GO Markets

让交易更进一步

智慧交易,从选择值得信赖的全球券商开始。低点差、快速成交、零入金手续费、功能强大的交易平台,以及屡获殊荣的客户支持,让您的交易更进一步。

全球交易者共同的选择

自 2006 年起,GO Markets 已帮助全球数十万交易者实现他们的投资目标。凭借严格监管、以客户为本的服务,以及屡获殊荣的教育资源,我们始终是交易者值得信赖的合作伙伴。

GO Markets

让交易更进一步

探索上千种交易机会,享受专业机构水准的交易工具、流畅稳定的交易体验,以及屡获殊荣的客户支持。开户流程简单快捷,让您轻松开启交易之旅。

.jpg)

好久不写文章了,重新到电脑前找感觉,果然还是验证之前小时候的那句话,一天不练自己知道,三天不练同行知道,十天不练观众也知道。虽然平时事情太多,但是为了给新来的同事们树立榜样,再忙我也可以做到一周一篇,其他人就不能找借口。所以我必须以身作则。

言归正传,最近墨尔本很不太平,不仅仅是各种偷盗,当街伤人事件层出不穷。更严重的是每个月几乎都有大规模的反移民游行抗议。这是非常危险的信号,虽然澳洲主流阶层和过去30年买房的既得利益者都因为大量移民的获利丰厚,但是更多的底层民众,没有买房的,或者还在租房的人群,却的的确确因为不断上涨的住房成本和不断上涨的生活成本而举步艰难。

墨尔本,这个曾经连续多年全球最适宜居住城市,在过去的5年却经历了惊人的倒退。由于州政府巨大的债务欠款,导致过去几年整个州的财政都围绕着尽快还清欠款的主题在制定政策:从翻倍的地税,到增加的企业工资税,到为了还债而减少的公共投入,以及过于宽松的青少年保释政策,使得墨尔本的整体经商,就业和居住环境出现了明显的恶化。以房价举例,作为澳洲第二大城市墨尔本,其平均房价现在居然还低于了更小的城市布里斯班和阿德雷德,这种短期的价格倒挂无疑就是在讽刺维州当局。连澳洲的投资者都逃离墨尔本,还不能说明问题吗?当然咱们今天的内容不是喷社会问题,抱怨了一大堆,内心增加负能量,还得我自己消化。不划算。

言归正传,澳洲最大的财经媒体AFR,在上周四发表了一篇文章,基本意思就是,澳洲最新出台的就业数据太差,基本注定了澳洲央行距离降息不远了。

根据澳洲统计数数据,澳洲9月的失业率从之前的4.2%骤然上升到了4.5%,短期的严重恶化,可能会使得澳洲央行原本准备稳定慢慢降息的计划被再次打乱。

大家可以参考我过去几个月甚至去年的文章,其实我本人一直认为,并且坚持我的观点,就是澳洲的物价并没有怎么好转。不论是买菜,吃饭,手机电器,还是娱乐消费,旅游,开车汽油保险,以及租房建房。所有澳洲统计局在计算物价时会参考的项目,我看了一遍,价格上涨幅度就几乎没有低于10%的。更别说这每天喝的咖啡了,墨尔本CBD一杯咖啡你要是选豆奶的,很多咖啡店都快7澳元了,这样的情况下,你告诉我物价控制住了?当然,政府为了给央行台阶下,也非常配合的出台了每家每年300澳元的电费减免计划,直接从统计数据里花钱作弊。这种自欺欺人的做法真的让我非常无语。

然后呢?4次补贴用完以后,电费还不是越来越高?煤气费更是翻天了。这种情况下,你告诉我物价控制住了,没事了?咱们是活在电视剧里吗?

当然,咱们知道这个世界不可能完美。澳洲央行和澳洲各界政府在做每个决定时我们也相信他们是抱着很好的愿景和希望的。只是结果没有达到预期。那么现在澳洲央行对比一年前那是还较为强劲的经济表现,现在应该说他们的决定更为艰难:

4.5%的失业率其实是一个明显的信号:企业招人少了,因为企业觉得未来不确定,甚至觉得未来可能会更不好,因此要节约开支,少招人。而不断增加的失业率,也将给目前依然在工作的人一个信号:外面的环境不好,不要轻易辞职,花钱要更谨慎。如此长期一来肯定会减少消费,帮助缓解通胀。

但是,在另一方面,即使在当前的利息下,悉尼和墨尔本的拍卖率又重新回到了80%甚至更高,这也意味着已经非常高的房价可能会再次上涨。这对于原本就因为生活成本高企而抱怨新移民的那批民众更加痛恨移民:他们会觉得是新移民抢走了工作,抢走了住房,抢走了一切。

但是他们忘记了自己的祖上曾经也是澳洲移民大军中的一员。在澳洲,除了本地的原住民,大家都是移民。我们不能因为自己移民了,就不让别人上车。澳洲的繁荣和发展,正是靠着不断增加的移民所带动的。在过去20年的历次金融危机中,只有澳洲是发达国家里唯一没有明显衰退的幸运儿。而其原因,就是靠着每次巨大的移民放水,通过直接提高社会住房,消费和物质需求来抵消金融危机带来的恐慌和消费紧缩。

扯远了,我要说的是,现在澳洲央行面临更加困难的情况:

1. 经济似乎在变差,失业率增加,国际局势以及铁矿石需求都对澳洲不利,这时理论上就需要通过降息来刺激消费,刺激经济,恢复市场信心。从这方面看,澳洲需要降息。

2. 但是物价还太高,根本没怎么下降。房价却还在上涨,如果再次降息,房价会上涨的更快,这样一来社会矛盾会更加尖锐,物价也更难回归正常。现任央行女行长是财政部长一手提拔的,或者说是超规格提拔的,因此她也在尽可能的配合联邦政府的经济政策。因此在目前社会矛盾尖锐,贫富差距进一步扩大,选民愤怒的情况下,似乎选择不降息也是正确选择。

那在左右为难的情况下,央行会怎么做?

我怎么知道,我又不是他们的蛔虫。但是这不妨碍我们瞎扯和猜。还是那句话,不论哪个专家哪个首席,归根结底都是猜。无非就是名头响亮的猜。

如果我是央行行长,在当前情况下,我不会选择马上降息。因为第一,即使我降息了,也无法改变国际环境:啥国际环境?中美贸易扯皮,中国对铁矿石需求降低,美国要澳洲站队,这个大环境短期不会变。就算澳洲把利息降到0,如果铁矿石卖不出去,那经济还是会受挫。所以如果降息不能直接,马上,立即刺激经济的话,我就会考虑另一个选择:不降息,可以带来什么好处?

1. 控制依然很高的物价,至少不会继续上涨。给普通大众生活成本带来一线改善,不要再激化社会矛盾。

2. 控制反弹过快的房价,这个不仅有利于缓解民间矛盾,更重要的是可以赢得选票。

那如果不降息,经济怎么办?

这时就要靠财政部长去说服总理,在移民闸口上送一下,靠100%新刚需来给帮澳洲撑一下。

所以总结来说,也许我判断有误,但是如果我是行长,在综合考虑各种利弊的情况下,我不会马上降息,而是会继续等待更多的数据和中美谈判结果,再做考虑。

而下一个话题,如果澳洲不马上降息,是不是意味着澳元不会继续下跌了?

答案是,你想多了,我依然坚持我从年初以来的看法:澳元和美元在未来很长一段时间,都会保持弱势。为啥?因为澳元看三个因素:铁矿石 价格,中国经济,和美元政策。什么时候中国的房价重新大规模反弹了,那澳元的长期走势就会重新开始上涨。

免责声明:GO Markets 分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表 GO Markets 的观点或立场。

联系方式:

墨尔本 03 8658 0603

悉尼 02 9188 0418

中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903

作者:

Mike Huang | GO Markets 销售总监

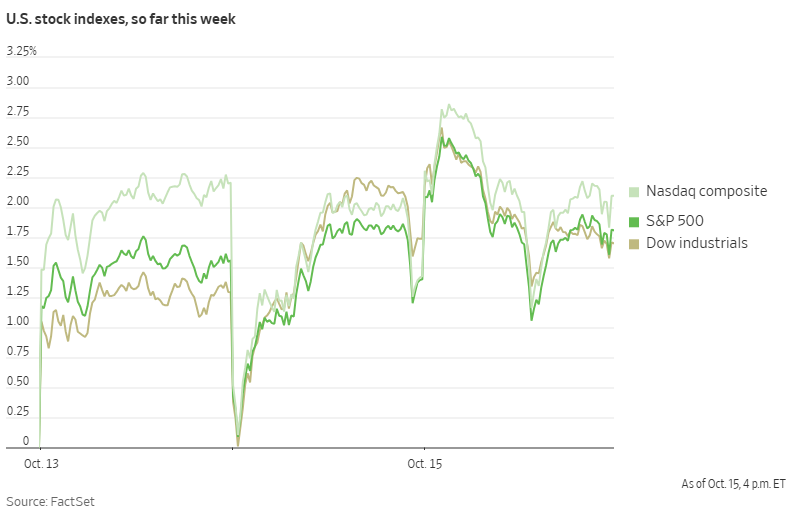

S&P 500 and ASX Rally as Big Banks Drive Markets

Both the S&P 500 and ASX have rallied on the back of stronger-than-expected major bank earnings reports on both sides of the Pacific.

In the US, Bank of America reported a 31% year-over-year increase in earnings per share at $1.06, exceeding Wall Street's estimate of $0.95. Meanwhile, Morgan Stanley delivered a record-breaking quarter with EPS of $2.80, a nearly 49% increase from the same period last year.

On the Australian front, the benchmark ASX 200 leapt 1.03% to 8990.99, with all four major Australian banks playing a major role. CBA closed 1.45% higher, Westpac 1.98%, NAB 1.87%, and ANZ 0.53%.

These strong bank results indicate broader economic strength, despite recent concerns about US-China trade tensions. US Treasury Secretary Scott Bessent emphasised that Washington did not want to escalate trade conflict with China and noted that President Trump is ready to meet Chinese President Xi Jinping in South Korea later this month.

With the third-quarter earnings season just getting underway, these early positive results from financial institutions could prove as the start of continued market strength through to the end of the year.

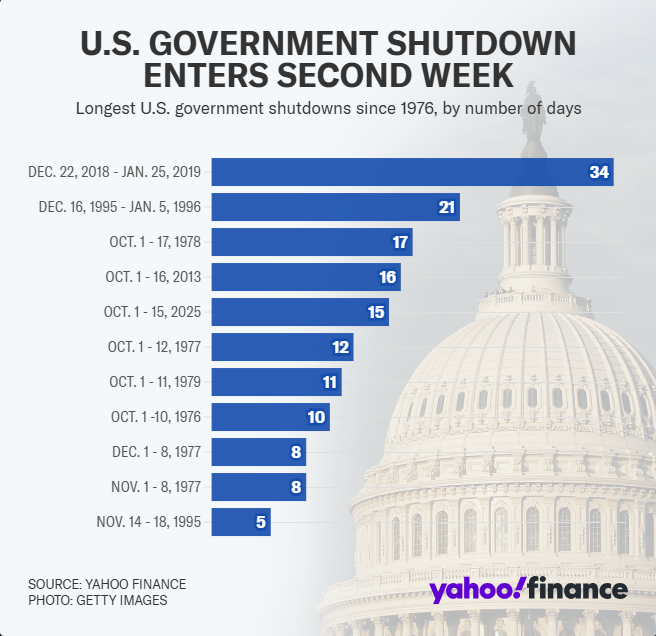

U.S. Government Shutdown Likely to Last Into November

Washington remains gridlocked as the U.S. enters its 16th day of shutdown. With no signs of compromise on the horizon, it appears increasingly likely the shutdown will extend into November and could even compromise the Thanksgiving holiday season.

Treasury Secretary Scott Bessent has warned "we are starting to cut into muscle here" and estimated "the shutdown may start costing the US economy up to $15 billion a day."

The core issue driving the shutdown is healthcare policy, specifically the expiring Affordable Care Act subsidies. Democrats are demanding these subsidies be extended, while Republicans argue this issue can be addressed separately from government funding.

The Trump administration has taken steps to blunt some of the shutdown's immediate impact, including reallocating funds to pay active-duty soldiers this week and infusing $300 million into food aid programs.

However, House Speaker Mike Johnson has emphasised these are merely "temporary fixes" that likely cannot be repeated at the end of October when the next round of military paychecks is scheduled.

By the end of this week, this shutdown will become the third-longest in U.S. history. If it continues into November 4th, it will surpass the 34-day shutdown of 2018-2019 to become the longest government shutdown ever recorded.

This prolonged shutdown adds another layer of volatility to markets. While previous shutdowns have typically had limited long-term market impacts, the unprecedented length and timing of this closure, combined with its expanding economic toll, warrant closer attention as we move toward November.

Trump Announces Modi Has Agreed to Stop Buying Russian Oil

Yesterday, Trump announced that Indian Prime Minister Narendra Modi has agreed to stop purchasing Russian oil. He stated that Modi assured him India would halt Russian oil imports "within a short period of time," describing it as "a big step" in efforts to isolate Moscow economically.

The announcement comes after months of trade tensions between the US and India. In August, Trump imposed 50% tariffs on Indian exports to the US, doubling previous rates and specifically citing India's Russian oil purchases as a driving factor.

India has been one of Russia's top oil customers alongside China in recent years. Both countries have taken advantage of discounted Russian oil prices since the start of the Ukraine invasion.

Analysis suggests India saved between $2.5 billion to $12.6 billion since 2022 by purchasing discounted Russian crude compared to other sources, helping support its growing economy of 1.4 billion people.

Trump suggested that India's move would help accelerate the end of the Ukraine war, stating: "If India doesn't buy oil, it makes it much easier." He also mentioned his intention to convince China to follow suit: "Now I've got to get China to do the same thing."

The Indian embassy in Washington has not yet confirmed Modi's commitment. Markets will be closely watching for official statements from India and monitoring oil trading patterns in the coming weeks to assess the potential impact on global energy flows and prices.

Chart of the Day - Gold futures CFD (XAUUSD)

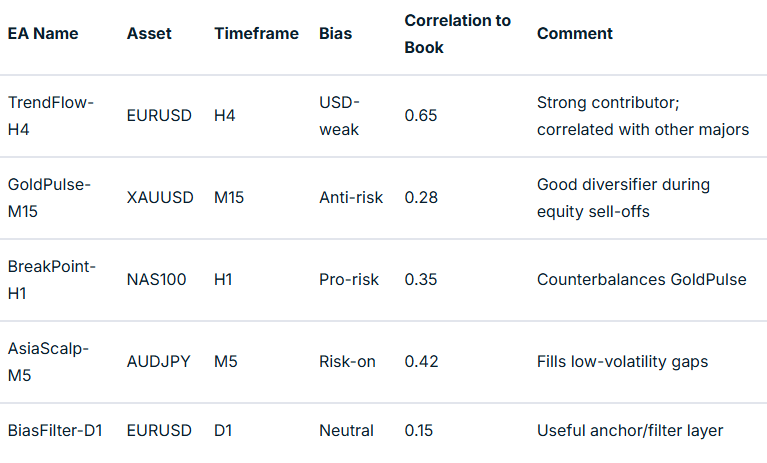

Most traders understand EA portfolio balance through the lens of traditional risk management — controlling position sizes, diversifying currency pairs, or limiting exposure per trade.

But in automated trading, balance is about deliberately constructing a portfolio where different strategies complement each other, measuring their collective performance, and actively managing the mix based on those measurements.

The goal is to create a “book” of EAs that can help diversify performance over time, even when individual strategies hit rough patches.

A diversified mix of EAs across timeframes and assets can, in some cases, reduce reliance on any single strategy. This approach reduces dependency on any single EA’s performance, smooths your overall equity curve, and builds resilience across changing market conditions.

It’s about running the right mix, identifying gaps in your coverage, and viewing your automated trading operation as an integrated whole rather than a collection of independent systems.

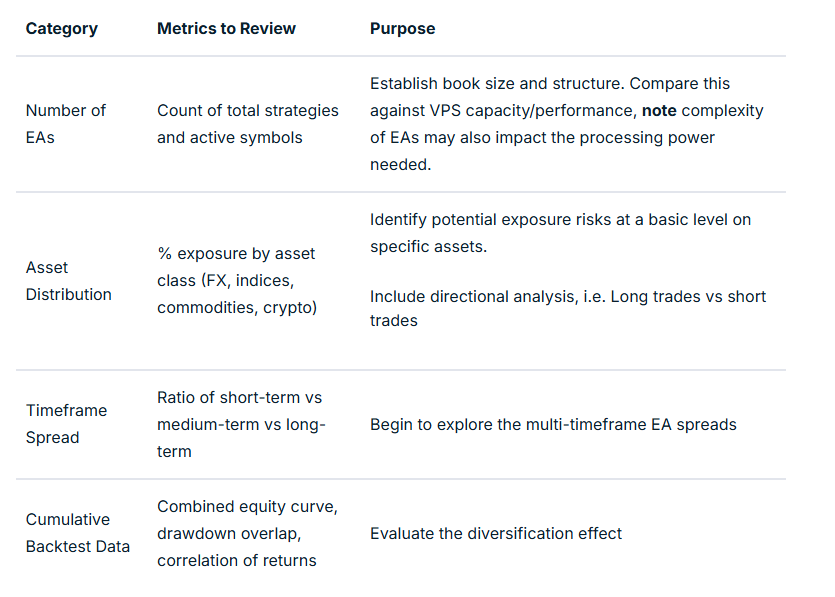

Basic Evaluation Metrics – Your Start Point

Temporal (timeframe) Balancing

When combined, a timeframe balance (even on the same model and instrument) can help flatten equity swings.

For example, a losing phase in a fast-acting M15 EA can often coincide with a profitable run in an H4 trend model.

Combining this with some market regime and sessional analysis can be beneficial.

Asset Balance: Managing Systemic Correlation Risk

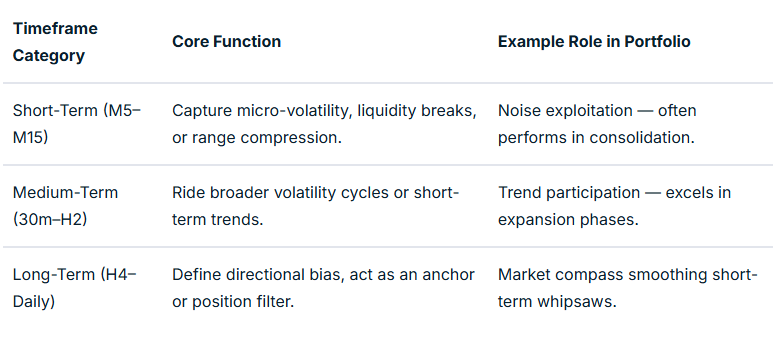

Running five different EAs on USDJPY might feel diversified if each uses different entry logic, even though they share the same systemic market driver.

But in an EA context, correlation measurement is not necessarily between prices, but between EA returns (equity changes) relating to specific strategies in specific market conditions.

Two EAs on the same symbol might use completely different logic and thus have near-zero correlation.

Conversely, two EAs on a different symbol may feel as though they should offer some balance, but if highly correlated in specific market conditions may not achieve your balancing aim.

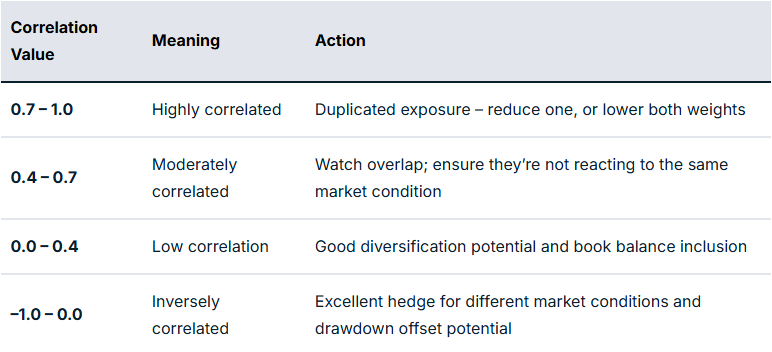

In practical terms, the next step is to take this measurement and map it to potential actionable interventions.

For example, if you have a EURUSD Trend EA and a GBPUSD Breakout EA with a correlation of 0.85, they are behaving like twins in performance related to specific market circumstances. And so you may want to limit exposure to some degree if you are finding that there are many relationships like this.

However, if your gold mean reversion EA correlates 0.25 compared to the rest of your book, this may offer some balance through reducing portfolio drawdown overlap.

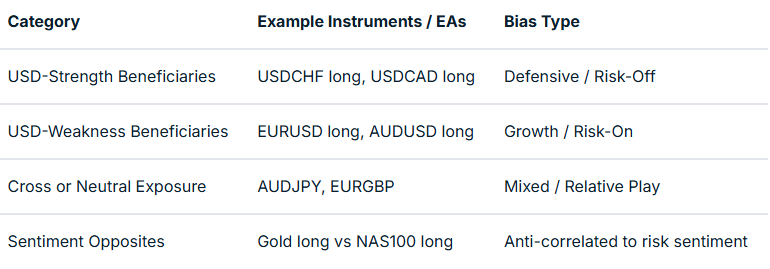

Directional and Sentiment Balance

Markets are commonly described as risk-on or risk-off. This bias at any particular time is very likely to impact EA performance, dependent on how well balanced you are to deal with each scenario.

You may have heard the old market cliché of “up the staircase and down the elevator shaft” to describe how prices may move in alternative directions. It does appear that optimisation for each direction, rather than EAs that trade long and short, may offer better outcomes as two separate EAs rather than one catch-all.

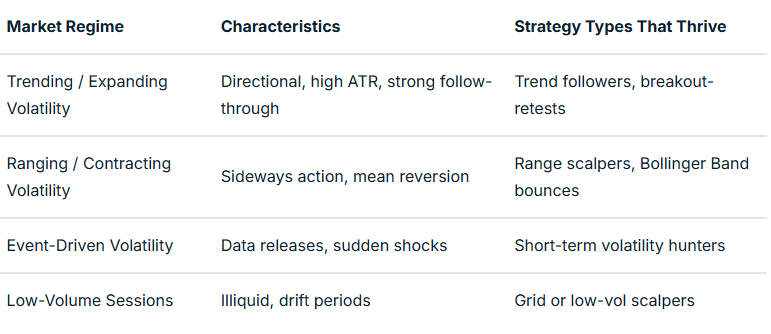

Market Regime and Volatility Balance

Trend and volatility states can have a profound impact on price action, whether as part of a discretionary or EA trading system. Much of this has a direct relationship to time of day, including the nature of individual sessions.

We have a market regime filter that incorporates trend and volatility factors in many EAs to account for this. This can be mapped and tested on a backtest and in a live environment to give evidence of strategy suitability for specific market conditions.

For example, mean reversion strategies may work well in the Asian session but less so in strongly trending markets and the higher volatility of the early part of the US session.

As part of balancing, you are asking questions as to whether you actually have EA strategies suited to different market regimes in place, or are you using these together to optimise book performance?

The table below summarises such an approach of regime vs market mapping:

Multi-Level Analysis: From Composition to Interaction

Once your book is structured, the challenge is to turn it into something workable. An additional layer of refinement that turns theory and measurement into something meaningful in action is where any difference will be made.

This “closing the circle” is based on evidence and a true understanding of how your EAs are behaving together. It is the step that takes you to the point where automation can begin to move to the next level.

Mapping relationships with robust and detailed performance evaluation will take time to provide evidence that these are actually making a difference in meeting balancing aims.

To really excel, you should have systems in place that allow ongoing evaluation of the approaches you are using and advise of refinements that may improve things over time.

What Next? – Implementing Balance in Practice

Theory must ultimately translate into an executable EA book. A plan of action with landmarks to show progress and maintain motivation is crucial in this approach.

Defining classification tags, setting risk weights, and building monitoring dashboards are all worth consideration.

Advanced EA traders could also consider a supervisory ‘Sentinel’ EA, or ‘mothership’ approach, to enable or disable EAs dynamically based on underlying market metrics and external information integrated into EA coding decision-making.

Final Thoughts

A balanced EA portfolio is not generated by accident; it is well-thought-out, evidence-based and a continuously developing architecture. It is designed to offer improved risk management across your EA portfolio and improved trading outcomes.

Your process begins with mapping your existing strategies by number, asset, and timeframe, then expands into analysing correlations, directional bias, and volatility regimes.

When you reach the stage where one EA’s drawdown is another’s opportunity, you are no longer simply trading models but managing a system of EA systems. To finish, ask yourself the question, “Could this approach contribute to improved outcomes over time?”. If your answer is “yes,” then your mission is clear.

If you are interested in learning more about adding EAs to your trading toolbox, join the new GO EA Programme (coming soon) by contacting [email protected].