- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- US Markets rally strongly after strong data and big tech rebound

- Home

- News & analysis

- Economic Updates

- US Markets rally strongly after strong data and big tech rebound

News & analysisNews & analysis

News & analysisNews & analysisUS Markets rally strongly after strong data and big tech rebound

28 June 2023 By Lachlan MeakinUS indices bounced back strongly in Tuesday’s session as the yesterdays losers in big tech became the winners as strong data encouraged traders to buy the dip. MSFT, AMZN, META and TSLA all posted strong sessions after Mondays sell-off, helping the Nasdaq to outperform, finishing up over 200 points or +1.65%

Risk sentiment was spurred by strong data out of the US, showing the resilience of the US economy with both housing data (New Home Sales +763k vs 677k expected) and Consumer confidence figures (109.7 vs expected 103.9) easily beating consensus.

FX Markets

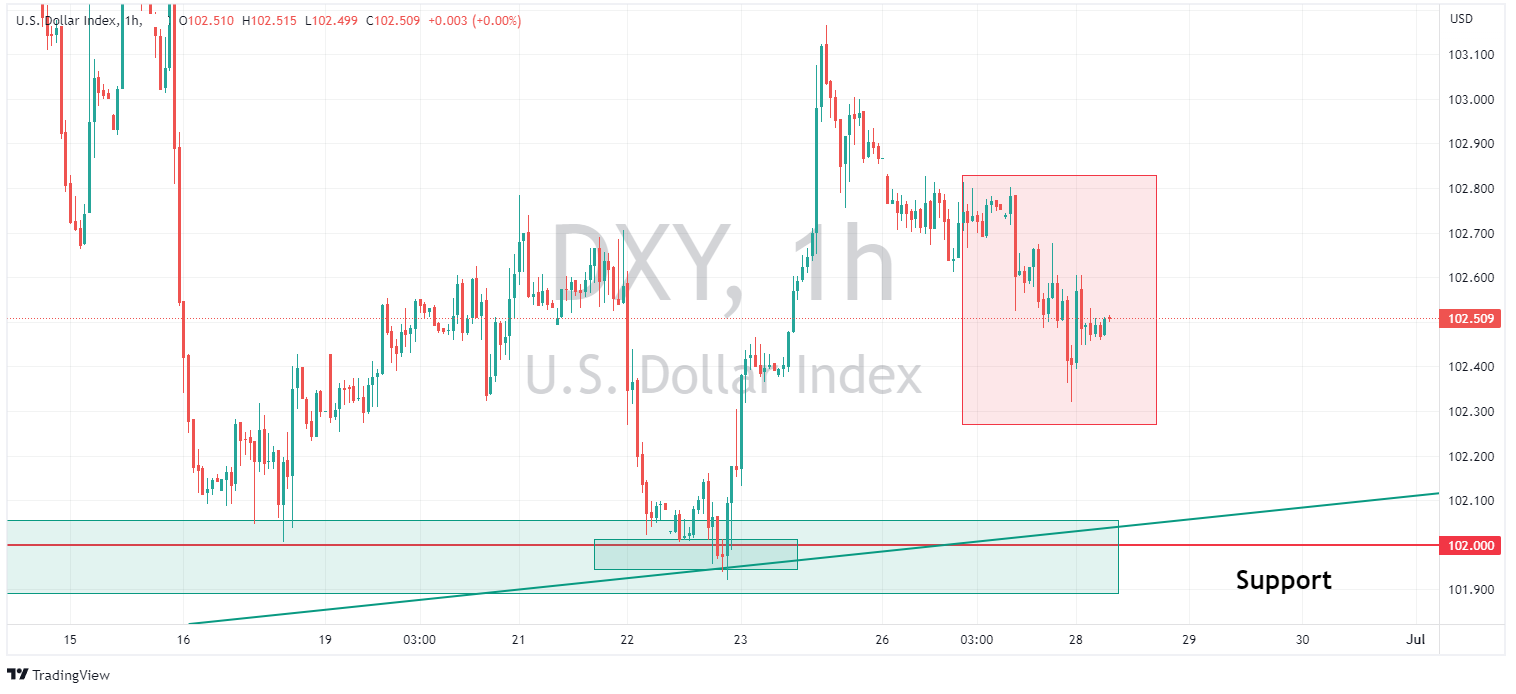

USD sold off on Tuesday on month-end selling and a risk on session reducing the demand for the Dollar further despite strong US data. The Dollar Index fell from highs of 102.80 seen in the Asian session to drift lower during US hours to a low of 102.32, DXY still holding above the major 102 support level and trend line for now.

EUR saw gains as the Dollar sold-off, also helped by several hawkish ECB speakers. ECB’s Kazaks pushed back on rate cuts in 2024 and President Lagarde noted the ECB cannot declare victory on inflation just yet. EURUSD reclaimed the psychological 1.09 level, which acted as support, before pushing to a high of 1.0976 before re-tracing modestly.

JPY was weaker despite a softer USD as it primarily traded off rising rate differentials with US Treasury yields rallying on strong US data. USDJPY restarting its slow march to 145 it seems after breaching and holding a 144 handle. Recent BoJ jawboning, signaling a possible intervention incoming, seeming to fall on deaf ears for now.

Gold dipped again as rising yields and a risk-on market saw haven flows dry up. XAUUSD again attempting to reclaim the 1933 level, which was strong support up until recently, but again found stiff resistance seeing XAUUSD dip to last weeks lows of 1910 USD an ounce.

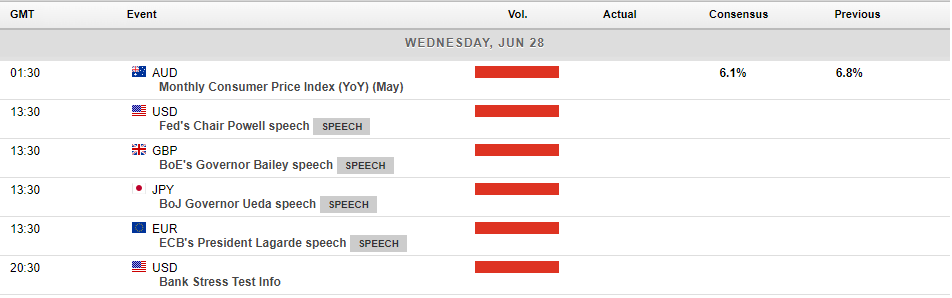

Today’s economic calendar see a diverse selection of central bank speakers, including more from ECB president Lagarde and Fe Chair Jerome Powell. Aussie CPI will also be one to watch, with the market split on the RBA’s next move, we could see some action in the AUD over this figure if we get a surprise either way.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

GBPJPY Breaks Through to 2015 Levels

The GBJPY has continued to climb strongly to the upside, since the end of March 2023 and currently trades just below the 183.00 price level. This move higher is driven by a combination of the weakness of the Japanese Yen and renewed strength in the British Pound. The Bank of Japan (BoJ) has begun to sound warning bells regarding potentially exce...

June 28, 2023Read More >Previous Article

US Markets finish mostly down in quiet session as Big Tech drags down the Nasdaq

US Indices were mixed to start the week in Monday’s session in a low volatility session, Big Tech gave back some of their recent gains with a major ...

June 27, 2023Read More >Please share your location to continue.

Check our help guide for more info.