- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

CFD trading

Trade CFDs on forex, commodities, indices, and more.

Open accountTo open a CFD trading account as a Company, Trust, or SMSF, click here.

Share trading

Invest in shares and ETFs on the Australian share market.

Open accountOpen a Personal or Company/Trust/SMSF share trading account.

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- The Impact of China’s Lockdown

News & analysisChina’s recent covid shutdown has wreaked havoc on its economy and the impact may be felt globally. With the world so integrated the second largest global economy suffering through a lockdown has the potential to severely disrupt the global economy.

China has had to face its worst covid outbreak since the beginning of the pandemic. To curb the spread, it placed its two largest cities, Shanghai, and Beijing in lockdown. China is one of the last places to continue with a ‘Covid Zero’ strategy. Shanghai for instance, has a population of 25 million people has barred its citizens from doing anything except for shopping for essentials. This has had an obvious negative effect on the economy.

Economic Repercussions

Manufacturing and Services activity slipped to their lowest levels since February 2020. China’s economy was already struggling, with major construction company Evergrande, struggling to stay afloat for much of last year. Companies such as Tesla, Sony, Ford, and Apple were forced to shut down their factories. President Xi had previously committed to keeping China’s growth at 5.5% GDP growth. However, economists struggle to see how this will be possible with the current covid measures.

The government did concede some concessions by creating a ‘whitelist’

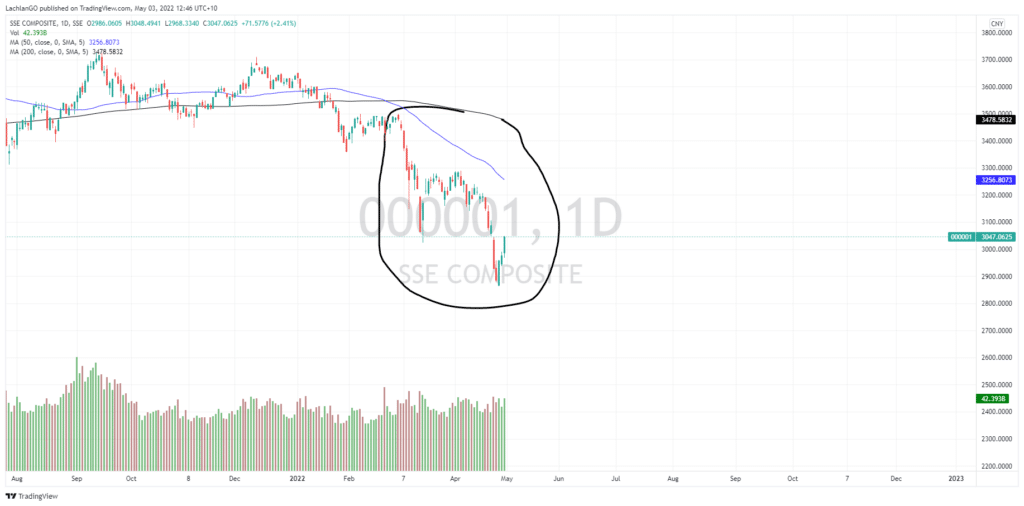

on 18th April of 666 companies that could resume production to keep the economy running. Almost 40% these companies are automakers or companies involved in supplying parts to the auto industry. Due to the lockdown, the most recent economic figures showed retail sales figures slipping by 3.5%, unemployment rising by 5.8%, the highest figures since May 2020 and property was down 26% year on year. The Shanghai stock exchange also saw a dramatic drop and continues to struggle as the country deals with the outbreak. The chart below captures much of the drop off since the outbreak. In recent times a slight recovery has occurred. However, the trend is still bearish overall and without the prospect of significant easing of restrictions there is no guarantee of a sustained move strong reversal.

Global Effects of the shutdown

China’s economic crackdown is being felt globally with global supply chains suffering. Figures show that suppliers are facing their longest delays in two years for products. In addition, as shortages become more problematic it will add further inflationary pressure. Products that may be in short supply and increase inflationary pressure such as electronics and cars may suffer the most. On the contrary, with lower demand for commodities such as oil and gas coming from China it may balance out the negative impact of the supply crunch for electronics and cars.

Effect on Australia

As China is such a large importer of Australian resources, specifically Coal and Iron Ore, if the lockdown drags on it may affect the Australian economy. Large mining companies such as RIO, BHP, FMG and WHC may suffer. In addition, the property market in Australia is heavily influenced by South East Asian buyers and investors who play a big role within the Australian property market.

Ultimately, an economic problem in China is an economic problem for the entire world. Whilst the country is under lockdown it increases the pressure on the global supply chain and inflationary pressure. The world must be on alert for the threat of a weakened Chinese economy.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Pfizer gets a boost – Q1 earnings beat estimates

Pfizer Inc. reported its first quarter financial results before the market open in the US on Tuesday. The American pharmaceutical giant reported revenue of $25.661 billion in the first quarter of the year (up by 77% year-over-year) vs. $24.099 billion expected. Earnings per share also reported above analyst expectations at $1.62 per share (up...

May 4, 2022Read More >Previous Article

Arista Networks tops estimates for Q1

Arista Networks Inc. reported its Q1 financial results after the closing bell in the US on Monday, beating Wall Street estimates. The US computer n...

May 3, 2022Read More >Please share your location to continue.

Check our help guide for more info.