- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- US Markets finish mostly down in quiet session as Big Tech drags down the Nasdaq

- Home

- News & analysis

- Economic Updates

- US Markets finish mostly down in quiet session as Big Tech drags down the Nasdaq

News & analysisNews & analysis

News & analysisNews & analysisUS Markets finish mostly down in quiet session as Big Tech drags down the Nasdaq

27 June 2023 By Lachlan MeakinUS Indices were mixed to start the week in Monday’s session in a low volatility session, Big Tech gave back some of their recent gains with a major pullback in Tesla (-6% on a Goldman Sachs downgrade) and Meta, Amazon and Microsoft all falling 2-3% saw the Nasdaq down over 1% to be the worst performing index.

The Russell 200 was the only major index to finish in the green, with a bounce in regional banking helping to lift that index seeing the Nasdaq 100 / Russell 2000 ratio again find stiff resistance at 8.2, a level that historically indicated Tech being overvalued to the broader market.

FX Markets

USD was flat to start the week in a thin session with a lack of any real news flow, the US Dollar index trading within a tight range, highlighted by a low of 102.610 and a high of 102.830 as traders await a slew of central bank speakers and US data in todays session which should see some more volatility.

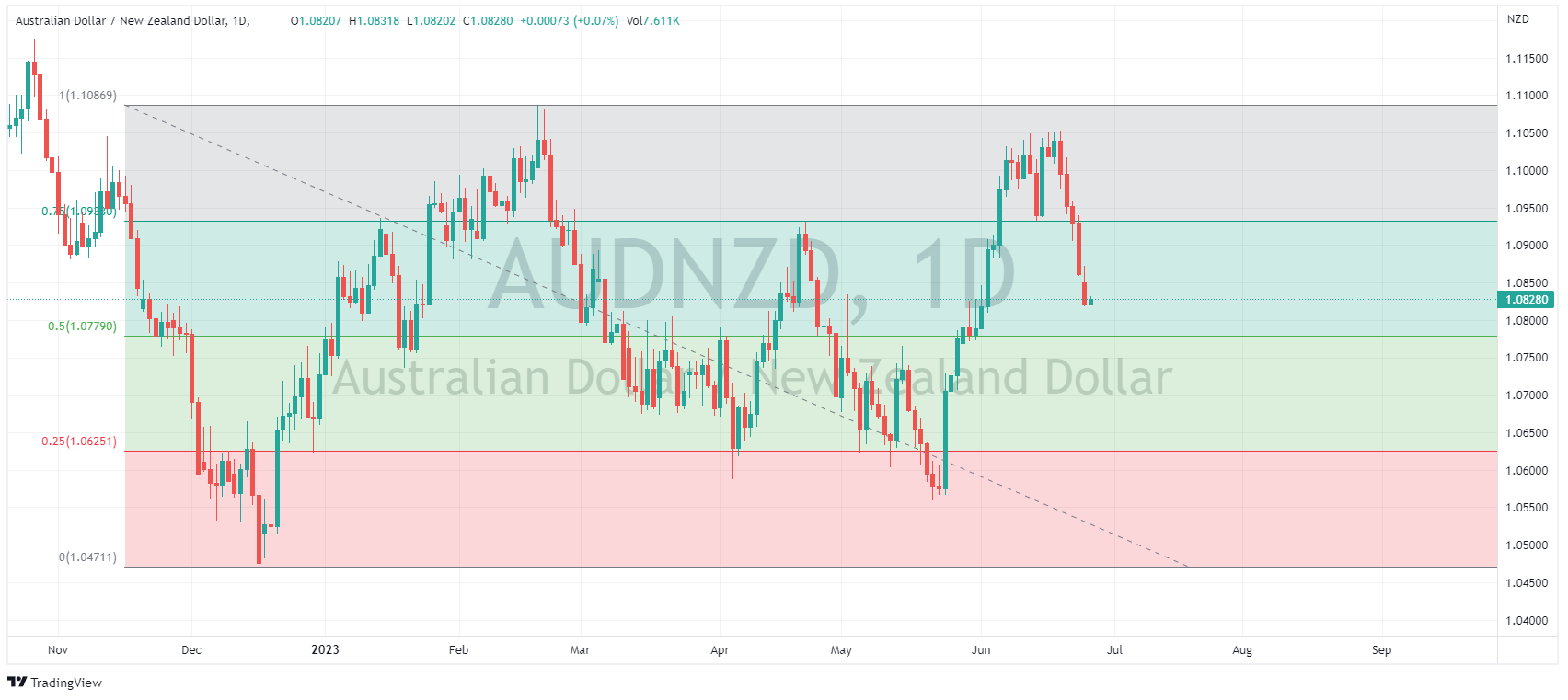

NZD was the G10 outperformer while the AUD was flat against the USD. NZD saw tailwinds after New Zealand’s Trade Minister said he had positive discussions with China on joining the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). NZDUSD hitting a high of 0.6177 and seeing the AUDNZD take a leg down and looking to test the 1.08 level.

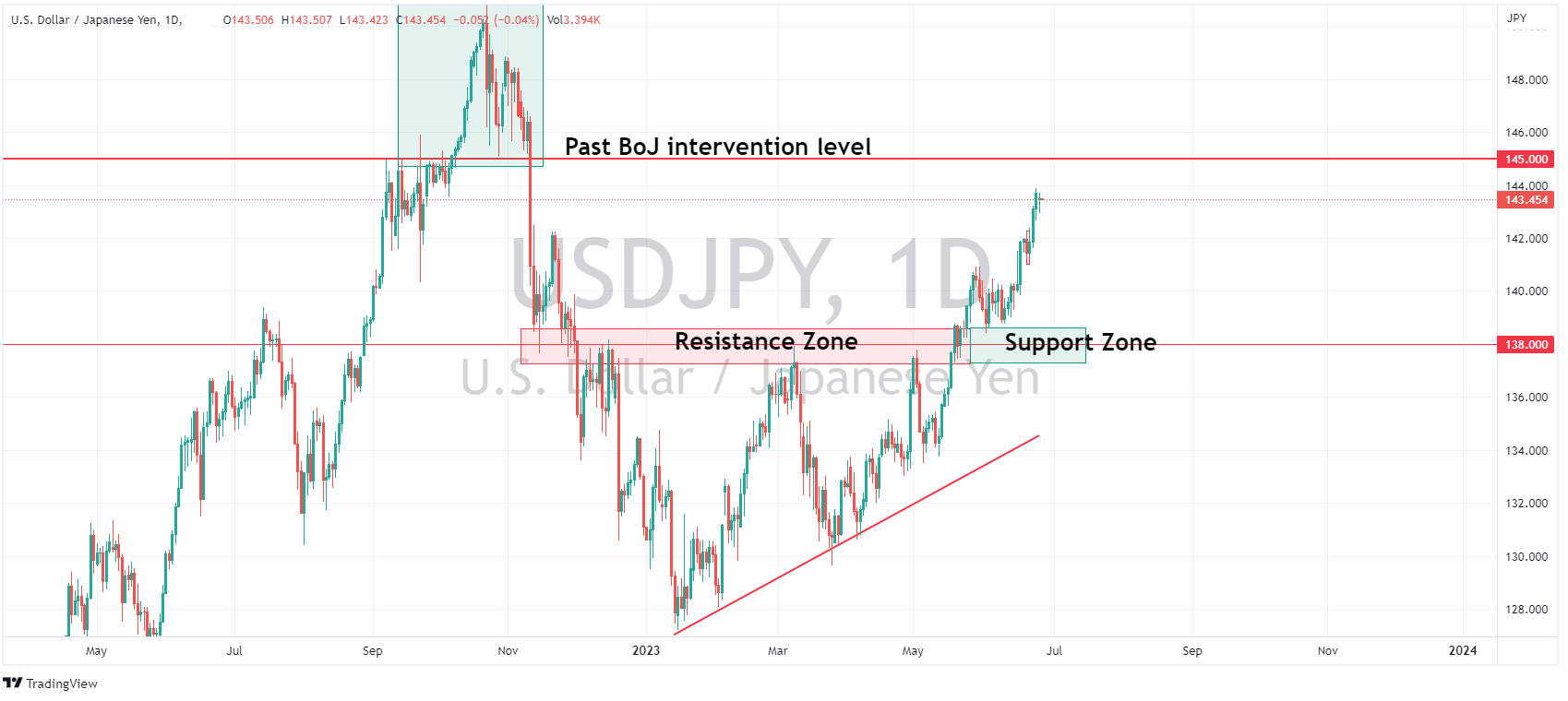

Safe-havens, CHF and JPY, were both marginally firmer against the USD. The recent slide towards 145 halted in USDJPY as comments from Secretary Matsuno and BoJ member Kanda regarding their displeasure at the one-sided trading of the Yen raised the specter of FX intervention (which the BoJ is no stranger to)

EUR was more-or-less flat as EURUSD traded between 1.0888-0920, with the single-currency briefly losing grip of the psychological 1.0900 level on the back of a bleak German Ifo survey and downbeat accompanying commentary. A late session rally did see EURUSD reclaim it , though as support it would be best described as precarious and is shaping to be a key level in the short term.

Gold tested the lower band of its recent range at 1933 to the upside in an attempt to re-enter the range. XAUUSD found some stiff resistance though, with the up move halted, and gold settling below the range where 1933 is shaping to have switched from support to resistance.

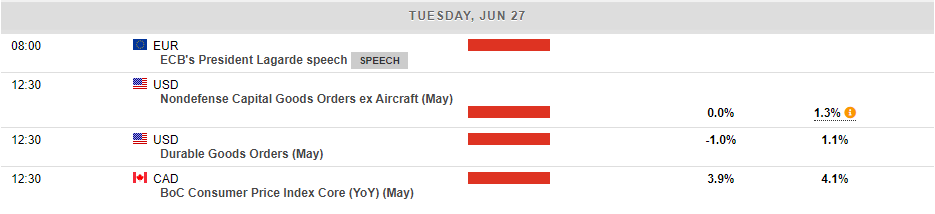

Tuesdays calendar is a little busier with Canadian CPI, US Consumer data and an appearance from ECB President Lagarde.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

US Markets rally strongly after strong data and big tech rebound

US indices bounced back strongly in Tuesday's session as the yesterdays losers in big tech became the winners as strong data encouraged traders to buy the dip. MSFT, AMZN, META and TSLA all posted strong sessions after Mondays sell-off, helping the Nasdaq to outperform, finishing up over 200 points or +1.65% Risk sentiment was spurred by str...

June 28, 2023Read More >Previous Article

The Week Ahead – More Fed speak, Inflation and the Charts to Watch, AUD, USD, JPY, BTC

Despite a pull back last week, Global markets are coming into the last week of June and marking the half year point on an impressive run, with the Nas...

June 26, 2023Read More >Please share your location to continue.

Check our help guide for more info.