GO Markets,让交易更进一步

智慧交易,从选择值得信赖的全球券商开始。低点差、快速成交、零入金手续费、功能强大的交易平台,以及屡获殊荣的客户支持,让您的交易更进一步

二十年稳健实力,成就值得信赖。

二十年专注打造极致交易体验。

自2006年起,致力缔造卓越的交易环境。

全球交易者共同的选择

自 2006 年起,GO Markets 已帮助全球数十万交易者实现他们的投资目标。凭借严格监管、以客户为本的服务,以及屡获殊荣的教育资源,我们始终是交易者值得信赖的合作伙伴。

*Trustpilot reviews are provided for the GO Markets group of companies and not exclusively for GO Markets Ltd.

*Awards were awarded to GO Markets group of companies and not exclusively to GO Markets Ltd.

GO Markets

让交易更进一步

探索上千种交易机会,享受专业机构水准的交易工具、流畅稳定的交易体验,以及屡获殊荣的客户支持。开户流程简单快捷,让您轻松开启交易之旅。

February opens with a policy-heavy tone led by Australia’s RBA decision, while Japan provides the core macro anchors through GDP and inflation updates. In contrast, China’s calendar lightens due to the Spring Festival, shifting attention to liquidity and policy headlines. Across the region, a firmer USD and softer metals continue to frame cross-asset performance, especially for commodity-linked currencies.

Australia: RBA

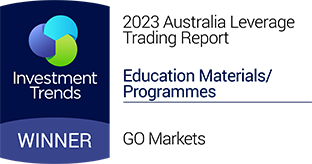

Australia begins February with a policy-driven focus as the Reserve Bank of Australia (RBA) delivers its monetary policy decision, setting the month’s initial tone for rates, currency, and equities. While markets had priced around a 70% chance of a hike as of 30 January, expectations remain highly sensitive to evolving data and RBA commentary.

Key dates

- RBA Monetary Policy Decision: 2:30 pm, 3 February (AEDT)

- Wage Price Index (WPI): 11:30 am, 18 February (AEDT)

- Labour Force: 11:30 am, 19 February (AEDT)

What markets look for

Aussie traders will gauge whether the RBA reinforces a data‑dependent stance or shifts more decisively toward tightening.

Wage and labour data will be central in testing inflation persistence, while the next CPI reading anchors positioning heading into March. A balanced or mildly hawkish tone could keep short‑term yields elevated and limit downside in the AUD.

Market sensitivities

AUD and ASX performance will primarily reflect the RBA’s policy tone and broader USD momentum, while resource‑linked sectors should continue to track metals and bulk commodity trends.

The February earnings season, highlighted by CBA and CSL (11 Feb), BHP (17 Feb), and Rio Tinto (19 Feb), is also set to reintroduce stock‑specific drivers once the initial policy focus fades.

Australia: CPI

Australia’s February Consumer Price Index (CPI) release will be a key post‑RBA event, offering the clearest read on whether domestic inflation pressures are easing in line with the central bank’s expectations.

The data following the RBA’s February policy decision and could quickly reset rate path probabilities reflected in ASX futures pricing.

Key dates

- Consumer Price Index (CPI): 11:30 am, 25 February (AEDT)

What markets look for

Markets will focus on whether trimmed‑mean and services inflation components show further moderation.

Persistent strength in non‑tradables or wage‑related sectors could reinforce expectations for additional tightening later in Q1, while a softer headline would support the view that policy rates have peaked.

Market sensitivities

A stronger‑than‑expected CPI print would likely lift front‑end yields and support the AUD, while a downside surprise could weigh on the currency and flatten the yield curve.

Equity sentiment may diverge and financials could find relief from a pause bias, whereas rate‑sensitive sectors like real estate and consumer discretionary would benefit most from a cooler inflation read.

Japan: Q4 GDP

Japan’s Q4 GDP release will be a key reference point for how firmly the recovery is progressing after recent quarters of uneven growth momentum. Arriving ahead of the Tokyo CPI print, it helps shape expectations for domestic demand, external trade performance, and how much scope policymakers have to adjust their stance without derailing activity.

Key dates

- Q4 GDP: 11:50 pm, 15 February (GMT)/ 10:50 am, 16 February (AEDT)

What markets look for

Investors pay close attention to the balance between consumption, business investment, and net exports to judge whether growth is broad‑based or narrowly supported.

A stronger‑than‑expected print tends to reinforce confidence in Japan’s expansion story, while a weaker outcome can revive concerns about stagnation and delay expectations for any meaningful policy shift.

Japan: Tokyo CPI

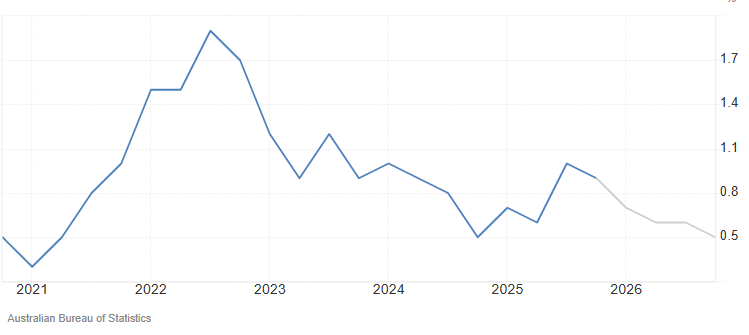

Tokyo’s latest inflation reading shows headline CPI easing to 1.5% year‑on‑year in January from 2.0% in December 2025, dipping further below the recent peaks seen during the post‑pandemic upswing.

The CPI release offers one of the timeliest reads on Japan’s inflation pulse and is closely watched as a lead indicator for nationwide price trends.

Coming late in the month, it serves as a check on whether the recent inflation upswing is sustaining at levels consistent with policymakers’ many objectives.

- Tokyo CPI: 11:30 pm, 26 February (GMT)/ 10:30 am, 27 February (AEDT)

What markets look for

Attention centres on core measures that strip out volatile components, alongside services prices, to see whether underlying inflation is holding near target or drifting lower.

A firmer profile strengthens the case that Japan is exiting its low‑inflation regime, while softer readings suggest that price pressures remain fragile and dependent on external factors.

Market sensitivities

A hotter‑than‑expected Tokyo CPI print can push Japanese yields higher and lend support to the yen, often translating into pressure on exporter‑heavy equity names.

Conversely, a softer outcome tends to ease yield pressures, weaken the yen, and provide some relief to equity sectors that benefit from a more accommodative policy backdrop.

China

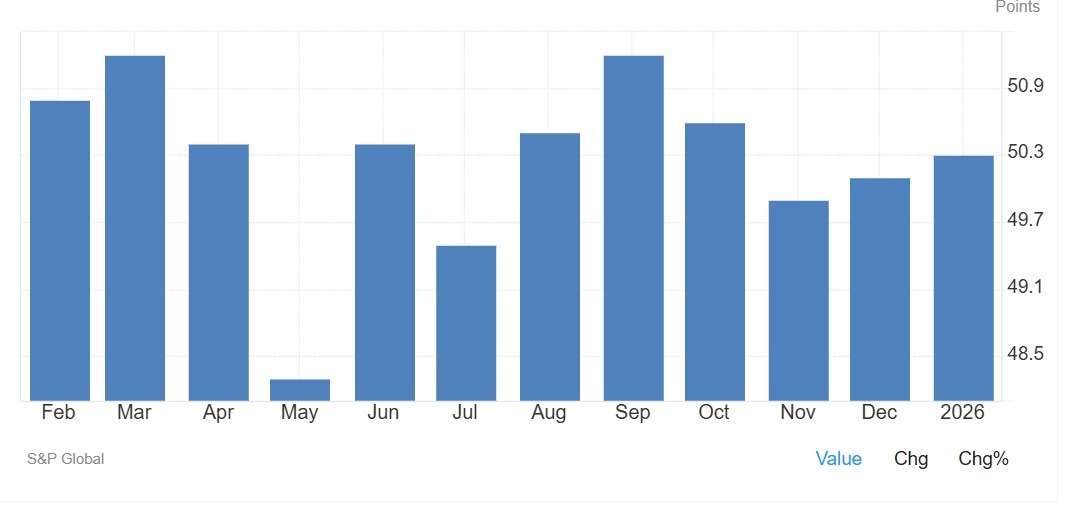

China’s February macro calendar is structurally lighter due to Spring Festival timing.

The National Bureau of Statistics of China notes that some releases are adjusted around Spring Festival timing, with the February PMI scheduled for early March leaving markets without major domestic data anchors for much of the month.

Key dates

- Spring Festival: 17 February to 3 March

What markets look for

Markets turn their focus to policy signals out of Beijing — think targeted stimulus or liquidity injections, as well as shifts in funding conditions and flows responding to global risk sentiment or USD moves.

Trade and tariff rhetoric, or surprise consumption measures like expanded trade-in subsidies and festive spending incentives recently flagged by the Ministry of Commerce, often spark sharper reactions than the usual data releases.

Market sensitivities

CNH and CNY pairs turn more reactive to USD flows and external headlines, often amplifying volatility in regional equities, commodity currencies like AUD, and China-exposed EM assets.

Holiday-thinned liquidity elevates headline risk, particularly in materials (iron ore, copper), tech hardware supply chains, and regional financials, where policy surprises or US tariff updates can trigger 1–2% daily index swings.

Expected earnings date: Wednesday, 4 February 2026 (US, after market close) / ~8:00 am, Thursday, 5 February 2026 (AEDT)

Alphabet’s earnings provide insight into global digital advertising demand, enterprise cloud spending, and broader technology-sector investment trends.

As Google Search and YouTube are widely used by both consumers and businesses, results are often used as one input when assessing online activity and corporate marketing budgets, alongside other indicators.

Key areas in focus

Search

Search advertising remains Alphabet’s largest revenue driver. Markets are likely to focus on ad growth rates, pricing metrics such as cost-per-click, and overall advertiser demand across sectors such as retail, travel, and small-to-medium businesses.

YouTube

YouTube contributes to both advertising and subscription revenue. Markets commonly monitor advertising momentum, engagement trends, and monetisation developments as indicators of digital media conditions and brand spending.

Google Cloud

Sustained Cloud profitability is often discussed as a factor that may influence longer-term earnings expectations, though outcomes remain uncertain. Markets are expected to focus on revenue growth, enterprise adoption trends, and operating margins.

Other bets

Initiatives such as autonomous driving and life sciences, while typically smaller contributors to revenue, markets may still watch spending levels and progress updates as indicators of capital allocation and cost discipline.

Cost and margin framework

Management has previously flagged elevated capex tied to AI infrastructure, including data centres, specialised chips, and computing capacity. Traffic acquisition costs, staffing levels, and infrastructure expansion are also key variables influencing profitability.

What happened last quarter

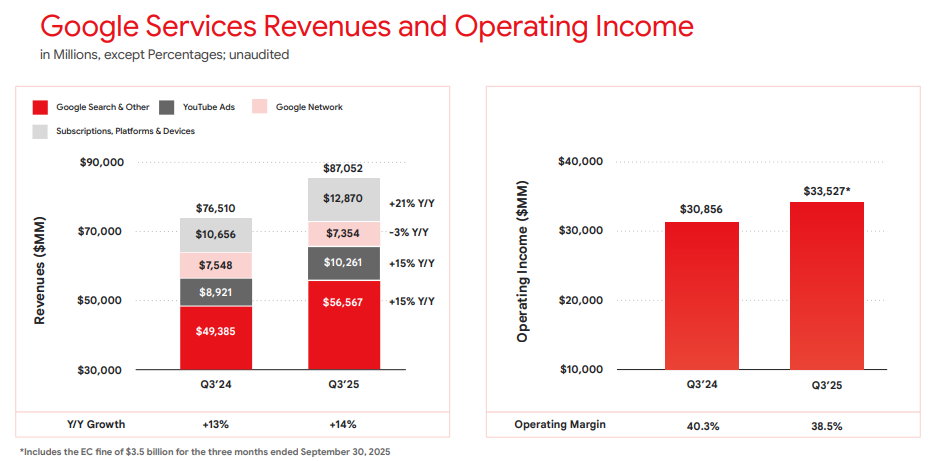

Alphabet’s most recent quarterly update highlighted advertising trends, Cloud profitability, and continued increases in capex to support AI initiatives.

Management commentary has indicated that infrastructure spending is intended to support long-term competitiveness, while the market continues to assess the near-term margin trade-offs.

Last earnings key highlights

For reported figures and segment detail from the most recent quarter, refer to Alphabet’s latest earnings release materials, including revenue, earnings per share (EPS), Services mix, Cloud operating income, and capex commentary.

- Revenue: US$102.35 billion

- EPS: US$2.87

- Operating income: US$31.23 billion

- Services revenue: US$87.05 billion

- Cloud revenue: US$15.16 billion

Google Services revenues and operating income Q3 2025 | Alphabet earnings release

What’s expected this quarter

Bloomberg consensus estimates moderate year-on-year (YoY) revenue growth and higher EPS versus the prior-year quarter, with ongoing focus on operating margins given AI-related investment.

Bloomberg consensus reference points:

- EPS: low-to-mid US$2 range

- Revenue: high US$80 billion to low US$90 billion range

- Capex: expected to remain elevated

*All above points observed as of 31 January 2026.

Market-implied expectations

Listed options implied an indicative expected move of around ±4% to ±6% over the relevant near-dated expiry window. Movements derived from option prices observed at 11:00 am AEDT, 2 February 2026.

These are market-implied estimates and may change. Actual post-earnings price moves can be larger or smaller.

What this means for Australian market participants

Alphabet’s earnings can influence near-term sentiment across major US equity indices, particularly Nasdaq-linked products, with potential spillover into the Asia session following the release.

Important risk note

Immediately after the US close and into the early Asia session, Nasdaq 100 (NDX) futures and related CFD pricing can reflect thinner liquidity, wider spreads, and sharper repricing around new information.

Such an environment can increase gap risk and execution uncertainty relative to regular-hours conditions.

.jpg)

2026 年1 月 29日,全球黄金市场经历了“疯狂星期四”。金价在站上 5600 美元 巅峰后,随即上演了时速惊人的“自由落体”,一度跌破 5100 美元。这一波动不仅刷新了单日振幅纪录,更让全市场见证了高位杠杆博弈的残酷性。

一、 5602 到 5097:为何会出现 500美元的“闪崩”?

这场高位跳水并非偶然,而是多重压力瞬间释放的结果:

1. 极度超买后的“技术性多杀多”:

1 月以来金价涨幅已近 30%,RSI 指数一度飙升至 90 以上。在 5600 美元这个极值点,获利盘的离场指令引发了连环踩踏,导致盘面瞬间失去支撑。

2. 流动性“黑洞”与自动止损触发:

当金价从 5600 跌落至 5400 附近时,由于短线资金过于密集,触发了海量高频交易系统的强制平仓单。在缺乏买盘承接的深夜时段,金价出现“真空式”下跌,一路跌向 5100 美元 这个前期重要支撑区。

3. 白银市场的溢出效应:

昨晚现货白银从 120 美元高位一度暴跌 12%,作为联动性极强的贵金属兄弟,白银的剧烈崩盘直接拖累了黄金的信心。

二、 核心驱动逻辑的变化:从“单边狂欢”到“宽幅震荡”

尽管跌幅惊人,但 5100 美元 的迅速企稳也传递了关键信号:

•基本面依然强劲:美联储虽在 1 月 29 日凌晨维持利率不变,但其“鸽派停顿”和对通胀的默许,意味着实际利率的下行趋势未改。

•避险底色仍在:美伊局势及全球关税政策带来的不确定性,使得 5100 美元以下依然有强劲的买盘(如各国央行和长线主权基金)在“接飞刀”。

三、 市场新常态:黄金已进入“超高波动率”时代

昨晚的行情告诉我们,目前的黄金已经不再是那个“慢牛”的避险资产,它表现出了明显的“类数字货币”特征:

•估值锚点模糊:在信用货币受质疑的背景下,市场在5100 与 5600 之间反复寻找新的定价共识。

•散户 FOMO 情绪高涨:国内金饰报价突破 1700 元/克,这种全民抢金的狂热,往往伴随着极高的波动风险。

结语:趋势未死,但“杠杆”已死

昨晚 5600 至 5100 的惊心动魄,是一次教科书式的风险出清。它标志着本轮行情从“共识性上涨”进入了“高波动震荡期”。

•长期看:黄金作为对冲信用风险的地位依然稳固。

•短期看:5100 美元已成为本轮行情的“生命线”。