Noticias del mercado & perspectivas

Anticípate a los mercados con perspectivas de expertos, noticias y análisis técnico para guiar tus decisiones de trading.

La volatilidad no discrimina. Pero puede castigar a los no preparados.

Detiene ser golpeado en movimientos que se invierten en cuestión de minutos. Las primas en opciones de fecha corta están subiendo. Y el yen ya no se comportaba como el seto confiable que alguna vez fue.

Para los comerciantes de toda Asia, navegar por este entorno significa hacer preguntas más difíciles sobre el riesgo, el tiempo y las suposiciones incorporadas en estrategias creadas para mercados más tranquilos.

1. ¿Cómo puedo operar con CFDs VIX durante un choque geopolítico?

El Índice de Volatilidad CBOE (VIX) mide la expectativa del mercado de volatilidad implícita a 30 días en el S&P 500. A menudo se le llama el “indicador del miedo”. Durante los choques geopolíticos como las actuales escaladas de Irán, los anuncios de sanciones y las acciones sorpresa de los bancos centrales, el VIX puede repuntar bruscamente y rápidamente.

¿Qué hace que los CFDs de VIX sean diferentes en un shock?

VIX en sí no es comercializable directamente. Los CFD de VIX suelen tener un precio de los futuros de VIX, lo que significa que tienen un arrastre de contango en condiciones normales.

Durante un choque geopolítico, varias cosas pueden suceder a la vez

- El Spot VIX puede repuntar inmediatamente mientras que los futuros a corto plazo se quedan rezagados, creando una desconexión.

- Los diferenciales de los CFDs de VIX pueden ampliarse significativamente a medida que disminuye la liquidez.

- Los requerimientos de margen pueden cambiar intradiamente a medida que se ajustan los modelos de riesgo de los brókers.

- VIX tiende a la reversión promedio después de los picos, por lo que el tiempo y la duración son críticos.

Lo que esto significa para los comerciantes de horas asiáticas

Las horas del mercado asiático significan que muchos eventos geopolíticos pueden romperse mientras los comerciantes locales están activos o apenas comienzan su sesión.

Una conmoción que golpea durante las horas de Tokio ya podría estar cotizada en futuros de VIX antes de la apertura de Sydney.

Algunos operadores utilizan las posiciones VIX CFD como una cobertura a corto plazo contra las carteras de acciones en lugar de una operación direccional. Otros negocian la reversión (el retroceso hacia promedios históricos una vez que el pico inicial se desvanece). Ambos enfoques conllevan riesgos distintos, y ninguno garantiza un resultado específico.

2. ¿Por qué mis primas de opciones 0DTE son tan caras en este momento?

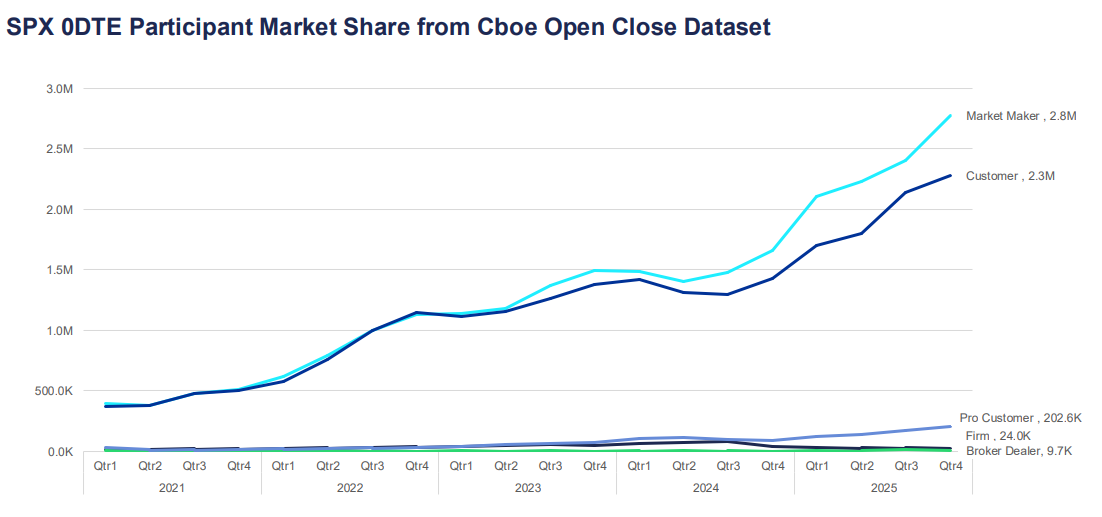

Las opciones de cero días hasta el vencimiento (0DTE) expiran el mismo día en que se negocian. Se han convertido en uno de los segmentos de más rápido crecimiento del mercado de opciones, representando ahora más del 57% del volumen diario de opciones del S&P 500 según datos de mercados globales de Cboe.

Para los participantes con sede en Asia que acceden a los mercados de opciones de Estados Unidos, las primas elevadas durante períodos volátiles pueden sentirse como un mal precio, pero por lo general reflejan factores estructurales de precios.

¿Por qué las primas se repuntan?

El precio de las opciones está impulsado por el valor intrínseco y el valor de tiempo. Para las opciones 0DTE, casi no queda valor de tiempo, lo que podría sugerir que deberían ser baratas pero el componente implícito de volatilidad compensa eso.

Cuando aumenta la incertidumbre, los vendedores pueden exigir una mayor compensación por el riesgo de movimientos intradía brusca.

Esto puede reflejarse en

- Insumos de mayor volatilidad implícita.

- Mayor margen de puda-tarea.

- Ajustes más rápidos en cobertura delta y gamma.

En entornos de VIX más alto, los flujos de cobertura pueden contribuir a los bucles de retroalimentación a corto plazo en el índice subyacente. Esto puede amplificar las oscilaciones de precios, particularmente en torno a niveles clave.

Lo que esto significa para los comerciantes de horas asiáticas

Muchos contratos de opciones 0DTE ven sus flujos de precios y cobertura más activos durante las horas de negociación de EE. UU. Ingresar posiciones durante la sesión asiática puede significar enfrentar precios obsoletos o diferenciales más amplios.

Si está viendo primas costosas, puede reflejar que el mercado esté valorando con precisión el riesgo de una mudanza grande el mismo día. Si vale la pena pagar esa prima depende de su visión del rango intradiario probable y su tolerancia al riesgo, no solo de la cifra absoluta en dólares.

3. ¿Cómo ajusto mi bot de trading algorítmico para un entorno con alto nivel de VIX?

Muchos sistemas de comercio algorítmico se basan en parámetros calibrados durante regímenes de baja volatilidad. Cuando VIX alcanza picos, esos parámetros pueden quedar obsoletos rápidamente.

El problema del desajuste del régimen

La mayoría de los algoritmos comerciales utilizan datos históricos para establecer tamaños de posición, distancias de parada y umbrales de entrada. Esos datos reflejan las condiciones durante las cuales se probó el sistema. Si VIX pasa de 15 a 35, es posible que las suposiciones estadísticas que sustentan esas configuraciones ya no se mantengan.

Los modos de falla comunes en entornos con alto nivel de VIX incluyen

- Se detiene repetidamente provocada por el ruido antes de que se produzca el movimiento direccional previsto.

- Dimensionamiento de posiciones basado en el riesgo fijo en dólares, que se vuelve relativamente pequeño en comparación con los rangos intradiarios reales.

- Supuestos de correlación entre activos desglosando.

- Deslizamiento en la ejecución que erosiona el borde.

Enfoques que algunos comerciantes algorítmicos consideran

En lugar de ejecutar un único conjunto fijo de parámetros, algunos sistemas incorporan un filtro de régimen de volatilidad. Esta es una verificación en tiempo real en VIX o ATR que activa un interruptor a diferentes configuraciones cuando cambian las condiciones.

Ajustes de enfoque que algunos operadores revisan en entornos con alto nivel de VIX

- Ampliar las distancias de parada proporcionalmente al ATR para reducir las salidas impulsadas por ruido.

- Reducir el tamaño de la posición para mantener el riesgo constante en dólares en relación con rangos esperados más amplios.

- Agregue un umbral VIX por encima del cual el sistema hace una pausa o se mueve al modo de comercio en papel.

- Reducir el número de posiciones simultáneas, ya que las correlaciones tienden a aumentar durante el estrés del mercado.

Ningún ajuste elimina el riesgo. El backtesting de nuevos parámetros en períodos históricos de alto VIX puede proporcionar alguna indicación del probable desempeño, aunque las condiciones pasadas no son una guía confiable para los resultados futuros.

4. ¿Sigue siendo el yen japonés (JPY) un comercio seguro confiable?

Durante los períodos de aversión al riesgo global, el capital históricamente ha fluido hacia el JPY a medida que los inversores se desenrollan en las operaciones de carry y buscan tenencias de menor volatilidad. No obstante, la confiabilidad de esta dinámica se ha vuelto más condicional.

¿Por qué el yen se ha movido históricamente como un refugio seguro?

Las tasas de interés históricamente bajas de Japón hicieron del JPY la moneda de financiamiento preferida para las operaciones de carry y cuando llega el sentimiento de riesgo, esas operaciones se desenrollan rápidamente, creando demanda de yen.

Además, la gran posición neta de activos extranjeros de Japón significa que los inversores japoneses tienden a repatriar capital durante las crisis, apoyando aún más al JPY.

Lo que ha cambiado

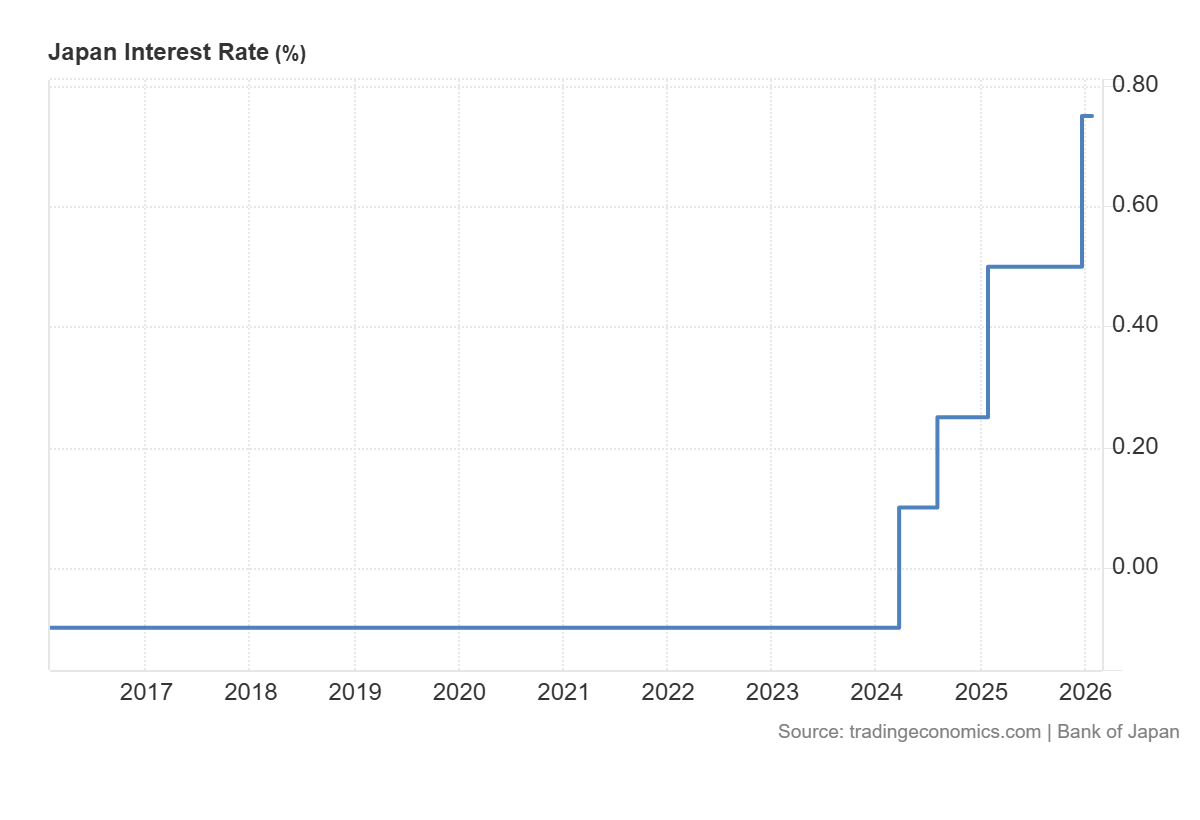

El alejamiento del Banco de Japón de la política monetaria ultra flexible en los últimos años ha complicado la dinámica tradicional de refugio seguro.

A medida que aumentan las tasas de interés japonesas:

- La escala de posicionamiento de carry trade puede cambiar.

- El USD/JPY puede volverse más sensible a los diferenciales de las tasas de interés.

- La comunicación del BoJ y los datos de inflación interna pueden influir en el JPY independientemente del apetito de riesgo global.

El yen aún puede comportarse como un refugio seguro, particularmente durante las fuertes vendas de acciones. Pero puede responder de manera más lenta o inconsistente en comparación con ciclos anteriores cuando la divergencia política entre Japón y el resto del mundo era más extrema.

Qué ver

Para los comerciantes que monitorean el JPY como una señal de refugio seguro, las fechas de reunión del BoJ, las publicaciones del IPC japonés y los datos de spread de tasas entre Estados Unidos y Japón en tiempo real se han convertido en insumos más relevantes que hace unos años.

5. ¿Cómo evito los 'azotes' en los CFDs sobre energía?

Whipsawing describe la experiencia de ingresar a una operación en una dirección, ser detenido a medida que el precio se invierte, luego ver el precio retroceder en la dirección original.

Los CFDs sobre energía, particularmente el petróleo crudo, son especialmente propensos a esto en los mercados volátiles. Y para los comerciantes en Asia, la combinación de poca liquidez durante el horario local y sensibilidad a los titulares geopolíticos puede hacer que esto sea particularmente desafiante.

¿Por qué los CFDs de energía whipsaw?

El petróleo crudo es sensible a una amplia gama de impulsores generales: decisiones de producción de la OPEP+, datos de inventario de Estados Unidos, interrupciones geopolíticas del suministro y movimientos de divisas.

En entornos de alta volatilidad, el mercado puede reaccionar fuertemente a cada titular antes de dar marcha atrás cuando llegue el siguiente.

- Los picos de precios en un titular, las paradas se activan en posiciones cortas.

- Los comerciantes vuelven a entrar largo tiempo, esperando continuación.

- Un segundo titular o toma de ganancias revierte la jugada.

- Se golpean paradas largas. El ciclo se repite.

Enfoques que los comerciantes pueden considerar para administrar el riesgo de Whipsaw

Algunos comerciantes optan por cambiar sus controles de riesgo en condiciones volátiles (por ejemplo, revisar la colocación de stop en relación con las medidas de volatilidad). Sin embargo, estos pueden aumentar las pérdidas; los riesgos de ejecución y deslizamiento pueden aumentar considerablemente en los mercados rápidos.

Otros enfoques que algunos comerciantes revisan:

- Evite operar con CFD de petróleo crudo en los 30 minutos antes y después de las principales publicaciones de datos programadas.

- Utilice un gráfico de plazos más largo para identificar la tendencia predominante antes de entrar en un período de tiempo más corto, lo que reduce la posibilidad de operar contra flujos institucionales más grandes.

- Escale a posiciones en etapas en lugar de comprometer el tamaño completo en la entrada inicial.

- Monitoree el interés abierto y el volumen para distinguir entre movimientos con participación genuina y faltas de baja liquidez.

Los latiguillos no se pueden eliminar por completo en los mercados energéticos volátiles. El objetivo de la administración de riesgos en estas condiciones no es predecir qué movimientos se mantendrán, sino asegurar que las pérdidas en movimientos falsos sean menores que las ganancias cuando sigue un movimiento direccional genuino.

Consideraciones prácticas para los mercados asiáticos volátiles

Los mercados asiáticos tienen características estructurales que interactúan con la volatilidad de manera diferente a los mercados estadounidenses o europeos:

- Una liquidez más delgada durante el horario local puede exagerar los movimientos en volúmenes delgados, particularmente en CFDs de energía y FX.

- Los eventos en China, incluidas las publicaciones del PMI, los datos comerciales y las señales de política del PBOC, pueden mover los índices regionales.

- Las decisiones políticas del BoJ se han convertido en un impulsor más activo de la volatilidad del JPY y el Nikkei en los últimos años.

- Las brechas de la noche a la mañana de los movimientos de la sesión de Estados Unidos son un riesgo estructural persistente para los operadores que no pueden monitorear las posiciones durante todo el día.

- Los requerimientos de margen de los productos apalancados pueden cambiar a corto plazo durante los períodos de alto VIX.

Preguntas frecuentes sobre la volatilidad en los mercados asiáticos

¿Qué significa una lectura alta de VIX para los índices bursátiles asiáticos?

VIX mide la volatilidad esperada en el S&P 500, pero las lecturas elevadas suelen reflejar la aversión global al riesgo que fluye a través de los mercados. Los índices asiáticos como el Nikkei 225, Hang Seng y ASX 200 a menudo pueden ver una mayor volatilidad y correlación negativa con fuertes picos de VIX.

¿Se pueden negociar las opciones de 0DTE durante el horario asiático?

El acceso depende de la plataforma y del instrumento específico. Las opciones del índice de acciones 0DTE de EE. UU. tienen un precio más activo durante las horas de negociación de Estados Unidos. Los comerciantes asiáticos pueden enfrentar diferenciales más amplios y precios menos representativos fuera de esas horas.

¿Las estrategias algorítmicas de trading son inherentemente más riesgosas en condiciones de alta volatilidad?

Las estrategias calibradas durante períodos de baja volatilidad pueden funcionar de manera diferente en entornos de alto VIX. La revisión periódica de los parámetros frente a las condiciones actuales del mercado es prudente para cualquier enfoque sistemático.

¿El comercio de refugio seguro del JPY ha cambiado permanentemente?

La normalización de las políticas del Banco de Japón ha introducido nuevas dinámicas, pero el JPY ha seguido fortaleciéndose durante algunos episodios de riesgo. Puede estar más condicionado a la naturaleza del choque y a la postura concurrente del BoJ.

¿Cuál es la mejor manera de establecer paradas en los CFDs de energía en condiciones de alta volatilidad?

No existe un método universalmente mejor. Muchos comerciantes hacen referencia a ATR para calibrar las distancias de parada a las condiciones prevalecientes en lugar de usar niveles fijos. Esto no garantiza la salida al precio deseado y no elimina el riesgo de whipsaw.

The outside bar is a powerful price action pattern that often signals a potential reversal. Unlike single-wick setups such as a pinbar strategy, the outside bar forms when a candle’s high and low both exceed those of the prior candle, effectively “engulfing” it completely.This wide-ranging bar represents a change in buying or selling pressure and illustrates the decisive battle, with one side clearly emerging stronger by the close. For traders looking at reversal setups, this pattern may provide a clear structural clue that market sentiment has shifted significantly.

Bearish Outside Bar

A bearish outside bar occurs at the end of a bullish upswing in price and sellers move in to overwhelm any buyer volume that is left in the market. The outside bar pushes above the prior candle’s high but then collapses through its low, closing below the low of the previous candle.This sudden failure at higher prices can often signal price move exhaustion of the uptrend and may be the start of a bearish reversal.

- A: Prior advance (bull candles) → strong upward movement into resistance.

- B: Outside bar (bearish close) → candle exceeds both high and low of previous candle, closing down.

- C: Confirmation candle (bearish close) → follow-through selling that validates the reversal.

The NZDUSD 1-hourly chart below shows two examples of this setup in action:

Bullish Outside Bar

A bullish outside bar appears after a decline when buyers step in aggressively. The candle drives below the prior low but then rallies strongly, closing higher and engulfing the prior candle.This shift signals that selling pressure has been absorbed, and buyers are likely taking control.

- A: Prior decline (bear candles) → downside momentum into support.

- B: Outside bar (bullish close) → candle exceeds both high and low of previous candle, closing up.

- C: Confirmation candle (bullish close) → follow-through buying that confirms the reversal.

The AUDJPY daily chart below shows two examples of this setup in action:

Stop Placement and Exits

A logical stop placement that indicates your trading idea may not have gone as you had hoped it might, and may be a placement beyond the extreme of the outside bar. Therefore:

- In bearish setups, a stop is placed above the high of the outside bar.

- In bullish setups, a stop is placed below the low of the outside bar.

Common additional exit approaches may include:

- Targeting the next key support/resistance zone,

- Using a fixed risk-to-reward ratio (e.g., 2:1 or 3:1),

- Or trailing stops behind subsequent highs/lows as the price moves in your desired direction to capture extended moves whilst locking in profit,

Final Thoughts

The outside bar is a clear visual signal that suggests a change in the balance of buyers versus sellers, where one side overwhelms the other. It may often offer a high probability of follow-through when it appears at significant levels of support or resistance.Like all setups, outside bars are fallible. For example, choppy markets can generate multiple false signals, so combining the pattern with context trend alignment, confirmation candles, and other confluence factors such as increased volume may help improve signal reliability.As always, it is worth reinforcing that an entry set alone will rarely be successful unless you have robust and unambiguous rules around the primary price action of an outside bar.Testing what these factors are and which confluence factors may work for you across different markets and timeframes is critical in creating a complete trading strategy. Only then should traders add the outside bar to their price action toolbox.

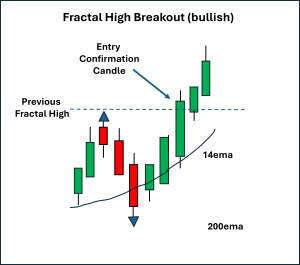

Rather than looking for a reversal, fractal breakouts use the last fractal high (in an uptrend) or last fractal low (in a downtrend) as confirmation of a trend after a retracement in priceIt is a continuation strategy designed to capture momentum once the price has confirmed direction. When price breaks beyond the most recent fractal, it signals that the prevailing trend has the strength to continue.

Bullish Fractal Breakout

A bullish fractal breakout occurs when price pushes above the last swing high (marked by a fractal). This indicates buyers have overcome the previous barrier, and the uptrend may continue after a small pullback in price.Confirmation is strengthened when the breakout candle also closes above both the 14 EMA and the 200 EMA, showing alignment of short-term momentum with long-term trend direction.

A: Prior uptrend (bull candles) → sustained buying pressure pushing toward resistance.B: Fractal high → the last swing high marked by a fractal, acting as a breakout trigger.C: Breakout candle → strong bullish candle closing ABOVE the fractal high (and ideally above both 14 EMA and 200 EMA).You can see a real chart example of this on the 1-hourly Gold (XAUUSD) CFD chart:[caption id="attachment_713057" align="aligncenter" width="722"]

Red squares show the last fractal of note. “E” shows where the entry points could be placed[/caption]

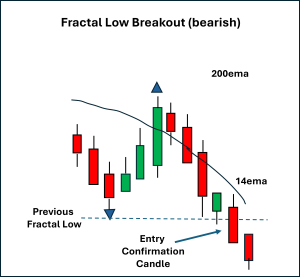

Bearish Fractal Breakout

A bearish fractal breakout occurs when price pushes below the last swing low (marked by a fractal). This shows that sellers have reconfirmed control after a small retracement, and the downtrend is likely to continue.As with the bullish version, the signal is considered stronger if the breakout candle also closes below both the 14 EMA and the 200 EMA.

A: Prior downtrend (bear candles) → sustained selling pressure pushing toward support.B: Fractal low → the last swing low marked by a fractal, acting as a breakout trigger.C: Breakout candle → strong bearish candle closing BELOW the fractal low (and ideally below both 14 EMA and 200 EMA).You can see a real-world example of this on the 1-hourly EURUSD chart: [caption id="attachment_713059" align="aligncenter" width="793"]

Red squares show the last fractal of note. “E” shows where the entry points could be place[/caption]

Stop Placement and Exits for Fractal Breakouts

Stops are logically placed on the opposite side of the breakout fractal:

- For bullish breakouts: The stop goes below the breakout candle or below the prior swing low.

- For bearish breakouts: The stop goes above the breakout candle or above the prior swing high.

Exits can be managed by:

- Targeting the next logical resistance (bullish) or support (bearish) level

- Using a fixed risk-reward ratio (e.g., 2 or 3:1)

- Trailing stops along a moving average (e.g., the 14 EMA).

- Variation: Some suggest a close beneath this (rather than just a touch) may be worth exploring as a variation.

The combination of fractals with moving averages can assist in avoiding weaker signals, but a failure to follow through on this concept is at the basis of exit approaches.

Final Thoughts

The fractal breakout setup is a clean and structured way to trade with the trend. It provides confirmation that buying pressure still exists, even after a recent pullback in price. By waiting for price to confirm beyond the last fractal point, rather than the common “buy on the dip,” you can avoid premature entries and align with the story that price action is telling you.Adding moving average filters, such as the 14 EMA for momentum and the 200 EMA for long-term bias, can significantly improve reliability, though different combinations may suit different market types and timeframes.Like all strategies, it will not always go in your favour, and even if it does, you should endeavour to reduce the amount of “give-back” of potential profit. Breakout ideas can fail, especially in choppy conditions. Risk management and unambiguous pre-defined exit criteria are essential — the only real failure is when you fail to have these in place or fail to execute your risk management.

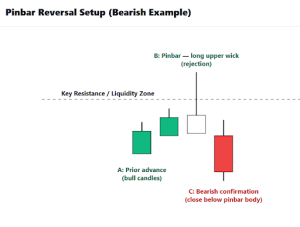

The pinbar reversal is one of the most-used price action signals in trading. It reflects a battle between buyers and sellers where one side attempts to push the market further in their favour, but is met with an observable and often strong rejection. The resulting full pinbar candle leaves a long “wick” showing where price was rejected, and usually has a small body showing where it finally closed.It suggests that momentum has shifted — traders tried to push through support or resistance but were overwhelmed by opposing pressure. This makes the pinbar a valuable signal when it forms at key levels.

Bearish Pinbar Reversal

A bearish pinbar forms after price has been moving upwards to a resistance level, but despite a test during the life of a candle, ultimately fails to hold. The long upper wick shows rejection of higher prices, suggesting sellers could be taking control:

A: Prior advance (bull candles) → strong push into a resistance zone.B: Pinbar (long upper wick) → rejection of higher prices as sellers absorb demand.C: Confirmation candle (bearish close) → follow-through selling that validates the reversal and closes BELOW the pinbar candle body.You can see a real-world example of this on the BTCUSD - 1 hourly chart:[caption id="attachment_712324" align="aligncenter" width="582"]

Entry point at ''E'' as confirmation candle close below pinbar body is needed.[/caption]

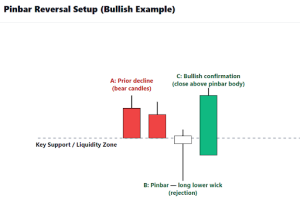

Bullish Pinbar Reversal

A bullish pinbar forms after the price has been moving downwards into support, but fails to hold below that level. The long lower wick shows rejection of lower prices, suggesting an absence of further selling pressure, with buyers expecting a bounce of the rejected support level.

A: Prior decline (bear candles) → strong push down into a support zone.B: Pinbar (long lower wick) → rejection of lower prices as buyers absorb selling.C: Confirmation candle (bullish close) → follow-through buying that confirms the reversal and closes ABOVE the pinbar candle body.You can see a real-world example of this on the USDJPY - 30-minute chart:[caption id="attachment_712327" align="aligncenter" width="614"]

Strong pinbar reversal with confirmation candle immediate after pinbar. Entry at E at candle close.[/caption]

Stop Placement and Exits for Pinbar Set-ups

Risk management is critical when trading pinbar setups. A common approach is to place the stop-loss beyond the pinbar wick (above the upper wick in a bearish pinbar, or below the lower wick in a bullish pinbar).This ensures if the market pushes past the level of rejection, the original trading idea is no longer valid, and an exit would likely be wise. For other general exits, traders will often:

- Target the next logical support or resistance zone,

- Use a fixed risk-to-reward ratio (e.g., 2:1 or 3:1),

- Or trail stops behind subsequent swing highs/lows to capture larger moves.

As with all trading strategies, the key is consistency in action. Exits should be planned before entering the trade, not improvised on emotional whims during the life of the trade.

Final Thoughts

The pinbar reversal setup captures shifts in market sentiment in a clear, visual way. Its popularity amongst traders is a reflection of its successes and its relative simplicity, even for less experienced traders. By combining context (support/resistance zones), structure (A/B/C sequence), and disciplined risk management, traders can use pinbars as part of a robust price action strategy.However, it is worth noting that not every pinbar is significant. The most reliable signals occur at meaningful levels, with confirmation from the next candle. Invest some of your time practicing, seeing how many you can spot on various historical charts (and of course, make notes on what happened next) to build confidence in recognition before trading them live.

Market Character is the big sister of Market Structure. While Market Structure can show the framework of price highs and lows, Market Character reveals the behaviour of price moves in greater detail.Market character takes into account the speed of price movement, changing volatility, and the level of conviction behind the move.The combination of Break of Market Structure (BOS) and Change in Market Character (CIMC) can form a powerful duo for reading price action with greater clarity and understanding.

What is Market Character?

If market structure is about the price map over a period of time — indicating the formation of highs, lows, and swings — then market character is about the personality of price movement during the life of such a trend.Two markets can look similar in structure but may have behaved very differently over the same time period.One may have trended relatively smoothly with measured impulses to the upside and shallow retracements in price before trend continuation, whereas the other may be choppier in nature, hesitating regularly, with more frequent false breaks. This 'how it moves' is what we mean by character.Key aspects of market character include:

- Momentum: Are moves strong and one-sided, or hesitant?

- Volatility: Are price ranges expanding or compressing?

- Reaction to levels: Do support and resistance break cleanly or have frequent and prolonged pauses?

- Consistency: Are breakouts following through or reversing and forming a series of false breakouts?

- Session tone: Are there relationships associated with different times of the trading day consistent with new session times? e.g., start of European or US sessions.

BOS and CIMC in Tandem

Break of Market Structure (BOS) occurs when the old pattern of swings is violated. For example, when an uptrend shows its first lower low. Change in Market Character (CIMC) is the confirmation that the way the market moves has shifted. For example, momentum may slow, volatility may show changes, or support/resistance breaches may be more/ less compelling in nature. A BOS without a change in character is often a false alarm. Whereas a BOS followed by a CIMC is a much stronger sign of a genuine shift.

Momentum Shifts

In a strong uptrend, price rallies are invariably strong, and pullbacks or price retracements are shallow. If rallies start weakening while retracements deepen or show a weaker recovery, momentum may be fading.Why it matters: Weakening momentum makes trend continuation less reliable.How to confirm: A flattening moving average slope or MACD histograms decreasing in size or signal line crosses over the histogram level (when in a long trade and vice versa for short), suggests that momentum is running out.

Volatility Regime Change

Markets alternate between calm, controlled moves and fast, wide swings. A sudden shift is a character change.Why it matters: Stop placement and expectations must adapt to the current market normal; otherwise, trades may be prematurely closed due to increased market noise.How to confirm: ATR rising shows volatility expansion; ATR falling shows compression. Using an ATR multiple for stop placement accounts for this volatility change. Bollinger Bands placed on your chart may offer another visual cue as the bands show narrowing or widening as volatility changes.

Reaction to Key Levels

Markets that have previously rewarded breakout trades may start to reject new breakouts and snap back into a previous price range. They will then limp through the level (often with reduced volume), suggesting buying or selling pressure may not have the required levels to produce a sustained move. How to confirm: The number one sign of rejection is if a candle closes back in range (even if earlier in the candle showed potential promise). Volume is also a strong indicator. If volume is lacking or price fails to follow through on a single slightly higher volume bar, then character may have shifted.

Liquidity and Session Tone

Markets behave differently at different times of day. A shift aligned with session opening times is often a change in character as new information comes around these times, and a different set of traders enter the market.Why it matters: The 'best time to trade' may change depending on the instruments and timeframe(s) you are trading, How to confirm: Session indicators or volume profiles can highlight which hours show the strongest moves. Measuring relative volume may be worth exploring, i.e., comparing the current volume with the standard profile for that day and time.

Final Thoughts

A Break of Market Structure (BOS) is your early warning that the pricing story may be changing. A Change in Market Character (CIMC) is confirmation that the behaviour has shifted, and a new set of opportunities could be developing.Using both together can give clear clues as to whether those potential opportunities add weight to your thinking or are worth trading.

Even during the strongest of market trends, prices do not move in straight lines for long.Nor do they move in random lines. Price structure has a tendency to be more like a wave, creating a visual rhythm on a chart. You can think of market structure as the framework on which all price action sits. If you can read structure clearly, it helps everything else make more sense and adds more weight to your decision-making.

Key Principles of Market Structure

Trends vs. Ranges

What you see on a chart is a reflection of sentiment toward the asset you are looking at in real time. Markets will either be trending (moving in one direction for a period of time) or ranging (moving sideways between two price points).A trend shows a strong imbalance between buyers and sellers, while a range shows balance and potential uncertainty about what should happen next.Recognising which environment the price action is in is vital. Trend strategies will often fail in a range, and range strategies will often be punished in a strong trend.

Swing Points

Swing highs and lows are fundamental pieces of price information and are the turning points of price. In an uptrend, the market trend builds with higher swing highs and higher swing lows. In a downtrend, it does the opposite. These points help traders map the direction and strength of a move. A failure to form the expected swing can be an early warning sign of change — a ‘break of market structure’.

Support and Resistance

Past swing levels often act as areas where traders make decisions. A prior swing high may act as resistance (a ceiling where price struggles to break higher), and a prior swing low may act as support (a floor where price struggles to break lower). This happens because many orders — stops, entries, or take-profits — are clustered at these levels.

Order Flow Reflection

Market structure is a reflection of order flow. Simple supply and demand based on the perception that an asset is under- or overpriced compared to its valuation.This is a battle between buyers and sellers over a succession of candles on the chosen timeframe you are looking at. If a series of higher highs is being made, it shows that sentiment-driven buying pressure is consistently strong enough to push prices to new levels. If that rhythm breaks, it tells us something has changed in the underlying supply/demand balance.

Fractality

The strongest structure (arguably) is fractal. What looks like potential noise or range forming on a daily chart may be a clear structure on a 30-minute chart, and vice versa. Imagine you have a group of 100 traders. 25 trade a 15-minute chart, 25 trade an hourly, 25 trade a 4-hourly, and 25 trade a daily.That means a confirmed trade on one timeframe has 25 interested participants, whereas if there is agreement on three, you have 75 traders about to press the entry button. In practical terms, a common approach is to use one or more higher timeframes for context and a short timeframe for entry.The image below shows an uptrend with higher highs and higher lows marked in green and red circles as the trend develops, and then a final breach of the previous swing low — a break of market structure.[caption id="attachment_712309" align="aligncenter" width="686"]

Chart showing the break of market structure[/caption]

What Is a Break of Market Structure?

A Break of Market Structure (BOS) happens when the price no longer follows the established rhythm it has been in for a period of time.Break of Market structure involves either:

- Price stops making higher highs and instead makes a lower low in an uptrend

- Price stops making lower lows and instead makes a higher high in a downtrend

This is the first sign that the “previous market story” that has brought the price to its current level may no longer apply. However, this doesn’t guarantee a full reversal. It may just see price move into a rangebound or sideways holding pattern until more information comes to the market.The bottom line is that it could be a critical clue that the balance of power between buyers and sellers has now shifted.With open trades you may have, it could be the time to consider exiting and moving into something else that is showing a new trend or continuation using the same market structure principles.

Why Is BOS Important to Traders?

Early Warning of Reversal

A BOS can be the very first sign that a trend is ending. Catching the shift early means avoiding overstaying in a trade or getting ready to position yourself for a potential trade in a new direction. Of course, this is a “get ready” and you would only take action when all confluence factors are in place as per your trading plan. i.e., don’t assume it is good until there is evidence that it is actually happening.

Liquidity Insight

Stop clusters are areas where many traders place their stop-loss orders, place profit targets, and where pending orders for entry may also be sitting. Many automated trading models are also primed to take action on a break of market structure within their coding.All of these can create pauses or reversals. Once these have all been swept away, this can be a signal of a BOS, and new momentum may be emerging.This can create a “liquidity sweep.” A liquidity sweep occurs when the price pushes temporarily beyond a swing high/low, triggering stops and attracting breakout traders, before snapping back the other way. In charting terms, you may see a one or two-candle “probe” beyond a key level before reversing. In practical terms, you can account for this in your decision-making by (for example) giving a little space below a previous swing high/low.

Helps Manage Risk

If you’re in a trend trade, a BOS against your position tells you to tighten stops, scale out, or exit. It’s a clear signal that your initial trading idea may no longer be valid, or it might be time to lock in any profits.

Framework for Strategy

Many discretionary traders and automated model builders create whole strategies around BOS events. For example, entering after a liquidity sweep and break, or waiting for retests of the broken market structure levels.

Final Thoughts

Market structure can give you a useful trading map of the evolution of sentiment behind a price move. Understanding this can help you define and act upon a break of structure, which is telling you when the map has changed (or is about to).By developing a greater understanding of the principles of structure, learning what BOS means in practice, and recognising related concepts like stop clusters and liquidity sweeps, traders can gain invaluable insights that help them take practical action to take for entry and exit decision-making.The reality is that most effective strategies will have these principles at their base. A BOS, especially when confirmed with context and market character, is one of the clearest signs of that shift.

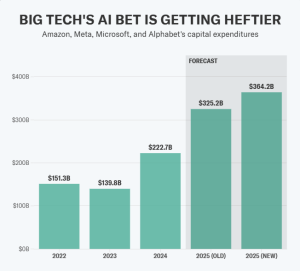

The “Magnificent Seven” technology companies are expected to invest a combined $385 billion into AI by the end of 2025.

Microsoft is positioning itself as the platform leader. Nvidia dominates the underlying AI infra. Google leads in research. Meta is building open-source tech. Amazon – AI agents. Apple — on-device integration. And Tesla pioneering autonomous vehicles and robots.

With such enormous sums pouring into AI, is this a winner-take-all game?

Or will each of the Mag Seven be able to thrive in the AI future?

Microsoft: The AI Everywhere Strategy

Microsoft has made one of the biggest bets on AI out of the Mag Seven — adopting the philosophy that AI should be everywhere.

Through its deep partnership with OpenAI, of which it is a 49% shareholder, the company has integrated GPT-5 across its entire ecosystem.

Key initiatives:

- GPT-5 integration across consumer, enterprise, and developer tools through Microsoft 365 Copilot, GitHub Copilot, and Azure AI Foundry

- Azure AI Foundry for unified AI development platform with model router technology

- Copilot ecosystem spanning productivity, coding, and enterprise applications with real-time model selection

- $100 billion projected AI infrastructure spending for 2025

Microsoft’s centrepiece is Copilot, which can now detect whether a prompt requires advanced reasoning and route to GPT-5's deeper reasoning model.

This (theoretically) means high-quality AI outputs become invisible infrastructure rather than a skill users need to learn.

However, this all-in bet on OpenAI does come with some risks. It is putting all its eggs in OpenAI's basket, tying its future success to a single partnership.

Elon Musk warned that "OpenAI is going to eat Microsoft alive"[/caption]

Google: The Research Strategy

Google’s approach is to fund research to build the most intelligent models possible. This research-first strategy creates a pipeline from scientific discovery to commercial products — what it hopes will give it an edge in the AI race.

Key initiatives:

- Over 4 million developers building with Gemini 2.5 Pro and Flash

- Ironwood TPU offering 3,600 times better performance compared to Google’s first TPU

- AI search overviews reaching 2 billion monthly users across Google Search

- DeepMind breakthroughs: AlphaEvolve for algorithm discovery, Aeneas for ancient text interpretation, AlphaQubit for quantum error detection, and AI co-scientist systems

Google’s AI research branch, DeepMind, brings together two of the world's leading AI research labs — Google Brain and DeepMind — the former having invented the Transformer architecture that underpins almost all modern large language models.

The bet is that breakthrough research in areas like quantum computing, protein folding, and mathematical reasoning will translate into a competitive advantage for Google.

Today, we're introducing AlphaEarth Foundations from @GoogleDeepMind , an AI model that functions like a virtual satellite which helps scientists make informed decisions on critical issues like food security, deforestation, and water resources. AlphaEarth Foundations provides a… pic.twitter.com/L1rk2Z5DKk

— Google AI (@GoogleAI) July 30, 2025

Meta: The Open Source Strategy

Meta has made a somewhat contrarian bet in its approach to AI: giving away their tech for free. The company's Llama 4 models, including recently released Scout and Maverick, are the first natively multi-modal open-weight models available.

Key initiatives:

- Llama 4 Scout and Maverick - first open-weight natively multi-modal models

- AI Studio that enables the creation of hundreds of thousands of AI characters

- $65-72 billion projected AI infrastructure spending for 2025

This open-source strategy directly challenges the closed-source big players like GPT and Claude. By making AI models freely available, Meta is essentially commoditizing what competitors are trying to monetize. Meta's bet is that if AI models become commoditized, the real value will be in the infrastructure that sits on top. Meta's social platforms and massive user base give it a natural advantage if this eventuates.

Meta's recent quarter was also "the best example to date of AI having a tangible impact on revenue and earnings growth at scale," according to tech analyst Gene Munster.

However, it hasn’t been all smooth sailing for Meta. Their most anticipated release, Llama Behemoth, has all but been scrapped due to performance issues. And Meta is now rumored to be developing a closed-source Behemoth alternative, despite their open-source mantra.

Amazon: The AI Agent Strategy

Amazon’s strategy is to build the infrastructure for AI that can take actions — booking meetings, processing orders, managing workflows, and integrating with enterprise systems.

Rather than building the best AI model, Amazon has focused its efforts on becoming the platform where all AI models live.

Key initiatives:

- Amazon Bedrock offering 100+ foundation models from leading AI companies, including OpenAI models.

- $100 million additional investment in AWS Generative AI Innovation Center for agentic AI development

- Amazon Bedrock AgentCore enabling deployment and scaling of AI agents with enterprise-grade security

- $118 billion projected AI infrastructure spending for 2025

The goal is to become the “orchestrator” that lets companies mix and match the best models for different tasks.

Amazon’s AgentCore will provide the underlying memory management, identity controls, and tool integration needed for these companies to deploy AI agents safely at scale.

This approach offers flexibility, but does carry some risks. Amazon is essentially positioning itself as the middleman for AI. If AI models become commoditized or if companies prefer direct relationships with AI providers, Amazon's systems could become redundant.

Nvidia: The Infra Strategy

Nvidia is the one selling the shovels for the AI gold rush. While others in the Mag Seven battle to build the best AI models and applications, Nvidia provides the fundamental computing infrastructure that makes all their efforts possible.

This hardware-first strategy means Nvidia wins regardless of which company ultimately dominates. As AI advances and models get larger, demand for Nvidia's chips only increases.

Key initiatives:

- Blackwell architecture achieving $11 billion in Q2 2025 revenue, the fastest product ramp in company history

- New chip roadmap: Blackwell Ultra (H2 2025), Vera Rubin (H2 2026), Rubin Ultra (H2 2027)

- Data center revenue reaching $35.6 billion in Q2, representing 91% of total company sales

- Manufacturing scale-up with 350 plants producing 1.5 million components for Blackwell chips

With an announced product roadmap of Blackwell Ultra (2025), Vera Rubin (2026), and Rubin Ultra (2027), Nvidia has created a system where the AI industry must continuously upgrade to Nvidia’s newest tech to stay competitive.

This also means that Nvidia, unlike the others in the Mag Seven, has almost no direct AI spending — it is the one selling, not buying.

However, Nvidia is not indestructible. The company recently halted its H20 chip production after the Chinese government effectively blocked the chip, which was intended as a workaround to U.S. export controls.

Apple: The On-Device Strategy

Apple's AI strategy is focused on privacy, integration, and user experience. Apple Intelligence, the AI system built into iOS, uses on-device processing and Private Cloud Compute to help ensure user data is protected when using AI.

Key initiatives:

- Apple Intelligence with multi-model on-device processing and Private Cloud Compute

- Enhanced Siri with natural language understanding and ChatGPT integration for complex queries

- Direct developer access to on-device foundation models, enabling offline AI capabilities

- $10-11 billion projected AI infrastructure spending for 2025

The drawback of this on-device approach is that it requires powerful hardware from the user's end. Apple Intelligence can only run on devices with a minimum of 8GB RAM, creating a powerful upgrade cycle for Apple but excluding many existing users.

Tesla: The Robo Strategy

Tesla's AI strategy focuses on two moonshot applications: Full Self-Driving vehicles and humanoid robots.

This is the 'AI in the physical world' play. While others in the Mag Seven are focused on the digital side of AI, Tesla is building machines that use AI for physical operations.

Key initiatives:

- Plans for 5,000-10,000 Optimus robots in 2025, scaling to 50,000 in 2026

- Robotaxi service targeting availability to half the U.S. population by EOY 2025

- AI6 chip development with Samsung for unified training across vehicles, robots, and data centers

- $5 billion projected AI infrastructure spending for 2025

This play is exponentially harder to develop than digital AI, and the markets have reflected low confidence that Tesla can pull it off.

TSLA has been the worst-performing Mag Seven stock of 2025, down 18.37% in H1 2025.

However, if Tesla’s strategy is successful, it could be far more valuable than other AI plays. Robots and autonomous vehicles could perform actual labour worth trillions of dollars annually.

The $385 billion Question

The Mag Seven are starting to see real revenue come in from their AI investments. But they're pouring that money (and more) back into AI, betting that the boom is just getting started.

The platform players like Microsoft and Amazon are betting on becoming essential infrastructure. Nvidia’s play is to sell the underlying hardware to everyone. Google and Meta compete on capability and access. While Apple and Tesla target specific use cases.

The $385 billion question is which of the Magnificent Seven has bet the right way? Or will a new player rise and usurp the long-standing tech giants altogether?

You can access all Magnificent Seven stocks and thousands of other Share CFDs on GO Markets.