- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Oil, Metals, Soft Commodities

- Oil on the Rise

News & analysisOil on the Rise

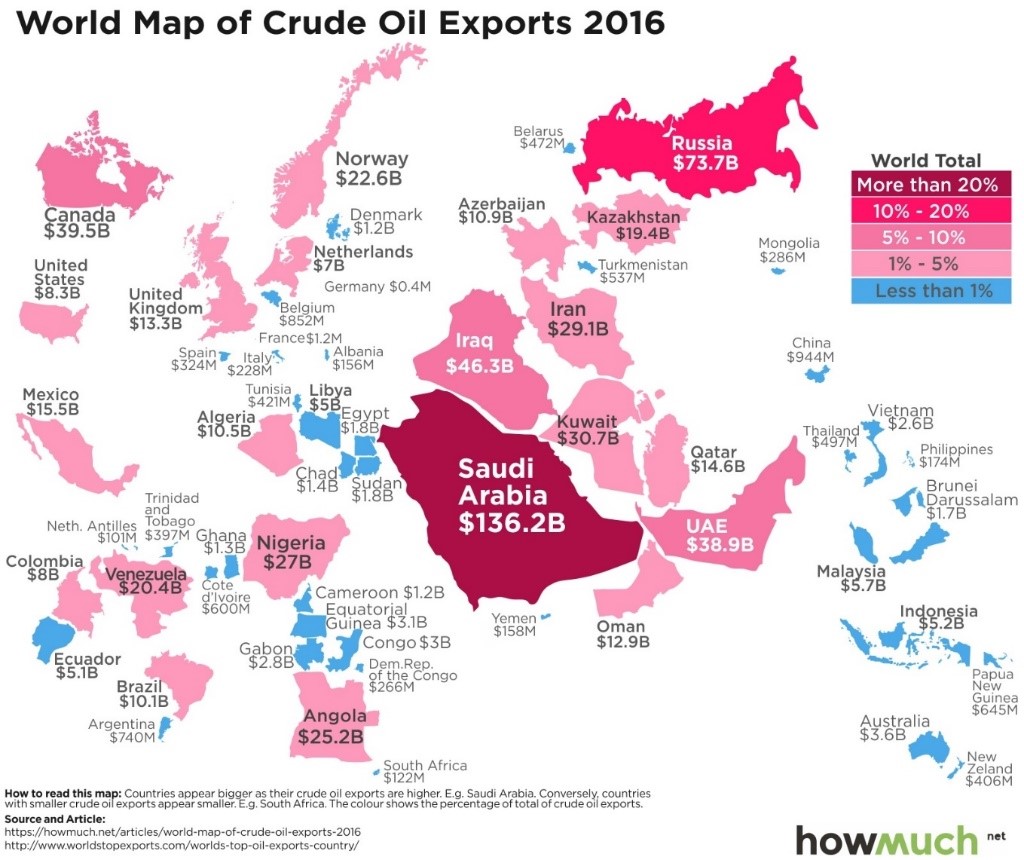

After reaching its lowest price for 15 years back in January, we have seen the oil prices rising in the recent months since June. The price recently reached a two-year high following a partial closure of the Keystone pipeline connecting Canada-US oilfields. With more upcoming meetings and geopolitical tensions rising in the Middle East, the future of the oil prices will depend on how the future events unfold.

OPEC Meeting

The next Organization of the Petroleum Exporting Countries (OPEC) is taking place on 30th November in its headquarters in Vienna, Austria. It is expected that the pact on cutting output beyond March 2018 expiry will be extended, although Russia – a non-OPEC member and the second largest oil exporter in the world has sent mixed signals about its support for an extension on the cuts. “With the majority of OPEC members endorsing an extension, Russian support is the key risk,” Jon Rigby, head of oil research at UBS, wrote in a note.

Last month, President Vladimir Putin indicated that Russia is backing extending the deal to the end of next year, but recent comments by officials and Russian media have created uncertainty since Putin’s comments.

British bank and financial services company Barclays expects a 6 to 9-month extension of an OPEC led deal to limit oil output during the meeting on 30th November. The bank expects Brent to remain above $60 per barrel in the last quarter of this year and fall to $55 in 2018. “Whether or not the countries extend and the duration of the deal are not the relevant questions in our view. We believe the level of the cut is what really matters, and we assign a low likelihood to this detail being announced on November 30,” analysts at the bank said in a note.

“If the meeting concludes as the market expects, prices could experience a short-term selloff, but the technicals and fundamentals will likely remain constructive,” the bank said.

Other concerns for oil prices are the geopolitical tensions in the Middle East. Saudi Arabia and Iran have been involved in aggressive exchanges over the conflict in Yemen with both countries backing different sides. The Gulf region exports around 28 million barrels a day which is almost one third of a global production, therefore its important the relationships in the Middle East does not intensify further.

UKOUSD:

Source: GO Markets MT4USOUSD:

Source: GO Markets MT4See here for more information on Oil Commodity Trading.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#SpotGold #SpotSilver #GoldTrading #SilverTrading #SpotWTICrudeOil #WTICrudeOil #SpotBrentCrudeOil #BrentCrudeOil #OilTrading #Commodities #CommoditiesTrading #CommodityMarket #CommodityTradingNext Article

Deal or No Deal

Deal or No Deal Brexit negotiations have been ongoing for some months now, and even while officials state that ‘sufficient progress’ in the talks has been made, the public are still unaware of what the details of said progress are. This week Theresa May was in Brussels and it was expected that here a deal would be agreed upon, with key issues ...

December 6, 2017Read More >Previous Article

Mugabe Steps Down

Mugabe Steps Down Political tensions have been rising in the southern African nation of Zimbabwe over the last few days as the long-standing leader Ro...

November 22, 2017Read More >Please share your location to continue.

Check our help guide for more info.