Berita & analisis pasar

Tetap selangkah lebih maju di pasar dengan wawasan ahli, berita, dan analisis teknikal untuk memandu keputusan trading Anda.

Volatilitas tidak membeda-bedakan. Tapi itu bisa menghukum yang tidak siap.

Berhenti terkena pukulan pada gerakan yang mundur dalam beberapa menit. Premi pada opsi jangka pendek naik. Dan yen tidak lagi berperilaku sebagai lindung nilai yang dapat diandalkan seperti dulu.

Bagi para pedagang di seluruh Asia, menavigasi lingkungan ini berarti mengajukan pertanyaan yang lebih sulit tentang risiko, waktu, dan asumsi yang dimasukkan ke dalam strategi yang dibangun untuk pasar yang lebih tenang.

1. Bagaimana cara memperdagangkan CFD VIX selama guncangan geopolitik?

Indeks Volatilitas CBOE (VIX) mengukur ekspektasi pasar terhadap volatilitas tersirat 30 hari pada S&P 500. Hal ini sering disebut “pengukur ketakutan.” Selama guncangan geopolitik seperti eskalasi Iran saat ini, pengumuman sanksi, dan tindakan bank sentral yang mengejutkan, VIX dapat melonjak tajam dan cepat.

Apa yang membuat CFD VIX berbeda dalam kejutan

VIX sendiri tidak dapat diperdagangkan secara langsung. CFD VIX biasanya dihargai dari VIX futures, yang berarti mereka membawa hambatan contango dalam kondisi normal.

Selama kejutan geopolitik, beberapa hal dapat terjadi sekaligus

- Spot VIX dapat melonjak segera sementara futures jangka pendek tertinggal, menciptakan pemutusan hubungan.

- Spread pada CFD VIX dapat melebar secara signifikan saat likuiditas menipis.

- Persyaratan margin dapat berubah intraday saat model risiko broker menyesuaikan.

- VIX cenderung rata-rata kembali setelah lonjakan, jadi waktu dan durasi sangat penting.

Apa artinya ini bagi pedagang jam Asia

Jam pasar Asia berarti banyak peristiwa geopolitik dapat pecah saat pedagang lokal aktif atau baru memulai sesi mereka.

Kejutan yang melanda selama jam Tokyo mungkin sudah dihargai ke VIX futures sebelum Sydney dibuka.

Beberapa pedagang menggunakan posisi CFD VIX sebagai lindung nilai jangka pendek terhadap portofolio ekuitas daripada perdagangan terarah. Yang lain memperdagangkan pembalikan (pergerakan kembali ke rata-rata historis setelah lonjakan awal memudar). Kedua pendekatan membawa risiko yang berbeda, dan tidak menjamin hasil tertentu.

2. Mengapa premi opsi 0DTE saya begitu mahal sekarang?

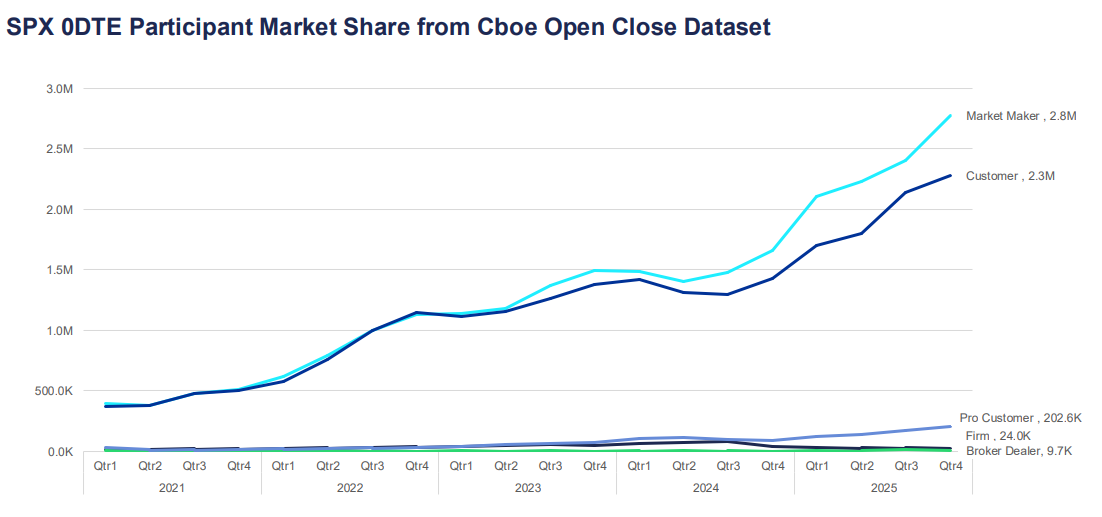

Opsi nol hari hingga kedaluwarsa (0DTE) kedaluwarsa pada hari yang sama saat mereka diperdagangkan. Mereka telah menjadi salah satu segmen pasar opsi yang tumbuh paling cepat, sekarang mewakili lebih dari 57% volume opsi harian S & P 500 menurut data pasar global Cboe.

Bagi peserta yang berbasis di Asia yang mengakses pasar opsi AS, peningkatan premi selama periode volatilitas dapat terasa seperti salah harga, tetapi biasanya mencerminkan faktor penetapan harga struktural.

Mengapa premi melonjak

Harga opsi didorong oleh nilai intrinsik dan nilai waktu. Untuk opsi 0DTE, hampir tidak ada nilai waktu yang tersisa, yang mungkin menunjukkan harganya harus murah tetapi komponen volatilitas tersirat mengkompensasi itu.

Ketika ketidakpastian meningkat, penjual mungkin menuntut kompensasi yang lebih besar untuk risiko pergerakan intraday yang tajam.

Hal ini dapat tercermin dalam

- Input volatilitas tersirat yang lebih tinggi.

- Spread bid-ask yang lebih luas.

- Penyesuaian yang lebih cepat dalam hedging delta dan gamma.

Dalam lingkungan VIX yang lebih tinggi, aliran lindung nilai dapat berkontribusi pada loop umpan balik jangka pendek dalam indeks yang mendasarinya. Ini dapat memperkuat perubahan harga, terutama di sekitar level kunci.

Apa artinya ini bagi pedagang jam Asia

Banyak kontrak opsi 0DTE melihat arus harga dan lindung nilai paling aktif selama jam perdagangan AS. Memasuki posisi selama sesi Asia dapat berarti menghadapi harga basi atau spread yang lebih luas.

Jika Anda melihat premi mahal, itu mungkin mencerminkan pasar secara akurat menetapkan harga risiko pergerakan besar pada hari yang sama. Apakah premi itu layak dibayar tergantung pada pandangan Anda tentang kemungkinan kisaran intraday dan toleransi risiko Anda, bukan pada angka dolar absolut saja.

3. Bagaimana cara menyesuaikan bot perdagangan algoritmik saya untuk lingkungan VIX tinggi?

Banyak sistem perdagangan algoritmik dibangun di atas parameter yang dikalibrasi selama rezim volatilitas rendah. Ketika VIX melonjak, parameter tersebut dapat menjadi usang dengan cepat.

Masalah ketidakcocokan rezim

Sebagian besar algoritma perdagangan menggunakan data historis untuk mengatur ukuran posisi, jarak berhenti, dan ambang batas masuk. Data tersebut mencerminkan kondisi di mana sistem diuji. Jika VIX bergerak dari 15 menjadi 35, asumsi statistik yang mendasari pengaturan tersebut mungkin tidak lagi berlaku.

Mode kegagalan umum di lingkungan VIX tinggi meliputi

- Berhenti dipicu berulang kali oleh kebisingan sebelum gerakan arah yang dimaksudkan terjadi.

- Ukuran posisi berdasarkan risiko dolar tetap, yang menjadi relatif kecil dibandingkan dengan rentang intraday aktual.

- Asumsi korelasi antara aset yang rusak.

- Selip pada eksekusi yang mengikis tepi.

Pendekatan yang dipertimbangkan oleh beberapa pedagang algoritmik

Alih-alih menjalankan satu set parameter tetap, beberapa sistem menggabungkan filter rezim volatilitas. Ini adalah pemeriksaan real-time pada VIX atau ATR yang memicu peralihan ke pengaturan yang berbeda ketika kondisi bergeser.

Pendekatan penyesuaian yang ditinjau oleh beberapa pedagang di lingkungan VIX tinggi

- Memperluas jarak berhenti secara proporsional dengan ATR untuk mengurangi pintu keluar yang didorong oleh kebisingan.

- Kurangi ukuran posisi untuk mempertahankan risiko dolar yang konstan relatif terhadap rentang yang diharapkan lebih luas.

- Tambahkan ambang VIX di mana sistem berhenti atau pindah ke mode perdagangan kertas.

- Kurangi jumlah posisi simultan, karena korelasi cenderung meningkat selama tekanan pasar.

Tidak ada penyesuaian yang menghilangkan risiko. Menguji kembali parameter baru pada periode VIX tinggi historis dapat memberikan beberapa indikasi kemungkinan kinerja, meskipun kondisi masa lalu bukanlah panduan yang dapat diandalkan untuk hasil di masa depan.

4. Apakah Yen Jepang (JPY) masih merupakan perdagangan safe-haven yang andal?

Selama periode penghindaran risiko global, modal secara historis mengalir ke JPY karena investor melepas carry trade dan mencari kepemilikan dengan volatilitas rendah. Namun, keandalan dinamika ini menjadi lebih kondisional.

Mengapa yen secara historis bergerak sebagai tempat berlindung yang aman?

Suku bunga Jepang yang rendah secara historis menjadikan JPY mata uang pendanaan pilihan untuk carry trade dan ketika sentimen risk-off melanda, perdagangan tersebut mereda dengan cepat, menciptakan permintaan untuk yen.

Selain itu, posisi aset asing bersih Jepang yang besar berarti investor Jepang cenderung memulangkan modal selama krisis, yang selanjutnya mendukung JPY.

Apa yang telah berubah

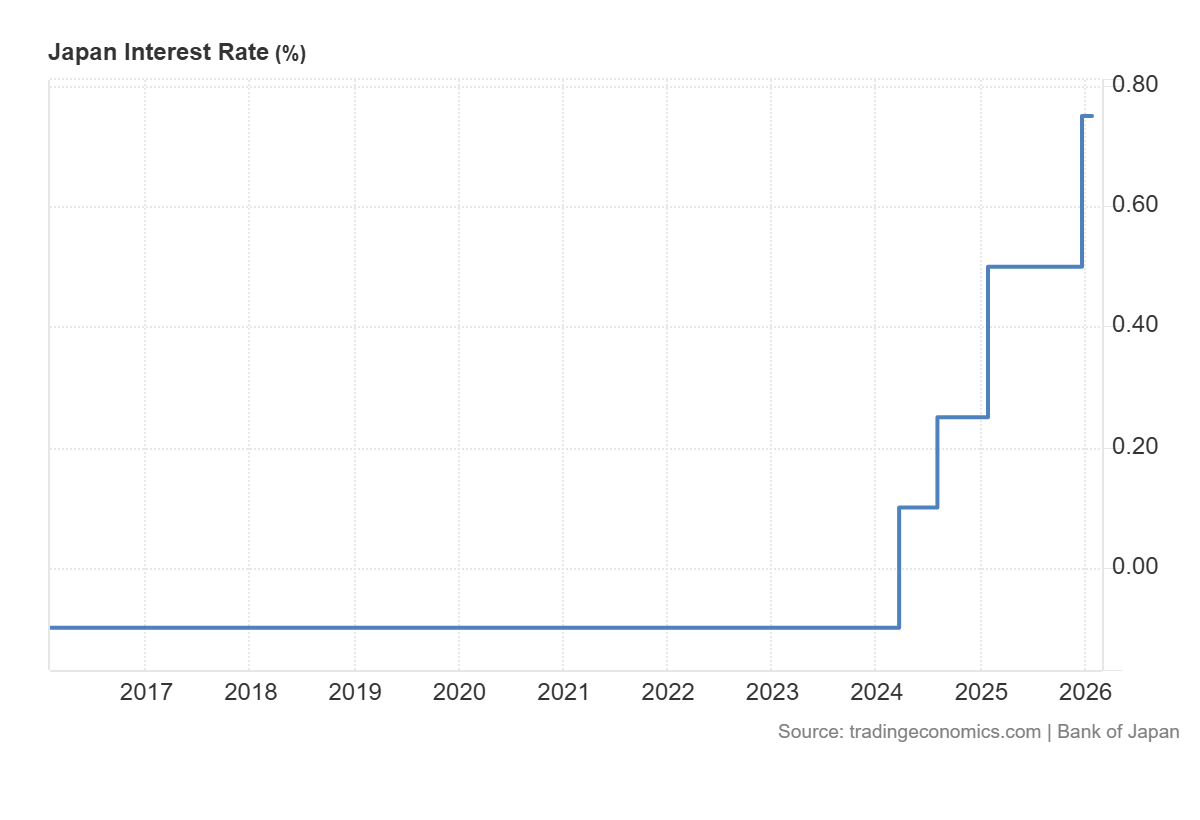

Pergeseran Bank of Japan dari kebijakan moneter yang sangat longgar dalam beberapa tahun terakhir telah memperumit dinamika safe-haven tradisional.

Seiring kenaikan suku bunga Jepang:

- Skala posisi carry trade dapat berubah.

- USD/JPY bisa menjadi lebih sensitif terhadap spread suku bunga.

- Komunikasi BoJ dan data inflasi domestik dapat mempengaruhi JPY secara independen dari selera risiko global.

Yen masih dapat berperilaku sebagai tempat berlindung yang aman, terutama selama aksi jual ekuitas yang tajam. Tetapi mungkin merespons lebih lambat atau tidak konsisten dibandingkan dengan siklus sebelumnya ketika perbedaan kebijakan antara Jepang dan seluruh dunia lebih ekstrem.

Apa yang harus ditonton

Bagi pedagang yang memantau JPY sebagai sinyal safe haven, tanggal pertemuan BoJ, rilis CPI Jepang, dan data spread kurs AS-Jepang real-time telah menjadi input yang lebih relevan daripada beberapa tahun yang lalu.

5. Bagaimana cara menghindari 'whipsawing' pada CFD energi?

Whipsawing menggambarkan pengalaman memasuki perdagangan dalam satu arah, berhenti saat harga berbalik, kemudian melihat harga bergerak kembali ke arah semula.

CFD energi, terutama minyak mentah, sangat rentan terhadap hal ini di pasar yang bergejolak. Dan bagi para pedagang di Asia, kombinasi likuiditas tipis selama jam-jam lokal dan kepekaan terhadap berita utama geopolitik dapat membuat ini sangat menantang.

Mengapa CFD energi meledak

Minyak mentah sensitif terhadap berbagai pendorong utama: keputusan produksi OPEC+, data inventaris AS, gangguan pasokan geopolitik, dan pergerakan mata uang.

Dalam lingkungan volatilitas tinggi, pasar dapat bereaksi kuat terhadap setiap judul sebelum berbalik ketika yang berikutnya tiba.

- Harga melonjak pada judul, stop dipicu pada posisi pendek.

- Pedagang kembali memasuki panjang, mengharapkan kelanjutan.

- Judul kedua atau pengambilan keuntungan membalikkan langkah.

- Perhentian panjang terpukul. Siklus berulang.

Pendekatan yang dapat dipertimbangkan pedagang untuk mengelola risiko whipsaw

Beberapa pedagang memilih untuk mengubah kontrol risiko mereka dalam kondisi yang tidak stabil (misalnya, meninjau penempatan berhenti relatif terhadap ukuran volatilitas). Namun ini dapat meningkatkan kerugian; risiko eksekusi dan slippage dapat meningkat tajam di pasar cepat

Pendekatan lain yang ditinjau oleh beberapa pedagang:

- Hindari perdagangan CFD minyak mentah dalam 30 menit sebelum dan sesudah rilis data utama yang dijadwalkan.

- Gunakan grafik jangka waktu yang lebih panjang untuk mengidentifikasi tren yang berlaku sebelum memasuki kerangka waktu yang lebih pendek, mengurangi peluang perdagangan terhadap arus institusional yang lebih besar.

- Skalakan ke posisi secara bertahap daripada melakukan ukuran penuh pada entri awal.

- Pantau minat terbuka dan volume untuk membedakan antara pergerakan dengan partisipasi asli dan pemalsuan likuiditas rendah.

Whipsawing tidak dapat dihilangkan sepenuhnya di pasar energi yang bergejolak. Tujuan manajemen risiko dalam kondisi ini bukanlah untuk memprediksi pergerakan mana yang akan bertahan, tetapi untuk memastikan bahwa kerugian pada pergerakan palsu lebih kecil daripada keuntungan ketika gerakan arah yang sebenarnya mengikuti.

Pertimbangan praktis untuk pasar Asia yang bergejolak

Pasar Asia memiliki karakteristik struktural yang berinteraksi dengan volatilitas berbeda dari pasar AS atau Eropa:

- Likuiditas yang lebih tipis selama jam lokal dapat membesar-besarkan pergerakan volume tipis, terutama dalam energi dan CFD FX.

- Peristiwa di China, termasuk rilis PMI, data perdagangan, dan sinyal kebijakan PBOC, dapat menggerakkan indeks regional.

- Keputusan kebijakan BoJ telah menjadi pendorong volatilitas JPY dan Nikkei yang lebih aktif dalam beberapa tahun terakhir.

- Kesenjangan semalam dari pergerakan sesi AS merupakan risiko struktural persisten bagi pedagang yang tidak dapat memantau posisi sepanjang waktu.

- Persyaratan margin pada produk leverage dapat berubah dalam waktu singkat selama periode VIX tinggi.

Pertanyaan yang sering diajukan tentang volatilitas di pasar Asia

Apa arti pembacaan VIX yang tinggi untuk indeks ekuitas Asia?

VIX mengukur volatilitas yang diharapkan pada S&P 500, tetapi pembacaan yang meningkat biasanya mencerminkan penghindaran risiko global yang mengalir di seluruh pasar. Indeks Asia seperti Nikkei 225, Hang Seng, dan ASX 200 sering dapat melihat peningkatan volatilitas dan korelasi negatif dengan lonjakan VIX yang tajam.

Bisakah opsi 0DTE diperdagangkan selama jam Asia?

Akses tergantung pada platform dan instrumen spesifik. Opsi indeks ekuitas AS 0DTE paling aktif dihargai selama jam perdagangan AS. Pedagang Asia mungkin menghadapi spread yang lebih luas dan harga yang kurang representatif di luar jam-jam tersebut.

Apakah strategi perdagangan algoritmik secara inheren lebih berisiko dalam kondisi volatilitas tinggi?

Strategi yang dikalibrasi selama periode volatilitas rendah dapat bekerja secara berbeda di lingkungan VIX tinggi. Tinjauan rutin parameter terhadap kondisi pasar saat ini bijaksana untuk pendekatan sistematis apa pun.

Apakah perdagangan safe-haven JPY berubah secara permanen?

Normalisasi kebijakan Bank of Japan telah memperkenalkan dinamika baru, tetapi JPY terus menguat selama beberapa episode risiko off. Ini mungkin lebih tergantung pada sifat kejutan dan postur BoJ yang bersamaan.

Apa cara terbaik untuk menghentikan CFD energi dalam kondisi volatilitas tinggi?

Tidak ada metode terbaik secara universal. Banyak pedagang merujuk ATR untuk mengkalibrasi jarak berhenti ke kondisi yang berlaku daripada menggunakan level tetap. Ini tidak menjamin keluar pada harga yang diinginkan dan tidak menghilangkan risiko whipsaw.

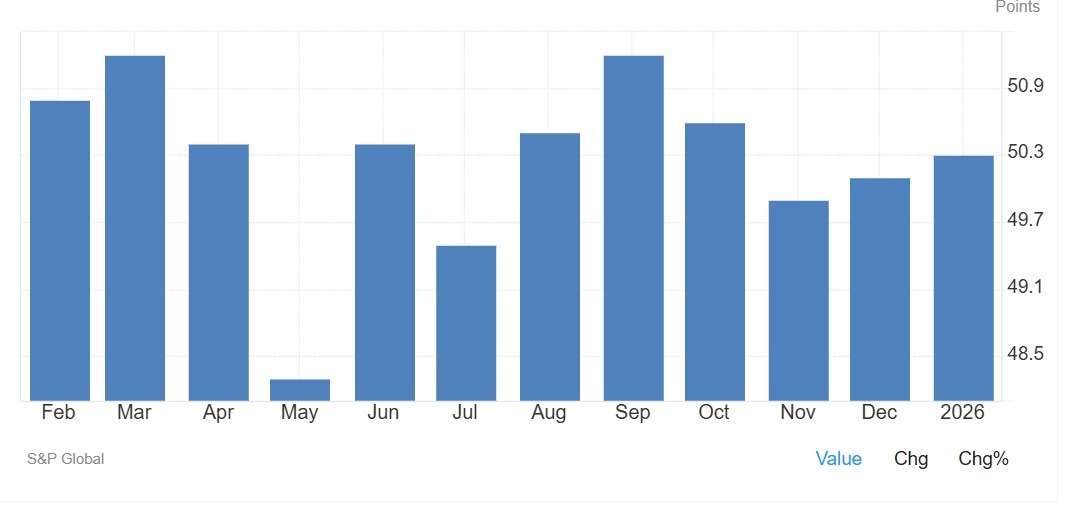

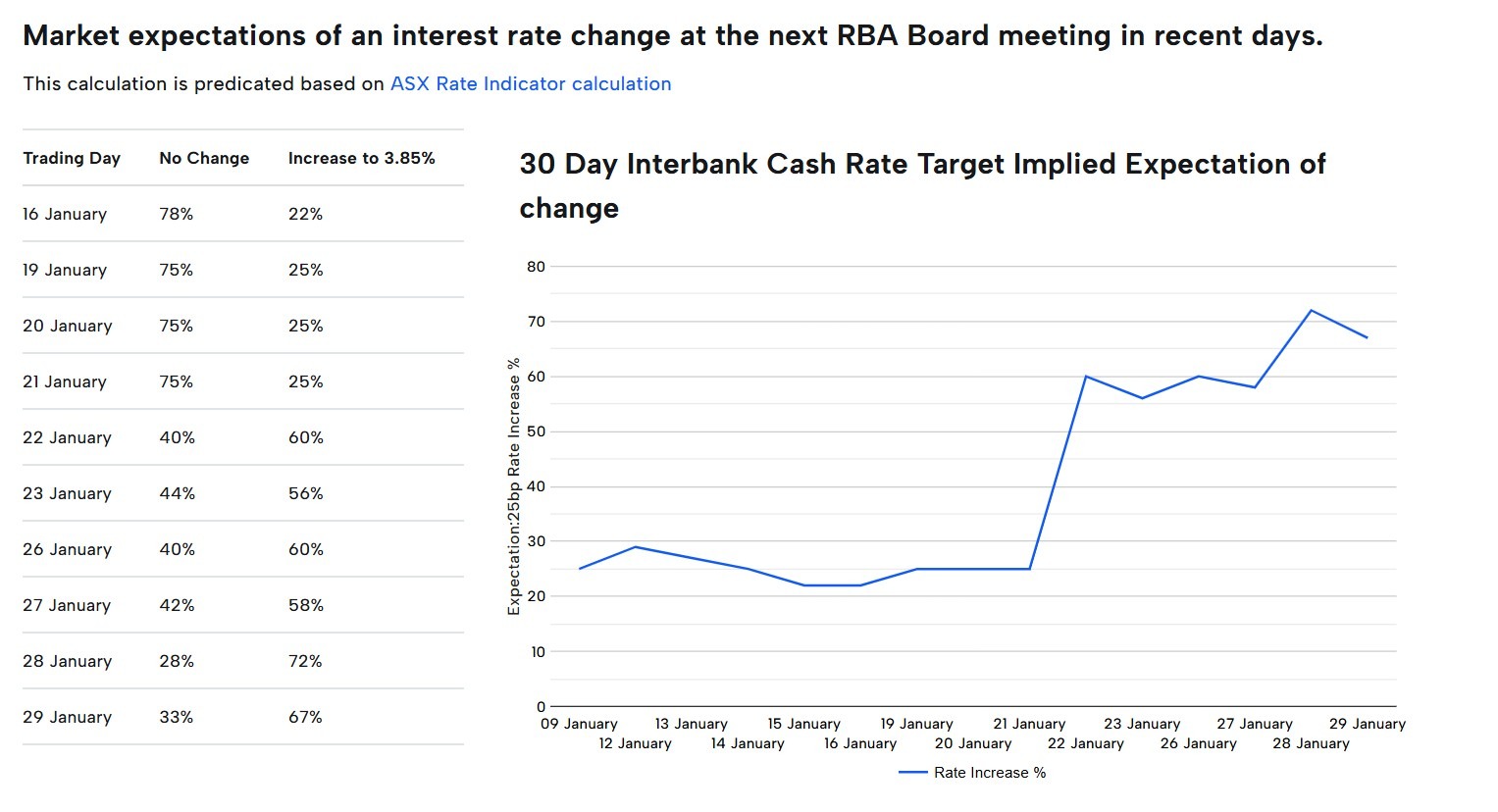

Februari dibuka dengan nada kebijakan berat yang dipimpin oleh keputusan RBA Australia, sementara Jepang menyediakan jangkar makro inti melalui pembaruan PDB dan inflasi. Sebaliknya, kalender China menjadi lebih ringan karena Festival Musim Semi, mengalihkan perhatian ke likuiditas dan berita utama kebijakan. Di seluruh kawasan, USD yang lebih kuat dan logam yang lebih lunak terus membingkai kinerja lintas aset, terutama untuk mata uang terkait komoditas.

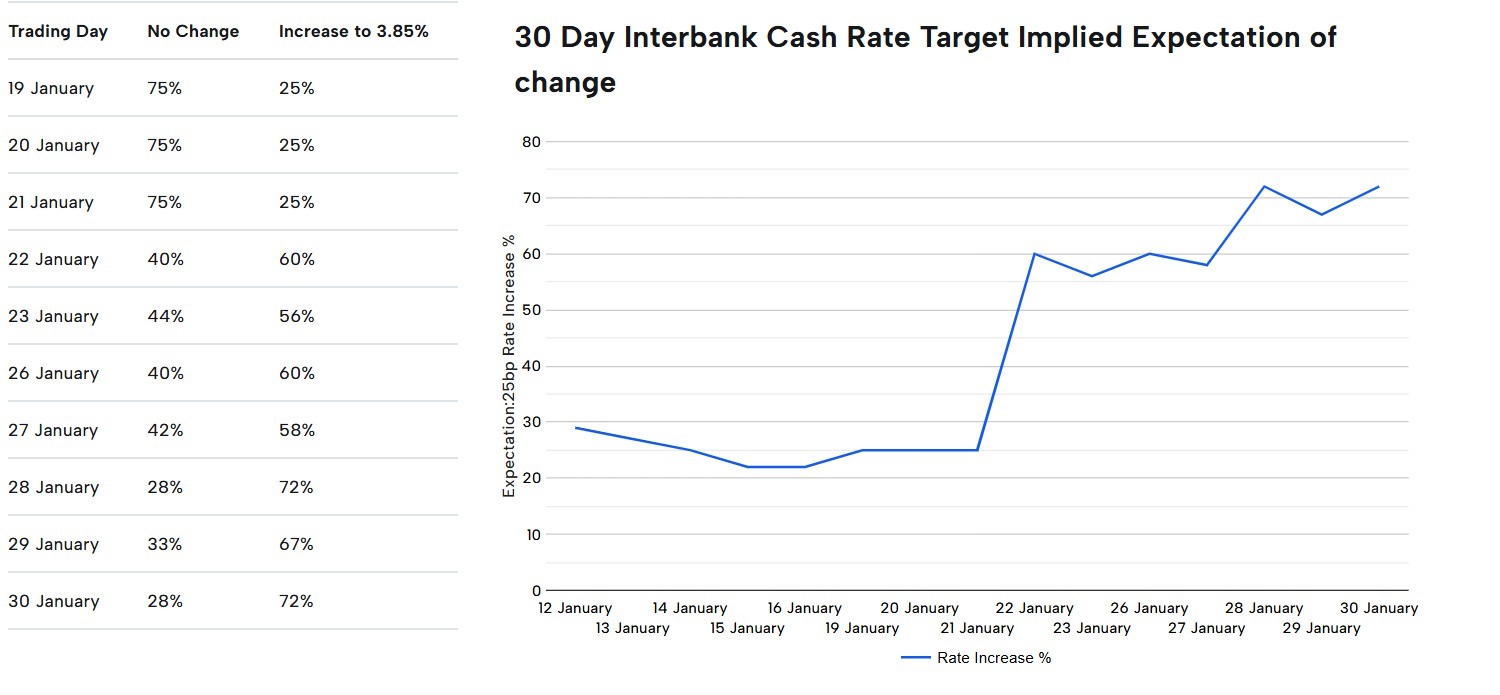

Australia: RBA

Australia memulai Februari dengan fokus yang digerakkan oleh kebijakan saat Reserve Bank of Australia (RBA) menyampaikan keputusan kebijakan moneternya, menetapkan nada awal bulan untuk suku bunga, mata uang, dan ekuitas. Sementara pasar telah memberi harga sekitar 70% peluang kenaikan pada 30 Januari, ekspektasi tetap sangat sensitif terhadap data yang berkembang dan komentar RBA.

Tanggal utama

- Keputusan Kebijakan Moneter RBA: 14:30, 3 Februari (AEDT)

- Indeks Harga Upah (WPI): 11:30 pagi, 18 Februari (AEDT)

- Tenaga Kerja: 11:30 pagi, 19 Februari (AEDT)

Apa yang dicari pasar

Pedagang Australia akan mengukur apakah RBA memperkuat sikap yang bergantung pada data atau bergeser lebih tegas ke arah pengetatan.

Data upah dan tenaga kerja akan menjadi pusat dalam menguji persistensi inflasi, sementara pembacaan CPI berikutnya akan memposisikan posisi menuju bulan Maret. Nada yang seimbang atau agak hawkish dapat menjaga imbal hasil jangka pendek tetap tinggi dan membatasi penurunan dalam AUD.

Sensitivitas pasar

Kinerja AUD dan ASX terutama akan mencerminkan nada kebijakan RBA dan momentum USD yang lebih luas, sementara sektor yang terkait dengan sumber daya harus terus melacak tren logam dan komoditas massal.

Musim pendapatan Februari, yang disorot oleh CBA dan CSL (11 Februari), BHP (17 Februari), dan Rio Tinto (19 Februari), juga akan memperkenalkan kembali driver khusus saham setelah fokus kebijakan awal memudar.

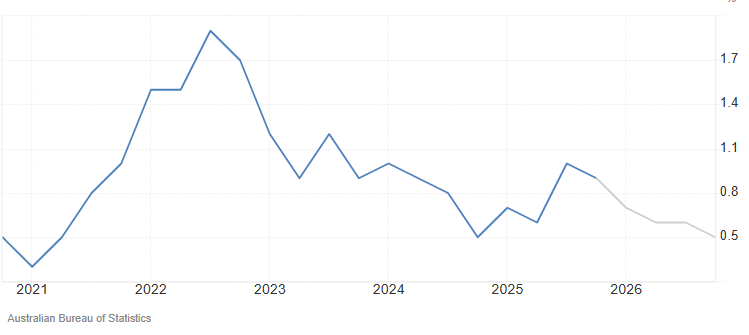

Australia: CPI

Rilis Indeks Harga Konsumen (CPI) Februari Australia akan menjadi peristiwa penting pasca-RBA, menawarkan bacaan paling jelas tentang apakah tekanan inflasi domestik mereda sejalan dengan ekspektasi bank sentral.

Data mengikuti keputusan kebijakan RBA Februari dan dapat dengan cepat mengatur ulang probabilitas jalur suku bunga yang tercermin dalam harga berjangka ASX.

Tanggal utama

- Indeks Harga Konsumen (IHK): 11:30 pagi, 25 Februari (AEDT)

Apa yang dicari pasar

Pasar akan fokus pada apakah komponen inflasi rata-rata yang dipangkas dan layanan menunjukkan moderasi lebih lanjut.

Kekuatan yang terus-menerus di sektor non-perdagangan atau terkait upah dapat memperkuat ekspektasi untuk pengetatan tambahan di kemudian hari di Q1, sementara berita utama yang lebih lembut akan mendukung pandangan bahwa suku bunga kebijakan telah mencapai puncaknya.

Sensitivitas pasar

CPI yang lebih kuat dari perkiraan kemungkinan akan mengangkat imbal hasil front-end dan mendukung AUD, sementara kejutan penurunan dapat membebani mata uang dan meratakan kurva imbal hasil.

Sentimen ekuitas mungkin berbeda dan keuangan dapat menemukan kelegaan dari bias jeda, sedangkan sektor yang sensitif terhadap suku bunga seperti real estat dan diskresioner konsumen akan mendapat manfaat paling besar dari pembacaan inflasi yang lebih dingin.

Jepang: PDB Q4

Rilis PDB Q4 Jepang akan menjadi titik referensi utama untuk seberapa kuat kemajuan pemulihan setelah kuartal terakhir mengalami momentum pertumbuhan yang tidak merata. Tiba menjelang cetak CPI Tokyo, ini membantu membentuk ekspektasi untuk permintaan domestik, kinerja perdagangan eksternal, dan seberapa banyak ruang lingkup pembuat kebijakan harus menyesuaikan sikap mereka tanpa menggagalkan aktivitas.

Tanggal utama

- Q4 PDB: 11:50 malam, 15 Februari (GMT) /10:50 pagi, 16 Februari (AEDT)

Apa yang dicari pasar

Investor memperhatikan keseimbangan antara konsumsi, investasi bisnis, dan ekspor bersih untuk menilai apakah pertumbuhan berbasis luas atau didukung secara sempit.

Hasil cetak yang lebih kuat dari perkiraan cenderung memperkuat kepercayaan pada kisah ekspansi Jepang, sementara hasil yang lebih lemah dapat menghidupkan kembali kekhawatiran tentang stagnasi dan menunda harapan untuk perubahan kebijakan yang berarti.

Jepang: CPI Tokyo

Pembacaan inflasi terbaru Tokyo menunjukkan CPI utama melemah menjadi 1,5% tahun-ke-tahun di bulan Januari dari 2,0% pada Desember 2025, turun lebih jauh di bawah puncak baru-baru ini yang terlihat selama kenaikan pascapandemi.

Rilis IHK menawarkan salah satu bacaan tercepat tentang denyut nadi inflasi Jepang dan diawasi ketat sebagai indikator utama untuk tren harga nasional.

Datang di akhir bulan ini, ini berfungsi sebagai pemeriksaan apakah kenaikan inflasi baru-baru ini bertahan pada tingkat yang konsisten dengan banyak tujuan pembuat kebijakan.

- CPI Tokyo: 11:30 malam, 26 Februari (GMT) /10:30 pagi, 27 Februari (AEDT)

Apa yang dicari pasar

Perhatian berpusat pada langkah-langkah inti yang menghilangkan komponen volatil, di samping harga jasa, untuk melihat apakah inflasi yang mendasarinya bertahan mendekati target atau melayang lebih rendah.

Profil yang lebih kuat memperkuat kasus bahwa Jepang keluar dari rezim inflasi rendah, sementara pembacaan yang lebih lembut menunjukkan bahwa tekanan harga tetap rapuh dan bergantung pada faktor-faktor eksternal.

Sensitivitas pasar

CPI Tokyo yang lebih panas dari perkiraan dapat mendorong imbal hasil Jepang lebih tinggi dan memberikan dukungan kepada yen, sering kali diterjemahkan ke dalam tekanan pada nama-nama ekuitas besar eksportir.

Sebaliknya, hasil yang lebih lembut cenderung mengurangi tekanan imbal hasil, melemahkan yen, dan memberikan beberapa kelegaan bagi sektor ekuitas yang mendapat manfaat dari latar belakang kebijakan yang lebih akomodatif.

China

Kalender makro bulan Februari China secara struktural lebih ringan karena waktu Festival Musim Semi.

Biro Statistik Nasional China mencatat bahwa beberapa rilis disesuaikan sekitar waktu Festival Musim Semi, dengan PMI Februari dijadwalkan untuk awal Maret meninggalkan pasar tanpa jangkar data domestik utama untuk sebagian besar bulan ini.

Tanggal utama

- Festival Musim Semi: 17 Februari hingga 3 Maret

Apa yang dicari pasar

Pasar mengalihkan fokus mereka ke sinyal kebijakan keluar dari Beijing — pikirkan stimulus yang ditargetkan atau suntikan likuiditas, serta perubahan kondisi dan arus pendanaan yang menanggapi sentimen risiko global atau pergerakan USD.

Retorika perdagangan dan tarif, atau langkah-langkah konsumsi mengejutkan seperti subsidi tukar tambah dan insentif pengeluaran meriah yang baru-baru ini ditandai oleh Kementerian Perdagangan, sering memicu reaksi yang lebih tajam daripada rilis data biasa.

Sensitivitas pasar

Pasangan CNH dan CNY menjadi lebih reaktif terhadap arus USD dan berita utama eksternal, sering memperkuat volatilitas di ekuitas regional, mata uang komoditas seperti AUD, dan aset EM yang terpapar China.

Likuiditas yang menipis liburan meningkatkan risiko utama, terutama pada bahan (bijih besi, tembaga), rantai pasokan perangkat keras teknologi, dan keuangan regional, di mana kejutan kebijakan atau pembaruan tarif AS dapat memicu perubahan indeks harian 1-2%.

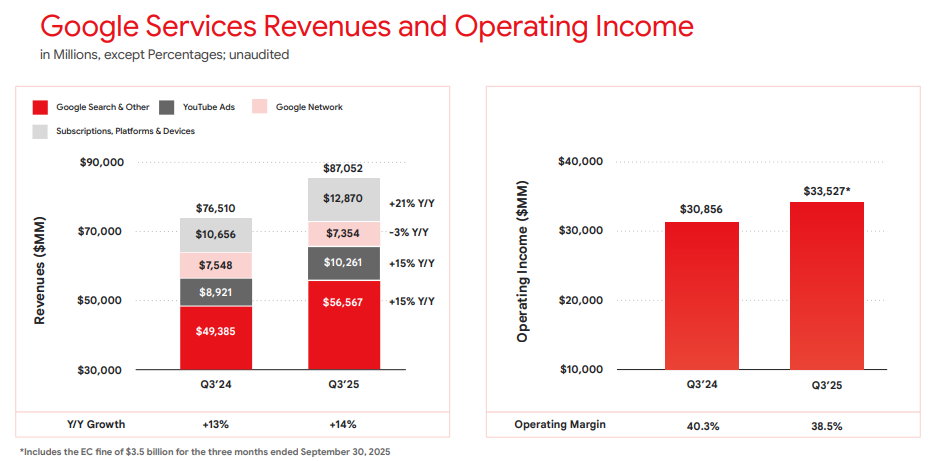

Tanggal penghasilan yang diharapkan: Rabu, 4 Februari 2026 (Amerika Serikat, setelah penutupan pasar) /~ 8:00 pagi, Kamis, 5 Februari 2026 (AEDT)

Penghasilan Alphabet memberikan wawasan tentang permintaan iklan digital global, manajemen cloud perusahaan, dan tren investasi sektor teknologi yang lebih luas.

Karena Google Search dan YouTube banyak digunakan oleh konsumen dan bisnis, hasil sering digunakan sebagai masalah ketika aktivitas online dan anggaran pemasaran perusahaan, di samping indikator lainnya.

Area utama dalam fokus

Cari

Iklan pencarian tetap menjadi pendorong pendapatan terbesar Alphabet. Pasar cenderung fokus pada tingkat pertumbuhan iklan, metrik harga seperti biaya per klik, dan permintaan iklan secara keseluruhan di seluruh sektor seperti ritel, perjalanan, dan bisnis kecil hingga menengah.

YouTube

YouTube berkontribusi pada pendapatan iklan dan langganan. Pasar biasanya memantau momentum periklanan, tren keterlibatan, dan perkembangan monetisasi sebagai indikator kondisi media digital dan pengeluaran merek.

Google Cloud

Profitabilitas Cloud yang berkelanjutan sering dianggap sebagai faktor yang dapat mempengaruhi ekspektasi pendapatan jangka panjang, meskipun hasilnya tetap tidak pasti. Pasar diharapkan fokus pada pertumbuhan pendapatan, tren adopsi perusahaan, dan margin operasi.

Taruhan lainnya

Inisiatif seperti mengemudi otonom dan ilmu kehidupan, sementara biasanya kontributor pendapatan yang lebih kecil, pasar mungkin masih memperhatikan tingkat pengeluaran dan pembaruan kemajuan sebagai indikator modal dan disiplin biaya.

Kerangka biaya dan margin

Manajemen sebelumnya telah menandai peningkatan capex terkait dengan infrastruktur AI, termasuk pusat data, chip khusus, dan kapasitas komputasi. Biaya akuisisi lintas batas, tingkat kebutuhan, dan kebutuhan infrastruktur juga merupakan variabel kunci yang mempengaruhi profitabilitas.

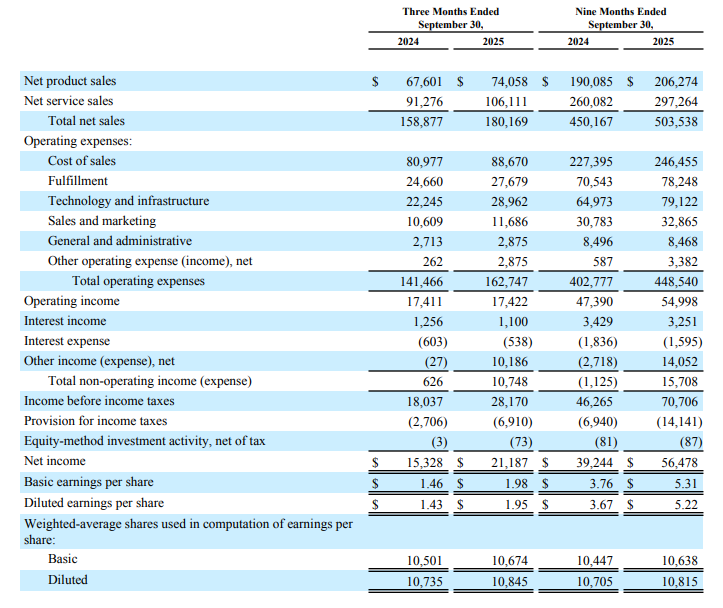

Apa yang terjadi kuartal terakhir

Pembaruan sistem Alphabet terbaru mencakup tren pemasaran, profitabilitas Cloud, dan peningkatan belanja modal berkelanjutan untuk mendukung AI inisiatif.

Komentar manajemen telah menunjukkan bahwa pengelolaan infrastruktur dimaksudkan untuk mendukung daya tahan jangka panjang, sementara pasar terus melakukan pertukaran margin jangka pendek.

Sorotan utama pendapatan terakhir

Untuk angka yang dilaporkan dan detail segmen dari kuartal terbaru, lihat materi rilis pendapatan terbaru Alphabet, termasuk pendapatan, laba per saham (EPS), pendapatan layanan, pendapatan operasi Cloud, dan komentar capex.

- Pendapatan: US$102,35 Milyar

- EPS: US $2,87

- Pendapatan operasional: US$31,23 miliar

- Pendapatan layanan: US$87,05 miliar

- Pendapatan awan: US$15,16 Milyar

Pendapatan Layanan Google dan Pendapatan Operasional Q3 2025 | Rilis pendapatan Alphabet

Apa yang diharapkan dari kuartal ini

Konsensus Bloomberg memperkirakan pertumbuhan pendapatan tahun ke tahun (YoY) moderat dan EPS yang lebih tinggi dibandingkan kuartal tahun sebelumnya, dengan fokus berkelanjutan pada margin operasi mengingat investasi terkait AI.

Poin referensi konsensus Bloomberg:

- EPS: kisaran rendah hingga menengah US$2

- Pendapatan: tinggi US $80 miliar hingga kisaran rendah US $90 miliar

- Pembelian modal: diperkirakan akan tetap tinggi

*Semua poin di atas diperkirakan pada 31 Januari 2026.

Harapan tersirat pasar

Opsi yang terdaftar menyetujui pergerakan indikasi yang diharapkan sekitar ± 4% hingga ± 6% selama jendela kedatangan mendekati tanggal yang relevan. Pergerakan berasal dari harga opsi yang terjadi pada pukul 11:00 pagi AEDT, 2 Februari 2026.

Ini adalah perkiraan pasar tersirat dan dapat berubah. Pergerakan harga pasca-laba saat ini bisa lebih besar atau lebih kecil.

Apa artinya ini bagi pelaku pasar Australia

Pendapatan Alphabet dapat mempengaruhi sentimen jangka pendek di seluruh indeks ekuitas utama AS, khususnya produk-produk terkait Nasdaq, dengan potensi penurunan di sesi Asia setelah rilis.

Catatan risiko penting

Segera setelah AS ditutup dan memasuki sesi awal Asia, harga jangka panjang Nasdaq 100 (NDX) dan CFD terkait dapat menunjukkan likuiditas yang lebih tipis, spread yang lebih luas, dan harga ulang yang lebih tajam di sekitar informasi baru.

Lingkungan seperti itu dapat meningkatkan risiko gangguan dan ketidakpastian eksekusi relatif terhadap kondisi jam yang teratur.

Pasar global memasuki minggu padat katalis di mana beberapa keputusan bank sentral, pendapatan AS yang sedang berlangsung, dan keputusan suku bunga Reserve Bank of Australia (RBA) dapat membantu membentuk arah jangka pendek.

- Keputusan suku bunga RBA: Ekspektasi pasar condong ke arah kenaikan Target Cash Rate.

- Bank sentral globalBank Sentral Eropa (ECB) dan Bank of England (BoE) keduanya berkomunikasi dalam minggu yang sama, menciptakan potensi kebijakan lintas arus.

- Penghasilan ASSiklus pendapatan berlanjut dengan laporan Alphabet dan Amazon minggu ini.

- Emas: Perdagangan mendekati level tinggi di tengah ketidakpastian makro dan pergeseran ekspektasi suku bunga.

Keputusan suku bunga RBA

- Keputusan RBA Selasa, 3 Februari, 14:30 (AEDT)

- Konferensi media RBA: Selasa, 3 Februari, 15:30 (AEDT)

Kemungkinan kenaikan suku bunga 67% disarankan pada pelacak suku bunga RBA dalam kerangka penetapan harga berjangka, menunjukkan probabilitas pergerakan yang tersirat di pasar.

Dampak pasar

- Pasangan AUD dapat merespons dengan cepat terhadap harga ulang jalur kurs.

- Sektor ekuitas yang sensitif terhadap suku bunga dapat mengalami rotasi.

- Imbal hasil obligasi pemerintah dapat menyesuaikan jika ekspektasi bergeser.

ECB dan BoE Inggris

Waktu keputusan utama

- Pertemuan kebijakan moneter ECB: 4—5 Februari

- Pengumuman BoE: Kamis, 5 Februari

Ketika beberapa bank sentral besar berkomunikasi dalam jendela yang sama, pasar sering fokus pada panduan ke depan sebanyak keputusan itu sendiri.

Dampak pasar

- Volatilitas EUR dan GBP dapat meningkat di sekitar komunikasi kebijakan.

- Ekspektasi hasil relatif dapat mempengaruhi aliran modal.

- Sentimen ekuitas dapat merespons perubahan asumsi likuiditas.

Pendapatan AS berlanjut

Siklus pendapatan tetap aktif, dengan investor biasanya berfokus pada panduan, margin, dan belanja modal di samping hasil utama.

Setelah kenaikan ekuitas yang diperpanjang, hasil yang konsisten dapat membantu menstabilkan sentimen, sementara kekecewaan dapat mempengaruhi posisi jangka pendek.

Penghasilan terjadwal

- Walt Disney: Senin, 2 Februari (waktu AS) /Selasa, 3 Februari (AEDT)

- Teknologi Palantir: Senin, 2 Februari (waktu AS) /Selasa, 3 Februari (AEDT)

- Perangkat Mikro Tingkat Lanjut: Selasa, 3 Februari (waktu AS) /Rabu, 4 Februari (AEDT)

- PayPal: Selasa, 3 Februari (waktu AS, setelah penutupan pasar) /Rabu, 4 Februari (AEDT)

- Alfabet: Rabu, 4 Februari (waktu AS, setelah penutupan pasar) /Kamis,5 Februari (AEDT)

- Amazon: Kamis, 5 Februari (waktu AS, setelah penutupan pasar) /Jumat, 6 Februari (AEDT)

Wartawan terkenal tambahan sepanjang minggu termasuk Eli Lilly, PepsiCo, Qualcomm, Ford, dan Roblox.

*Semua tanggal di atas berlaku pada 30 Januari 2026; tanggal dapat berubah.

Dampak pasar

- Pergerakan indeks mungkin bergantung pada daya tahan panduan di seluruh perusahaan.

- Volatilitas dapat mengelompok di sekitar rilis utama.

- Wartawan pertama di setiap sektor dapat mempengaruhi perusahaan lain yang belum melaporkan.

Mengapa Emas Tetap Fokus

Emas telah diperdagangkan mendekati level tinggi di tengah ketidakpastian makro dan pergeseran ekspektasi suku bunga. Bagi banyak pedagang, kekuatan emas kadang-kadang dikaitkan dengan posisi defensif, meskipun harga emas bisa bergejolak dan bisa turun.

Dolar AS, pergerakan imbal hasil Treasury dan narasi geopolitik sering mempengaruhi arah jangka pendek.

Dampak pasar

- Kekuatan yang berkelanjutan mungkin menunjukkan beberapa investor condong ke arah posisi defensif.

- Pergerakan USD dan imbal hasil negara sering mempengaruhi arah jangka pendek.

- Setelah kemajuan yang kuat, periode konsolidasi atau pengambilan keuntungan adalah hal biasa.

Tanggal penghasilan yang diharapkan: Kamis, 5 Februari 2026 (AS, setelah penutupan pasar) /Jumat awal, 6 Februari 2026

Penghasilan Amazon memberikan wawasan tentang tren belanja konsumen global, permintaan infrastruktur cloud, dan monetisasi ekosistemnya di seluruh layanan ritel, periklanan, dan berlangganan.

Fokus diharapkan tetap pada kinerja di seluruh area bisnis utama, bersama dengan komentar tentang efisiensi biaya, belanja modal, dan investasi terkait AI, termasuk perluasan pusat data.

Area utama dalam fokus

Toko online dan layanan pihak ketiga

Bisnis ritel inti Amazon tetap sensitif terhadap permintaan konsumen diskresioner, terutama selama periode liburan kuartal Desember. Pasar cenderung fokus pada pertumbuhan pendapatan dan margin di kedua layanan ritel pihak pertama dan penjual pihak ketiga. Tekanan biaya juga akan dievaluasi.

AWS (Layanan Web Amazon)

AWS adalah pendorong pendapatan utama. Investor cenderung fokus pada tingkat pertumbuhan pendapatan, tren margin, dan indikasi seputar pengeluaran cloud perusahaan. Beban kerja AI juga akan patut diperhatikan. Setiap komentar tentang ekspansi kapasitas dan capex kemungkinan akan diawasi dengan cermat.

Layanan periklanan

Bisnis periklanan Amazon telah menjadi kontributor keuntungan yang semakin penting. Pasar cenderung menilai momentum pertumbuhan, permintaan pengiklan, dan bagaimana periklanan terintegrasi di seluruh ekosistem ritel dan Prime Amazon.

Layanan berlangganan (termasuk Prime)

Pendapatan berlangganan termasuk keanggotaan Prime dan layanan digital terkait. Investor dapat melihat keterlibatan, dinamika harga, dan tren retensi sebagai indikator kekuatan ekosistem.

Kerangka biaya dan margin

Manajemen sebelumnya telah menekankan perlunya disiplin biaya di seluruh pemenuhan, logistik, dan pengeluaran perusahaan. Margin operasi yang dilaporkan dan pembaruan apa pun tentang peningkatan efisiensi atau prioritas investasi ulang di seluruh layanan bisnis utama akan menarik.

Apa yang terjadi kuartal terakhir

Pembaruan kuartalan terbaru Amazon melaporkan pertumbuhan pendapatan dan hasil pendapatan operasional, dengan AWS dan iklan dirujuk sebagai kontributor utama, di samping langkah-langkah pengendalian biaya berkelanjutan di seluruh bisnis ritel.

Pembaruan sebelumnya juga mencakup diskusi yang relevan dengan prioritas investasi di infrastruktur cloud dan AI, yang terus mempengaruhi ekspektasi pasar.

Sorotan utama pendapatan terakhir

- Pendapatan: US$180,2 miliar

- Laba per saham (EPS): US$1,95 (diencerkan)

- Pendapatan AWS: US$33.0 miliar

- Pendapatan layanan periklanan: US$17,7 miliar

- Pendapatan operasional: US$17,4 miliar

Bagaimana pasar bereaksi terakhir kali

Saham Amazon bergerak lebih tinggi dalam perdagangan setelah jam kerja setelah rilis sebelumnya, berdasarkan laporan pada saat itu.

Apa yang diharapkan kuartal ini

Perkiraan konsensus Bloomberg menunjukkan pertumbuhan EPS tahun-ke-tahun untuk kuartal yang berakhir Desember 2025, dengan pasar berfokus pada hasil pendapatan, margin operasi, dan kinerja AWS, mengingat pentingnya kuartal Desember (Q4) untuk profil pendapatan Amazon.

Poin referensi konsensus Bloomberg (Januari 2026):

- EPS: sekitar US$1,60

- Pendapatan: sekitar US$170 miliar

- EPS tahun penuh FY2026: sekitar US$5.10

*Semua poin di atas diamati pada 27 Januari 2026.

Harapan

Sentimen pasar di sekitar Amazon mungkin sensitif terhadap kekecewaan dalam pertumbuhan AWS, margin operasi, atau kinerja ritel kuartal Desember (Q4 2025), mengingat bobot indeks saham yang besar dalam indeks ekuitas utama AS dan perannya di area ini.

Opsi yang terdaftar menetapkan harga pergerakan indikatif sekitar ± 4% hingga ± 5% berdasarkan perkiraan pergerakan perkiraan opsi yang tersirat sesuai tanggal yang tertanggal yang diamati pada Barchart pada 11:00 pagi AEDT, 28 Januari 2026.

Volatilitas tersirat sekitar 32% tahunan pada saat itu.

Ini adalah perkiraan tersirat pasar (bukan perkiraan) dan dapat berubah. Pergerakan harga pasca-laba aktual bisa lebih besar atau lebih kecil.

Apa artinya ini bagi investor Australia

Pendapatan Amazon dapat mempengaruhi sentimen jangka pendek di seluruh indeks ekuitas utama AS, dengan potensi limpahan ke sesi Asia setelah rilis. Ini juga dapat mempengaruhi sentimen terhadap perusahaan yang terdaftar di ASX dengan eksposur penjualan online yang signifikan.

Catatan risiko penting

Segera setelah penutupan AS dan memasuki sesi Asia awal, Nasdaq 100 (NDX) berjangka dan harga CFD terkait dapat mencerminkan likuiditas yang lebih tipis, spread yang lebih luas, dan harga ulang yang lebih tajam di sekitar informasi baru.

Lingkungan seperti itu dapat meningkatkan risiko kesenjangan dan ketidakpastian eksekusi relatif terhadap kondisi jam reguler.

Terobosan emas di atas US $5.000 dan lonjakan perak melalui US $100 sinyal tahun ini bisa menjadi salah satu buku sejarah bagi pedagang logam (dengan satu atau lain cara).

Fakta singkat

- Meningkatnya permintaan safe-haven mengangkat target Emas dari US $5.400 menjadi US $6.000 setelah terobosan awal tahun US$5.000.

- Kecerdasan buatan (AI) dan peningkatan infrastruktur pusat data dapat membantu mendorong permintaan perak dan tembaga.

- Ketidakpastian geopolitik yang berkelanjutan dan perubahan kebijakan moneter dapat memicu volatilitas logam sepanjang tahun.

5 logam teratas untuk ditonton pada tahun 2026

1. Emas

Terobosan emas di atas US $5.100 tiba tiga kuartal di atas beberapa perkiraan. Dengan Bank of America dengan cepat menaikkan target akhir tahun menjadi US $6.000 dan Goldman Sachs memproyeksikan US $5.400, komoditas safe-haven tetap menjadi aset terbesar dalam fokus untuk tahun 2026.

Driver utama:

- Bank sentral saat ini membeli rata-rata 60 ton emas per bulan, dibandingkan dengan 17 ton sebelum 2022.

- Dua pemotongan suku bunga Fed dihargai untuk tahun 2026, mengurangi biaya peluang memegang aset non-imbal hasil seperti emas.

- Kebijakan tarif Trump, ketegangan Timur Tengah, dan kekhawatiran keberlanjutan fiskal membuat permintaan safe-haven tetap tinggi.

- Pangsa emas dari total aset keuangan mencapai 2,8% pada Q3 2025, dengan ruang untuk tumbuh seiring berjalannya FOMO ritel.

Apa yang harus ditonton

- Jerome Powell akan digantikan sebagai ketua Fed pada Mei 2026. Arah kebijakan aktual pasca-penggantian mungkin berbeda dari ekspektasi pasar saat ini untuk pemotongan.

- Jika lindung nilai geopolitik ke tempat berlindung yang aman tetap ada atau jika ada pelepasan seperti pasca-pemilihan AS 2024.

- Potensi persenjataan kepemilikan aset dolar oleh negara-negara Eropa sebagai tanggapan terhadap tarif AS.

2. Perak

Perak adalah logam yang paling diuntungkan dari ledakan AI 2025, dengan lonjakan ke level tertinggi sepanjang masa US$112 untuk memulai 2026 (70% di atas nilai fundamental sesuai sinyal Bank of America), menunjukkan potensi volatilitasnya.

Driver kunci

- Permintaan industri dari infrastruktur AI, tenaga surya, dan kendaraan listrik (EV), semikonduktor dan pusat data saat ini tidak memiliki pengganti yang layak untuk konduktivitas perak.

- Enam tahun berturut-turut defisit pasokan, dengan stok di atas tanah menipis dan kemacetan daur ulang membatasi pasokan sekunder.

- Optik kebijakan mungkin penting. Keputusan AS untuk menambahkan perak ke daftar “mineral kritis” telah dikutip sebagai faktor potensial dalam volatilitas, termasuk seputar risiko kebijakan perdagangan.

- Partisipasi ritel dapat memperkuat pergerakan harga, terutama ketika permintaan emas menjadi “terlalu mahal”.

Apa yang harus ditonton

- Jika permintaan panel surya melanjutkan lintasannya, atau jika 2025 adalah puncaknya.

- Apakah pasokan daur ulang merespons rekor harga dengan meningkatkan pemurnian perak dan kapasitas pemrosesan material.

- Bagaimana persediaan pertukaran dan suku bunga sewa bergerak sebagai sinyal potensial dari keketatan fisik.

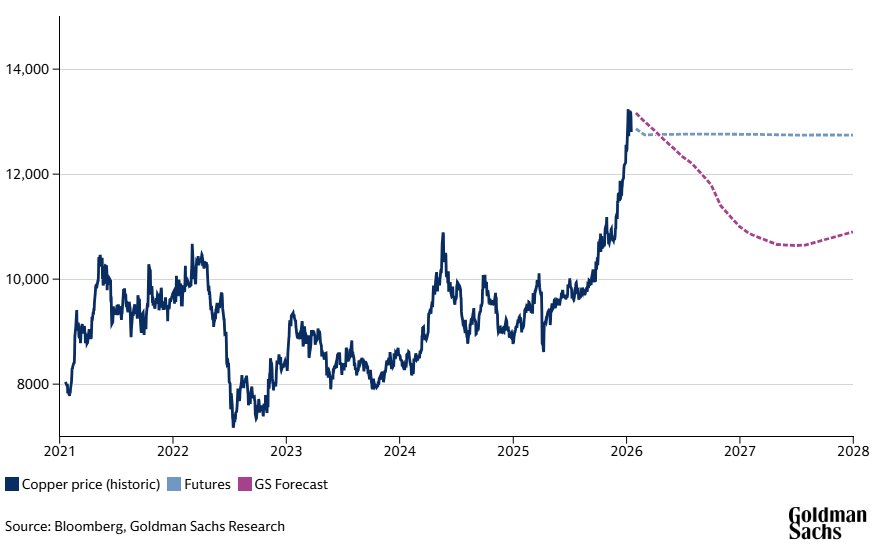

3. Tembaga

Kisah Copper tahun 2026 bergantung pada permintaan pusat data yang berkelanjutan, pertumbuhan infrastruktur energi terbarukan, dan pasar properti China yang sedang berjuang.

Driver kunci

- Konsumsi tembaga pusat data diproyeksikan mencapai 475.000 ton pada tahun 2026, naik 110.000 ton dari tahun 2025.

- Pemogokan pekerja di Chili dan penundaan memulai kembali Grasberg membuat pasar Tembaga tetap ketat secara struktural.

- Keputusan tarif AS pada impor tembaga olahan diharapkan pada pertengahan 2026 (15% + saat ini diantisipasi), menciptakan potensi penimbunan dan distorsi arus perdagangan.

- Goldman Sachs telah memperkirakan bahwa infrastruktur jaringan listrik dan pembangunan EV dapat menambah permintaan tembaga “Amerika Serikat lain” pada tahun 2030.

- Kelemahan properti China saat ini menciptakan ketidakpastian permintaan, berpotensi mengimbangi pengeluaran infrastruktur.

Apa yang harus ditonton

- Apakah Grasberg meningkatkan produksi dengan lancar atau menghadapi kemunduran lebih lanjut.

- Efektivitas stimulus pasar properti China.

- Waktu dan besarnya implementasi tarif aktual.

- Pergerakan premium Yangshan menandakan permintaan fisik nyata versus posisi keuangan.

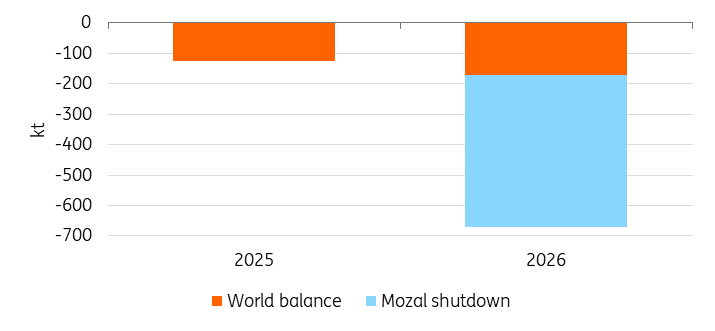

4. Aluminium

Perdagangan mendekati level tertinggi tiga tahun yaitu US $3.200, aluminium menghadapi keketatan yang berlanjut hingga 2026 karena plafon kapasitas China memaksa pasar global untuk menyesuaikan diri.

Driver kunci

- Batas kapasitas 45 juta ton China tercapai pada tahun 2025. Untuk pertama kalinya dalam beberapa dekade, produksi China tidak dapat berkembang, berpotensi mengakhiri 80% pertumbuhan pasokan global.

- Seiring kenaikan harga tembaga, Reuters telah melaporkan bahwa beberapa produsen telah mengganti aluminium dengan tembaga dalam aplikasi tertentu karena harga relatif bergeser.

Apa yang harus ditonton

- South32 mengatakan Mozal Aluminium diperkirakan akan ditempatkan pada perawatan dan pemeliharaan sekitar 15 Maret 2026, sehingga menghilangkan pasokan signifikan Mozambik 560.000 ton.

- Jika penambahan kapasitas lepas pantai Indonesia dan China dapat mengimbangi plafon domestik China.

- Restart Mount Holly seberat 50.000 ton Century Aluminium pada Q2 dapat memberikan sinyal bagi industri yang lebih luas karena smelter diperkirakan akan mencapai produksi penuh pada 30 Juni 2026.

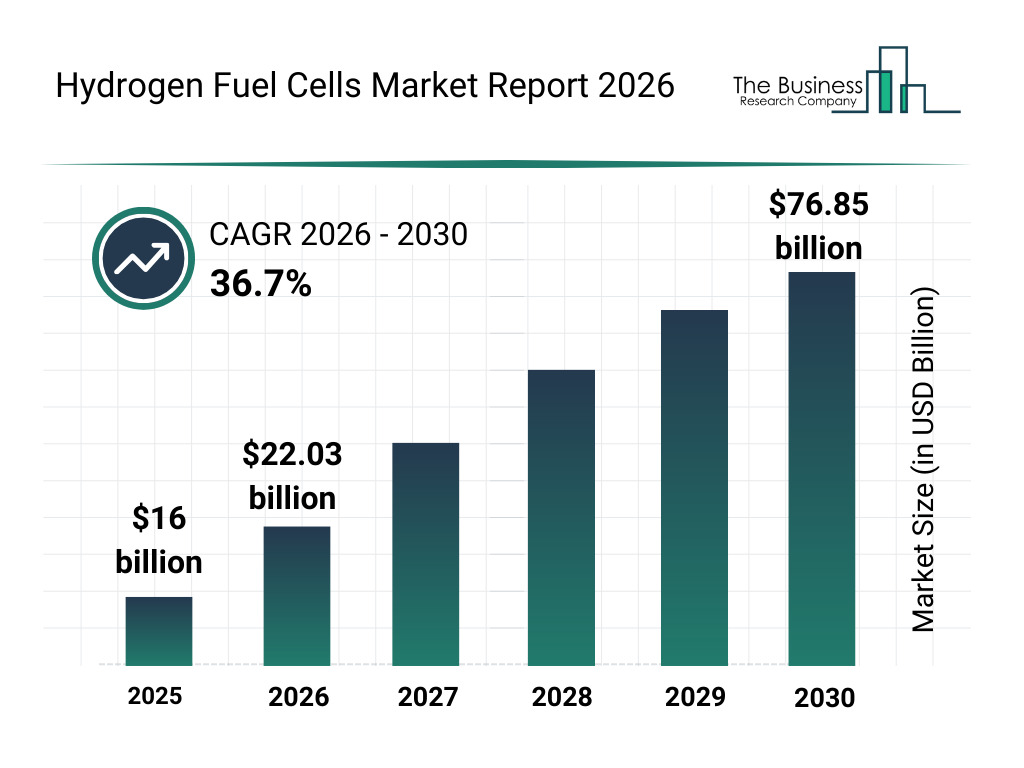

5. Platinum

Pelemahan Platinum di atas US $2.800 menyusul tiga tahun berturut-turut defisit pasokan dan peningkatan adopsi sel bahan bakar hidrogen (yang merupakan komponen penting).

Driver kunci

- Dewan Investasi Platinum Dunia (WPIC) telah memperkirakan defisit pasokan yang signifikan sebesar 850.000 ons pada tahun 2026 yang dapat menguras persediaan, dengan produksi baru terbatas yang datang secara online.

- WPIC memperkirakan penyerapan 875.000 hingga 900.000 ons pada tahun 2030 untuk truk tugas berat, bus, dan elektroliser hidrogen hijau.

- Substitusi paladium-ke-platinum dalam konverter katalitik meningkat dalam produksi EV.

Apa yang harus ditonton

- Respon pasokan dari produsen. Platreef dan Bakubung menambahkan 150.000 ons, tetapi disiplin produksi dapat membatasi peningkatan yang lebih luas.

- Tarif AS pada paladium Rusia dapat menciptakan permintaan limpahan platinum dalam produksi EV.

- Laju investasi infrastruktur hidrogen dan tingkat adopsi kendaraan tugas berat di Eropa, China, dan AS.

- Permintaan perhiasan China bisa ikut berperan. Hanya substitusi 1% dari emas dapat memperlebar defisit platinum sebesar 10% dari pasokan global.

Anda dapat memperdagangkan Emas, Perak, dan lainnya CFD Komoditas, termasuk energi dan produk pertanian, pada Pasar GO.

Pasar FX memasuki jendela penting dengan keputusan kebijakan Federal Reserve dan konferensi pers, data aktivitas ISM AS, rilis inflasi Jerman, PMI China, dan angka tenaga kerja Australia semuanya jatuh tempo.

Fakta singkat

- Yang akan datang Keputusan kebijakan Fed dan konferensi pers diawasi ketat untuk panduan tentang potensi waktu penurunan suku bunga, dengan implikasi untuk imbal hasil Treasury AS dan arah USD.

- Luas Penjualan USD meningkat selama 48 jam terakhir. Langkah ini bertepatan dengan retorika tarif yang diperbarui dan sensitivitas yang meningkat terhadap narasi intervensi FX.

- PMI Manufaktur ISM Dijadwalkan untuk Senin, 2 Februari, dengan ISM Services PMI pada Rabu, 4 Februari, memberikan wawasan tepat waktu tentang momentum pertumbuhan AS.

- CPI Jerman, PDB dan pengangguran kawasan euro, PMI China, dan data tenaga kerja Australia memberikan konteks regional, terutama untuk persilangan EUR dan AUD.

USD/JPY

Apa yang harus ditonton

Keputusan Federal Reserve dan konferensi pers berikutnya adalah peristiwa penting yang mempengaruhi imbal hasil Treasury AS.

Setiap perubahan nada seputar kemajuan inflasi, risiko ekonomi, atau ekspektasi waktu penurunan suku bunga dapat mempengaruhi perbedaan hasil dan sensitivitas USD jangka pendek.

Kelemahan USD yang luas baru-baru ini, diperkuat oleh berita utama terkait tarif dan sensitivitas intervensi, telah menambah tekanan penurunan pada USD.

Di sisi JPY, sinyal inflasi Jepang, termasuk CPI Tokyo, relevan sebagai indikator tren harga domestik dan arah kebijakan potensial.

Rilis dan acara utama

- Kamis 30 Jan: Jepang Tokyo CPI (Januari)

- Kamis 30 Jan: Keputusan kebijakan Federal Reserve dan konferensi pers

- Sen 2 Feb: PMI Manufaktur ISM AS

- Rab 4 Feb: PMI Layanan ISM AS

Cuplikan teknis

USDJPY telah menembus lebih rendah dari zona konsolidasi baru-baru ini, dengan kisaran penurunan terbukti selama 48 jam terakhir. Harga telah bergerak turun ke rata-rata pergerakan 200 eksponensial (EMA) dan sedang menguji level yang tidak terlihat sejak Oktober 2025.

EUR/USD

Apa yang harus ditonton

Keputusan Fed dan konferensi pers dapat mempengaruhi EUR/USD terutama melalui pergerakan USD terkait dengan reaksi imbal hasil Treasury.

Di sisi EUR, IHK Jerman akan menunjukkan tren inflasi, sementara PDB flash kawasan euro dan data pengangguran menginformasikan prospek pertumbuhan regional.

Rilis dan acara utama

- Kamis 29 Jan: CPI Jerman (pendahuluan)

- Kamis 29 Jan: PDB kilat zona euro, Q4 2025

- Kamis 30 Jan: Keputusan Federal Reserve dan konferensi pers

- Jum 30 Jan: Tingkat pengangguran zona euro

Cuplikan teknis

EURUSD telah meluas di atas level resistance sebelumnya, dengan rentang harian yang diperluas dan momentum yang kuat. Aksi harga di persimpangan USD lainnya menunjukkan pergerakan tersebut mungkin mencerminkan kelemahan USD, bukan pergeseran material dalam fundamental kawasan euro.

EUR/AUD

Apa yang harus ditonton

Bersamaan dengan angka pertumbuhan kawasan euro, data ketenagakerjaan Australia dapat mempengaruhi sensitivitas EUR/AUD jangka pendek menjelang keputusan kebijakan RBA minggu depan.

PMI resmi China tetap relevan, karena perubahan ekspektasi aktivitas China dapat mempengaruhi AUD melalui permintaan komoditas dan sentimen risiko regional.

Rilis dan acara utama

- Kamis 29 Jan: Angkatan Kerja Australia, Dirinci (Desember 2025), 11:30 pagi AEDT

- Jum 31 Jan: PMI Manufaktur dan Non-Manufaktur resmi China

- Sel 4 Feb: Keputusan kebijakan RBA

Cuplikan teknis

EUR/AUD telah secara tegas menembus di bawah zona support sebelumnya, dengan tingkat pengujian harga yang sekarang tidak terlihat sejak April 2025. Momentum tetap negatif, konsisten dengan fase penurunan baru daripada konsolidasi.

Intinya

Keputusan Fed dan konferensi pers, data PMI AS, rilis inflasi Jerman, PMI China, dan angka tenaga kerja Australia dikelompokkan dalam jendela pendek.

Pasar akan mengawasi apakah kelemahan USD terbukti selama 48 jam terakhir meluas lebih jauh.