- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- Charts to watch this week – Gold and Oil gap up on Mid-East turmoil, US Dollar

- Home

- News & analysis

- Economic Updates

- Charts to watch this week – Gold and Oil gap up on Mid-East turmoil, US Dollar

News & analysisNews & analysis

News & analysisNews & analysisCharts to watch this week – Gold and Oil gap up on Mid-East turmoil, US Dollar

9 October 2023 By Lachlan MeakinGold and Oil have unsurprisingly gapped higher on Mondays open after the weekend’s hostilities in the Middle East, Gold reclaiming it’s safe haven status and Oil opening 2% higher on supply problems from fears of a protracted and escalating conflict.

Geo-political events are looking to dominate the market narrative this week, though key US inflation figures will also play a big part, these are the charts I’ll be watching closely in the week ahead.

Gold

XAUUSD has had a rough two weeks as the relentless rise in US treasury yields and the Dollar has seen a steep drop in the precious metals price. Last week we did see strong support at the February and March support lows at 1811 USD an ounce, seeing a nice bounce on Friday which has followed through at today’s open, obviously propped up by its safe haven status after the weekend’s events.

Fibonacci levels from the Feb lows to the cycle high in May have played a big role in the decline as both resistance and support, the next level to watch to the upside will be the 78.6 Fib level at 1866, downside level to watch will be the aforementioned support at 1811. Fundamentals will also be a big driver of gold this week with any escalation in hostilities presumably supporting the upward move on haven flows.

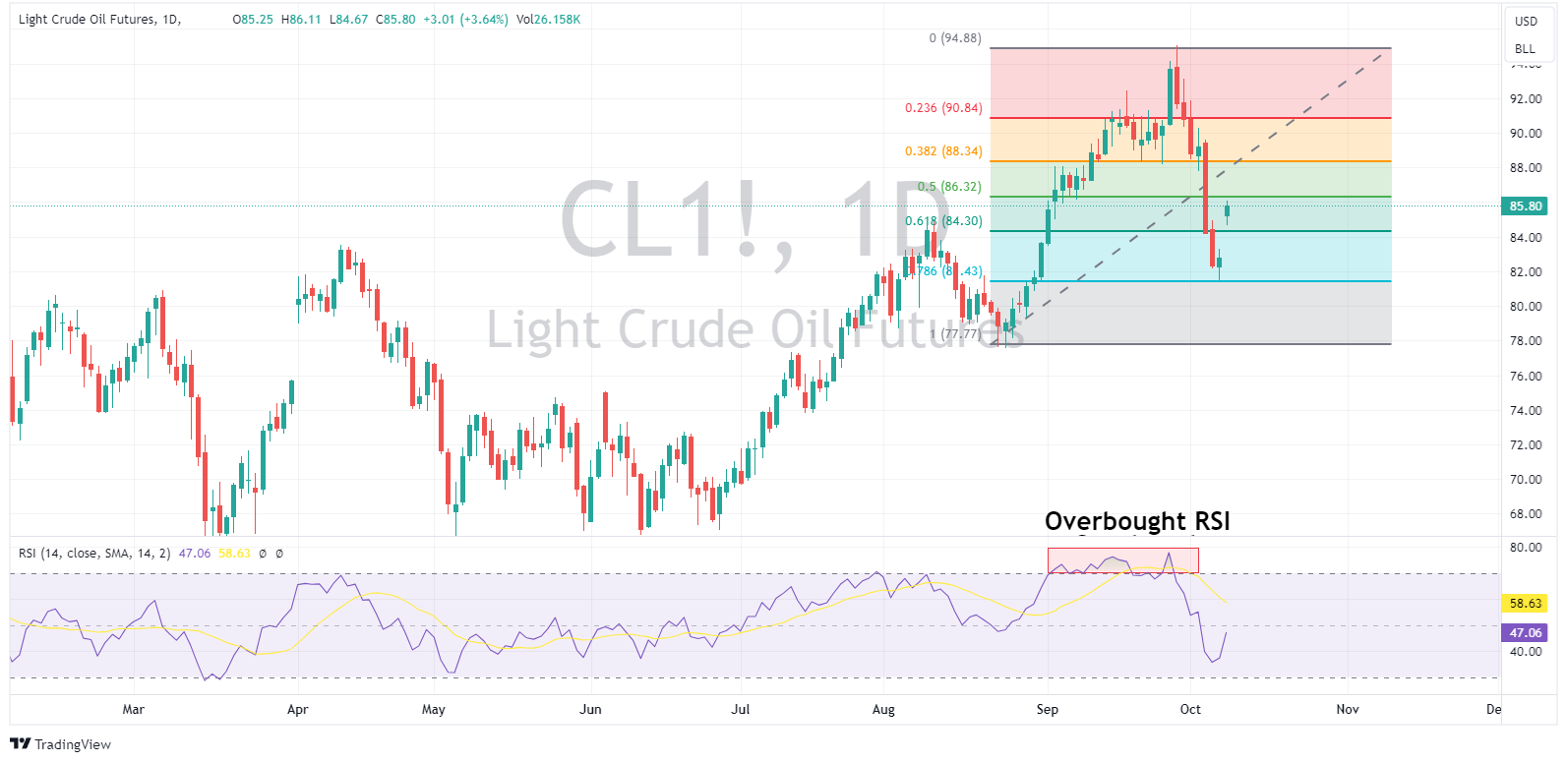

Oil

WTI oil has gapped higher over 2% on Mondays open, Oil did find some support at the 78.6 Fib level on Friday after a bumper NFP report showing the resilience of the US labor market, though this morning gap higher was all about the hostilities in the Middle-East and fears of supply disruptions.

Technical levels will take a back seat to the fundamental news this week, an escalation in hostilities could see Oil restart the bull run that began in July before the recent overbought technical pullback we saw in September.

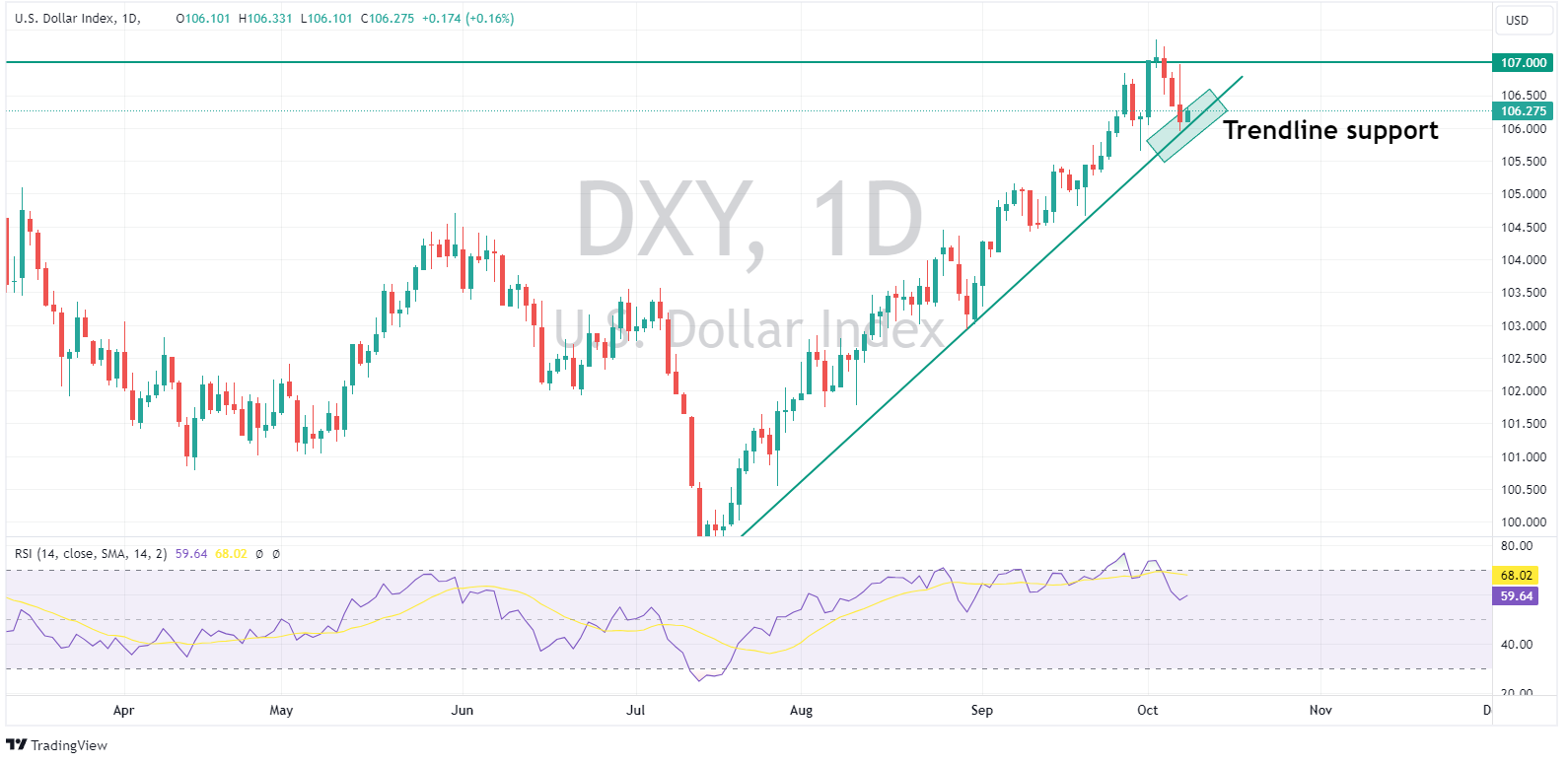

US Dollar

USD has a wild ride on Friday, initially rallying strongly on the Non-Farm Payroll beat, but ultimately paring gains as equity markets rallied. DXY did find good support at the upward trendline which has been established since the start of the bull run back in July, like Gold the USD safe haven status has seen DXY bounce strongly this morning. Fundamentals will also play a big part in USD direction this week, though key inflation figures in the PPI and more importantly CPI later in the week will also have a big effect with the market still split on whether the Fed will hike or hold at the next FOMC meeting on November 2.

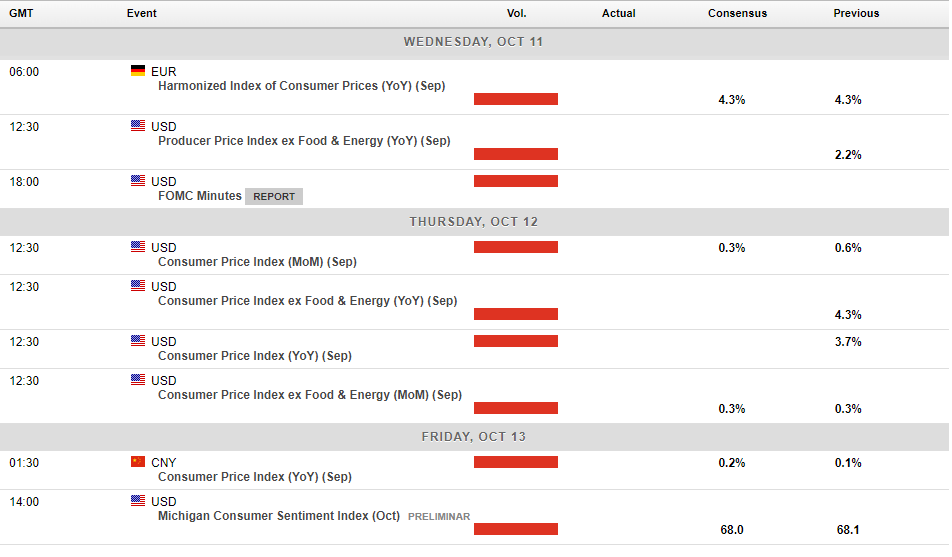

The weeks Calendar below:

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Gold and Oil surge on Geopolitical risk, USD pumps and dumps as Fed turns dovish

USD had a volatile session on Monday seeing two-way price action, with geopolitical risks from the conflict in the Middle East seeing DXY gap higher on the open and rally to a high of 106.60. The move higher dramatically reversed after dovish Fed commentary from both FOMC members Logan and Jefferson who acknowledged the recent move higher in yields...

October 10, 2023Read More >Previous Article

FX Analysis – Yields and Dollar drop ahead of NFP , AUD and NZD outperform, JPY traders watching the 150 level

The USD sell off continued Thursday moving in lockstep with yields again ahead of today’s key non-farm payroll figure. Unemployment claims came in...

October 6, 2023Read More >Please share your location to continue.

Check our help guide for more info.