- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

CFD trading

Trade CFDs on forex, commodities, indices, and more.

Open accountTo open a CFD trading account as a Company, Trust, or SMSF, click here.

Share trading

Invest in shares and ETFs on the Australian share market.

Open accountOpen a Personal or Company/Trust/SMSF share trading account.

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- Arista Networks tops estimates for Q1

- 1 Month -17.16%

- 3 Month -4.87%

- Year-to-date -17.73%

- 1 Year +31%

- Morgan Stanley: $144

- Wells Fargo: $160

- Citigroup: $160

- Barclays: $140

News & analysisArista Networks Inc. reported its Q1 financial results after the closing bell in the US on Monday, beating Wall Street estimates.

The US computer networking company reported revenue of $877.066 million (up by 31.4% year-over-year) vs. $856.14 million expected.

Earnings per share reported at $0.84 per share (up by 35.48% year-over-year) vs. $0.81 per share estimate.

Jayshree Ullal, President and CEO of Arista Networks commented on the latest results: ”Arista has delivered record Q1 2022 sales despite the sustained supply chain challenges. I am pleased with our enterprise execution and cloud titan strength in these uncertain times.”

”We are pleased with the continued growth of our enterprise business in the first quarter, combined with robust next generation product qualification and deployment activity with our cloud customers,” Arista’s CFO, Ita Brennan said after the results were announced.

The company expects revenue between $950 million to $1 billion in Q2.

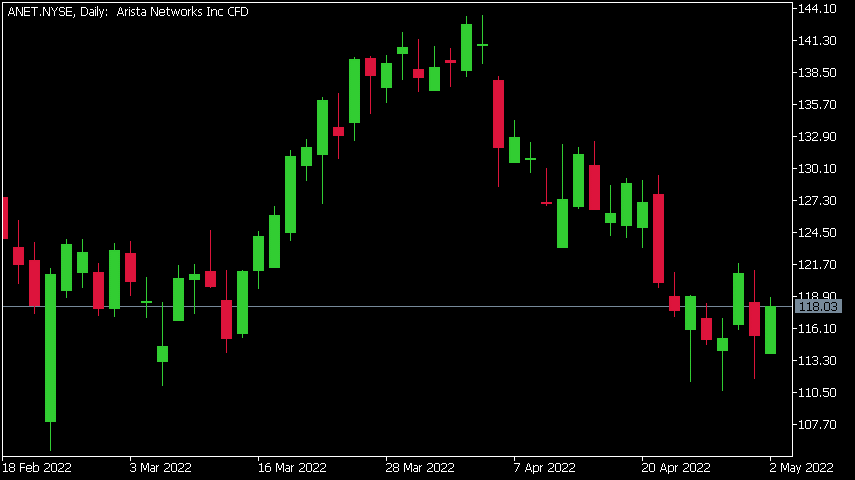

Arista Networks Inc. chart

Shares of Arista Networks ended the trading day on Monday at $118.03 per share, up by 2.33%. The stock price climbed by around 3% in the after-market trading hours.

Here is how the stock has performed in the past year:

Arista Networks price targets

Arista Networks Inc. is the 474th largest company in the world with a market cap of $36.34 billion.

You can trade Arista Networks Inc. (ANET) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Arista Networks Inc., TradingView, CompaniesMarketCap

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

The Impact of China’s Lockdown

China’s recent covid shutdown has wreaked havoc on its economy and the impact may be felt globally. With the world so integrated the second largest global economy suffering through a lockdown has the potential to severely disrupt the global economy. China has had to face its worst covid outbreak since the beginning of the pandemic. To curb the...

May 3, 2022Read More >Previous Article

QANTAS confirms its plan for Project Sunrise

The major Australian airline announced its commitment to direct flights from Sydney and Melbourne to mainland Europe and the East Coast of America by ...

May 2, 2022Read More >Please share your location to continue.

Check our help guide for more info.