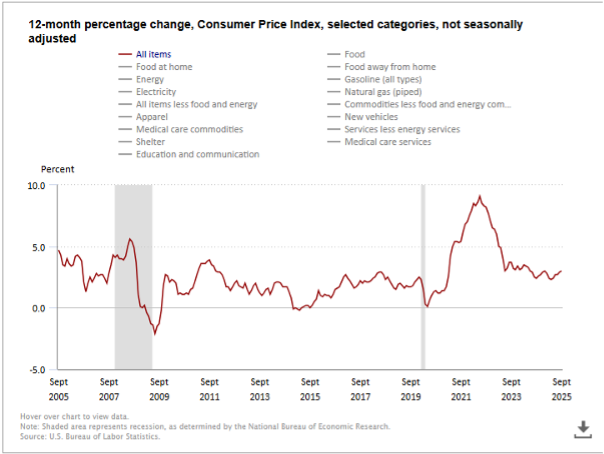

上周我们看到美联储在十月的利率决议一如市场预期的进行了25个基点的降息操作,在决议公布后全球的金融市场波动较为平淡;但是重点集中在鲍威尔和记者在一些尖锐问题上的看法和一些话外音当中。利率决议重要信息总结:预期管理方面:

- 全面否认12月必定降息的预期,美联储官员内部存在分歧

- 利率已经接近中性利率,在这个观点上相较于九月来说有所提升

- 在风险平衡方面表示通胀问题暂时比就业问题影响要大

就业数据方面:

- 就是市场放缓,但是病危显著恶化

- 将主要因素归功于劳动力供给下降

通胀

- 9月CPI表现温和,剔除关税核心PCE 2.3-2.4%

- 服务通胀(除住房)“横盘”,将逐步回落

资产负债表

- 将在12月1日起停止缩表,已达“充裕储备”

- 未来再投资短期美债,缩短久期

- 准备金将随现金增长自然下降,但“不会太久”

其他方面答记者问:

- AI投资对利率不敏感,对AI泡沫化表示不是工作重点

- 车贷和商业地产的次级贷违约局部、可控,未系统性蔓延

- 银行资本十分充足,整体金融体系稳健,压力测试并无风险

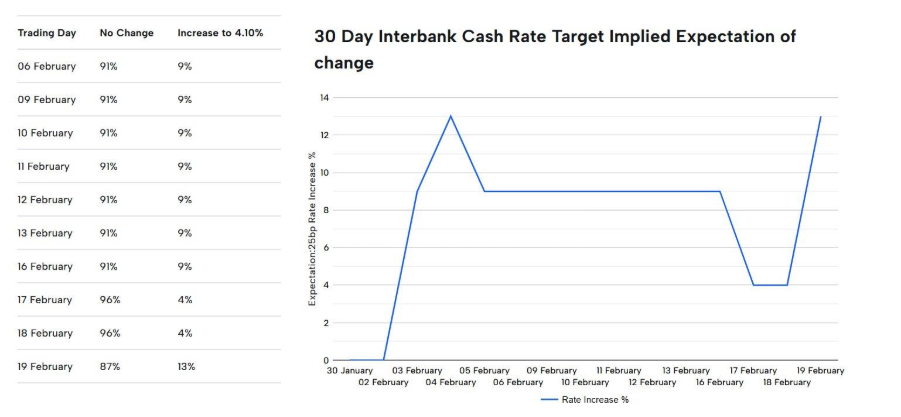

对鲍威尔讲话的数据交叉验证尽管从鲍威尔本次的利率决议中我们发现市场并没有过度敏感,甚至在鲍威尔口中一切欣欣向荣,数据空窗期只给美联储的决策带来了小部分影响,但是并不会对整体经济走势带来大的逆转,所以全球市场并未表现出任何的过度恐慌和逆向交易,在短暂波动中便产生了震荡的收敛,但是事实也许并无那么乐观。就业方面:根据已知数据,美国现阶段就业“稳固”:失业4.3%(BLS数据),随后陷入了数据真空期,而我们也可以从图表中看到,失业率数据在2025年整体上呈现上升态势,也许现在的真空隐藏了数据中最会促使市场衰退恐慌的一面,而鲍威尔通过一句整体稳健维持市场对美联储决策方向的信心;恰巧利用了该真空期对市场进行议论新的预期管理。

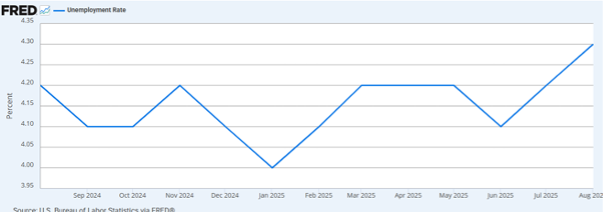

通胀方面:如果对美国通胀进行长期的观测会看到实际上美国通胀水平已从疫情期间回归常态,而逐渐在现水平出现下行放缓的迹象,尽管鲍威尔提及了关税可能带来的影响,但是随后中美会谈对关税带来的通胀影响实际上是多方利好,从通胀角度看,美联储的压力将会逐步缩减,但是也从长期中可以关注为何鲍威尔会重点强调中性利率的攀升,而这也会对市场对长期的利率预期产生一定程度的影响。

美国现在的次级贷问题:近期市场十分关注的二手车暴雷事件在两周前引起了一波小范围的恐慌,本次利率决议记者也就该问题对鲍威尔进行了相关问答,美联储主席在该话题上表现得非常含糊粉饰太平,基本上话语中处处透露本次事件影响范围较小,不会带来较大范围的扩散和金融市场的整体压力,但是实际数据并非如此支持。

从真实数据上看多重数据显示房地产由于受到了08年的教训影响,整体违约率水平处于低位看起来并不存在大范围暴雷的潜在危机,但是二手车和商业地产确实实打实的在数据上已经亮起了黄灯。如果接下来出现中等银行的挤兑和暴雷那将是对金融系统带来真正意义上的考验。结论来看:从近期中美更新合作协议,降低关税来看,美国的通胀压力或将不会过度挤压美联储后续的政策空间,但是美国的失业率真空也许会在公布后给美国带来一定程度的惊吓,而鲍威尔尽管言辞已经极其谨慎仍然在次级贷近期的问题上表态过于乐观,各类型数据并不支持该市场不存在隐患的定论,对于风险偏好类的投资,也许赛道的拥挤或将拱火危机进行进一步发酵,所以在投资偏好和风险均摊上投资者应进行更进一步的风险管理。

免责声明:GO Markets 分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表 GO Markets 的观点或立场。

联系方式:

墨尔本 03 8658 0603

悉尼 02 9188 0418

中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903

作者:

William Zhao | GO Markets 墨尔本中文部

.jpg)

.jpg)

.jpg)

%20(1).jpg)