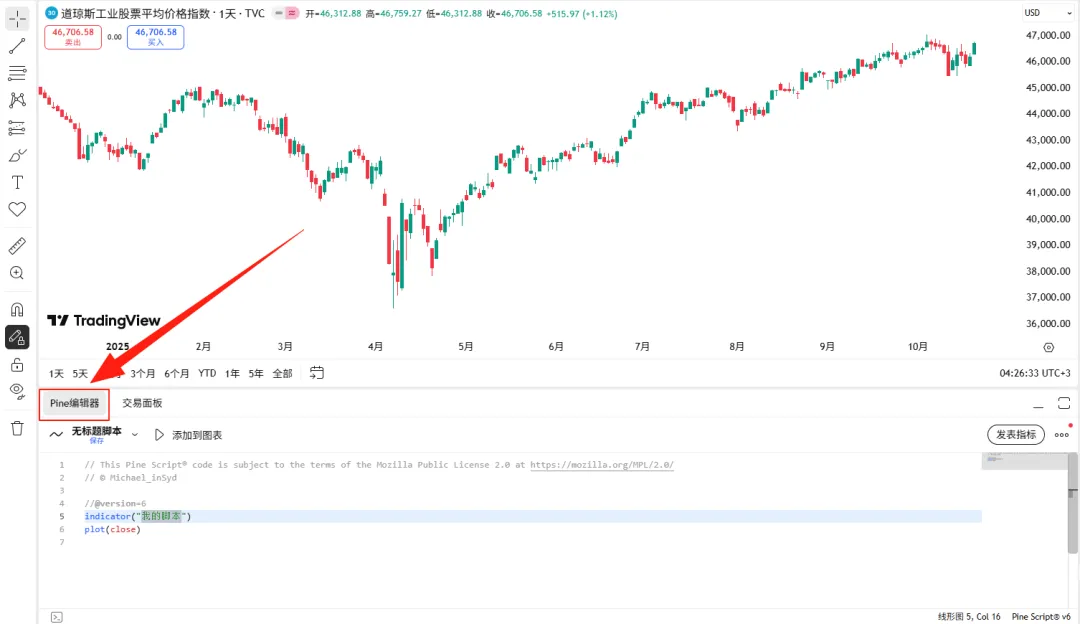

Pine Script是TradingView提供的专属编程语言,旨在帮助交易者创建自定义指标和策略,进行回测和实时分析。作为一种轻量级但功能强大的语言,Pine Script 使用户能够在TradingView平台上实现个性化的技术分析工具。要在TradingView上使用Pine Script,首先需要在图表界面打开“Pine 编辑器”。在编辑器中,用户可以编写脚本并将其应用于图表。脚本可以是指标(如移动平均线、RSI 等)或策略(用于回测交易信号)。

官方文档提供了详细的函数和示例,帮助用户理解和应用各种功能。此外,TradingView拥有一个活跃的社区,用户可以在“公共库”中浏览和使用他人分享的脚本。通过搜索功能,可以找到各种类型的指标和策略,满足不同的交易需求。许多脚本是开源的,用户可以查看其源代码,学习他人的编程思路,并根据自己的需要进行修改和优化。介绍完 Pine Script 的基础功能后,接下来我们将动手实战,编写第一个简单的均线技术指标,并将其应用到K线图中。

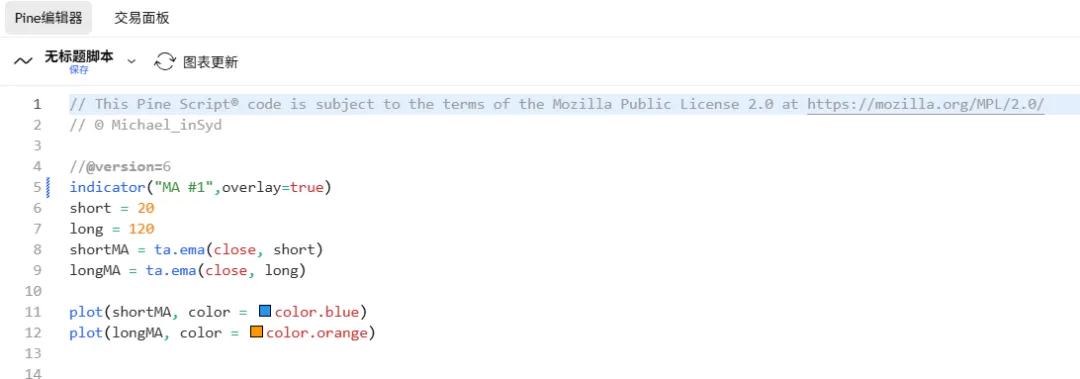

indicator("MA #1",overlay=true)short = 20long = 120shortMA = ta.ema(close, short)longMA = ta.ema(close, long)plot(shortMA, color = color.blue)plot(longMA, color = color.orange)这段Pine Script脚本实现了在TradingView的主图(也就是 K 线图)上绘制两条不同周期的指数移动平均线(EMA)。它的作用是帮助交易者观察市场的短期与长期趋势,是很多技术分析中常见的基础工具。首先,脚本通过indicator("MA #1", overlay=true)定义了指标的基本信息。其中"MA #1"是该指标在图表上显示的名称,而overlay=true表示该指标将直接绘制在价格图上,而不是在单独的副图中显示。接下来,脚本定义了两个变量short=20和long=120,分别代表短期和长期均线的周期。周期指的是计算均线时所参考的历史K线数量,比如在日线图中,20就代表20个交易日。之后,使用ta.ema(close, short)和ta.ema(close, long)计算出这两个周期的EMA值,分别赋值给shortMA 和longMA。EMA是一种常用的平滑移动平均方式,相较于简单移动平均(SMA),它对最新的数据更敏感,因此在趋势判断上更及时。最后,通过plot(shortMA, color=color.blue) 和 plot(longMA, color=color.orange) 将两条 EMA 线绘制到图表上,分别使用蓝色和橙色加以区分。这样,交易者在图表中就可以直观地看到短期与长期的价格趋势,有助于进行技术分析、识别趋势方向或寻找潜在的买卖点。

整体而言,这段代码是非常适合初学者的 Pine Script 示例,简洁清晰,同时具备实用性,为后续扩展更多交易逻辑(如信号提示、策略测试等)打下良好基础。

免责声明:GO Markets 分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表 GO Markets 的观点或立场。

联系方式:

墨尔本 03 8658 0603

悉尼 02 9188 0418

中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903

作者:

Michael Miao | GO Markets 悉尼中文部

%20(1).jpg)

.jpg)