Strategi trading untuk mendukung pengambilan keputusan Anda

Temukan teknik praktis untuk membantu Anda merencanakan, menganalisis, dan meningkatkan trading Anda.

Volatilitas memiliki cara untuk muncul tanpa diundang.

Suatu hari ASX melayang diam-diam... dan berikutnya, persyaratan margin naik, stop tidak terisi di tempat yang diharapkan, dan portofolio terbuka dengan celah semalam yang tidak nyaman.

Jika Anda telah mencari jawaban, Anda tidak sendirian. Beberapa pertanyaan yang paling banyak dicari tentang volatilitas di kalangan pedagang Australia berhubungan dengan margin call, slippage, gap semalam, leverage exchange trading funds (ETF), dan alat seperti rata-rata true range (ATR).

Inilah yang terjadi.

Mengapa ini penting sekarang

Pasar global menjadi lebih sensitif terhadap suku bunga, data inflasi, geopolitik, dan arus yang digerakkan oleh teknologi. Ketika likuiditas menipis dan ketidakpastian meningkat, perubahan harga melebar. Itu adalah volatilitas.

Dan volatilitas tidak hanya mempengaruhi arah harga, tetapi juga mengubah cara perdagangan dieksekusi, berapa banyak modal yang dibutuhkan, dan bagaimana risiko berperilaku di bawah permukaan.

Terjemahan: Volatilitas bukan hanya tentang pergerakan yang lebih besar, melainkan tentang pergerakan yang lebih cepat dan likuiditas yang lebih tipis - saat itulah mekanisme perdagangan paling penting.

Ingin studi kasus volatilitas dunia nyata?

Mengapa broker saya meningkatkan persyaratan margin?

Salah satu pertanyaan yang paling dicari tentang volatilitas adalah mengapa persyaratan margin meningkat tanpa peringatan.

Ketika pasar menjadi tidak stabil, broker dapat meningkatkan persyaratan margin pada kontrak untuk perbedaan (CFD) dan produk leverage lainnya. Perubahan harga yang lebih besar dapat meningkatkan risiko akun bergerak ke ekuitas negatif sehingga meningkatkan persyaratan margin mengurangi leverage yang tersedia dan dapat membantu mengelola eksposur selama kondisi ekstrem.

Apa artinya ini dalam praktiknya

-Margin call dapat terjadi bahkan jika harga tidak bergerak secara signifikan.

Leverage yang efektif dapat turun dengan cepat.

Posisi mungkin perlu dikurangi dalam waktu singkat.

Penyesuaian margin biasanya merupakan respons terhadap perubahan risiko pasar, bukan keputusan acak. Di pasar yang sangat fluktuatif, adalah bijaksana untuk mengasumsikan pengaturan margin dapat berubah dengan cepat, oleh karena itu banyak pedagang memilih untuk meninjau ukuran posisi dan buffer yang tersedia mengingat risiko itu.

Apa itu slippage dan mengapa stop saya tidak terisi dengan harga saya?

Topik lain yang sering dicari adalah selip.

Slippage dapat terjadi ketika stop order memicu dan dieksekusi pada harga yang tersedia berikutnya, hasilnya dapat bergantung pada jenis order, likuiditas pasar dan kesenjangan. Di pasar yang tenang, perbedaannya mungkin kecil sedangkan di pasar cepat, harga bisa berada di luar level stop.

Pengemudi umum termasuk

-Rilis ekonomi atau pendapatan utama.

-Likuiditas tipis.

-Tingkat pemberhentian yang penuh sesak.

-Sesi semalam.

Order stop-loss umumnya memprioritaskan eksekusi daripada kepastian harga dan selama periode volatilitas tinggi, perbedaan ini menjadi penting. Menyesuaikan ukuran posisi dan menempatkan stop dengan mengacu pada pergerakan harga yang khas mungkin lebih efektif daripada sekadar mengencangkan stop dalam kondisi yang tidak stabil.

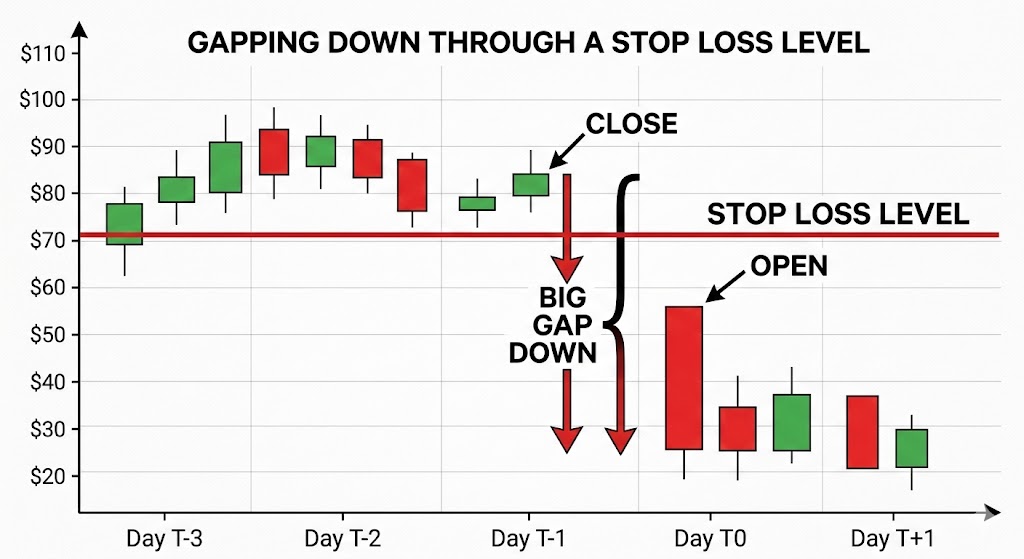

Bagaimana cara mengelola gap semalam di ASX?

Australia berdagang sementara Amerika Serikat tidur, dan sebaliknya. Sayangnya, perbedaan zona waktu ini adalah salah satu alasan mengapa risiko celah semalam sering dicari oleh pedagang Australia. Jika pasar AS turun tajam, ASX dapat dibuka lebih rendah keesokan paginya, tanpa peluang untuk keluar antara penutupan dan pembukaan.

Contoh pendekatan manajemen risiko yang dapat digunakan pedagang pasar meliputi

-Indeks lindung nilai menggunakan ASX 200 futures atau CFD*.

-Lindung nilai sebagian selama peristiwa berisiko tinggi.

-Mengurangi eksposur menjelang pengumuman makro utama.

Lindung nilai dapat mengimbangi bagian dari pergerakan, tetapi memperkenalkan risiko dasar karena saham individu mungkin tidak bergerak sejalan dengan indeks yang lebih luas.

Tidak ada perlindungan yang sempurna, hanya pertukaran antara biaya, kompleksitas, dan pengurangan risiko.

*CFD adalah instrumen yang kompleks dan memiliki risiko tinggi kehilangan uang karena leverage.

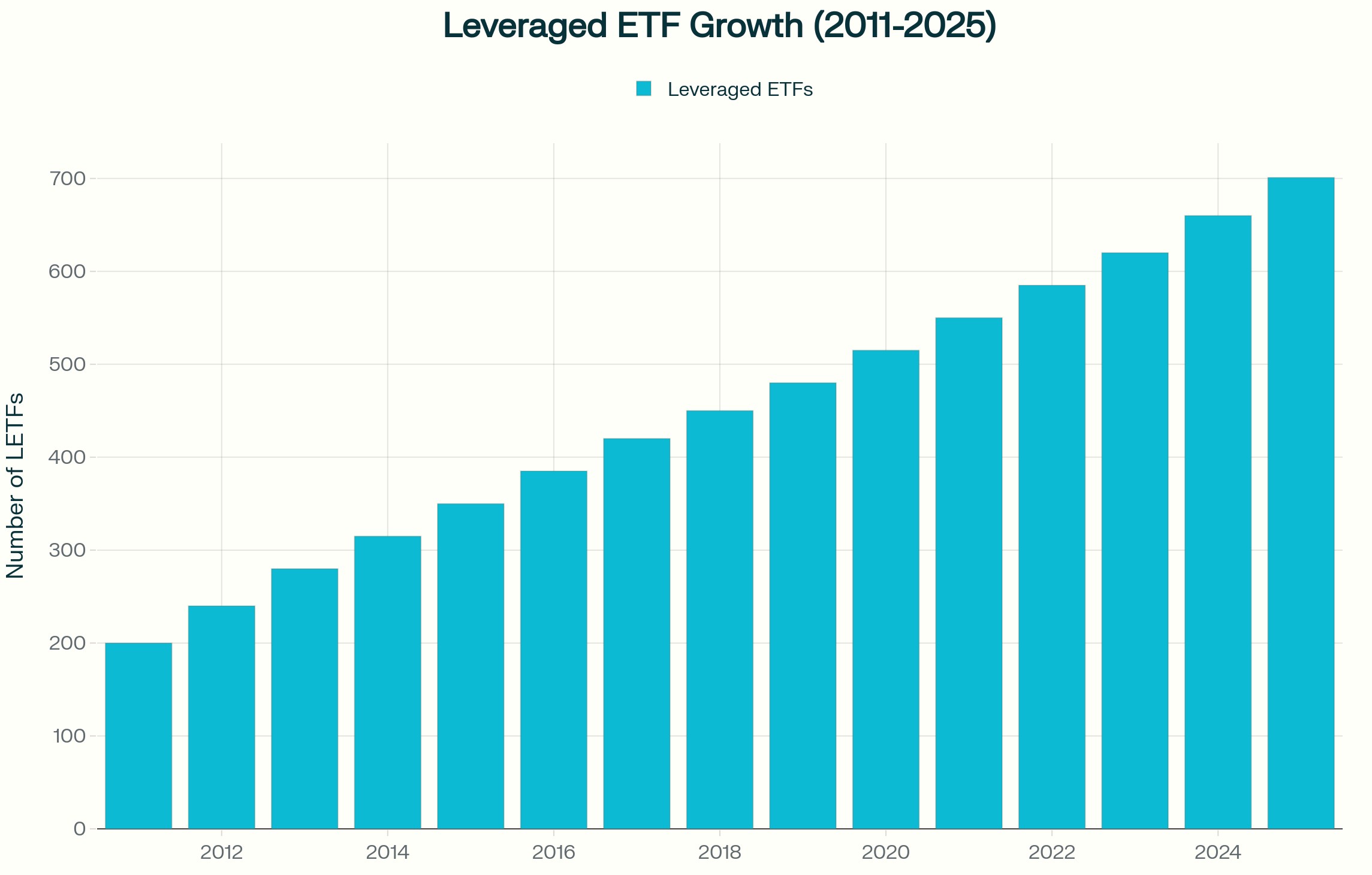

Apa risiko utama ETF leverage atau terbalik di pasar yang tidak stabil?

ETF leverage dan invers sering dicari selama periode volatilitas tinggi.

Meskipun produk-produk ini biasanya diatur ulang setiap hari, mereka bertujuan untuk memberikan kelipatan pengembalian harian indeks, bukan pengembalian jangka panjangnya. Di pasar yang bergejolak dan bergejolak, penggabungan harian dapat mengikis nilai bahkan jika indeks berakhir di dekat level awal.

Ini terjadi karena keuntungan dan kerugian bertambah secara asimetris. Penurunan 10 persen membutuhkan keuntungan lebih dari 10 persen untuk pulih. Ketika efek itu dikalikan setiap hari, hasil dapat menyimpang secara material dari indeks yang mendasarinya dari waktu ke waktu.

Instrumen tersebut dapat digunakan secara taktis oleh beberapa pelaku pasar. Mereka umumnya tidak dirancang sebagai alat lindung nilai jangka panjang dan memahami strukturnya sangat penting sebelum menggunakannya dalam strategi.

Bagaimana ATR dapat digunakan untuk menginformasikan penempatan berhenti?

Rata-rata true range (ATR) adalah indikator yang umum digunakan untuk mengukur volatilitas.

ATR memperkirakan berapa banyak aset biasanya bergerak selama periode tertentu, termasuk kesenjangan. Alih-alih menetapkan stop pada persentase sewenang-wenang, beberapa pedagang merujuk ATR dan menempatkan stop pada kelipatan, seperti dua atau tiga kali ATR, untuk mencerminkan kondisi yang berlaku.

Ketika volatilitas meningkat, ATR mengembang dan itu dapat menyiratkan stop yang lebih luas atau ukuran posisi yang lebih kecil jika risiko keseluruhan tetap konstan. Pergeseran adalah dari bertanya, “Seberapa jauh saya bersedia kalah?” untuk bertanya, “Apa langkah normal dalam kondisi saat ini?”

Pertimbangan praktis di pasar yang bergejolak

Selama periode volatilitas tinggi, pedagang dapat mempertimbangkan

- Memungkinkan kemungkinan perubahan margin

- Mengukur posisi secara konservatif jika volatilitas meningkat

- Mengakui bahwa order stop-loss tidak menjamin harga keluar tertentu

- Meninjau eksposur menjelang peristiwa ekonomi besar

- Memahami mekanisme reset harian ETF leverage

- Menggunakan ukuran volatilitas seperti ATR untuk menginformasikan penempatan berhenti

- Mempertahankan buffer tunai yang memadai

Volatilitas tidak menghargai prediksi saja. Persiapan dan kesadaran risiko dapat membantu pedagang dalam memahami potensi risiko, tetapi hasilnya tetap tidak dapat diprediksi.

Baca: Volatilitas global dan cara berdagang CFD

Apa artinya ini bagi pedagang Australia

Pasar Australia menghadapi pertimbangan struktural spesifik yang dimapkan ke Pasar Asia dan AS. Risiko gap semalam dipengaruhi oleh jam perdagangan AS dan indeks sumber daya berat seperti ASX dapat merespons dengan cepat pergerakan harga komoditas dan data dari China. Eksposur mata uang, termasuk pergerakan AUD dan dolar AS (USD), dapat menambah lapisan variabilitas lainnya.

Volatilitas tidak seragam di seluruh wilayah. Ini berperilaku berbeda tergantung pada struktur pasar dan kedalaman likuiditas.

Pertanyaan yang sering diajukan tentang volatilitas

Apa yang menyebabkan lonjakan tiba-tiba dalam volatilitas pasar?

Keputusan suku bunga, data inflasi, perkembangan geopolitik, kejutan pendapatan dan kendala likuiditas adalah pemicu umum.

Mengapa broker meningkatkan margin selama pasar yang bergejolak?

Untuk mengurangi eksposur leverage dan mengelola risiko saat perubahan harga melebar.

Bisakah order stop-loss gagal selama volatilitas?

Mereka dapat mengalami slippage jika pasar berada di luar level stop, yang berarti eksekusi dapat terjadi pada harga yang lebih buruk dari yang diharapkan. Di pasar cepat atau tidak likuid, perbedaan ini bisa signifikan.

Apakah ETF leverage cocok untuk lindung nilai jangka panjang?

Mereka umumnya terstruktur untuk eksposur jangka pendek karena reset harian. Apakah mereka sesuai tergantung pada tujuan Anda, situasi keuangan, dan toleransi risiko.

Bagaimana volatilitas dapat diukur sebelum melakukan perdagangan?

Alat seperti ATR, indikator volatilitas tersirat dan analisis rentang historis dapat membantu mengukur kondisi yang berlaku.

Peringatan risiko: Periode volatilitas tinggi dapat menyebabkan pergerakan harga yang cepat, perubahan margin dan eksekusi pada harga yang berbeda dari yang diharapkan. Alat manajemen risiko seperti stop-loss order dan indikator volatilitas dapat membantu dalam menilai kondisi pasar tetapi tidak dapat menghilangkan risiko kerugian, terutama ketika menggunakan produk leverage.

As a serious trader, one of the key areas you must work on is to develop an awareness of the way the market affects your mind, and subsequently the decisions you make whilst in a trading situation. What are trading biases? People have inbuilt set of belief and value systems that develop over the years through learning and instruction from others and experiences.

Many of these developmental factors are outside the trading context but when the trader interacts with the market, these individual natural ways of thinking and feeling become part of decision-making. Some of these natural in-built responses may not serve you well and are termed ‘cognitive biases’. In many instances in the ‘heat of the action’ when in OPEN trades, these ‘cognitive biases’ take over from your written and planned ‘trading system’ and become the major influence on your market behaviour.

Results that you may produce from your trading can reinforce these in-built biases making them more acute, and so have and ever-increasing influence on what you may do when in the market, until finally they potentially end up destroying the capital and also confidence of the investor. There are several of these outlined in the “behavioural finance” research literature and we intend over a series of articles to look at the more commonly described of these. Loss aversion A loss aversion bias is arguably one of the more common trading cognitive biases.

The trader has an overt focus on avoiding taking a loss in a trade. Obviously, taking a loss, with of course risk management to limit any such loss to a tolerable level (often 2-4% of trading account size) is an accepted reality of trading practice. However, in those with a loss aversion bias, there are two potential behavioural responses when in an open trade that may be damaging to capital and ultimately sabotage the potential for on-going successful trading outcomes. 1.

Stop losses are often moved downwards in a long position (and upwards in a short position) from that originally planned on entry. This is an attempt to regain a losing position with the hope that a price may move back in your desired direction. There may be multiple such “moves” of that stop, each potentially inflicting more damage on capital way beyond any planned maximum risk level.

Commonly, there will be an internal dialogue to justify staying in a trade. 2. Conversely, so potentially acute is the fear of losing a profitable trade that such trades are often exited prematurely throwing out of the window any pre-planned profit target or trailing stop system articulated within your trading plan. The internal dialogue we have occasionally heard form traders is “you will never go broke taken a profit”.

So, in practice these two factors result in a reversal of the traditional market wisdom of ‘keeping your losses small and letting your profits run’, in that losses are extended, and profits are cut short. The basis of such a bias maybe be multi-fold, including: • Previous losses in investments, • Lack of education and confidence, • Over-confidence in your ability beyond competence with a view that a loss in a trade meaning you were “wrong” (an underlying feeling of “I am better than that”), • Pre-set beliefs about how the market SHOULD move i.e. trading what you think not what you see, • taking on the “trades of others” without due diligence and perhaps against your plan (e.g. in forums, trading rooms), • Incorrect position sizing with a small initial trading capital where the effect of trading fees is more acutely felt. And it can get worse… One of the MAJOR problems with a loss aversion bias is that it becomes cyclical in its severity, as results continue to fall short of what you had hoped.

This is not only with individual trades where losses may become more extended and even smaller than possible profits taken. Desperation may eventually set in, with an obsession to get trading capital back, whilst account value continues to diminish until the trade reaches a point of “no more pain” and leaves the market completely. This unfortunately has double impacts - not only has there been a loss of a trading capital now, but in many cases have been sufficiently painful that the individual may never again return to trading (so eliminating any potential for future positive investment experiences).

What you can do If this resonates with you, then the purpose of this article is fulfilled, as recognising and “owing” that there is something that needs to be addressed is the VITAL first step in making a change. Obviously, there are steps you can take to address this (and you MUST). Here are some suggestions: a.

You have a complete trading plan that articulates trading actions once in trades i.e. an exit strategy. b. Start a journal. Sometimes the very process of formally recording what you are doing helps in doing the right thing more consistently. c.

Press the “reset button” on your trading account. What we mean by this is an acceptance that your trading capital is what it is now. Rather than a mission to regain your initial capital this needs to be replaced by a drive to achieve consistently positive trading results (and including that taking a loss within your tolerable level is a positive outcome).

The long-term reality is that through changing this focus as described, addressing the bias through developing that consistency in action, you could give yourself the chance for some sustainable results. d. Re-align with your trading plan prior to every trading session. e. Make it a mission to “challenge” your existing plan on at least a 3-monthly basis through gathering an increased weight of evidence that its component parts are working for you as an individual trader.

This breeds confidence in actioning a plan, enabling more disciplined trading. f. There are a couple of ‘unhealthy’ statements that fly around the investment world which you need to check to not become part of your thinking. The first, “do not invest with money you can’t afford to lose” although is from a well-meaning perspective, arguably can contribute to a mindset which gives some sort of permission to lose.

The second and more dangerous from a capital perspective is “it is not a loss until you take it”. This is a massive distance away from what is recognised as good trading practice and is completely contradictory to the positive idea that you should take a loss as soon as it hits your tolerable dollar level. g. Take regular breaks from the market during any session, particularly when trading shorter timeframes, to re-align with purpose and plan. h.

Ensure that you are trading within your level of competence, have a personal trading development plan that outlines your learning for the next quarter. i. Trade smaller positions until you have evidence of developing good consistent habits that break away from your bias. There are a few different ways to action this, reducing your tolerable risk level significantly e.g. from 3% to 1% of trading account capital, or trading micro-lots rather than mini-lots are a couple of examples.

Finally, be gentle on yourself in terms of your development, biases by nature are usually deeply ingrained and will take some work to replace. Our education programmes inluding the popular Inner Circle group are there to help you move forward in your trading and our team is there to support 24 hours a day, 5 days a week.

Forex is one of the heaviest news driven markets in the world. Major news announcements play such a critical role to the intraday volatility, which in turn create trading opportunities. Most of the time, particularly for the active traders, market volatility can present more trading opportunities.

So it stands to reason, all Forex traders should be very mindful of upcoming news announcements. Even if you are a position trader or someone who likes to hold your FX positions for the medium to long term, knowing what news is coming up is essential. Tracking the markets across the globe Using MT4 Genesis, the session map shows you the key trading times for the main 'fixes' around the world including Sydney, Tokyo, London and New York.

Trading around the major fixes is important for those who trade on an intraday timeframe. For example, it is important to note that the Australian session is first and it is often the quietest, unless of course there is a Reserve Bank of Australia (RBA) rates announcements or even the Reserve Bank of New Zealand (RBNZ) can be enough to move the markets on a regular basis. Other than that, the Australian fix rarely moves the markets.

It is not until you get the crossover to the London session that volatility picks up. You can then expect more volatility when the London session meets the New York session. The session map shows a clear red line for your current time so you can see when volatility may pick up.

The best feature of the session map is the news markers. At the bottom of the session map window, you will see grey, orange and red markers, highlighting upcoming news announcements. Grey is low impact, orange is medium impact and red is high impact.

By hovering your mouse over the news markers (or left clicking on one), you can see: » what the announcement is; » the time is will be released; and » its expected impact. [embed]https://www.youtube.com/watch?v=28uS8T7Ay9I[/embed] How many times have you had an open position rally significantly, to then have to scour the internet for a news item related to your currency pair? If you've been trading for any length of time, then probably too often. By applying the session map, you can see clearly what news is driving the spike.

Another great aspect of the session map is the ability to see your current open profit and loss at a glance. In addition, you have a host of other account details with one click, such as your: » balance; » equity; » floating P&L » margin in use; and » the amount of margin you have free. Applying session map is as easy as dragging it from the Expert Advisors folder straight on to your chart.

It’s that easy. Stay on top of the markets by using Connect and Analyse tools It’s been said that trading could be a lonely job, particularly if you’re trading on your own. While market action and price movements can definitely keep you on your toes, some people find it a bit isolating at some stage.

However, you can look at it as being on top of the world (or the markets, at least) as you need to keep tab of what’s happening across the globe. This is particularly true when trading the forex (FX) market as currencies tend to move pretty fast compared to equities. Using the Connect and Analyse tools in MT4 Genesis, you can be a step ahead already.

These tools will give you current and relevant information – breaking news, statistics and analysis – that you can use for your trading. These tools are readily available from within your GO Markets’ MT4 platform. Once the MT4 Genesis file has been run, the full suite of tools will be available from the Expert Advisors tab.

Simply left click and drag each tool on to the chart of your choice. Let’s have a look at the features of the Connect function. As a trader, you need to be in tune with market developments as well as current events and news that may impact the markets.

The Connect window will give you price action and technical updates on the relevant currency pairs. This is also where you can find news updates not only about the markets, but also general news. Monitoring the news is vital for your trading as big events can have a major impact on the markets.

For example, decisions and announcements from the US Federal Reserve are always being watched and monitored by traders because it could affect currency movements. Major decisions from the US Fed are notorious for having effects on other currencies. Using this feature, you can select a number of news providers that suit your information needs.

The Connect feature also has a calendar that informs you of all relevant upcoming announcements that may affect the FX market. The calendar highlights: » High-impact events » Medium-impact events » Low-impact events [embed]https://www.youtube.com/watch?v=oQoKmSFFDsE[/embed] Some of the high-impact events that usually generate big moves in the market include: » US non-farm payroll announcement » US Federal Reserve announcements » Retail sales data » Manufacturing data Another way to connect with the market and to make sure you’re on top of current developments is via the GO Markets website. Using this feature, you can do several things such as: » Open a new account » Deposit funds » Change the leverage on your account » Access current promotions or simply » Speak with one of the Go Markets’ team members.

Analyse tool The Analyse tool is also helpful if you want to do weekly, monthly or yearly review of your trading performance. As a trader you would like to know how you’re performing and you would like to keep track of some vital statistics including: » Account Balance » Profit » Profitability » Percentage return » Monthly return Sentiment indicator The sentiment indicator is another key feature that can be useful for your trading. Using this tool, you can identify the currency pairs you want to trade (or in your watch list) and see the bias towards long and short positions on those pairs.

This will give you a good appreciation of the overall market sentiment on a particular currency pair. For example, the falls in iron ore and oil prices are widely expected to have negative impact on commodity currencies including the Australian dollar. However, despite the negative sentiment, the Aussie dollar is still being supported at a healthy level. [embed]https://www.youtube.com/watch?v=m4TVU8PnIaA[/embed] Using the sentiment indicator, you can see how other traders are ‘feeling’ about the Aussie dollar as it would be reflected on the number or percentage of long positions versus short positions.

Take advantage of the Connect and Analyse tools as they could make a big difference in your trading performance. The opinions and information conveyed in the GO Markets newsletter are the views of the author and are not designed to constitute advice. Trading Forex and CFD's is high risk.

Rom Revita | Sales Manager Rom is the Sales Manager at Go Markets Pty Ltd and manages the day-to-day running of the Sales, Support and Marketing teams. He has been with the company since 2013 and is also one of our two appointed Responsible Managers, helping to ensure that the company follows all AFSL regulatory requirements. Rom has extensive financial markets experience and originally comes from an equities & derivatives trading background.

He has served on the Trading & Sales Desk with several large broking houses, and now specialises in Margin FX and CFDs. Connect with Rom: [email protected]

There is NO such thing as emotionless trading AND in many respects, it may be considered that it is a good thing too. After all, correctly targeted emotions will allow you to: Have an exciting, compelling trading purpose that drives you to do the hard yards with your learning (we know some people fail to complete a course or put learning into action). Be motivated to do your due diligence and make sure you have ticked all the boxes before you press any trading buttons and take action with entry and exit.

Celebrate when you do the right thing (Remember: this includes keeping that loss small when you should) and Feel PAIN when you donate to the market needlessly through poor or inappropriate execution (providing of course you take the lesson AND take more appropriate action next time while placing the blame where it should be). So YES, let’s get aroused! If we hit the right level of trading arousal EVERY TIME and it’s driven by channelled, enabling emotion, this may create a higher probability that when we get to the ‘press-the-button’ stage we do it with a calm confidence and will more likely have a better trading outcome, or as we have called it here the “Potential Profit Zone” (Remember: it is equally a win to make sure that any loss is within your tolerable risk level meaning your long term results are more likely to be positive).

Either extreme of arousal is not likely to produce the results we desire, either through not taking our trading seriously enough (the “Hobby Zone”) to do the things we must (due diligence; careful consideration of strategy selection; making sure it REALLY fits your plan), or though making decisions that are most certainly extreme NOT from the right emotional place (the “Capital Danger Zone”). Take a look at the diagram below that aims to illustrate this: This middle zone is where we need to be, so sufficiently stimulated to do the right things consistently (even though these may appear to be a chore and some until they become habits). If you don’t apply this level of emotion to your trading and trade in the “Hobby Zone”, it is less likely you will be sufficiently “aroused” to spot an opportunity and then trade it without lengthy procrastination.

Or equally if not more important to exit a trade in a timely, confident manner either to take profit or minimise any loss from a single trade. You need to operate with the decisive action of a “trading Ninja” with the appropriate peak state of arousal or in other words in the “Potential Profit Zone”. This may be more likely to give yourself the best chance of optimising trading results.

Neither do we want to be in a state of being over-stimulated to the point where you become a trading ‘fruit-loop’ (not the technical term) and perilously exposed to some of the more “dangerous” emotions. To make trading decisions when anxious, angry (that revenge trading thing!), or trading out of fear rarely produces good results and can mutilate a portfolio value quicker than saying “not having a stop loss in place is completely bonkers”. So, it’s a balance of the two extremes – surely, it is logical that some emotion is good as it motivates you to do the right thing and follow through on your learning, direct trading and measuring, and there are some emotional states that are hugely damaging.

So, your mission after reading this post (as it’s always best to take some action) is to make a ten-second assessment of your ‘state of arousal’ before you press an entry or exit button for every trade this coming week (YES! You can start now). Make the judgement as to which of these described zones you may be trading from.

One final word: if you want evidence of whether the right state of arousal is likely to produce peak performance, then look at other situations where that might also be the case….just a different context, that’s all. GET AROUSED! PS Aroused to learn what you need to, but are not sure where to go?

Why not access your FREE “Next Steps” education course including two group coaching webinars sessions to help put LIVE market context to the theory learned in the videos? For more information click on the "Next Steps" image on the right. This article is written by an external Analyst and is based on his independent analysis.

He remains fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk. For more information on trading, check out our forex webinar.

Position accumulation is to increase exposure to a currency pair, by adding a second (or more) position in the same trading direction. Although on the surface the opportunity to increase potential return is attractive, there are also risks that MUST be at the forefront of your thinking. Are you ready to accumulate?

Before considering position accumulation to your trading behaviour, it is worth considering two important aspects. This is not a strategy for the trader beginners, but rather when other systems are already in place such as a written trading plan that includes statements that reference risk management approaches, particularly that of appropriate position sizing and clear exit approaches. Also, logically, as you are potentially increasing exposure with this approach, it is not only having a trading plan that is important, but also a record of follow through with that plan.

We know disciplined trading is a challenge for some, so if this is something you are battling with than master this first. Why a profitable position only? It is crucial that this is one of the rules of any system you choose to develop.

Accumulating into a losing position (akin to ‘dollar cost averaging)’ should be considered a very high-risk strategy. The essence of this approach is that at each accumulation point, as you increase exposure, you manage the additional risk by moving a stop on previous positions at each accumulation point. Your position accumulation system As with any aspect of trading behaviour, a measurable set of statements that dictate your actions as part of your trading plan should be developed with reference to your position accumulation.

These statements may include as a minimum: a. Under what market circumstances you would consider accumulating e,g. strong uptrend confirmed across multiple timeframes. b. What technical signals are you going to use to signal the time to accumulate (e.g. if into a long position break of a key point, subsequent to confirmation of continued uptrend after a retracement. c.

Your trail-stop process e.g. at each accumulation point for all previously opened positions -all opened positions should be treated as one re, exit point. d. Position sizing e.g. accumulate no more than the original position, meaning if you enter 5 mini-lots initially that is the maximum you can add on each accumulation. e. Your maximum exposure e.g. 2 standard lots f.

Other exit points or reason to delay/refrain from accumulating further e.g. economic data. Once your system is complete then it should be tested prospectively, and amended as appropriate, prior to implanting in the reality of your trading practice. We trust this review of position accumulating will help in your choice as to whether to integrate this into your trading strategy and of course, some of the considerations that are worth exploring.

One Emotional Discipline: This is the precise reason why not everyone can trade. Understanding the fundamentals of the market is not beyond you and learning a technical system that provides an edge in the market is certainly not hugely challenging. However learning the skill of emotional discipline is the greatest profit making skill great traders have.

To develop the emotional discipline that all great traders have takes time and it takes a lot of patience but it can be done. There are 3 things that can help you develop the emotional discipline required. » Most budding forex traders in my experience trade too much resulting in a “duck hunter” approach rather than a “sniper” approach. The result is they trade emotionally instead of logically following a specific trading plan.

Over many years I have seen forex traders substantially improve their trading results by simply trading less. » One thing you need as a trader is time, time to learn the skill of trading and being able to stay in the game without blowing your trading account. Nobody makes it in this business without experiencing trading losses however you need to fail gracefully and this means losing small and winning bigger. » Rather than looking at your forex trades in a win-loss fashion consider looking at your trade results in blocks of 10 trades. Trading is a numbers game and if you have a specific currency trading plan that has an edge then you have a historical probability of success, you just need to see it through and play the system properly.

The system or your results cannot be measured over one, two or even three forex trades. Great trades understand the numbers game over time and it allows them to develop the emotional discipline. Two Focus: Think about someone that you know to be successful and wealthy.

There is a strong possibility that person achieved their success and wealth from being a specialist in one field. Steve Jobs was successful at building computers, Richard Branson made his first fortune selling records, Rupert Murdoch made his fortune selling Newspapers, George Soros made his fortune trading currencies and Warren Buffett made his fortune buying companies on the stock market. They applied incredible focus to the business they were in and initially did not diversify.

It was this single-minded focus on one thing that drove them to the success and yes many of them have diversified since. But they focused on one thing to start with. So I believe you will improve your probability of trading success by focusing on one market and becoming a specialist in that market.

It will allow you to focus intently on what is driving that market, it will allow you to focus on becoming the detective that you need to be and it will allow you to likely find value in a market before everyone else has figured out what you are considering buying is a good idea. Consider focusing on one market and become your own master of that market and you will likely improve the chances of your success. Watch your inbox for the link to join Senior Currency Analyst and Sky News Money host Andrew Barnett for weekly free live currency coaching sessions.

They are at 7pm AEST every Wednesday. Andrew Barnett | Director / Senior Currency Analyst Andrew Barnett is a regular Sky News Money Channel Guest and one Australia’s most awarded and respected financial experts, and is regularly contacted by the Australian Media for the latest on what is happening with the Australian Dollar. Connect with Andrew: Email