Llega más lejos con GO Markets

Opera de forma más inteligente con un bróker global de confianza. Spreads bajos, ejecución rápida, sin comisiones por depósito, plataformas potentes y soporte al cliente galardonado.

20 Años de Solidez

Celebramos 20 años de excelencia en trading.

Diseñado para traders desde 2006.

Para principiantes

¿Estás

empezando?

Explora los fundamentos y gana confianza.

Para traders intermedios

Lleva tu estrategia

al siguiente nivel

Accede a herramientas avanzadas para obtener perspectivas más profundas que nunca.

Profesionales

Para traders

profesionales

Descubre nuestra oferta especializada para traders de alto volumen e inversionistas sofisticados.

Get Started with GO Markets

Whether you’re new to markets or trading full time, GO Markets has an

account tailored to your needs.

Con la confianza de traders en todo el mundo

Desde 2006, GO Markets ha ayudado a cientos de miles de traders a alcanzar sus objetivos de trading con confianza y precisión, todo ello respaldado por una regulación sólida, un servicio centrado en el cliente y una Educación galardonada.

*Trustpilot reviews are provided for the GO Markets group of companies and not exclusively for GO Markets Ltd.

*Awards were awarded to GO Markets group of companies and not exclusively to GO Markets Ltd.

Explora más de GO Markets

Mercado de CFD

Opera con CFDs en forex, índices, acciones, materias primas, metales, ETF y más.

Plataformas & herramientas

Cuentas de trading con tecnología sin complicaciones, soporte al cliente galardonado y acceso fácil a opciones de fondeo flexibles.

Academia

Aprende las habilidades, estrategias y mentalidad detrás del éxito en el trading a largo plazo.

Cuentas & tarifas

Compara tipos de cuenta, consulta los spreads y elige la opción que se adapte a tus objetivos.

Llega más lejos con GO Markets

Explore miles de oportunidades de negociación con herramientas de nivel institucional, ejecución fluida y Soporte galardonado. Abrir una cuenta es rápido y fácil.

Llega más lejos con GO Markets

Explore miles de oportunidades de negociación con herramientas de nivel institucional, ejecución fluida y Soporte galardonado. Abrir una cuenta es rápido y fácil.

Noticias & análisis

Herramientas potentes para todos los estilos y preferencias de trading.

Your complete day-by-day guide to Australian medal chances and market-moving moments during the Milano Cortina Winter Olympics.

Quick Facts

- Opening Ceremony: 6:00 am, 7 February AEDT (8:00 pm, 6 February Milan).

- Prime viewing window: 4:00 am to 2:00 pm AEDT daily coincides with pre-market and ASX trading hours.

- Medal ceremonies: Typically run from 6:00 am to 7:00 am AEDT. Perfect for pre-market position adjustments.

- 53 Australian athletes competing: The second-largest Australian Winter Olympic team ever, with 10 genuine medal contenders.

GO Markets Olympic Schedule

Olympic Schedule

All times shown in AEDT

Opening Ceremony + first medals - Saturday, February 7

Opening Ceremony at breakfast time, then the first gold medal awarded in primetime on Saturday.

Harry Laidlaw represents Australia in the Men's Downhill, the Games' first Gold medal event, while cross-country skiers Rosie Fordham and Phoebe Cridland compete late Saturday night.

This same-day pairing of ceremony and first medals creates maximum media saturation, with a full weekend news cycle processing before Monday's ASX open.

Key events

- Opening Ceremony: 6:00 am AEDT

- Men's Downhill Final (first gold medal of the games): 9:30 pm AEDT

- Women's 10km + 10km Skiathlon: 11:00 pm AEDT

For traders

- NEC (Nine Entertainment): Double viewership event. Opening Ceremony 6:00 am Saturday, lines up for the peak morning TV audience. First medals at 9:30 pm are a primetime Saturday night.

- Italian equities (FTSE MIB): Historically underperform during domestic Olympics. Turin 2006 saw -2.1% during the Games.

- STLA (Stellantis): ESG headline risk if environmental groups target the ceremony.

- Apparel sponsor arbitrage: If a non-favourite wins Men's Downhill, their sponsor sees average +2.3% pop (PyeongChang 2018, Beijing 2022 data).

First medals continue - Sunday, February 8

The medal rush continues on Sunday as 19-year-old Valentino Guseli takes flight in Men's Snowboard Big Air, offering Australia an early podium chance in one of the Games' most visually spectacular events.

With the ceremony glow still fresh, Guseli's performance sets the tone for Australia's snowboard campaign and could influence Monday's ASX open positioning for action sports stocks.

Key events

- Men's Snowboard Big Air Final (Valentino Guseli): 5:30 am AEDT

- Women's Normal Hill Individual Final: 5:57 am AEDT

For traders

- MNST (Monster Beverage): Action sports sponsor, benefits from multi-athlete Olympic presence.

- FL (Foot Locker), ZUMZ (Zumiez): Youth retail action sports exposure. Guseli gold could create a temporary buzz.

Monday, February 9

A rare quiet day in Australia's Olympic calendar. No Australian medal events are scheduled, making this a pure observation day for traders.

Monitor how Guseli's weekend result is processed through Monday's ASX open, and position ahead of Tuesday's Coady showdown.

Tuesday, February 10

Tess Coady attempts to upgrade her 2022 bronze to gold in Women's Snowboard Big Air. The Tuesday morning timing offers traders a potential pre-market positioning window, though Coady's modest mainstream profile limits exposure compared to the moguls stars on the following day.

Key events

- Women's Snowboard Big Air Final: 5:30 am AEDT

For traders

- FL (Foot Locker), ZUMZ (Zumiez): Youth retail. Coady gold could create a temporary buzz.

- MNST (Monster Beverage): Less volatile, general action sports sponsor.

Wednesday, February 11

The calm before Jakara Anthony. No Australian events on Wednesday means traders spend the day positioning for the biggest moment of the Games: Anthony's moguls final just past midnight.

Moguls Finals - Thursday, February 12

The biggest moment of the Games for Australia arrives just after midnight on Wednesday with Jakara Anthony defending her Olympic crown in the Women's Moguls Final.

As the nation's brightest gold medal hope with 26 World Cup victories, Anthony's 12:15 am performance is the single highest-impact potential event for NEC and VFC stocks across the entire Olympic fortnight.

Matt Graham also chases his first Olympic gold at 10:15 pm Thursday night. Both events carry high NEC and VFC volatility potential.

Key events

- Women's Moguls Final (Jakara Anthony): 12:15 am AEDT

- Men's Moguls Final (Matt Graham): 10:15 pm AEDT

For traders

- NEC (Nine Entertainment): Monitor overnight results and viewership for Thursday open direction.

- VFC (VF Corp/North Face): Sponsors both athletes. A double medal could bring a larger impact.

- Defending champion volatility: An Anthony loss could create higher emotional swings.

- Social sentiment: Track Twitter/Google Trends Thursday morning to gauge the magnitude of Anthony’s performance.

Friday, February 13

Snowboard cross takes centre stage with two Australian medal chances bookending Friday's trading day.

Adam Lambert's overnight final sets the morning open, while Josie Baff's evening showdown takes the Aus prime time slot.

Key events

- Men's Snowboard Cross Finals: 12:56 am AEDT

- Women's Snowboard Cross Finals: 7:30 pm AEDT

For traders

- NEC sentiment gauge: If Lambert medals Fri morning and Graham medaled Thu night, it could create positive momentum.

Jakara Anthony competes - Saturday, February 14

Jakara Anthony goes for the double in Saturday night's Women's Dual Moguls Final.

If she claims gold Thursday and again here, the "double gold Jakara" narrative writes itself, offering geometric rather than linear media value.

Key events

- Women's Dual Moguls Final (Jakara Anthony): 9:46 pm AEDT

For traders

- NEC narrative power: "Double gold Jakara" could draw in more casual viewers.

- If Anthony silver/bronze Thu: Redemption story potential.

- Weekend timing: Saturday night result = Monday ASX gap.

- Format risk: Monitor qualifying rounds; if margins are greater than 1 second (blowouts), engagement could drop.

Sunday, February 15

A quiet Sunday offers redemption arcs and low-impact action. Brendan Corey's morning short track effort carries minimal stock relevance, while Matt Graham's late-night dual moguls final provides a second medal chance after Friday's traditional event.

Key events

- Short Track Speed Skating 1500m Final: 8:42 am AEDT

- Men's Dual Moguls Final: 9:46 pm AEDT

For traders

- VFC second opportunity: If Graham misses on Friday’s moguls, dual moguls redemption is possible.

Monday, February 16

Harry Laidlaw returns to the slopes for late Monday night slalom action, but alpine skiing holds minimal sway over Australian audiences.

This is a placeholder day in the trading calendar, with markets more focused on digesting the weekend moguls results and positioning for Tuesday's monobob final.

Key events

- Men's Slalom: 11:00 pm AEDT

Bree Walker competes - Tuesday, February 17

Bree Walker could make Olympic history as she competes in the Women's Monobob Final, chasing Australia's first-ever bobsleigh medal.

While the narrative is powerful, the commercial reality is that bobsleigh has no retail sponsor footprint, limiting direct stock plays.

Key events

- Pairs Figure Skating Final: 6:00 am AEDT

- Women's Monobob Final: 7:06 am AEDT

For traders

- NEC: Bobsleigh historically gets low ratings, but a Walker gold could provide value as an Australian-first.

Wednesday, February 18

Veterans Laura Peel and Danielle Scott take centre stage on Wednesday night in an event with proud Australian history (2 golds since 2002). However, aerials' niche appeal and late-night timing may limit market impact.

Key events

- Women's Aerials Final: 9:30 pm AEDT

- Women's Slalom Final: 11:30 pm AEDT

For traders

- NEC: If either medals, potential for a small sentiment boost.

- VFC exposure: Limited potential as aerials athletes are less commercially developed.

Thursday, February 19

Thursday night aerials effort is a low-impact finale event with minimal medal expectation for Australian Reilly Flanagan, and even less market relevance.

Scotty James' Saturday halfpipe showdown is the real conversation as the games begin winding down, although a medal run from Flanagan could create an underdog narrative.

Key events

- Men's Aerials Final: 9:30 pm AEDT

Friday, February 20

The final calm before Scotty James' legacy-defining Saturday. Set up day for James' 5:30 am Saturday halfpipe final, the Games' last major potential volatility event for an Aussie athlete.

Scotty James competes - Saturday, February 21

Scotty James' legacy moment arrives Saturday morning. He’s represented Australia at five Olympics, with two medals and zero golds. This is his final chance and brings with it the Games' most emotionally charged event, and the last major trading catalyst before Monday's Closing Ceremony.

Key events

- Men's Snowboard Halfpipe Final (Scotty James): 5:30 am AEDT

- SkiMo Mixed Relay: 11:30 pm AEDT

For traders

- NEC: Potential weekend delays on price discovery. If James gold Saturday.

- NKE (Nike): Potential halo effect from gold via action sports lift.

- Guseli wildcard: Valentino is also competing (his second event after Big Air, Feb 8). A dual medal could create narrative amplification.

Sunday, February 22

Sixteen-year-old Indra Brown takes the Sunday morning spotlight in Women's Freeski Halfpipe, facing off against favourite Eileen Gu (CHN) in what could become a Gen-Z brand inflection point.

Key events

- Women's Freeski Halfpipe Final (Indra Brown): 5:30 am AEDT

- Two-Woman Bobsleigh Final: 7:05 am

For traders

- Mon-Tue watch: Monitor which brands announce Brown signings.

- MILN (Global X Millennials ETF): Action sports retailers, social platforms exposure for Gen Z.

Closing Ceremony - Monday, February 23

The curtain falls on Milano Cortina 2026 with Monday morning's Closing Ceremony, and history says this is where euphoria dies.

- Men's Ice Hockey Final (NHL Superstars): 12:10 am AEDT

- Closing Ceremony: 6:00 am AEDT

Markets to watch:

- French Alps 2030 rotation: Closing features handover to France.

- Australian medal count: If greater than 4 medals (Beijing total), the government may increase 2030 winter sports funding.

- Ice Hockey Final: NHL players compete for the first time since 2014. Major US/Canada viewership means a potential CMCSA boost.

Los mercados mundiales avanzan hacia la nueva semana con una serie de catalizadores potencialmente de alto impacto. Las elecciones generales de Japón aterrizan primero el domingo, seguidas por la inflación estadounidense y los datos del mercado laboral que continúan dando forma a las expectativas de tasas de interés.

- Elecciones de Japón: La continuidad de las políticas y la estabilidad política se ven generalmente como un apoyo para los mercados regionales.

- Inflación y mercado laboral de Estados Unidos: El índice de precios al consumidor (IPC) y el informe Situación del Empleo (nóminas no agrícolas, PNB) son los puntos macro focales inmediatos de la semana.

- Medidor de riesgo de Bitcoin: Bitcoin vuelve a estar cerca de los niveles vistos por última vez a finales de 2024 y se mantiene muy por debajo de su pico de octubre de 2025.

- Reloj de rotación sectorial: La tecnología ha tenido un desempeño inferior recientemente, mientras que los segmentos de valor y defensivos se han estabilizado, y la temporada de ganancias continúa influyendo en los flujos.

Elecciones de Japón

Las elecciones generales en Japón se ven principalmente a través de la lente de la certeza política. Los mercados suelen favorecer un resultado claro y una continuidad en los entornos fiscales y monetarios.

Los resultados inesperados o la incertidumbre de la coalición pueden aumentar la volatilidad a corto plazo en el JPY y los índices regionales al inicio de la semana.

Fechas clave

- Elecciones generales (Japón): Domingo, 8 Febrero

- Resultados a través de Asian trade el lunes

Impacto en el mercado

- El JPY puede ser sensible a los resultados, la incertidumbre o los posibles cambios en la dirección de la política

- Las renta variable de Asia podrían ver volatilidad a principios de semana hasta que los resultados sean claros

Inflación y mercado laboral de Estados Unidos

La inflación sigue siendo el insumo más directo a las expectativas de tasas de interés, mientras que el informe mensual del PNP proporciona una lectura amplia sobre las condiciones de empleo y las presiones salariales.

Los rendimientos del Tesoro y el USD a menudo reaccionan rápidamente a estas liberaciones, con efectos colaterales en las renta variable, el oro y los activos en crecimiento.

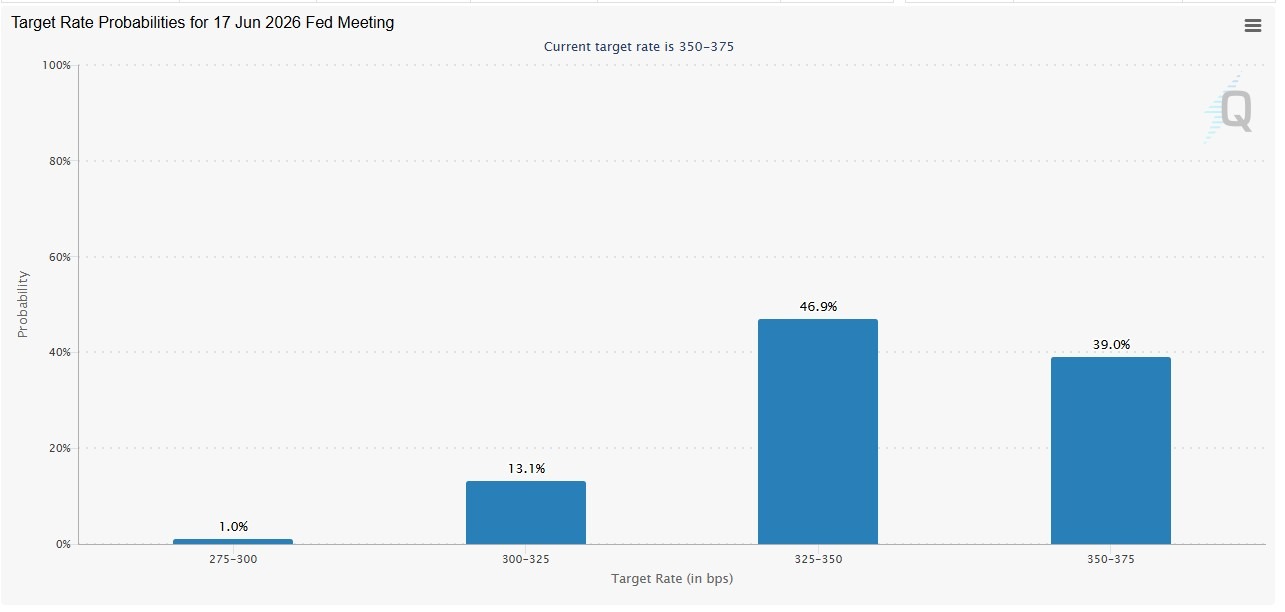

Los precios actuales indican que los mercados asignan menos de un 30% de probabilidad de un recorte para la reunión de abril, con probabilidades de alza de la reunión de junio por encima del 50%.

Fechas clave

- Situación de empleo: Miércoles, 11 Febrero 08:30 (ET) | Jueves, 12 Febrero 00:30 (AEDT)

- IPC (enero 2026): Viernes, 13 Febrero 08:30 (ET) Sábado, 14 Febrero 00:30 (AEDT)

Impacto en el mercado

- Los rendimientos a menudo se mueven primero, seguidos por el USD y luego los activos de riesgo

- Las expectativas para el tiempo de recorte de tasas pueden ajustarse rápidamente

- Las cuotas de crecimiento y tecnología siguen siendo más sensibles a las tasas

Bitcoin

Bitcoin ha disminuido a niveles vistos por última vez antes de las elecciones estadounidenses en noviembre de 2024 y está cerca de 50% por debajo de su pico de octubre de 2025.

Si bien no es un indicador macro tradicional, los cripto mercados podrían verse como una lectura en tiempo real sobre la tolerancia al riesgo de los inversores. La debilidad sostenida puede coincidir con un posicionamiento más cauteloso en los activos beta más altos, incluidas las acciones de tecnología.

Impacto en el mercado

- El sentimiento criptográfico más suave puede coincidir con la reducción de los flujos especulativos

- El apetito de riesgo puede seguir siendo más selectivo

Rotación sectorial

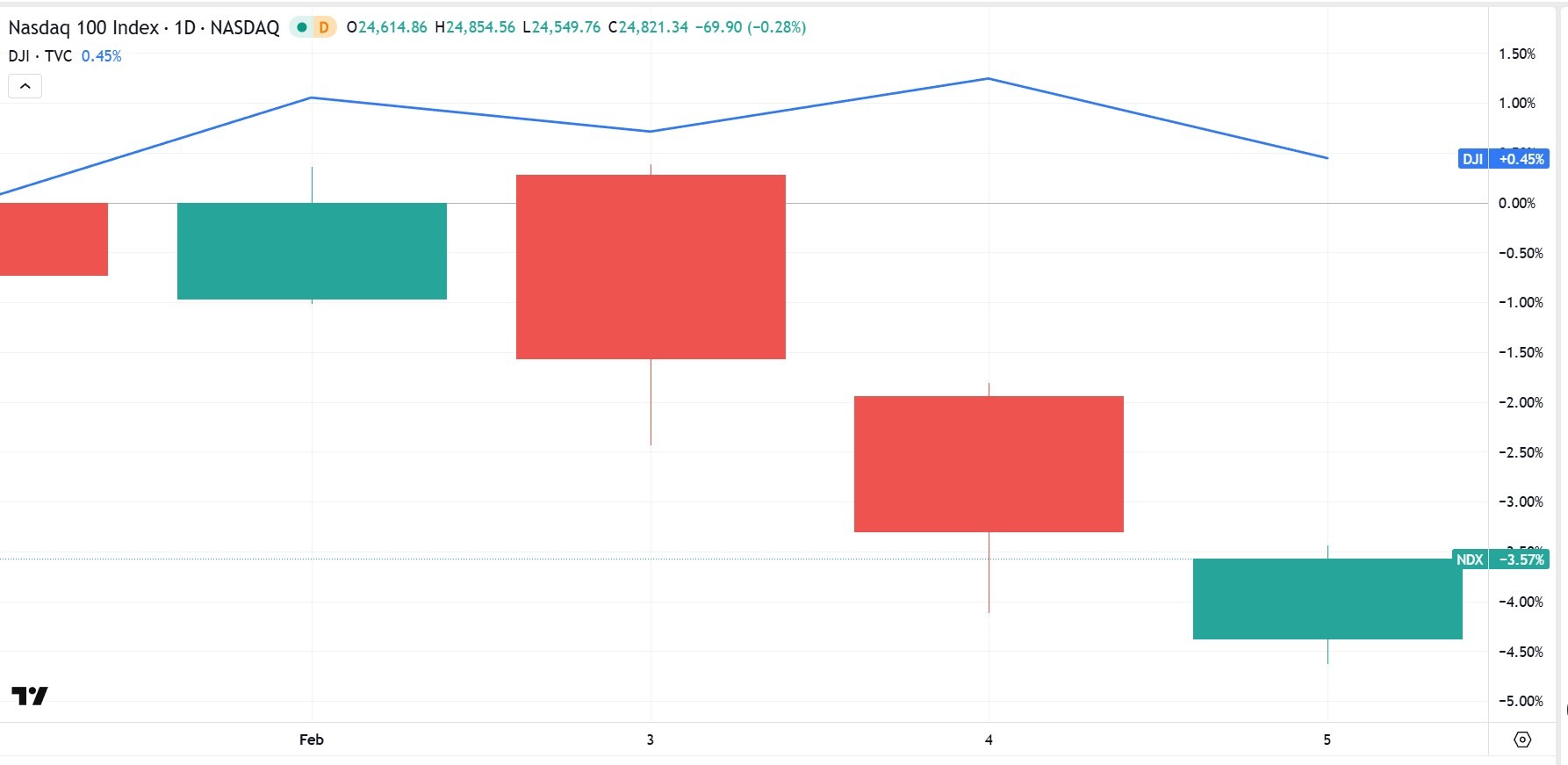

Durante la semana pasada, el Promedio Industrial Dow Jones ha tenido un desempeño superior, cotizando justo por debajo de la neutral, mientras que el Nasdaq-100 ha disminuido más de 4%, lo que refleja la sensibilidad en la tecnología de gran capitalización a rendimientos más firmes.

Lo que la mudanza puede reflejar

- Presión impulsada por las tasas sobre las acciones en crecimiento

- Toma de ganancias después de un sólido desempeño tecnológico

- Temporada de ganancias que favorece una mayor participación del sector

- Un tono generalmente más cauteloso en los activos beta más altos

Por lo general, los mercados buscan un desempeño superior sostenido durante varias semanas en los sectores financiero, industrial o defensivo antes de tildar el cambio como rotación estructural.

Impacto en el mercado

- La tecnología sigue siendo más sensible a los movimientos de rendimiento

- Los sectores de valor y defensivos pueden ver un apoyo relativo

- La orientación de ganancias continúa influyendo en el liderazgo

February’s FX landscape is likely to be driven by inflation persistence, labour resilience, and central bank communications. With several high-impact data releases across the US, Europe, Japan and Australia, near-term moves may be more event-driven and repricing-led, rather than trend-led.

Quick facts

- USD remains the key reference point, with US data driving repricing in yields and the broader FX market.

- EUR sensitivity remains high around European Central Bank (ECB) messaging and incoming inflation and activity signals.

- JPY remains tightly linked to domestic data and Bank of Japan (BOJ) communication, with USD/JPY often reacting sharply to shifts in yield expectations.

- AUD remains policy sensitive, with domestic inflation and labour data likely to matter most, alongside global risk tone and metals.

US dollar (USD)

Key events

- Nonfarm payrolls (NFP) and unemployment: 8:30 am, 11 February (ET) | 12:30 am, 12 February (AEDT)

- Consumer Price Index (CPI), headline and core: 8:30 am, 13 February (ET) | 12:30, 13 February (AEDT)

- Personal income and outlays (includes the PCE price index): 8:30, 20 February (ET) | 12:30, 21 February (AEDT)

What to watch

The USD is likely to remain primarily driven by shifts in inflation and labour data and their implications for Federal Reserve rate expectations. Recent headlines surrounding Federal Reserve independence have also added volatility to USD positioning.

Stronger inflation or labour resilience is often associated with firmer USD support via higher yield expectations. Softer outcomes could reduce rate support and allow pairs like EUR/USD and AUD/USD to stabilise.

Key chart: US dollar index (DXY) weekly chart

Euro (EUR)

Key events

- ECB policy decision: 12:15 am, 6 February (AEDT)

- ECB press conference: 12:45 am, 6 February (AEDT)

- ECB flash estimates for GDP and employment: 8:00 pm, 13 February (AEDT)

What to watch

EUR direction remains linked to whether the ECB can maintain its stance without a material deterioration in activity, or whether inflation and growth data pull forward easing expectations.

Resilient growth and firm inflation could support the “higher for longer” pricing bias. Weaker growth or softer inflation could weigh on the currency, particularly if they bring forward easing expectations.

Key chart: EUR/USD weekly chart

Japanese yen (JPY)

Key events

- Japan preliminary GDP (Q4 2025, first preliminary): 6:50 pm, 15 February (ET) | 10:50 am, 16 February (AEDT)

- National CPI (Japan): 20 February (Japan)

What to watch

JPY remains sensitive to domestic yield shifts and BOJ communication. Even modest adjustments to policy expectations could generate outsized moves in USD/JPY.

Firm growth or inflation outcomes could support JPY via higher domestic yields and shifting BOJ expectations. Softer outcomes or cautious policy messaging could keep USD/JPY supported.

Key chart: USD/JPY daily chart

Australian dollar (AUD)

Key events

- RBA minutes: 11:30 am, 17 February (AEDT)

- Wage Price Index: 11:30 am, 18 February (AEDT)

- Labour Force Survey: 11:30 am, 19 February (AEDT)

- Consumer Price Index (CPI): 11:30 am, 25 February (AEDT)

What to watch

AUD remains sensitive to policy, responding quickly to domestic inflation and labour data, as well as global risk sentiment and its impact on metal pricing.

Persistent wages or inflation pressures could support AUD via firmer policy expectations. Softening data could reduce rate support and weigh on AUD performance, particularly versus USD and JPY.

Key chart: EUR/AUD daily chart