- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- Supply Chains hit WHEAT

News & analysisAs we come to terms with the Russian invasion of Ukraine, which has affected most of us in one way or another, some more fortunate than those within Ukraine borders. We are coming to terms with certain facts of life, including that our economies have been affected by the pressure of imports and exports, inflation has reared its head hitting households spending power and international commerce has taken a hit. We can see this more clearly at our local gas stations but will likely see it add a few more dollars on our supermarket sweep receipts. Today we are going to discuss how wheat’s price action has performed since the war and key contributing factors.

Wheat’s price has been on an upward curve for a number of years, breaking its all time high (ATH) on the 24th November 2021. Curiously enough the price wasn’t revised until a day prior to the invasion. Call it coincidence but that’s rarely the case, I rather believe there were some sharp traders in the world, which had a clue or two on the effect this potential event (at the time) would have on the market and placed their big positions accordingly. This in turn moved the market to what we can safely say now, was the beginning of wheat mooning! Within the following 7 days wheat would rise from $856.37 USD to hit ATH of $1351.88 USD, a rise of 57.73%!! Huge gains, which were always due for a correction, but by then the trend had been set and it does not look like these prices are going dissipate any time soon. Why?

Well, the supply chains have been disrupted as it has in Europe and this puts a strain on the commodity and any other disruptions, i.e weather, could add to the strain. Looking at the current price action of the last week, you will see that an extra pressure has been added to the supply chains with countries such as India placing a restriction on exports of wheat.

The benchmark wheat index rose as much as 5.9% in Chicago, the highest it has been in two months. The export ban comes after a heatwave hit India’s wheat crops, taking domestic prices to a record high. Wheat prices have soared by around 60% on world markets this year, pushing up the cost of everything from bread to noodles.

India’s government said it would still allow exports backed by letters of credit that have already been issued, and to countries that request supplies “to meet their food security needs”. Government officials also said the ban was not permanent and could be revised. My colleague Adam Kahlberg has written an article on the Agriculture sector here, for more details on ASX200 companies within our assets offered by GO Markets.

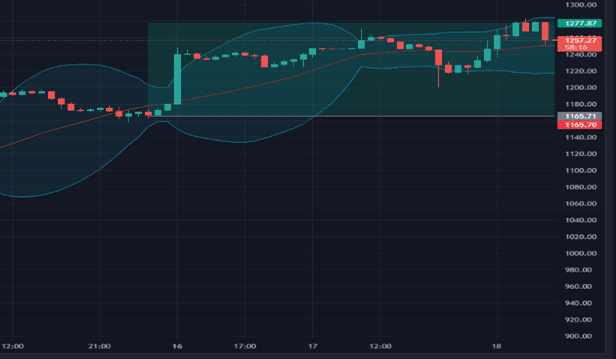

Since the news broke on India’s wheat ban on the 14th May, the price of the Futures commodity rose 9.62% to $1257.27 (see below), momentarily testing $1280.90 on the daily chart and at this stage a key resistance of a few weeks back but failing to break through.

We can rest assured that the commodity and sector will continue to feel the pressure from the supply chains and potentially see other governments copy India’s decision and create a domino effect of man-made shortage to protect each countries’ own interests.

“If this ban occurred in a normal year the impact would be minimal, but the loss of Ukraine volumes exacerbates the issues,” said Andrew Whitelaw, a grains analyst at Melbourne-based Thomas Elder Markets.

Sources: https://www.news.com.au/, https://www.aljazeera.com/, Tradingview.com, USDA estimates.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Target Q1 results announced

Target Corporation (TGT) reported its Q1 financial results before the market open in the US on Wednesday. The US department store chain reported revenue of $25.17 billion in Q1 (up by 4% vs. the same period last year), slightly beating analyst estimate of $24.475 billion. The company missed analyst expectations for earnings per share for the ...

May 19, 2022Read More >Previous Article

Walmart earnings results are in – the stock is falling

Walmart Inc. (WMT) reported its latest financial results before the opening bell on Wall Street on Tuesday. World’s largest supermarket chain rep...

May 18, 2022Read More >Please share your location to continue.

Check our help guide for more info.