- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Forex

- AUDUSD Soars on RBA Hike, EURUSD underperforms, CAD, GBP, JPY wrap

- Home

- News & analysis

- Forex

- AUDUSD Soars on RBA Hike, EURUSD underperforms, CAD, GBP, JPY wrap

News & analysisNews & analysis

News & analysisNews & analysisAUDUSD Soars on RBA Hike, EURUSD underperforms, CAD, GBP, JPY wrap

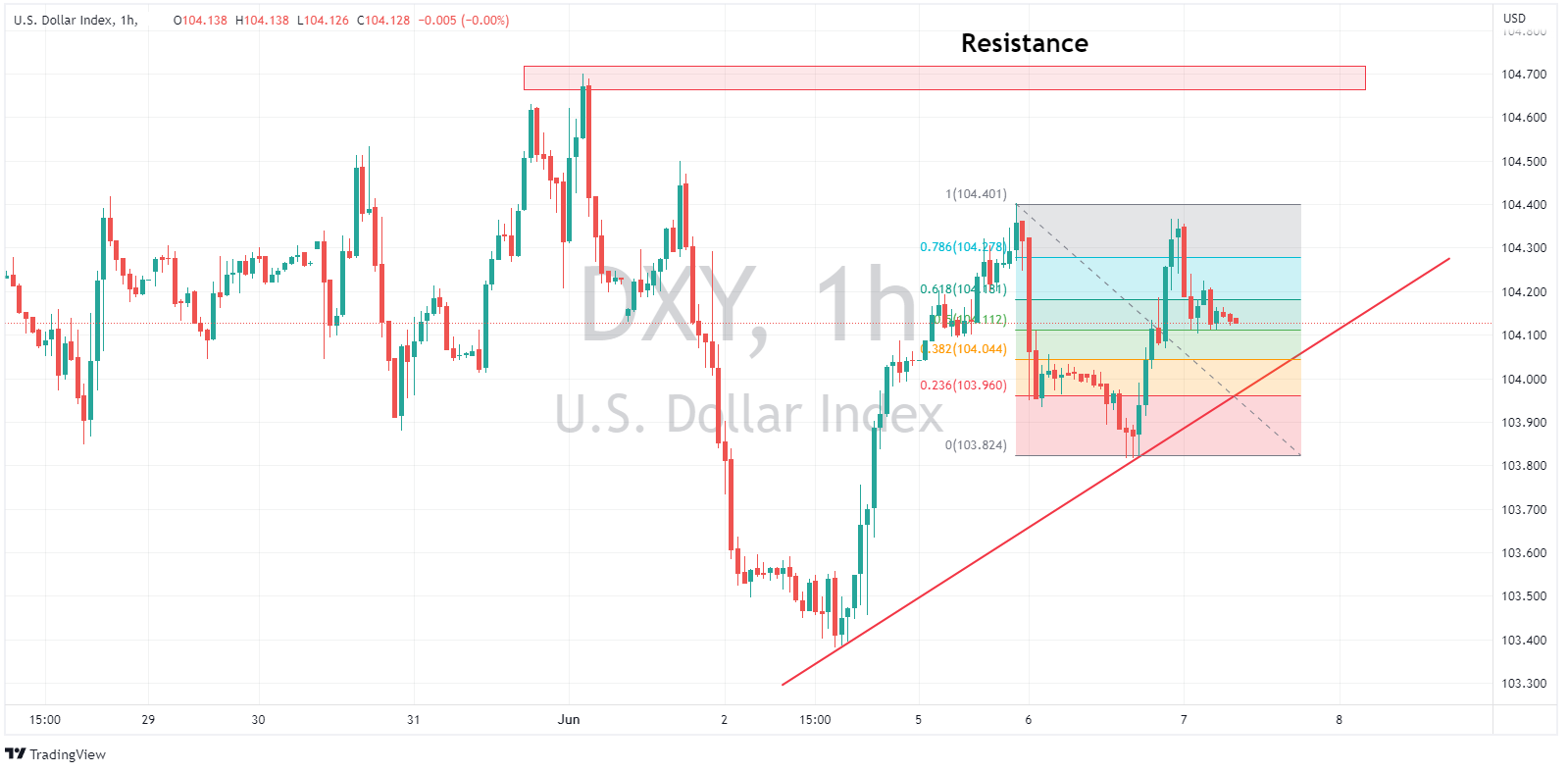

7 June 2023 By Lachlan MeakinUSD was firmer on Tuesday amid a light news calendar sparse in any key risk events. The US Dollar index again having a choppy session in a tight range with EURUSD weakness giving the Dollar a tailwind, also helping the greenback was ramped up US growth forecasts from Goldman Sachs and the World Bank hitting the wires.

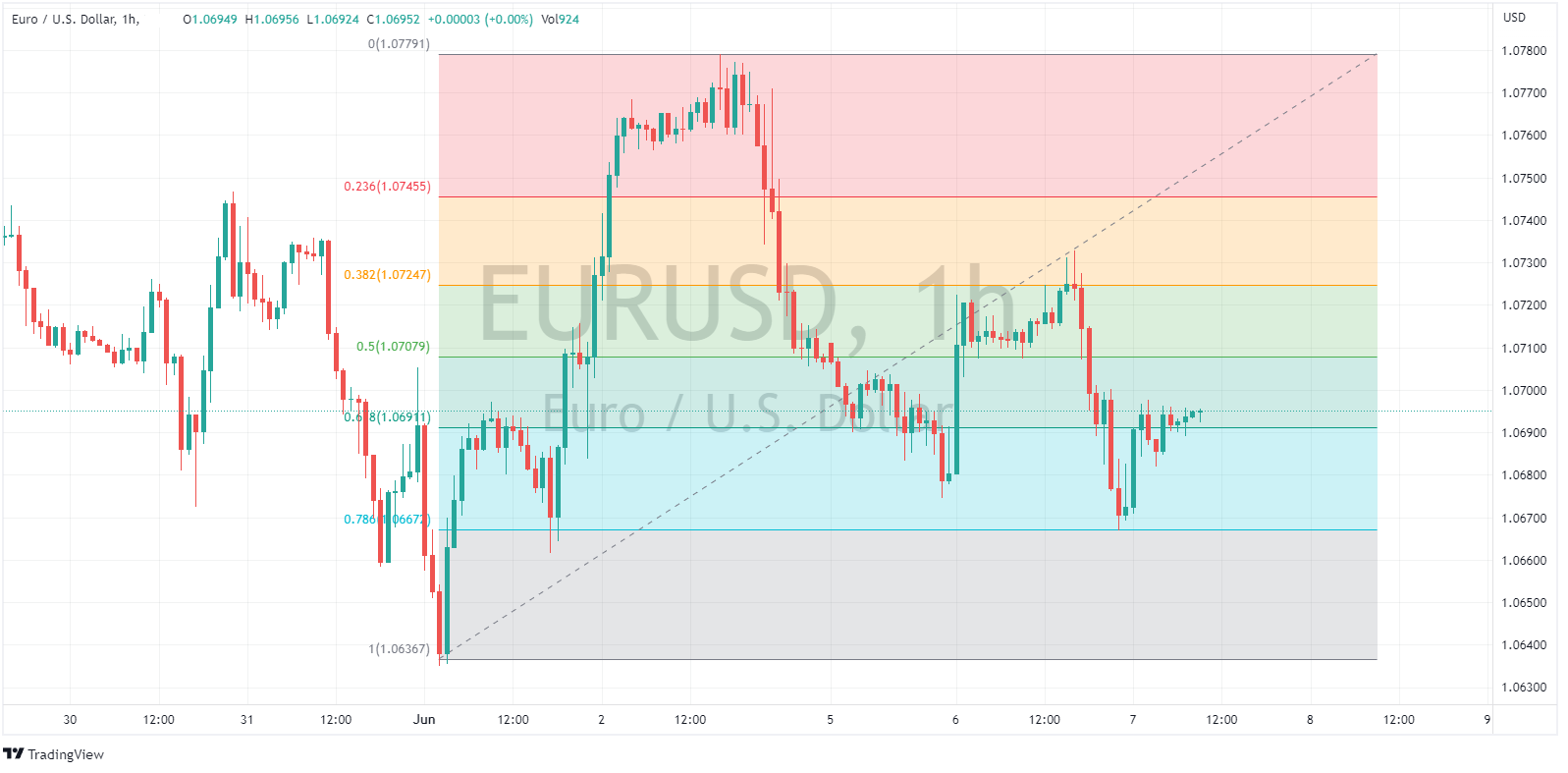

EUR was the G10 underperformer to see EURUSD hit lows of 1.0668 before finding support at a Fib level, this following a miss in German Industrial orders and an ECB consumers survey showing a sharp decline in inflation expectations. Adding to the dovish tone was comments from ECB member Knot (a known hawk) who made some dovish comments declaring “the worst of inflation is behind us”. More ECB talk is scheduled for Wednesday which could add to this narrative.

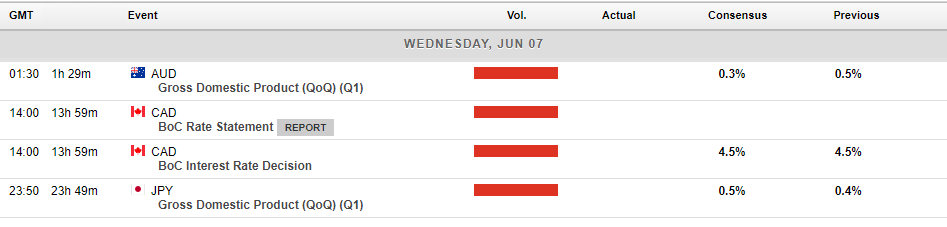

CAD managed to eke out some gains against the Dollar in a whipsawing session, USDCAD seeing a low low of 1.3391, breaching the key support level at 1.34.CAD was initially weighed on by lower oil prices, but an improved growth outlook saw Crude oil rebound with the CAD following suit. Later today CAD traders will have all eyes on the BoC rate decision where the Central Bank is expected to hold rates at 4.5%, but there is a distinct possibility of a 25bps hike in the wake of the recent beats on GDP and CPI readings. Current market pricing has a 46% chance of a hike priced in, so will be line ball.

GBP and JPY were modestly higher against the USD on the session. JPY pared some of its initial strength by a rise in UST yields widening the UST-JGB differential. GBPUSD traded within a tight range, printing a low of 1.2392 and a high of 1.2458. Weak home building figures and a rising recession fear capping gains on cable as the BoE’s aggressive rate hiking campaign appears to be slowing the economy.

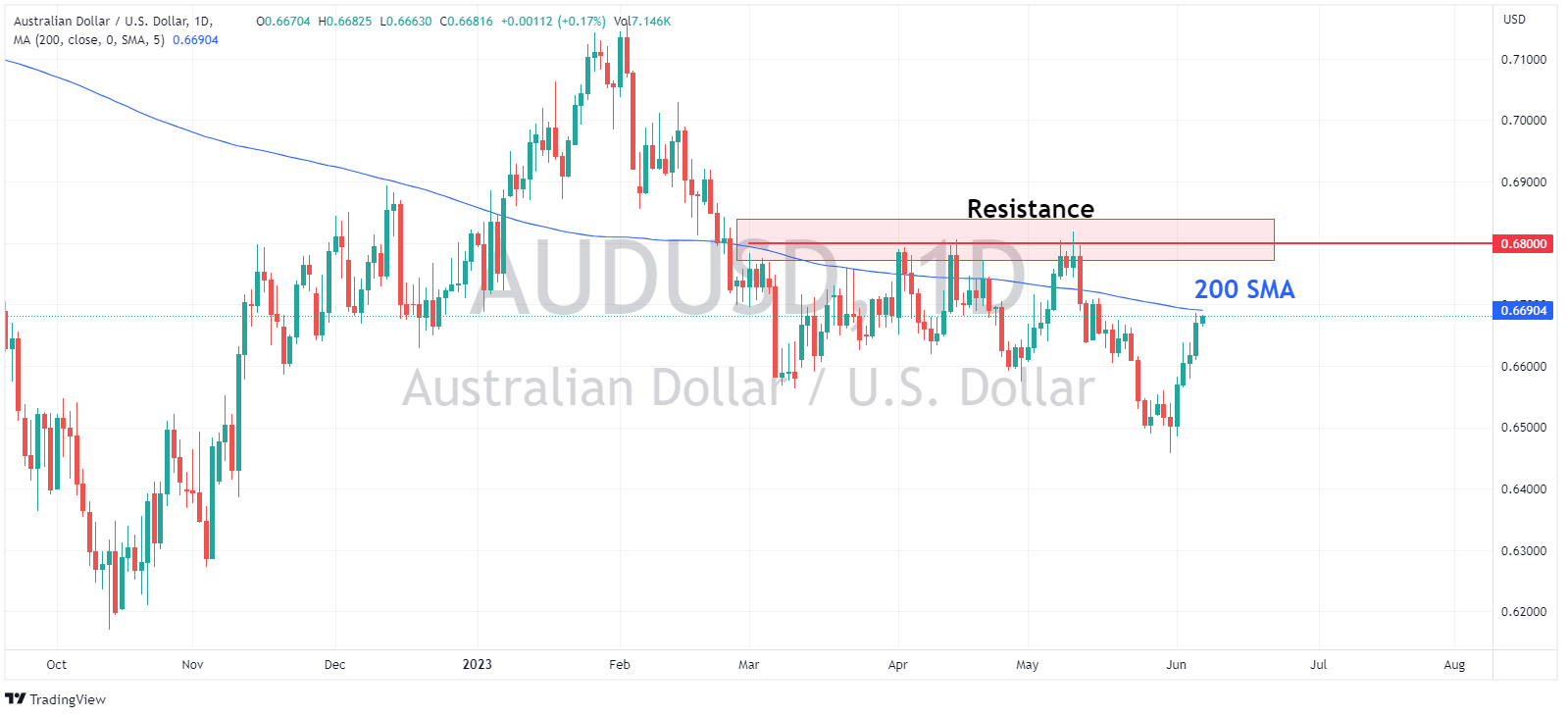

AUD was the clear G10 outperformer after the RBA surprised the market again with a 25bps hike to 4.10%, which along with a hawkish RBA statement noting further rate hikes “may be required” seeing AUDUSD hit a high of 0.6685, falling just short of the 200DMA at 0.6692 and holding most of the gains post announcement throughout the session. For AUD watchers today Q1 GDP will be released today at 11:30 AEST, though it could have limited impact given the RBA already opted to hike rates yesterday.

Calendar of today’s major risk events:

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Wall St rally sees S&P 500 enters technical bull market – VIX dumps, Gold pumps

A tech led rally saw the S&P 500 index enter a technical bull market after rallying 20% from the October 2022 lows, a big miss on unemployment claims which saw it hit 19-month highs added to the “bad news is good news” narrative, sending yields lower, chances of a Fed rate hike next week tumbling and risk assets soaring. Big mover in...

June 9, 2023Read More >Previous Article

Could the Reserve Bank of Australia hike rates further?

The Australian interest rate is currently at 3.85% and the most recent consumer price index (CPI) released at 6.8% which indicates slightly higher tha...

June 6, 2023Read More >Please share your location to continue.

Check our help guide for more info.