- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Forex

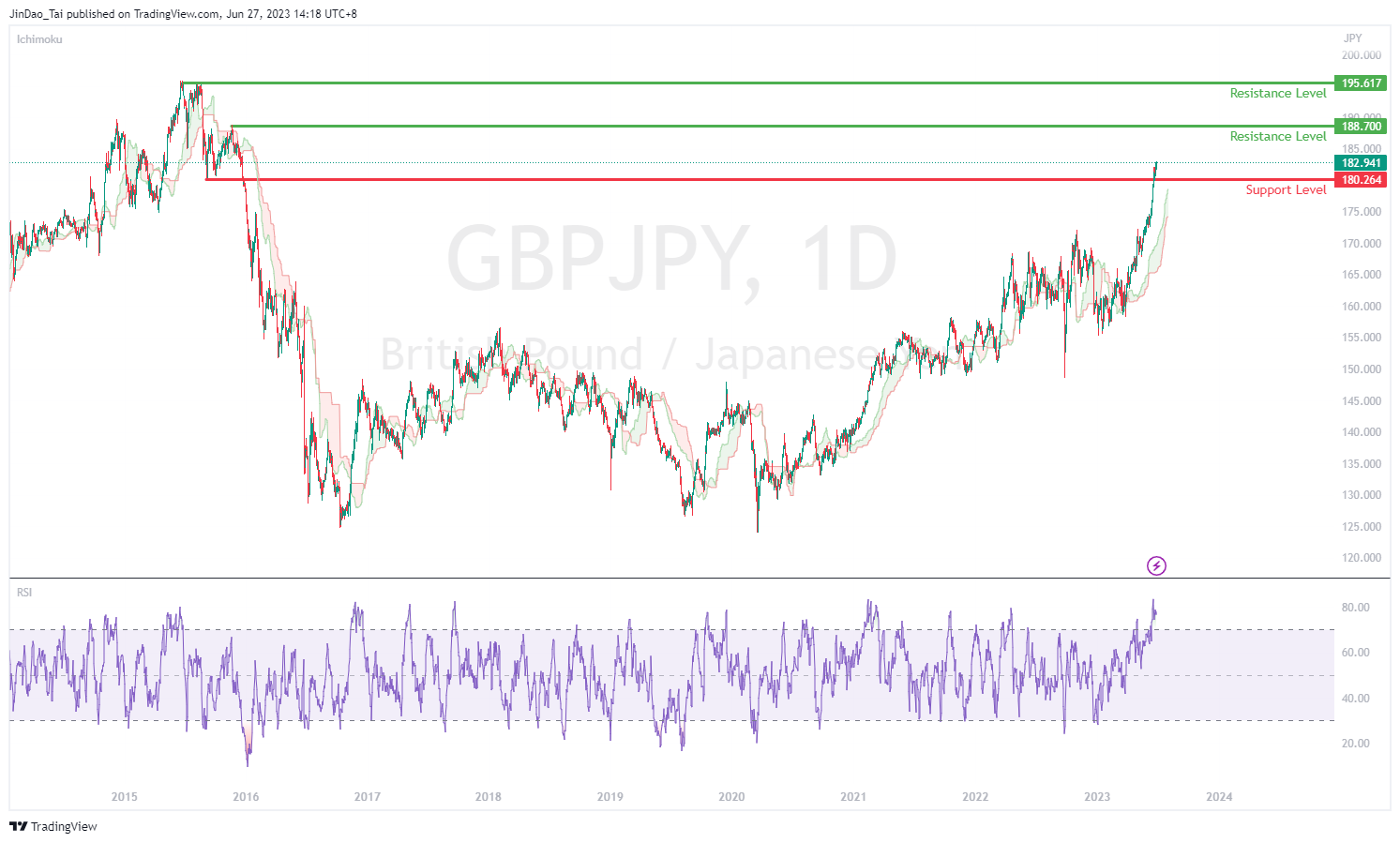

- GBPJPY Breaks Through to 2015 Levels

News & analysisThe GBJPY has continued to climb strongly to the upside, since the end of March 2023 and currently trades just below the 183.00 price level. This move higher is driven by a combination of the weakness of the Japanese Yen and renewed strength in the British Pound.

The Bank of Japan (BoJ) has begun to sound warning bells regarding potentially excessive moves in the Yen, and markets are speculating about the possibility of intervention from the BoJ. The previous intervention from the BoJ came when the USDJPY reached the 145 price level. The USDJPY currently trades along the 143.60 price level.

This could indicate that further upside could be anticipated on the GBPJPY before a strong correction to the downside. If the GBPJPY breaks above 183 the price could continue to climb towards the next key resistance level of 188.70, with the Ichimoku cloud providing strong support for the uptrend.

As the Relative Strength Index (RSI) is well into the overbought region, watch for a possible reversal if the BoJ intervenes, especially along the 188.70 resistance level or at the major swing high of 195.60 (last reached in June 2015)

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Key market data explained: The Non-farm Payrolls

The Non-Farm Payrolls (NFP) is one of the most significant economic events data release of the month and is released on the first Friday by the U.S. Department of Labor. It is a comprehensive snapshot of the current state of US employment, and encompasses the total number of paid employees in the U.S. economy, excluding agricultural, government, pr...

June 28, 2023Read More >Previous Article

US Markets rally strongly after strong data and big tech rebound

US indices bounced back strongly in Tuesday's session as the yesterdays losers in big tech became the winners as strong data encouraged traders to buy...

June 28, 2023Read More >Please share your location to continue.

Check our help guide for more info.