。每月的NFP报告以及每周四发布的每周申请失业救济人数通常会受到关注,看是否有降温或再次出现紧张的迹象。

关键日期

- 就业情况(非农就业人数、失业率、工资): 2 月 6 日上午 8:30(美国东部时间)/2 月 7 日上午 12:30(澳大利亚东部夏令时间)

市场在寻找什么

市场将关注总体就业人数,以评估创造就业的步伐、劳动力市场疲软信号的失业率以及作为工资压力的衡量标准的平均小时收入。逐步降温可以支持工资压力正在缓解的观点。持续的紧张局势可能会推高人们对放松政策的预期。

市场敏感度

薪资意外经常会迅速影响美国国债收益率和美元,对股票和大宗商品产生连锁反应。

通货膨胀:消费者价格指数、PPI和个人消费支出

通胀数据仍然是美联储政策路径预期的关键投入。

关键日期

- 消费者价格指数(CPI): 2 月 11 日上午 8:30(美国东部时间)/2 月 12 日上午 12:30(澳大利亚东部夏令时间)

- 个人收入和支出,包括个人消费支出价格指数): 2 月 20 日上午 8:30(美国东部时间)/2 月 21 日上午 12:30(澳大利亚东部夏令时间)

- 生产者价格指数(PPI): 2 月 27 日上午 8:30(美国东部时间)/2 月 28 日上午 12:30(澳大利亚东部夏令时间)

市场在寻找什么

生产者价格可以作为管道信号。消费者价格指数和个人消费支出价格指数可以帮助确认消费者层面的通货膨胀压力是扩大还是减弱。

利率和美元将如何反应

- 尽管市场反应可能有所不同,但通货膨胀降温可以支持较低的收益率和美元的疲软。

- 粘性通货膨胀会给收益率和财务状况带来上行压力,尤其是在它改变政策预期的情况下。

其他影响因素

政策与沟通

2月联邦公开市场委员会没有预定会议,但美联储的讲话和其他沟通以及前几次会议的会议纪要周期仍可能影响围绕政策路径的预期。如果没有决策事件,市场通常会对基调的变化做出反应,或者重新强调通货膨胀的持续性和劳动条件。

贸易和地缘政治

贸易流和能源市场可能仍然是次要的,风险状况通常以头条为导向,而不是与预定发布的内容挂钩。

美国贸易代表办公室发布了概况介绍和政策更新(包括有关美印贸易参与的政策更新),这些简报和政策更新,有时可能会在边际上影响行业和供应链情绪,具体取决于当时的实质内容和市场重点。

另外,与中东事态发展相关的波动性以及对能源定价的任何影响都可能渗透到通胀预期和债券收益率中。美国能源信息管理局的每周石油市场数据是市场经常关注的短期信号之一。

每隔四年,奥运会都会做一些市场非常了解的事情:它能集中注意力。当注意力集中时,标题、叙事、定位... 有时还有价格。

奥运会不只是 “为期两周的体育运动”。对于交易者来说,这是为期两周的全球营销和旅游活动,通常是在澳大利亚睡觉时实时进行的。

所以,让我们让它变得有用。

预定日期: 2026 年 2 月 6 日星期五至 2 月 22 日星期日

哪里: 米兰、科尔蒂纳丹佩佐和意大利北部的高山场馆

什么重要(什么不重要)

事情

- 资金提前流动: 基础设施、交通升级、赞助、媒体版权和旅游预订趋势。

- 流动性中的叙述: 主题交易可能比基本面交易更难,尤其是在交易量增加但也可能迅速逆转的情况下。

- 收入语言: 交易者经常关注公司是否开始参考需求、预订、广告支出或指导性利好因素。

不是

- 奖牌很重要(我知道有争议的说法)。

为什么奥运会对市场很重要

奥运会不只是为期两周的体育运动。对于东道地区来说,它们通常反映了多年的规划、投资和营销,然后所有这些都被推到了一个集中的全球媒体时刻。这就是市场关注的原因,即使基本面没有突然重塑自我。

以下是一些主题:主办地区 可能 看到。结果因宿主、时间和宏观背景而异。

主题地图:头条新闻通常聚集的地方

结构和材料

物流升级、运输连接和 “可持续” 建筑。

奢侈品和旅游

早在开幕之夜之前,米兰的时尚之都就开始转化为需求。

媒体和直播

随着受众激增和平台获利,广告也随之增加。

运输和旅行

航空公司、酒店和旅游科技公司推动了交易量和期望。

对于澳大利亚的交易者来说,关键思想是风险敞口,而不是地理位置。意大利的上市公司不需要看到这个主题,同时,有些人会寻找收益可能与类似力量(旅行需求、全权支出)相关的澳大利亚证券交易所上市公司。无法保证连接。这取决于业务、数字和估值。

澳大利亚证券交易所入围名单

澳大利亚证券交易所入围名单只是通过风险敞口组织本地市场的一种方式,因此您可以看到该指数的哪些部分最有可能获得溢出效应。它不是预测,也不是建议,它是一个框架,用于跟踪叙事如何从头条新闻转变为行业定价,以及将真正的主题曝光率与只会引起噪音的名字区分开来。

Wesfarmers (WES): 广泛的零售曝光度,可以了解当地消费者。

飞行中心 (FLT): 可能为零售和企业的旅行周期提供更高的曝光率。

企业差旅管理 (CTD): 对商务旅行的敏感性,它通常会对会议和活动需求做出反应。

澳大利亚工具包

奥运会会压缩注意力,当注意力压缩时,少数乐器往往会先记录注意力,而其他所有乐器只会吸收噪音。这里的重点是监督和纪律,而不是多样性。

FX:最快的标题吸收器

示例: 欧元/美元、欧元/澳元以及澳元/日元通常被视为更广泛的风险情绪信号。

它捕捉了什么: 市场如何定价欧洲乐观情绪、全球风险偏好以及资本的实时走向

指数基准:情绪仪表板

示例(索引级别): 欧洲斯托克50指数、DAX指数、富时指数、标准普尔500指数。

它能捕捉到什么: 标题是否足够宽泛,足以影响更广泛的定位,或者它是否仅限于狭义的主题。

大宗商品:二阶商品,通常是放大器

示例: 铜(工业敏感度),布伦特/WTI(能源和地缘政治),黄金(风险/不确定性)。

它能捕捉到什么: 更大的驱动力(美元、利率、增长预期、天气和地缘政治),而奥运会通常是包装而不是引擎。

综上所述,这不是预测,也不是购物清单。这是一张紧凑的地图,描绘了奥运故事最有可能首先出现在哪里,接下来可能传播到哪里,有时在每个人都已经决定了自己的感受之后才出现在哪里。

你的日历不是欧洲的日历

对于澳大利亚交易者来说,奥运会是一个为期两周的隔夜头条周期。大部分 “实时” 信息流可能会在欧洲和美国会议期间流动。但是,要记住三个窗口。

关注这个空间。

在下一篇文章中,我们将编制欧元清单并绘制米兰—科尔蒂纳周围的波动窗口,这样你就可以看到市场何时实际为故事定价,以及它何时只是在对噪音做出反应。

.jpg)

今年初澳元作为商品货币受大宗商品价格上涨和通胀持续反弹造成了澳元大幅持续反弹。 通过昨日澳洲联储在货币政策新闻发布会的信息会对澳元的走势会造成什么影响?

1. 通胀判断:通胀明显回潮,风险在“根深蒂固”

澳洲联储认为,尽管通胀已较2022 年高点明显回落,但2025 年下半年通胀再度走强、动能过于强劲,仍将长期高于2–3% 目标区间中值,因此必须防止通胀失控并固化。

2. 加息立场:这不是一次性动作,但会保持谨慎

澳洲联储此次一致通过加息25bp 至 3.85%,明确释放“加息未必止步于此”的信号,但同时强调将保持高度谨慎,不预设利率路径、不提供前瞻指引,且未考虑50bp 的激进加息。

3. 经济背景:需求强、供给受限,是通胀再起的根源

澳洲联储指出,私人需求增长显著超预期,而产能受限与生产力疲软等结构性问题叠加政府支出强劲,导致在经济整体表现尚可的情况下,供给难以匹配需求并持续推高通胀压力。

4. 劳动力与金融条件:仍偏紧,政策可能还不够“紧”

澳洲联储认为,在劳动力市场依然紧俏、工资和信贷增长走强的背景下,当前金融状况可能仍偏宽松,现金利率水平亦低于部分中性利率估计。

5. 澳元角色:欢迎升值,视为政策传导工具

行长布洛克表示,澳元升值不仅是政策传导机制的一部分,还可在边际上收紧金融条件、降低进口通胀,助力联储控制通胀。

6. 前景与市场含义:年内再加息概率显著上升

官方预测显示,假设利率按当前路径发展,年中将接近3.9%,年底可能升至4.10%–4.20%。

7. 结论:

澳洲联储因通胀回升、私人需求强劲及产能受限而鹰派加息25bp至3.85%,暗示年内可能继续加息,澳元短线走强,市场对加息周期预期明显升温。