- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- Gold and Oil surge on Geopolitical risk, USD pumps and dumps as Fed turns dovish

- Home

- News & analysis

- Economic Updates

- Gold and Oil surge on Geopolitical risk, USD pumps and dumps as Fed turns dovish

News & analysisNews & analysis

News & analysisNews & analysisGold and Oil surge on Geopolitical risk, USD pumps and dumps as Fed turns dovish

10 October 2023 By Lachlan MeakinUSD had a volatile session on Monday seeing two-way price action, with geopolitical risks from the conflict in the Middle East seeing DXY gap higher on the open and rally to a high of 106.60. The move higher dramatically reversed after dovish Fed commentary from both FOMC members Logan and Jefferson who acknowledged the recent move higher in yields had tightened financial conditions, meaning the Fed may not have to do as much as far as hiking rates goes. This saw a dovish repricing of Fed rate hike odds for their November meeting and a move forward of rate cuts to June 2024. DXY breaking it’s trendline support and the psychological 106 level.

JPY saw gains on haven flows on geopolitical risk seeing USDJPY fall below 149.00. A sharp move lower in US Treasury yields after the dovish Fed commentary also supporting the Yen. The ongoing Geopolitical risk, US inflation data and Fed commentary throughout the remainder of the week will likely be the driver of this pair going forward, and of course traders will be watching that 150 level as a “line in the sand”

Gold surged on Monday, XAUUSD continued it’s bounce off the Fib support level at 1811, buoyed by two major tailwinds being haven flows on geopolitical risk and a shar decline in the USD and yields on dovish Fed commentary, XAUUSD back to the highest level since the start of the month and looking to test the Fib resistance at 1866 USD an ounce.

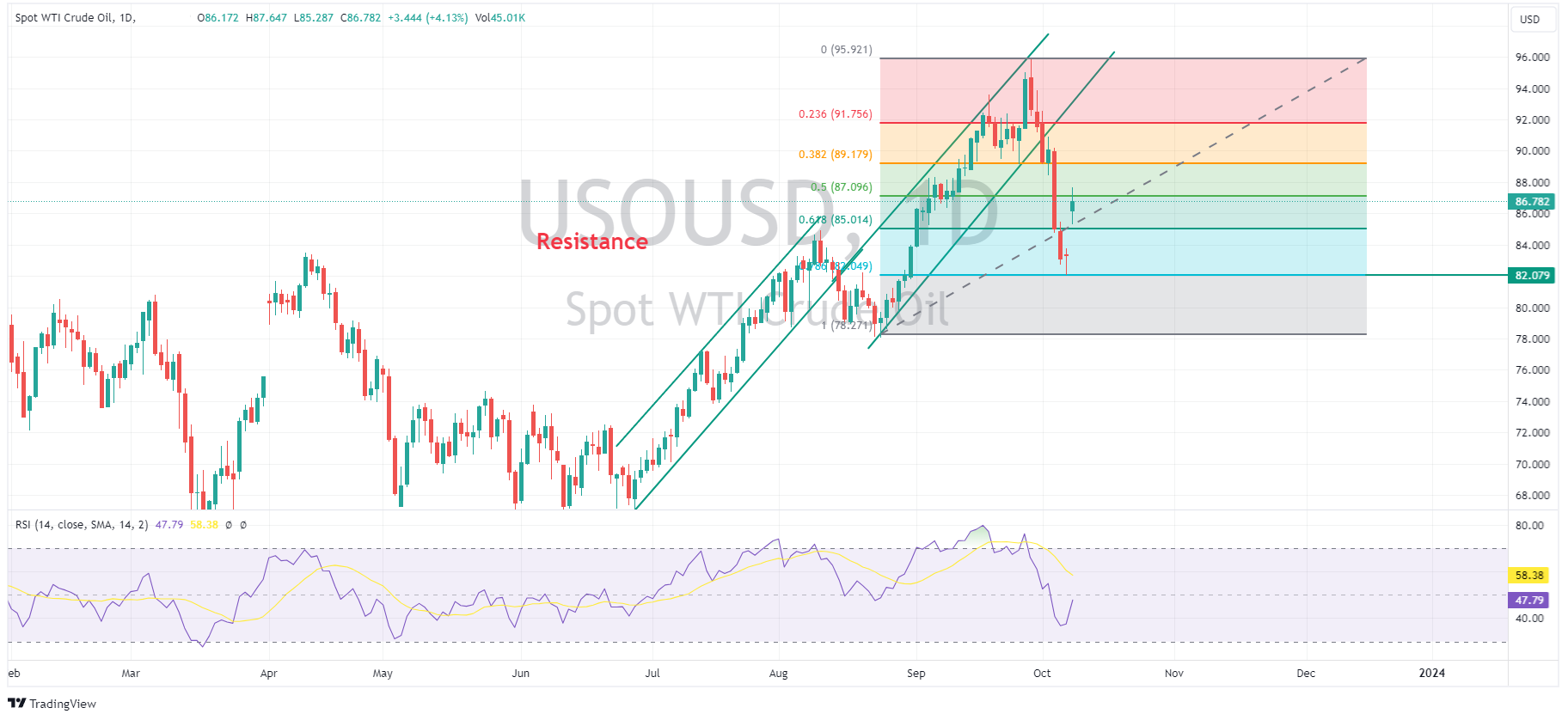

Oil also moved strongly higher as traders baked in a geopolitical risk premium after the weekend’s events, WTI crude gapped higher by over 2% and continued to rally to finish the session over 5% higher. Conflict driven supply disruption fears and a dovish Fed both supporting USOUSD and looking likely to be the main drivers this week. Technical level in play on USOUSD is the 50% Fib retracement level at 87.12, which so far is showing itself as a resistance level.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Crude Oil analysis – WTI drops 3% to fills the gap on inventory build and dwindling supply disruption fears

WTI Crude oil got off to a flyer on Monday open as news broke of conflict in the Middle East saw a hefty risk premium being priced in fueled by fears of supply disruptions. It seems some of those fears have abated and along with a massive crude inventory build of almost 13mm barrels reported by API on Wednesday, a classic gap fill chart pattern has...

October 12, 2023Read More >Previous Article

Charts to watch this week – Gold and Oil gap up on Mid-East turmoil, US Dollar

Gold and Oil have unsurprisingly gapped higher on Mondays open after the weekend’s hostilities in the Middle East, Gold reclaiming it’s safe haven...

October 9, 2023Read More >Please share your location to continue.

Check our help guide for more info.