Llega más lejos con GO Markets

Opera de forma más inteligente con un bróker global de confianza. Spreads bajos, ejecución rápida, sin comisiones por depósito, plataformas potentes y soporte al cliente galardonado.

20 Años de Solidez

Celebramos 20 años de excelencia en trading.

Diseñado para traders desde 2006.

Para principiantes

¿Estás

empezando?

Explora los fundamentos y gana confianza.

Para traders intermedios

Lleva tu estrategia

al siguiente nivel

Accede a herramientas avanzadas para obtener perspectivas más profundas que nunca.

Profesionales

Para traders

profesionales

Descubre nuestra oferta especializada para traders de alto volumen e inversionistas sofisticados.

Con la confianza de traders en todo el mundo

Desde 2006, GO Markets ha ayudado a cientos de miles de traders a alcanzar sus objetivos de trading con confianza y precisión, todo ello respaldado por una regulación sólida, un servicio centrado en el cliente y una Educación galardonada.

Disclaimer: *Trustpilot reviews are provided for the GO Markets group of companies and not exclusively for GO Markets Ltd.

Disclaimer: *Awards were awarded to GO Markets group of companies and not exclusively to GO Markets Ltd.

Explora más de GO Markets

Mercado de CFD

Opera con CFDs en forex, índices, acciones, materias primas, metales, ETF y más.

Plataformas & herramientas

Cuentas de trading con tecnología sin complicaciones, soporte al cliente galardonado y acceso fácil a opciones de fondeo flexibles.

Academia

Aprende las habilidades, estrategias y mentalidad detrás del éxito en el trading a largo plazo.

Cuentas & tarifas

Compara tipos de cuenta, consulta los spreads y elige la opción que se adapte a tus objetivos.

Llega más lejos con GO Markets

Explore miles de oportunidades de negociación con herramientas de nivel institucional, ejecución fluida y Soporte galardonado. Abrir una cuenta es rápido y fácil.

Llega más lejos con GO Markets

Explore miles de oportunidades de negociación con herramientas de nivel institucional, ejecución fluida y Soporte galardonado. Abrir una cuenta es rápido y fácil.

Noticias & análisis

Herramientas potentes para todos los estilos y preferencias de trading.

Global markets enter a catalyst-dense week where multiple central bank decisions, ongoing US earnings, and the Reserve Bank of Australia (RBA) rate decision may help shape near-term direction.

- RBA rate decision: Market expectations lean towards a Target Cash Rate increase.

- Global central banks: The European Central Bank (ECB) and Bank of England (BoE) both communicate within the same week, creating the potential for policy cross-currents.

- US earnings: The earnings cycle continues with Alphabet and Amazon reporting this week.

- Gold: Trading near elevated levels amid macro uncertainty and shifting rate expectations.

RBA rate decision

- RBA decision Tuesday, 3 February, 2:30 pm (AEDT)

- RBA media conference: Tuesday, 3 February, 3:30 pm (AEDT)

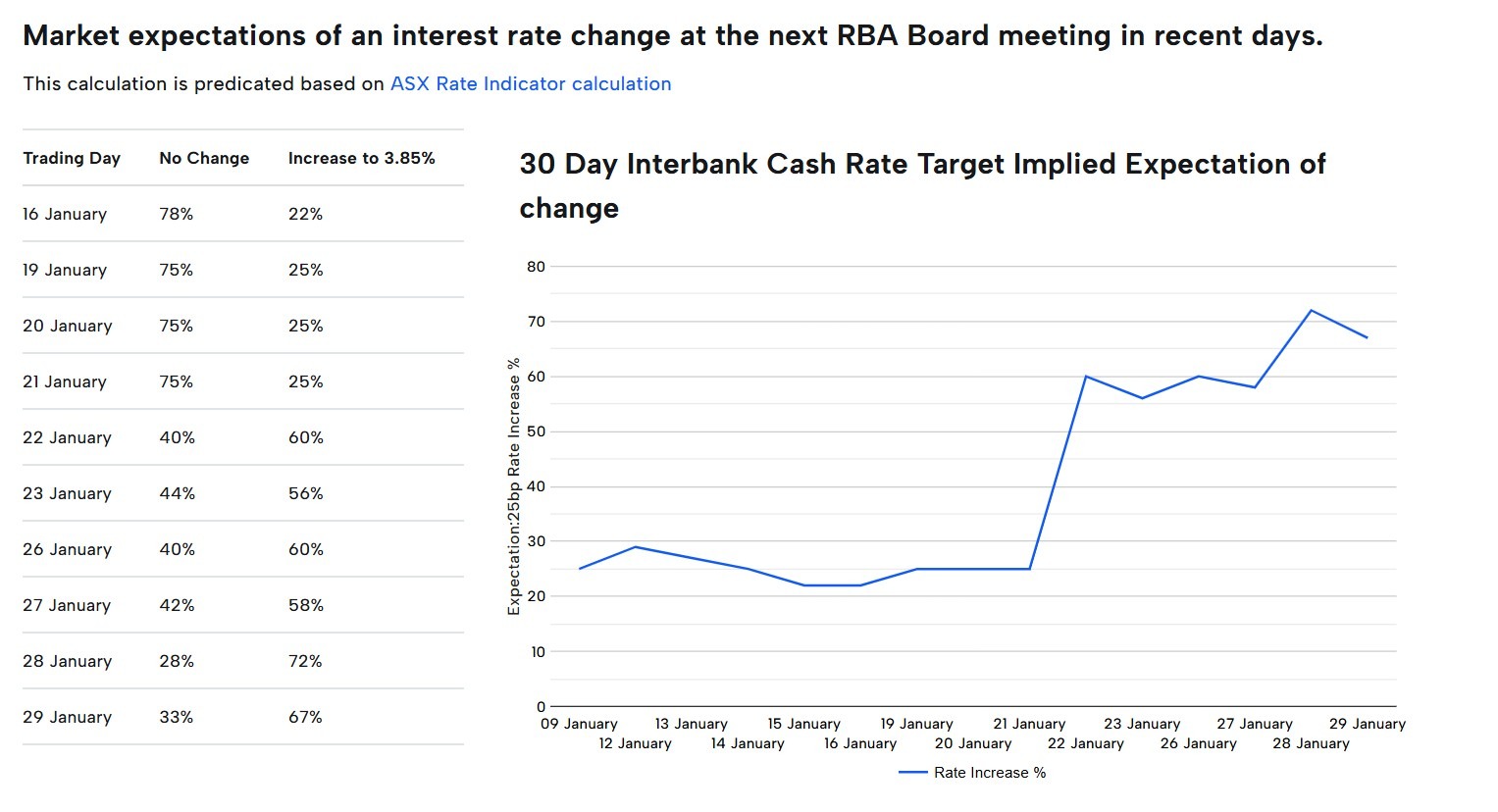

A 67% likelihood of a rate rise is suggested on the RBA rate-tracker within the futures pricing framework, indicating a market-implied probability of a move.

Market impact

- AUD pairs may respond quickly to any repricing of the rate path.

- Rate-sensitive equity sectors could see rotation.

- Government bond yields may adjust if expectations shift.

ECB and BoE of England

Key decision timing

- ECB monetary policy meeting: 4–5 February

- BoE announcement: Thursday, 5 February

When several major central banks communicate within the same window, markets often focus on forward guidance as much as the decisions themselves.

Market impact

- EUR and GBP volatility may increase around policy communication.

- Relative yield expectations could influence capital flows.

- Equity sentiment may respond to shifts in liquidity assumptions.

US earnings continue

The earnings cycle remains active, with investors typically focusing on guidance, margins, and capital expenditure alongside headline results.

After an extended equity advance, consistent outcomes may help stabilise sentiment, while disappointments can influence short-term positioning.

Scheduled earnings

- Walt Disney: Monday, 2 February (US time)/ Tuesday, 3 February (AEDT)

- Palantir Technologies: Monday, 2 February (US time)/ Tuesday, 3 February (AEDT)

- Advanced Micro Devices: Tuesday, 3 February (US time)/ Wednesday, 4 February (AEDT)

- PayPal: Tuesday, 3 February (US time, after market close)/ Wednesday, 4 February (AEDT)

- Alphabet: Wednesday, 4 February (US time, after market close)/ Thursday,5 February (AEDT)

- Amazon: Thursday, 5 February (US time, after market close)/ Friday, 6 February (AEDT)

Additional notable reporters across the week include Eli Lilly, PepsiCo, Qualcomm, Ford, and Roblox.

*All above dates observed as of 30 January 2026; dates subject to change.

Market impact

- Index moves may hinge on guidance durability across companies.

- Volatility may cluster around major releases.

- First reporters in each sector may influence other companies yet to report.

Why gold remains in focus

Gold has traded near elevated levels amid macro uncertainty and shifting rate expectations. For many traders, strength in gold is sometimes associated with defensive positioning, though gold prices can be volatile and can fall.

The US dollar, Treasury yield movements and geopolitical narrative often influence short-term direction.

Market impact

- Continued strength may suggest some investors are leaning toward defensive positioning.

- USD and sovereign yield movements often influence short-term direction.

- After a strong advance, periods of consolidation or profit-taking are common.

Expected earnings date: Thursday, 5 February 2026 (US, after market close)/early Friday, 6 February 2026

Amazon’s earnings provide insight into global consumer spending trends, cloud infrastructure demand, and the monetisation of its ecosystem across retail, advertising, and subscription services.

Focus is expected to remain on performance across key business areas, along with commentary on cost efficiency, capital expenditure, and AI-related investments, including data centre expansion.

Key areas in focus

Online stores and third-party services

Amazon’s core retail business remains sensitive to discretionary consumer demand, particularly through the December-quarter holiday period. Markets are likely to focus on revenue growth and margins across both first-party retail and third-party seller services. Cost pressures will also be evaluated.

AWS (Amazon Web Services)

AWS is a key earnings driver. Investors are likely to focus on revenue growth rates, margin trends, and indications around enterprise cloud spending. AI workloads will also be noteworthy. Any commentary on capacity expansion and capex is likely to be closely watched.

Advertising services

Amazon’s advertising business has become an increasingly important profit contributor. Markets are likely to assess growth momentum, advertiser demand, and how advertising integrates across Amazon’s retail and Prime ecosystems.

Subscription services (including Prime)

Subscription revenue includes Prime memberships and related digital services. Investors may watch engagement, pricing dynamics, and retention trends as indicators of ecosystem strength.

Cost and margin framework

Management has previously emphasised the need for cost discipline across fulfilment, logistics, and corporate expenses. Reported operating margins and any updates on efficiency gains or reinvestment priorities across key business services will be of interest.

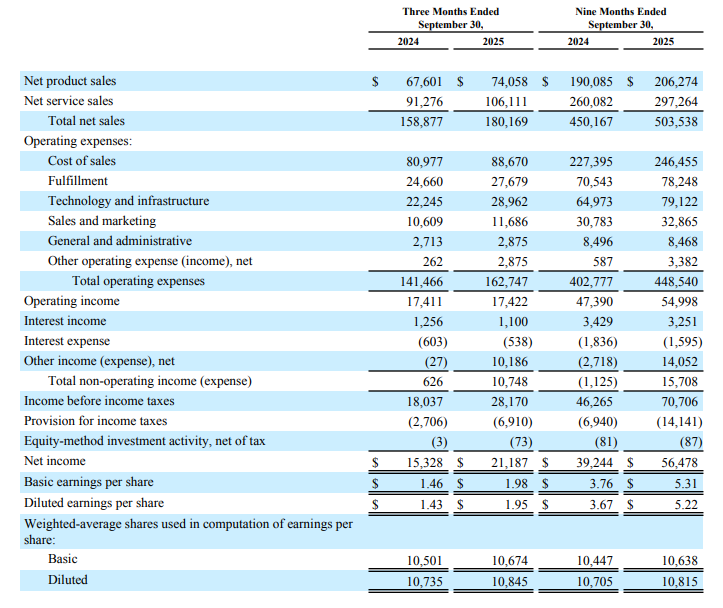

What happened last quarter

Amazon’s most recent quarterly update reported revenue growth and operating income outcomes, with AWS and advertising referenced as key contributors, alongside ongoing cost-control measures across the retail business.

The prior update also included discussion relevant to investment priorities in cloud and AI infrastructure, which continue to influence market expectations.

Last earnings key highlights

- Revenue: US$180.2 billion

- Earnings per share (EPS): US$1.95 (diluted)

- AWS revenue: US$33.0 billion

- Advertising services revenue: US$17.7 billion

- Operating income: US$17.4 billion

How the market reacted last time

Amazon shares moved higher in after-hours trading following the previous release, based on reporting at the time.

What’s expected this quarter

Bloomberg consensus estimates point to year-on-year EPS growth for the quarter ended December 2025, with markets focused on the revenue outcome, operating margins, and AWS performance, given the importance of the December quarter (Q4) to Amazon’s earnings profile.

Bloomberg consensus reference points (January 2026):

- EPS: about US$1.60

- Revenue: about US$170 billion

- Full-year FY2026 EPS: about US$5.10

*All above points observed as of 27 January 2026.

Expectations

Market sentiment around Amazon may be sensitive to any disappointment in AWS growth, operating margins, or December-quarter (Q4 2025) retail performance, given the stock’s large index weighting within major US equity indices and its role in these areas.

Listed options were pricing an indicative move of around ±4% to ±5% based on near-dated, at-the-money options-implied expected move estimates observed on Barchart at 11:00 am AEDT, 28 January 2026.

Implied volatility was approximately 32% annualised at that time.

These are market-implied estimates (not a forecast) and may change. Actual post-earnings price moves can be larger or smaller.

What this means for Australian investors

Amazon’s earnings can influence near-term sentiment across major US equity indices, with potential spillover into the Asia session following the release. It may also influence sentiment towards ASX-listed companies with significant online sales exposure.

Important risk note

Immediately after the US close and into the early Asia session, Nasdaq 100 (NDX) futures and related CFD pricing can reflect thinner liquidity, wider spreads, and sharper repricing around new information.

Such an environment can increase gap risk and execution uncertainty relative to regular-hours conditions.

Gold's breakthrough above US$5,000 and silver's surge through US$100 signal this year could be one for the history books for metal traders (one way or another).

Quick facts

- Elevated safe-haven demand lifts Gold targets from US$5,400 to US$6,000 after early-year US$5,000 breakout.

- Artificial intelligence (AI) and data-centre infrastructure ramp-up could help drive silver and copper demand.

- Continued geopolitical uncertainty and shifting monetary policy could trigger metal volatility throughout the year.

Top 5 metals to watch in 2026

1. Gold

Gold's breakout over US$5,100 arrived three quarters ahead of some forecasts. With Bank of America quickly raising its end-of-year target to US$6,000 and Goldman Sachs projecting US$5,400, the safe-haven commodity remains the biggest asset in focus for 2026.

Key drivers:

- Central banks are currently buying an average of 60 tonnes of gold per month, compared to 17 tonnes pre-2022.

- Two Fed rate cuts are priced in for 2026, reducing the opportunity cost of holding non-yielding assets like gold.

- Trump tariff policies, Middle East tensions, and fiscal sustainability concerns are keeping safe-haven demand elevated.

- Gold's share of total financial assets hit 2.8% in Q3 2025, with room to grow as retail FOMO kicks in.

What to watch

- Jerome Powell is set to be replaced as Fed chair in May 2026. Actual policy direction post-replacement may differ from current market expectations for cuts.

- If geopolitical hedges into safe havens remain or if there is an unwinding like post- 2024 US election.

- The potential weaponisation of dollar asset holdings by European nations as a response to US tariffs.

2. Silver

Silver is the metal that has benefited the most from the 2025 AI boom, with its surge to US$112 all-time-highs to kick off 2026 (70% above fundamental value as per Bank of America signal), demonstrating its volatile potential.

Key drivers

- Industrial demand from AI infrastructure, solar, and electric vehicles (EVs), semiconductors and data centres currently has no viable substitute for silver's conductivity.

- Six consecutive years of supply deficit, with above-ground stocks depleting and recycling bottlenecks limiting secondary supply.

- Policy optics may matter. The US decision to add silver to its list of “critical minerals” has been cited as a potential factor in volatility, including around trade policy risk.

- Retail participation can amplify price moves, particularly when the demand for gold becomes “too expensive”.

What to watch

- If solar panel demand continues its trajectory, or if 2025 was the peak.

- Whether the recycling supply responds to record prices by increasing silver refining and material processing capacity.

- How exchange inventory and lease rates move as potential signals of physical tightness.

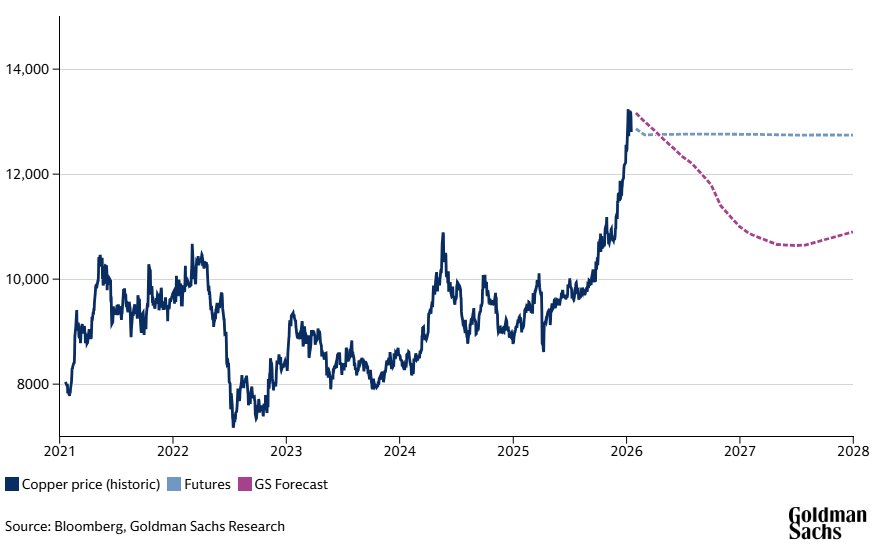

3. Copper

Copper's 2026 story hinges on continued data centre demand, renewable energy infrastructure growth, and China's struggling property market.

Key drivers

- Data centre copper consumption is projected to hit 475,000 tonnes in 2026, up 110,000 tonnes from 2025.

- Worker strikes in Chile and Grasberg restart delays are keeping the Copper market structurally tight.

- The US tariff decision on refined copper imports is expected in mid-2026 (15%+ currently anticipated), creating potential stockpiling and trade flow distortions.

- Goldman Sachs has forecast that power grid infrastructure and EV buildout could add "another United States" worth of copper demand by 2030.

- Current Chinese property weakness is creating demand uncertainty, potentially offsetting infrastructure spending.

What to watch

- Whether Grasberg ramps production smoothly or faces further setbacks.

- Chinese property market stimulus effectiveness.

- Actual tariff implementation timing and magnitude.

- Yangshan premium movements signalling real physical demand versus financial positioning.

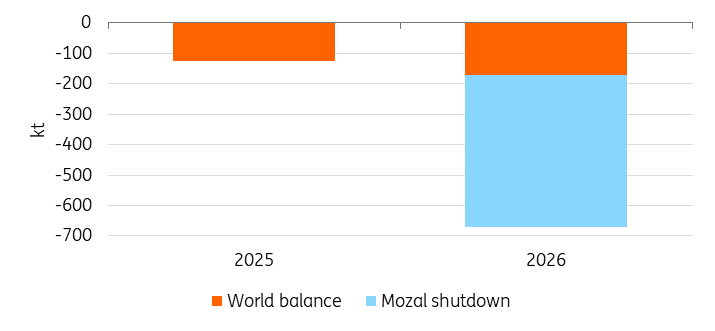

4. Aluminium

Trading near three-year highs of US$3,200, aluminium faces continued tightness into 2026 as China's capacity ceiling forces global markets to adjust.

Key drivers

- China's 45 million tonne capacity cap was reached in 2025. For the first time in decades, Chinese output cannot expand, potentially ending 80% of global supply growth.

- As copper prices increase, Reuters has reported that some manufacturers have been substituting aluminium for copper in certain applications as relative prices shift.

What to watch

- South32 has said Mozal Aluminium is expected to be placed on care and maintenance around 15 March 2026, thus removing Mozambique's 560,000 tonne significant supply.

- If Indonesian and Chinese offshore capacity additions can compensate for Chinese domestic ceiling.

- Century Aluminium's 50,000 tonne Mount Holly restart in Q2 could provide a signal for the broader industry as the smelter is expected to reach full production by 30 June 2026.

5. Platinum

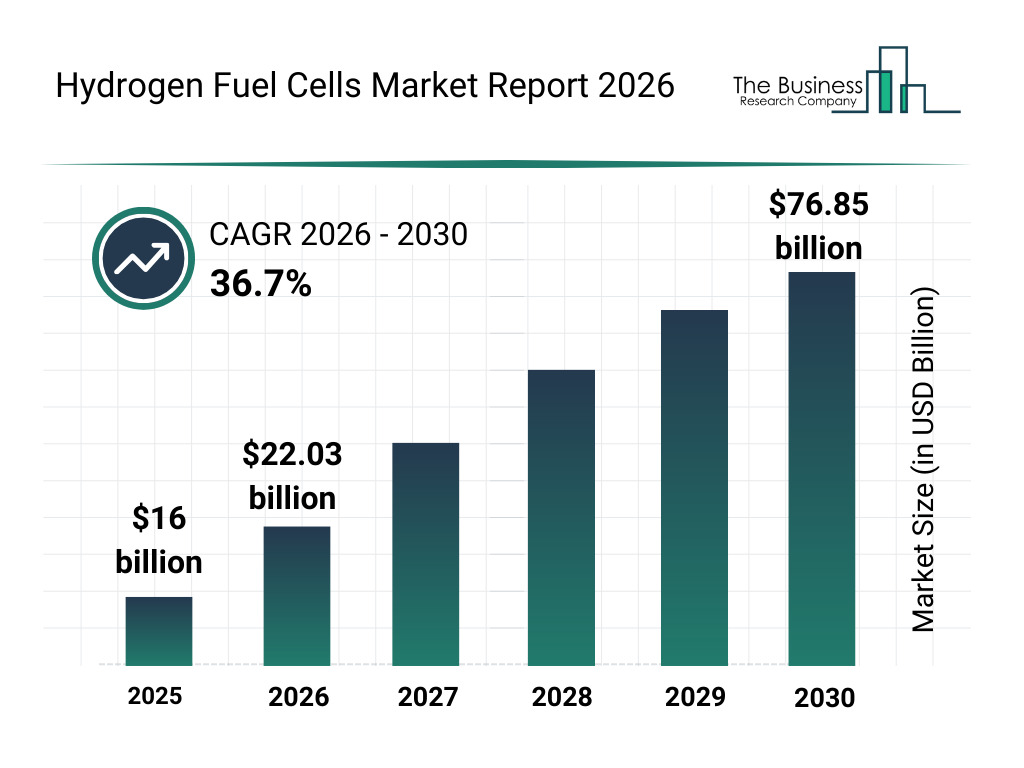

Platinum's breakout above US$2,800 follows three consecutive years of supply deficit and increased adoption of hydrogen fuel cells (for which it is a vital component).

Key drivers

- The World Platinum Investment Council (WPIC) has forecast a significant supply deficit of 850,000 ounces in 2026 which could drain inventories, with limited new production coming online.

- WPIC forecasts 875,000 to 900,000 oz uptake by 2030 for heavy-duty trucks, buses, and green hydrogen electrolysers.

- Palladium-to-platinum substitution in catalytic converters is increasing in EV production.

What to watch

- Supply response from producers. Platreef and Bakubung are adding 150,000 oz, but production discipline could limit a broader ramp-up.

- US tariffs on Russian palladium could create spillover demand for platinum in EV production.

- The pace of hydrogen infrastructure investment and heavy-duty vehicle adoption rates in Europe, China, and US.

- Chinese jewellery demand could come into play. Just a 1% substitution from gold could widen the platinum deficit by 10% of the global supply.

You can trade Gold, Silver, and other Commodity CFDs, including energies and agricultural products, on GO Markets.