- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- Walmart earnings results are in – the stock is falling

- Home

- News & analysis

- Economic Updates

- Walmart earnings results are in – the stock is falling

- 1 Month -13.98%

- 3 Month +92%

- Year-to-date -6.28%

- 1 Year -4.44%

- Deutsche Bank: $181

- Morgan Stanley: $165

- Jefferies: $175

- DA Davidson: $171

News & analysisNews & analysis

News & analysisNews & analysisWalmart Inc. (WMT) reported its latest financial results before the opening bell on Wall Street on Tuesday.

World’s largest supermarket chain reported revenue of $141.569 billion for the quarter (up 2.4% year-over-year) vs. $138.835 billion estimate.

Earnings per share reported at $1.30 per share, falling short of analyst forecast of $1.48 per share.

Doug McMillon President and CEO commented on the latest results: ”Across our businesses, we had a strong topline quarter. We’re grateful to our associates for their hard work and creativity. Bottomline results were unexpected and reflect the unusual environment. U.S. inflation levels, particularly in food and fuel, created more pressure on margin mix and operating costs than we expected. We’re adjusting and will balance the needs of our customers for value with the need to deliver profit growth for our future.”

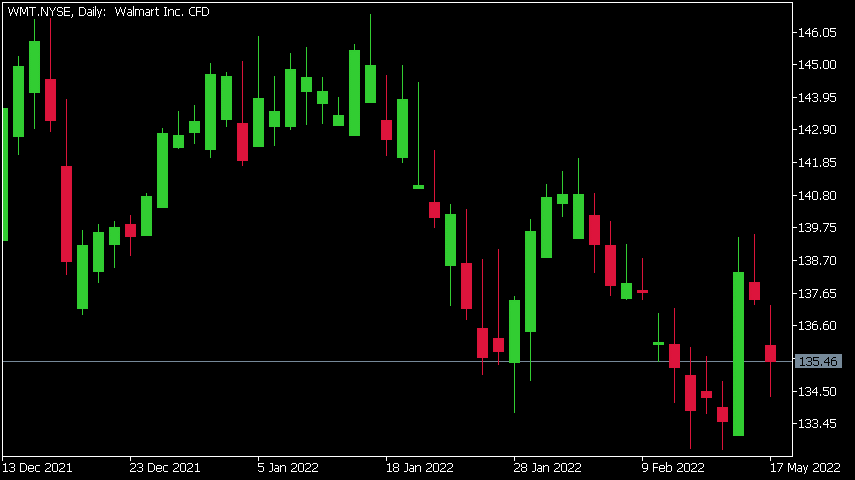

Walmart Inc. chart

Share price of Walmart fell by around 8% at the open on Tuesday, trading at $135.46 per share.

Here is how the stock has performed in the past year:

Walmart price targets

Walmart is the 17th largest company in the world and 14th biggest in the United States with a market cap of $373.49 billion.

You can trade Walmart Inc. (WMT) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Walmart Inc., TradingView, CompaniesMarketCap

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Supply Chains hit WHEAT

As we come to terms with the Russian invasion of Ukraine, which has affected most of us in one way or another, some more fortunate than those within Ukraine borders. We are coming to terms with certain facts of life, including that our economies have been affected by the pressure of imports and exports, inflation has reared its head hitting househo...

May 18, 2022Read More >Previous Article

Consequences of a Strong USD

The USD has been on a tear recently as inflation has engulfed the world economy. The USD, which has traditionally been a strong currency and haven for...

May 17, 2022Read More >Please share your location to continue.

Check our help guide for more info.