- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- Mugabe Steps Down

- 6th November – Robert Mugabe fires vice-president Emmerson Mnangagwa, clearing the way for his wife, Grace Mugabe to succeed him to lead Zimbabwe

- 15th November – Robert Mugabe is placed under house arrest by the country’s national army

- 16th November – The US calls for a new era in Zimbabwe and asks Mugabe to step down. Zimbabwe’s army chief’s trip to China last week raises questions on coup

- 17th November – Zimbabwe’s ruling party, Zane-PF calls for Mugabe to step down

- 18th November – People of Zimbabwe celebrate the army takeover and urge Mugabe to step down

- 19th November – Robert Mugabe had allegedly agreed to stand down and was expected to make the announcement during a national address, however he defied expectations and remained in charge

- 20th November – Mugabe is accused of swapping speeches before the national address

- 21st November – Mugabe officially steps down as president of Zimbabwe

News & analysisMugabe Steps Down

Political tensions have been rising in the southern African nation of Zimbabwe over the last few days as the long-standing leader Robert Mugabe was placed on house arrest by the army in a coup*. The people of Zimbabwe have experienced tough times under Mugabe since he became the leader back in 1980, and on the 21st of November he finally announced his decision to step down as the leader of the country. It’s a historic moment for a country which has suffered deep economic and political problems for many years.

*A coup is the illegal and overt seizure of a state by the military or other elites within the state apparatus.Timeline of events so far:

With Mugabe stepping down, most Zimbabweans will be looking positively into the future, but the future itself will all depend who the next leader will be. It is highly anticipated that the ex-Vice President Emmerson Mnangagwa will take over but that should all be decided in the coming weeks as the transition of power begins.

About Zimbabwe and Robert Mugabe:

Capital: Harare

Official language(s): 16 official languages, with English, Shona, and Ndebele being the most common

Population: 16,150,362 (2016 estimate)

Gross Domestic Product (GDP): 17 billion (total)

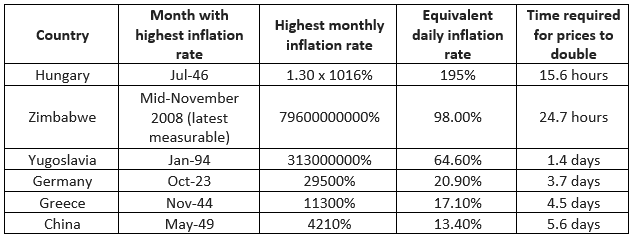

Currency: US DollarRobert Mugabe has been charge of Zimbabwe for nearly 40 years and at 93 years old, was the world’s oldest president. His time in charge has been full of controversy and corruption which lead Zimbabwe to reach the second highest level of inflation in history at 79,000,000,000% back in late 2008. In 2015, the country announced its decision to demonetise the Zimbabwean Dollar and start using the US dollar. It is worth pointing out that at one point the 100 trillion Zimbabwean Dollars were worth just 40 US cents which puts things in perspective to show how bad the economic situation was. Other currencies used in Zimbabwe include – Euro, South African Rand, Pound Sterling, Indian Rupee, Australian Dollar, Chinese Yuan, Botswana Pula and Japanese Yen.

Highest monthly inflation rates in history:

Source: Cato Institute

By: Klavs Valters

GO MarketsReady to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Oil on the Rise

Oil on the Rise After reaching its lowest price for 15 years back in January, we have seen the oil prices rising in the recent months since June. The price recently reached a two-year high following a partial closure of the Keystone pipeline connecting Canada-US oilfields. With more upcoming meetings and geopolitical tensions rising in the Middle E...

November 29, 2017Read More >Previous Article

Middle East Tensions

Report by Deepta Bolaky A buoyant open on Oil markets this week amidst clampdown on corruption. The sudden arrests of a dozen princes, business tycoon...

November 7, 2017Read More >Please share your location to continue.

Check our help guide for more info.