- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- Market Analysis – USD and yields rise on Fedspeak, Oil tumbles on OPEC+

- Home

- News & analysis

- Economic Updates

- Market Analysis – USD and yields rise on Fedspeak, Oil tumbles on OPEC+

News & analysisNews & analysis

News & analysisNews & analysisMarket Analysis – USD and yields rise on Fedspeak, Oil tumbles on OPEC+

1 December 2023 By Lachlan MeakinUSD bounced back in Thursday’s session with the US Dollar Index (DXY) recouping the weeks losses after finding some technical support at its 61.8 Fib level and an extreme oversold RSI reading. Fundamentally, some hawkish Fedspeak from voting member Daly, where she commented that it is too soon to call the end on rate hikes and the battle against inflation may not yet be over also lending a strong tailwind to USD as yields spiked on her comments. DXY retaking the 103 handle and pushing to the key levels of its 50% Fib level and 200 Day SMA before finding resistance. After some mixed messaging from Fed officials this week, no doubt Dollar watchers will be waiting for some clarification from Chair Powell who is due to speak during the US session.

Chart Source : TradingView.com

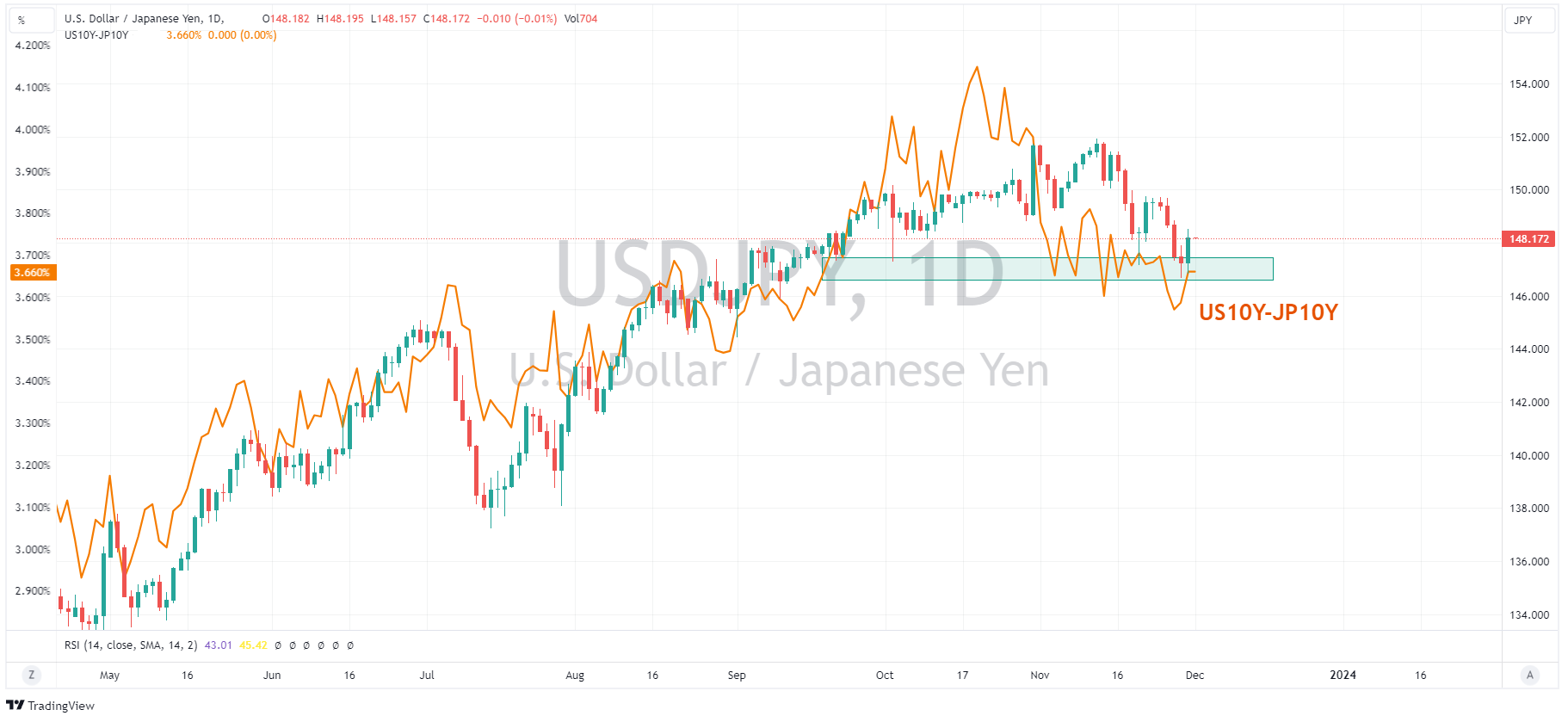

The Yen was hit by dollar strength and a jump in US yields saw US-JP yield differentials bounce back. USDJPY retaking the 148 handle to hit a high of 148.52. Thursday some mixed data out of Japan with a miss in retail sales but a beat in industrial production. Due out of today is Japanese Unemployment and a manufacturing data, but likely the biggest driver in this cross will be Powells comments later.

Chart Source : TradingView.com

The long awaited (and delayed) OPEC+ meeting on Thursday failed to inspire the Oil bulls, with Crude dumping over 2.5% as details of the meeting were released. Although cuts were confirmed to be extended until year end by Russia and the Saudis it was the “voluntary” nature of the cuts and some disagreement from smaller members as to their size which saw traders hit the sell button on crude. Crude finishing November down for a second straight monthly loss. Technically the 200 Day SMA has also proven stiff resistance for any further upside in WTI.

Chart Source : TradingView.com

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

FX Analysis – USD pushes above key level, AUD ahead of the the RBA

USD bounced back to start the first full week of December after a horror run in November where the Dollar Index (DXY) fell around 3%. DXY breaking through the 200 Day SMA resistance and printing a high of 103.850. Sour risk sentiment and higher treasury yields (particularly in the short end) helping DXY erase the Powell inspired drop on Friday. W...

December 5, 2023Read More >Previous Article

Kroger tops third quarter expectations

One of the largest food retailers in the United States, Kroger Co. (NYSE: KR), announced Q3 earnings results before the opening bell in Wall Street on...

December 1, 2023Read More >Please share your location to continue.

Check our help guide for more info.