- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- The Week Ahead – More Fed speak, Inflation and the Charts to Watch, AUD, USD, JPY, BTC

- Home

- News & analysis

- Economic Updates

- The Week Ahead – More Fed speak, Inflation and the Charts to Watch, AUD, USD, JPY, BTC

News & analysisNews & analysis

News & analysisNews & analysisThe Week Ahead – More Fed speak, Inflation and the Charts to Watch, AUD, USD, JPY, BTC

26 June 2023 By Lachlan MeakinDespite a pull back last week, Global markets are coming into the last week of June and marking the half year point on an impressive run, with the Nasdaq remaining up more than 28% and the S&P500 +13% throughout the first half of the year. The week ahead is fairly light on tier one economic releases, but there will be some flash points that will shape the narrative of Central Banks and their tightening cycles and will test whether last week’s price action was a technical pullback from overbought levels, or a more sustained move to the downside.

USA – USD

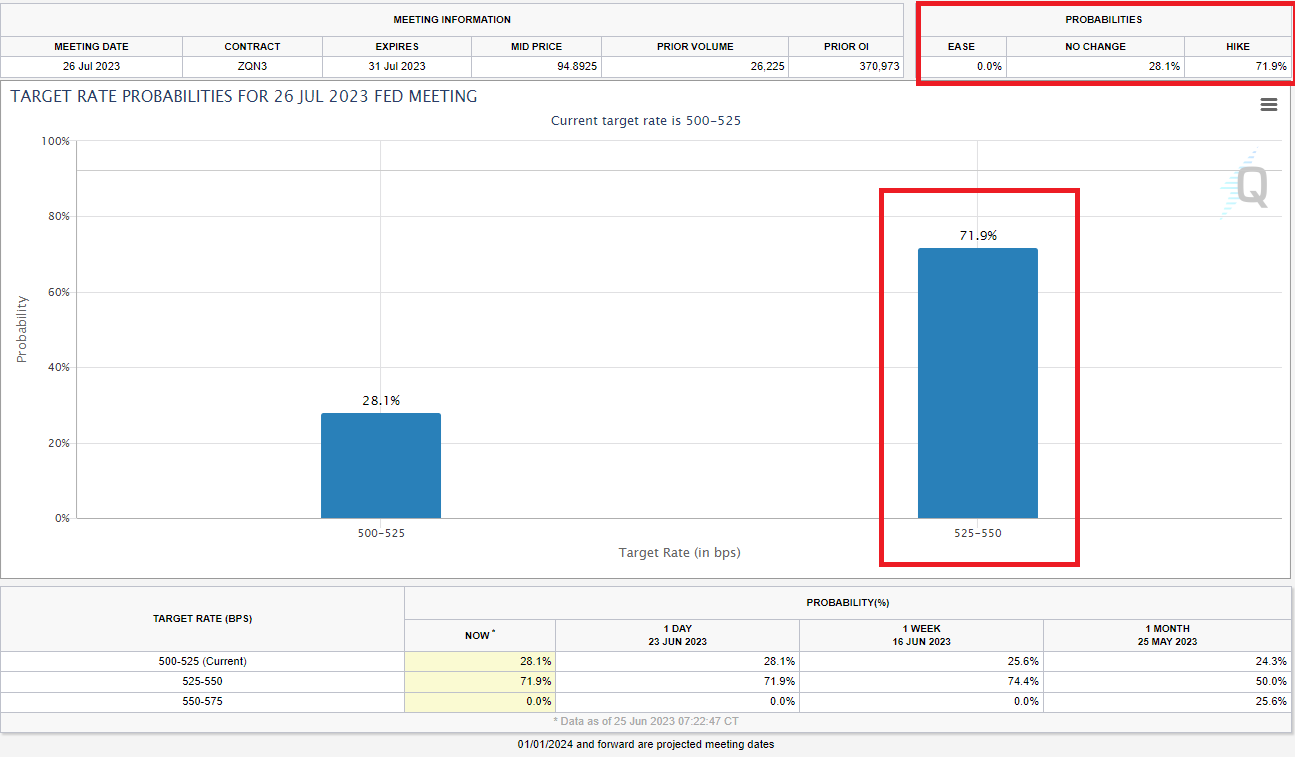

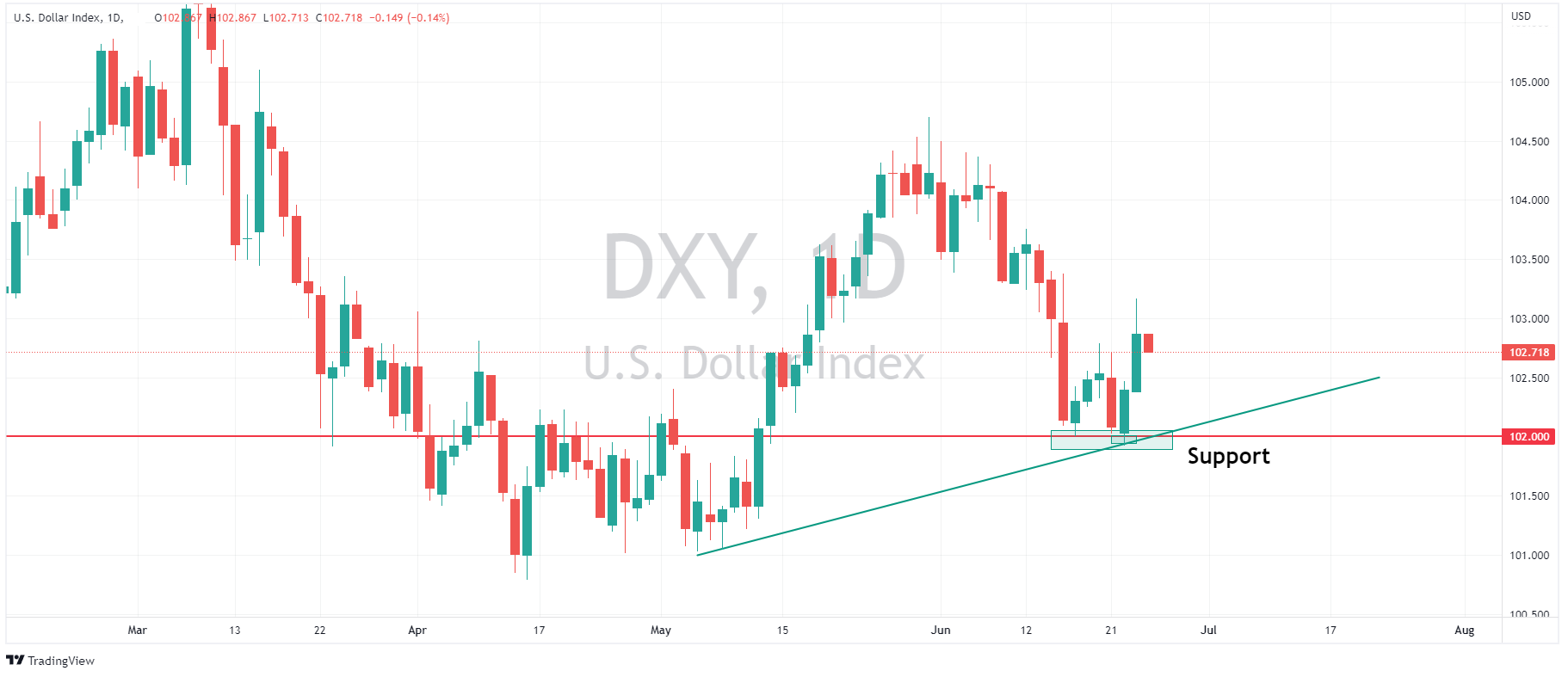

Hawkish messaging from the Fed continued last week, and we’ll likely see more of the same over the coming week with several officials scheduled to speak, including Chair Jerome Powell. The highlight, however, will be the Fed’s favoured measure of inflation, the core PCE figure released on Friday. Fed Fund futures are currently pricing in a 72% chance of a Hike from the Fed in July, a continued hawkish tone from Fed speakers and a hot figure here will see the pricing for a July hike is likely to build, supporting the USD further after a strong rally late last week which saw the US Dollar Index bounce decisively of it’s major support at 102.

Australia – AUD

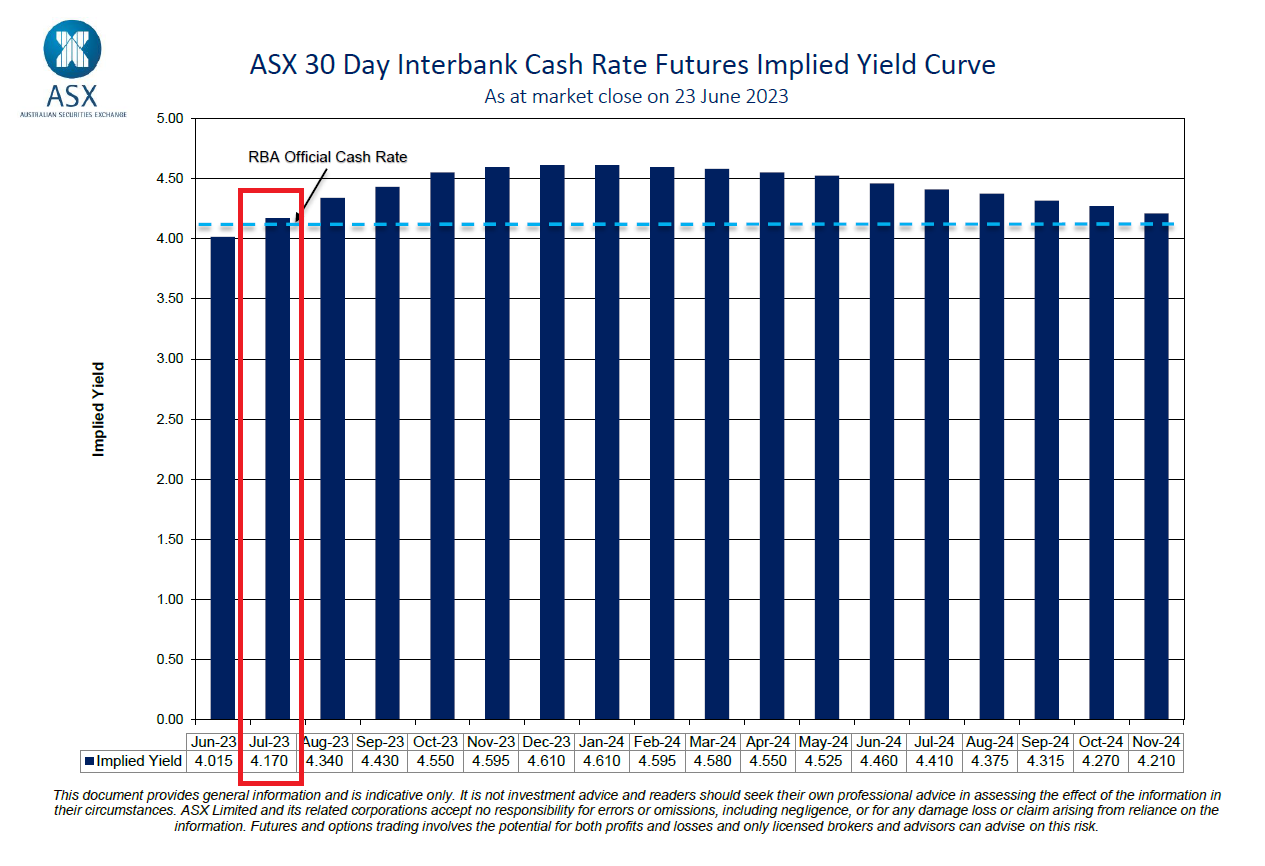

Australian May CPI is due out on Wednesday where a moderation in inflation is expected , though Aprils figure was expected to do the same but surprised with a hot reading that saw a sustained rally in AUDUSD to break out above the major resistance at 0.6800. AUDUSD has since pulled back on USD strength, but with the market split on the RBA’s next move (currently 32% chance of a hike in July) this CPI reading should be deciding factor in the short term whether AUDUSD can reclaim the 0.68 level, or whether this level re-asserts itself as major resistance again.

Japan – JPY

Based on the recent strong PMI readings, the Japanese economy has continued its gradual recovery which should be reflected in Industrial production figures this week. CPI figures on Tuesday and BoJ Governor speaking on Wednesday will be the ones to watch. With USDJPY grinding higher it seems to the key 145 level where BoJ intervention was enacted in 2022, this could be a pivotal week for the JPY. Carry traders are loving this pair at the moment as policy differentials are increasing the yield differential between US10y treasuries and 10 Year JGBs, it’s hard to see a change in momentum in the USDJPY without some clues to a change in policy out of Ueda this week.

Crypto

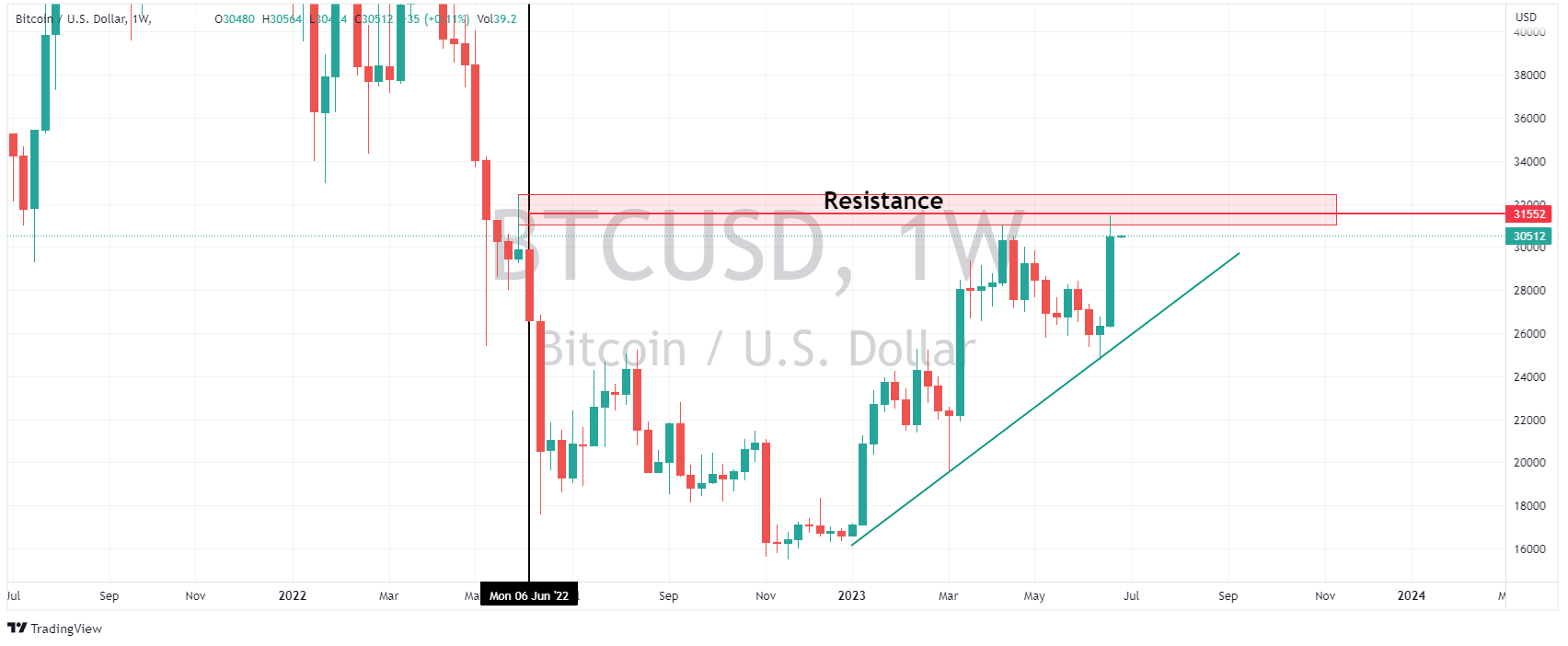

Another chart to watch this week is Bitcoin, which has rallied more than 12% in June on light volumes. Last week BTCUSD hit 12-month highs, before finding resistance around the 31k USD a token level. Historically, the volume has increased on strong up moves in Bitcoin, this week will be an interesting test if this trend continues and BTCUSD is able to make another leg up through the 31k level.

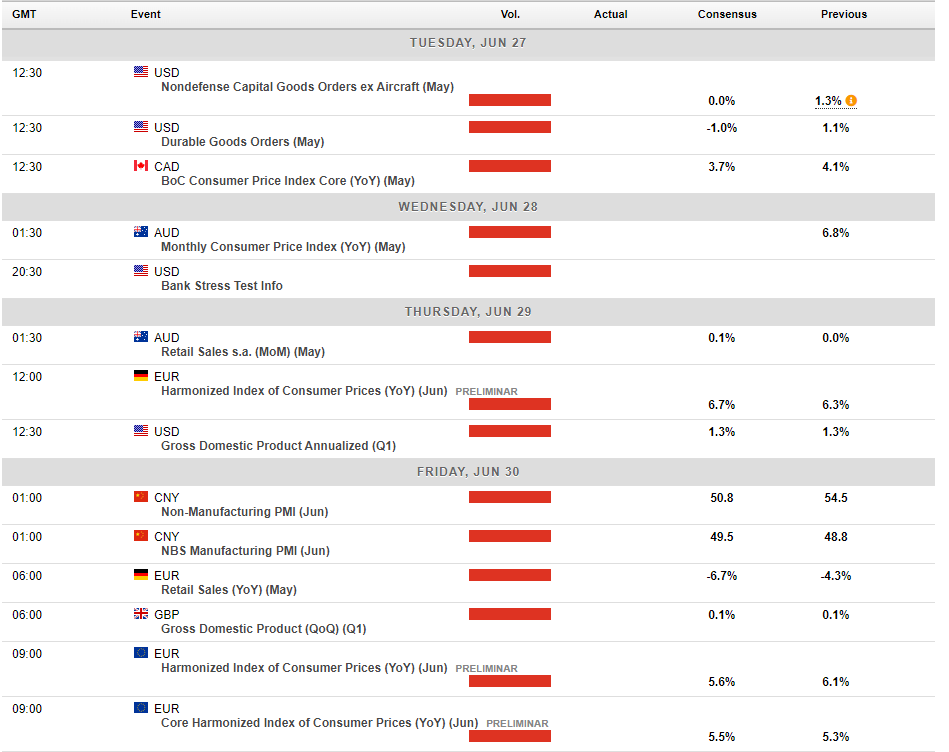

Full week of major economic news below:

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

US Markets finish mostly down in quiet session as Big Tech drags down the Nasdaq

US Indices were mixed to start the week in Monday’s session in a low volatility session, Big Tech gave back some of their recent gains with a major pullback in Tesla (-6% on a Goldman Sachs downgrade) and Meta, Amazon and Microsoft all falling 2-3% saw the Nasdaq down over 1% to be the worst performing index. The Russell 200 was the only m...

June 27, 2023Read More >Previous Article

The VIX Explained: What Every Trader Needs to Know

Introduction The VIX Index, or Volatility Index, often referred to as the "fear gauge," measures expected future volatility in the U.S. stock market....

June 23, 2023Read More >Please share your location to continue.

Check our help guide for more info.