- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Forex

- FX Analysis – USD pushes above key level, AUD ahead of the the RBA

- Home

- News & analysis

- Forex

- FX Analysis – USD pushes above key level, AUD ahead of the the RBA

News & analysisNews & analysis

News & analysisNews & analysisFX Analysis – USD pushes above key level, AUD ahead of the the RBA

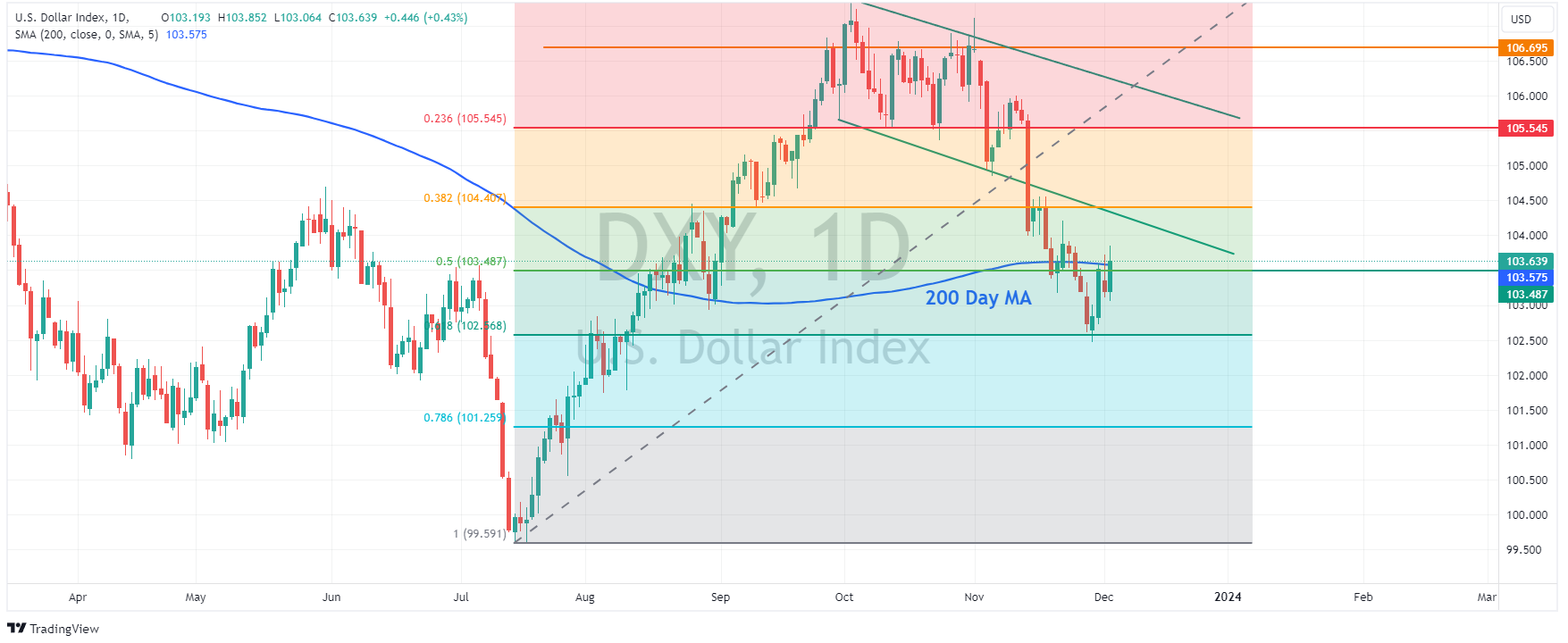

5 December 2023 By Lachlan MeakinUSD bounced back to start the first full week of December after a horror run in November where the Dollar Index (DXY) fell around 3%. DXY breaking through the 200 Day SMA resistance and printing a high of 103.850. Sour risk sentiment and higher treasury yields (particularly in the short end) helping DXY erase the Powell inspired drop on Friday. With the Fed having entered their blackout period ahead of next week’s FOMC meeting (meaning no Fed member jawboning) data this week will take on extra importance with USD traders particularly watching Services PMI data today and the NFP jobs report on Friday.

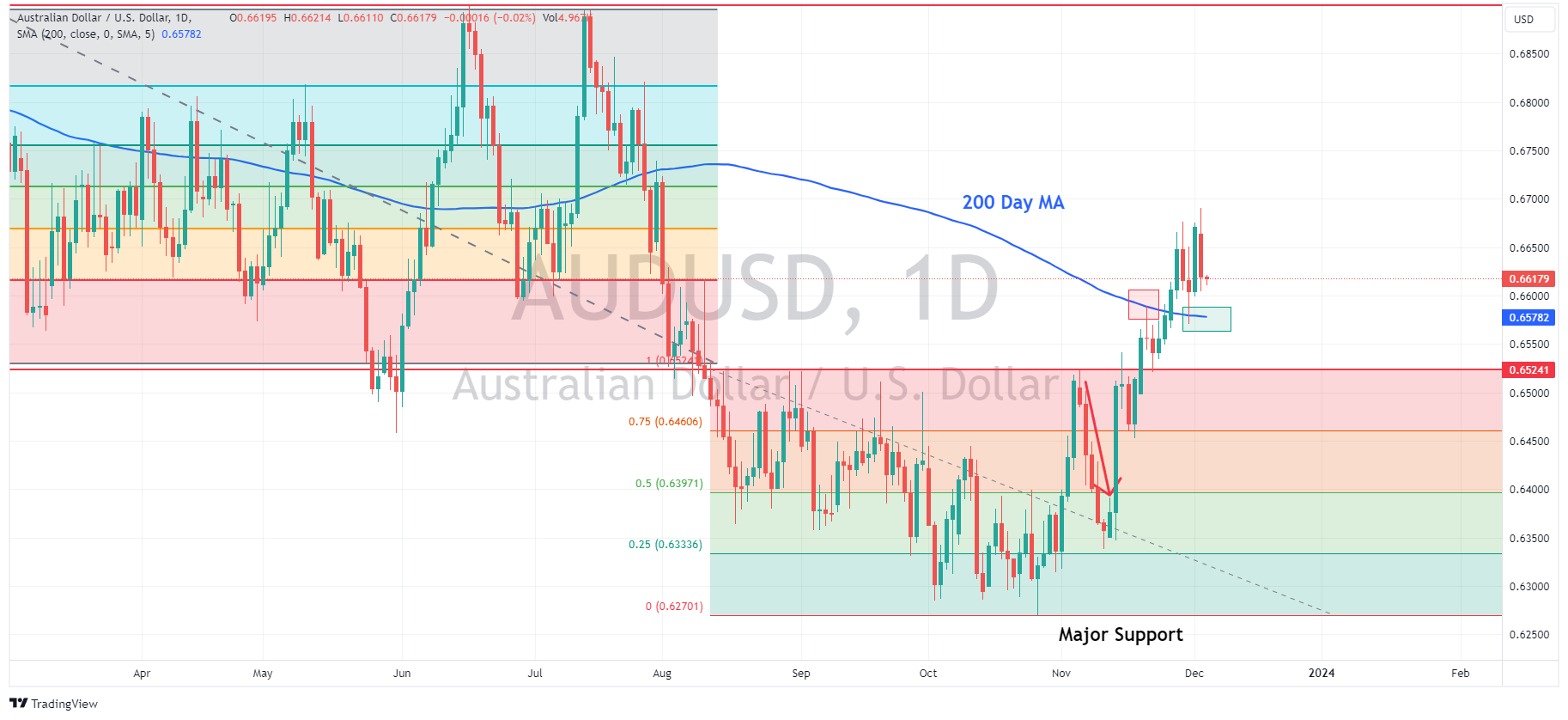

AUD and NZD were the G10 underperformers, a strong USD and a broad risk-off backdrop the main drivers rather than anything specific to the currencies. AUDUSD was looking to test the 0.67 resistance early in the session before reversing course to test the support at 0.66 before finding some buyers. Aussie traders have the December RBA meeting to navigate, with the Central Bank widely expected (95% chance according to futures) to keep rates unchanged. What AUD trader will be watching is for any change of language in the accompanying statement with regards to futures hikes, will the RBA leave the door ajar, wide open or shut it completely? Expect some volatility in the AUD as traders race to work that part out at announcement time.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

NIO Q3 results have arrived – the stock is rising

Chinese electric vehicle company, NIO Inc. (NYSE: NIO), reported Q3 results before the opening bell in the US on Tuesday. Company overview Founded: November 2014 Headquarters: Shanghai, China Number of employees: 20,000+ (2023) Industry: Automotive Key people: William Li (CEO), Lihong Qin (President), Wei Feng (CFO) The resul...

December 6, 2023Read More >Previous Article

Market Analysis – USD and yields rise on Fedspeak, Oil tumbles on OPEC+

USD bounced back in Thursday’s session with the US Dollar Index (DXY) recouping the weeks losses after finding some technical support at its 61.8 Fi...

December 1, 2023Read More >Please share your location to continue.

Check our help guide for more info.