Strategi trading untuk mendukung pengambilan keputusan Anda

Temukan teknik praktis untuk membantu Anda merencanakan, menganalisis, dan meningkatkan trading Anda.

Volatilitas memiliki cara untuk muncul tanpa diundang.

Suatu hari ASX melayang diam-diam... dan berikutnya, persyaratan margin naik, stop tidak terisi di tempat yang diharapkan, dan portofolio terbuka dengan celah semalam yang tidak nyaman.

Jika Anda telah mencari jawaban, Anda tidak sendirian. Beberapa pertanyaan yang paling banyak dicari tentang volatilitas di kalangan pedagang Australia berhubungan dengan margin call, slippage, gap semalam, leverage exchange trading funds (ETF), dan alat seperti rata-rata true range (ATR).

Inilah yang terjadi.

Mengapa ini penting sekarang

Pasar global menjadi lebih sensitif terhadap suku bunga, data inflasi, geopolitik, dan arus yang digerakkan oleh teknologi. Ketika likuiditas menipis dan ketidakpastian meningkat, perubahan harga melebar. Itu adalah volatilitas.

Dan volatilitas tidak hanya mempengaruhi arah harga, tetapi juga mengubah cara perdagangan dieksekusi, berapa banyak modal yang dibutuhkan, dan bagaimana risiko berperilaku di bawah permukaan.

Terjemahan: Volatilitas bukan hanya tentang pergerakan yang lebih besar, melainkan tentang pergerakan yang lebih cepat dan likuiditas yang lebih tipis - saat itulah mekanisme perdagangan paling penting.

Ingin studi kasus volatilitas dunia nyata?

Mengapa broker saya meningkatkan persyaratan margin?

Salah satu pertanyaan yang paling dicari tentang volatilitas adalah mengapa persyaratan margin meningkat tanpa peringatan.

Ketika pasar menjadi tidak stabil, broker dapat meningkatkan persyaratan margin pada kontrak untuk perbedaan (CFD) dan produk leverage lainnya. Perubahan harga yang lebih besar dapat meningkatkan risiko akun bergerak ke ekuitas negatif sehingga meningkatkan persyaratan margin mengurangi leverage yang tersedia dan dapat membantu mengelola eksposur selama kondisi ekstrem.

Apa artinya ini dalam praktiknya

-Margin call dapat terjadi bahkan jika harga tidak bergerak secara signifikan.

Leverage yang efektif dapat turun dengan cepat.

Posisi mungkin perlu dikurangi dalam waktu singkat.

Penyesuaian margin biasanya merupakan respons terhadap perubahan risiko pasar, bukan keputusan acak. Di pasar yang sangat fluktuatif, adalah bijaksana untuk mengasumsikan pengaturan margin dapat berubah dengan cepat, oleh karena itu banyak pedagang memilih untuk meninjau ukuran posisi dan buffer yang tersedia mengingat risiko itu.

Apa itu slippage dan mengapa stop saya tidak terisi dengan harga saya?

Topik lain yang sering dicari adalah selip.

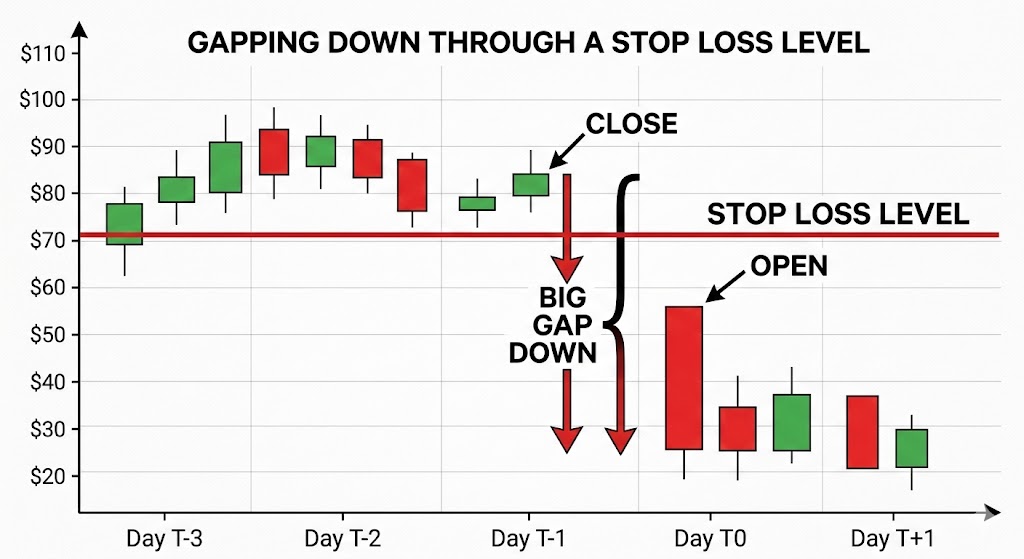

Slippage dapat terjadi ketika stop order memicu dan dieksekusi pada harga yang tersedia berikutnya, hasilnya dapat bergantung pada jenis order, likuiditas pasar dan kesenjangan. Di pasar yang tenang, perbedaannya mungkin kecil sedangkan di pasar cepat, harga bisa berada di luar level stop.

Pengemudi umum termasuk

-Rilis ekonomi atau pendapatan utama.

-Likuiditas tipis.

-Tingkat pemberhentian yang penuh sesak.

-Sesi semalam.

Order stop-loss umumnya memprioritaskan eksekusi daripada kepastian harga dan selama periode volatilitas tinggi, perbedaan ini menjadi penting. Menyesuaikan ukuran posisi dan menempatkan stop dengan mengacu pada pergerakan harga yang khas mungkin lebih efektif daripada sekadar mengencangkan stop dalam kondisi yang tidak stabil.

Bagaimana cara mengelola gap semalam di ASX?

Australia berdagang sementara Amerika Serikat tidur, dan sebaliknya. Sayangnya, perbedaan zona waktu ini adalah salah satu alasan mengapa risiko celah semalam sering dicari oleh pedagang Australia. Jika pasar AS turun tajam, ASX dapat dibuka lebih rendah keesokan paginya, tanpa peluang untuk keluar antara penutupan dan pembukaan.

Contoh pendekatan manajemen risiko yang dapat digunakan pedagang pasar meliputi

-Indeks lindung nilai menggunakan ASX 200 futures atau CFD*.

-Lindung nilai sebagian selama peristiwa berisiko tinggi.

-Mengurangi eksposur menjelang pengumuman makro utama.

Lindung nilai dapat mengimbangi bagian dari pergerakan, tetapi memperkenalkan risiko dasar karena saham individu mungkin tidak bergerak sejalan dengan indeks yang lebih luas.

Tidak ada perlindungan yang sempurna, hanya pertukaran antara biaya, kompleksitas, dan pengurangan risiko.

*CFD adalah instrumen yang kompleks dan memiliki risiko tinggi kehilangan uang karena leverage.

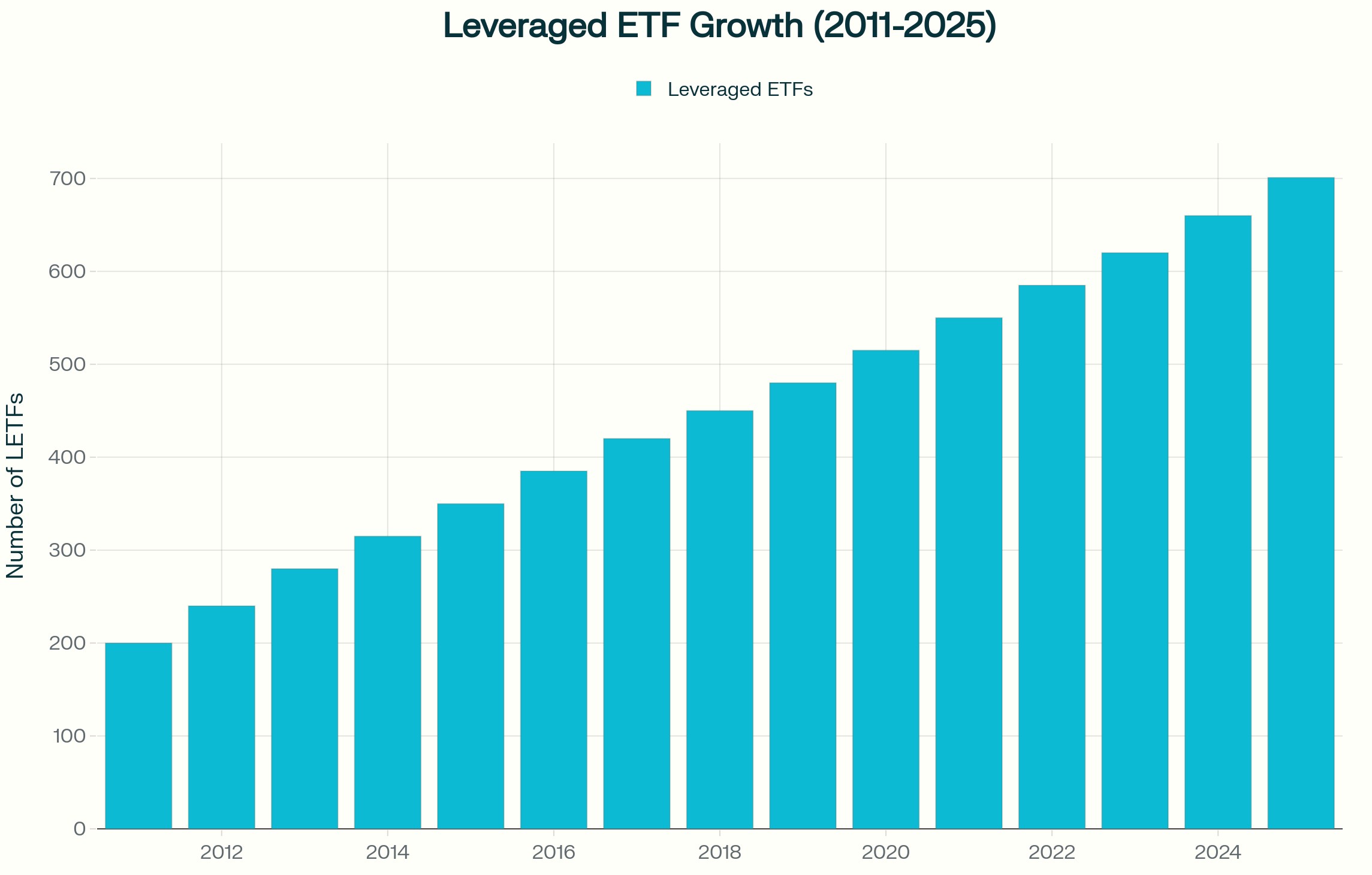

Apa risiko utama ETF leverage atau terbalik di pasar yang tidak stabil?

ETF leverage dan invers sering dicari selama periode volatilitas tinggi.

Meskipun produk-produk ini biasanya diatur ulang setiap hari, mereka bertujuan untuk memberikan kelipatan pengembalian harian indeks, bukan pengembalian jangka panjangnya. Di pasar yang bergejolak dan bergejolak, penggabungan harian dapat mengikis nilai bahkan jika indeks berakhir di dekat level awal.

Ini terjadi karena keuntungan dan kerugian bertambah secara asimetris. Penurunan 10 persen membutuhkan keuntungan lebih dari 10 persen untuk pulih. Ketika efek itu dikalikan setiap hari, hasil dapat menyimpang secara material dari indeks yang mendasarinya dari waktu ke waktu.

Instrumen tersebut dapat digunakan secara taktis oleh beberapa pelaku pasar. Mereka umumnya tidak dirancang sebagai alat lindung nilai jangka panjang dan memahami strukturnya sangat penting sebelum menggunakannya dalam strategi.

Bagaimana ATR dapat digunakan untuk menginformasikan penempatan berhenti?

Rata-rata true range (ATR) adalah indikator yang umum digunakan untuk mengukur volatilitas.

ATR memperkirakan berapa banyak aset biasanya bergerak selama periode tertentu, termasuk kesenjangan. Alih-alih menetapkan stop pada persentase sewenang-wenang, beberapa pedagang merujuk ATR dan menempatkan stop pada kelipatan, seperti dua atau tiga kali ATR, untuk mencerminkan kondisi yang berlaku.

Ketika volatilitas meningkat, ATR mengembang dan itu dapat menyiratkan stop yang lebih luas atau ukuran posisi yang lebih kecil jika risiko keseluruhan tetap konstan. Pergeseran adalah dari bertanya, “Seberapa jauh saya bersedia kalah?” untuk bertanya, “Apa langkah normal dalam kondisi saat ini?”

Pertimbangan praktis di pasar yang bergejolak

Selama periode volatilitas tinggi, pedagang dapat mempertimbangkan

- Memungkinkan kemungkinan perubahan margin

- Mengukur posisi secara konservatif jika volatilitas meningkat

- Mengakui bahwa order stop-loss tidak menjamin harga keluar tertentu

- Meninjau eksposur menjelang peristiwa ekonomi besar

- Memahami mekanisme reset harian ETF leverage

- Menggunakan ukuran volatilitas seperti ATR untuk menginformasikan penempatan berhenti

- Mempertahankan buffer tunai yang memadai

Volatilitas tidak menghargai prediksi saja. Persiapan dan kesadaran risiko dapat membantu pedagang dalam memahami potensi risiko, tetapi hasilnya tetap tidak dapat diprediksi.

Baca: Volatilitas global dan cara berdagang CFD

Apa artinya ini bagi pedagang Australia

Pasar Australia menghadapi pertimbangan struktural spesifik yang dimapkan ke Pasar Asia dan AS. Risiko gap semalam dipengaruhi oleh jam perdagangan AS dan indeks sumber daya berat seperti ASX dapat merespons dengan cepat pergerakan harga komoditas dan data dari China. Eksposur mata uang, termasuk pergerakan AUD dan dolar AS (USD), dapat menambah lapisan variabilitas lainnya.

Volatilitas tidak seragam di seluruh wilayah. Ini berperilaku berbeda tergantung pada struktur pasar dan kedalaman likuiditas.

Pertanyaan yang sering diajukan tentang volatilitas

Apa yang menyebabkan lonjakan tiba-tiba dalam volatilitas pasar?

Keputusan suku bunga, data inflasi, perkembangan geopolitik, kejutan pendapatan dan kendala likuiditas adalah pemicu umum.

Mengapa broker meningkatkan margin selama pasar yang bergejolak?

Untuk mengurangi eksposur leverage dan mengelola risiko saat perubahan harga melebar.

Bisakah order stop-loss gagal selama volatilitas?

Mereka dapat mengalami slippage jika pasar berada di luar level stop, yang berarti eksekusi dapat terjadi pada harga yang lebih buruk dari yang diharapkan. Di pasar cepat atau tidak likuid, perbedaan ini bisa signifikan.

Apakah ETF leverage cocok untuk lindung nilai jangka panjang?

Mereka umumnya terstruktur untuk eksposur jangka pendek karena reset harian. Apakah mereka sesuai tergantung pada tujuan Anda, situasi keuangan, dan toleransi risiko.

Bagaimana volatilitas dapat diukur sebelum melakukan perdagangan?

Alat seperti ATR, indikator volatilitas tersirat dan analisis rentang historis dapat membantu mengukur kondisi yang berlaku.

Peringatan risiko: Periode volatilitas tinggi dapat menyebabkan pergerakan harga yang cepat, perubahan margin dan eksekusi pada harga yang berbeda dari yang diharapkan. Alat manajemen risiko seperti stop-loss order dan indikator volatilitas dapat membantu dalam menilai kondisi pasar tetapi tidak dapat menghilangkan risiko kerugian, terutama ketika menggunakan produk leverage.

We are less than three weeks away from the ASX earning season and we are less than two weeks away from the earnings season in the US. So, we need to start prepping for trades and opportunities now. First and foremost, do not forget that confession season is well and truly upon us here in Australia.

Downgrades clearly have been coming from the discretionary sector; we've even seen companies hit the wall with the likes of Booktopia going into administration. There are some clear thematics that are growing in the Australian market. Energy, while the worst performing sector for the financial year 2024, may actually show you that earnings were slightly above expectation on higher than expected oil prices.

Materials led in the main by BHP, Rio and FMG Have once again benefited from higher than expected iron ore prices. It also benefited from a lower than expected AUD/USD where average FX prices were expected to be between $0.68 and $0.73 but instead have averaged between $0.63 and $0.67. What we're looking for is operational costs, overall margins and forward looking guidance, something that these firms have lacked in the last three financial updates.

Watch very closely for the excitement that will come from things like copper at the expense of the issues that are facing nickel lithium and other transition metals that have had really tough periods in FY24. Moving to the banks this is a sector people argue is fully valued. It's not hard to argue when through the financial year CBA made record all time highs several times and is still within a whisker of its record all time high.

Higher interest rates will indeed improve net interest margins. However, the unknown question and what we need to see at its August full year earnings is the impact higher rates are having on bad and doubtful debts, the possible increase in provisioning and more importantly the impact its having on new loans and refinancing. There is an argument to be made that banking is possibly fully priced and no matter what result is delivered won't necessarily create a leg further higher.

Finally, you can't go past consumer staples and discretionary. Retail sales numbers over the last 18 months have actually shown discretionary spending At or above 2022 levels although month on month figures have been erratic. The question that will come for discretionary spending is margins and how much sales revenue translates to the bottom line in earnings and profit.

Staples on the other hand have seen consistent movement on the revenue line but the question will be the margin and after the very targeted senate inquiry into supermarkets any sign profits are above trend may actually be met with concern as geopolitics raises its head. 33 times in 2024 the US 500 and the Tech 100 have made record highs – can it continue? Look into the US and the ending season that it is about to undertake. We have to look at several core thematics that are likely to be raised.

Artificial Intelligence (AI) The question you’ve got to ask is: is the time frame long or short? We raised this Mag 7 stocks etc Microsoft, Amazon, Alphabet, apple have clear potential. They are evolving their business models and see the integration of AI as the future of their individual businesses.

That will likely come up in their numbers but it will come with operational and initial upfront costs as the integration of AI begins. This is all long term may not fully capture short term opportunities which is still presenting very much in the semiconductor providers. NVIDIA and Advanced Micro Devices are taking full advantage and monetizing the compute cycle.

This clearly won't be forever because it will go from semiconductors to infrastructure to software and therefore the flows will move back towards the bigger end of town but overall the AI thematic still flows towards the semiconductors for now and that's likely to be shown in the earnings season that's coming. Data Centres That brings us to data centres because the potential for ensuring AI requires a heck of a lot of storage and a heck of a lot of processing. There are estimates the data centres will need to grow by 420% in Europe and 250% in the US by 2035 based on the rate of growth in AI right now.

Therefore, we need to watch providers like Dell Technologies and Intel which are big providers of data centres currently. We think the market hasn’t fully appreciated DC needs in the AI revolution. Cybersecurity The final key theme in the AI data centre technology space that we also think needs to be watched is cyber security.

It's been something along the lines of a 70% increase in ransomware attacks over the past 24 months. The regulatory requirements and the budgets required to deal with these increased threats is only just beginning. That brings players like Fortinet to the fore IT programmes and it's pensively to develop programs for enterprise makes it an interesting one going forward.

GLP-1 ‘Weight Loss’ Medicines Another theme of being a really strong driver of the S&P 500 is the rise of GLP-1 medicines. The weight loss craze that has come off the back of this Amazon has been incredible. Initially obviously developed for diabetes but having an additional effect of weight loss has created a product out of nowhere.

Eli Lilly and Co is a key player in this space with its GLP one class medicines already approved by the FDA. It's been launched in the US and its oral intake has posted adoption. It is not the only one in this space but shows very clearly the impact weight loss medicines are having on earnings.

The caveat we have though is side effects and long term impacts are still being found and could be said as a capping issue on price. Whatever way you look at it the US dating season however will be incredibly exciting and it is the reason The US markets continue to see huge capital inflows as they are much more exciting in this current environment than traditional value markets such as Australia.

It's well-known that many discretionary traders struggle with discipline, emotional control, and other psychological hurdles that can impact their decision-making process, particularly when it comes to entering and exiting trades. One of the widely recognized benefits of automated trading models, however, is the belief that these psychological barriers are removed or significantly reduced. Automation, after all, is designed to eliminate human emotion from trading decisions.

However, the assumption that psychological challenges vanish with automated trading is far from reality. As you delve into the exciting world of creating and trading “Expert Advisors” (EAs), it is crucial to understand that psychological challenges still exist, albeit in a different form. You must be prepared to face various mindset issues during the EA development and trading process.

This article outlines and aims to inform on nine key potential psychological challenges traders might encounter when working with EAs and offers guidance on how to navigate them effectively. Use this checklist to develop an awareness of potential issues and take meaningful action to enhance your trading performance. 1. Over-Optimization and Curve Fitting One of the most common challenges traders face when developing EAs is the temptation to over-optimize their algorithms.

This refers to tweaking the EA to perform perfectly in historical backtests but at the expense of real-world effectiveness. While an over-optimized EA may show stellar performance on past data, it often falters when faced with live market conditions, leading to frustration and self-doubt. To mitigate this, it is vital to stay focused on each stage of the EA creation process and avoid the trap of endless refinement.

Always keep in mind two fundamental principles: The purpose of an EA is to reliably generate profits. Once this is achieved, the next step is simply scaling the strategy. The purpose of backtesting is not just to validate that the settings work but to justify moving to a forward test. 2.

Fear of Loss Fear and anxiety can emerge when transitioning from testing to live trading, especially when real money is involved. Traders may worry about losing their capital or encountering a significant drawdown that tests their emotional resilience. This fear can act as a barrier, preventing traders from taking their EAs live or increasing trade sizes, even when results suggest it is the right time to scale up.

Developing confidence in your EA through thorough backtesting and forward testing is key to overcoming this fear. 3. Lack of Control Another psychological hurdle is the feeling of losing control when relying on an automated system. With discretionary trading, traders are actively involved in every decision, whereas, with an EA, the algorithm executes trades without human intervention.

This can lead to feelings of helplessness, especially if the EA doesn’t perform as expected. Watching trades unfold on your account without direct involvement can be unnerving, tempting traders to interfere prematurely. Resisting the urge to manually override the EA is crucial.

Trust the system you’ve created, as long as it is backed by solid logic and testing. 4. Confirmation Bias Traders may fall into the trap of confirmation bias, where they only acknowledge the positive aspects of their EA’s performance while overlooking warning signs or evidence of flaws. This bias can be dangerous, as it blinds traders to potential weaknesses that may lead to significant losses over time.

Creating a set of objective performance measures, such as maximum drawdowns and key profit metrics, can help maintain a clear and rational perspective on the EA’s success. Emotional attachment to an EA that has taken considerable effort to build can cloud judgment, so it’s important to remain objective, especially when difficult decisions arise. 5. Overconfidence Success with one or more EAs can lead to overconfidence, which is a major psychological pitfall.

Traders may begin to overlook necessary refinements, substitutions, or additional testing. Early successes might lead them to believe they can expedite the process of moving an EA to live trading and scaling it, without taking the time to gather sufficient data from a large enough sample of trades. Patience is essential when transitioning to live trading.

Ensure that a critical mass of data is available before making decisions about scaling or altering your approach. 6. Impatience Many traders expect immediate results from their EAs, which can lead to impatience. This impatience often results in premature modifications or abandonment of strategies that could have been profitable over a longer time horizon.

There are no shortcuts in trading. Allow time for your EA to demonstrate its potential over a defined period, rather than making snap judgments based on short-term performance. Regularly comparing live results to backtests over a reasonable timeframe can provide the necessary context to assess whether an EA is working as intended. 7.

Adaptability Market conditions change, and EAs that perform well in one environment may struggle in another. The psychological challenge here lies in being open to the necessity of adaptation. Some traders may hesitate to make changes or replace an EA, fearing the effort it took to develop the original model.

Consistent monitoring and having clear criteria for when adjustments are needed are vital to long-term success. Embrace the process of refinement, knowing that adaptability is essential for keeping your EA portfolio profitable in different market conditions. 8. Social Comparison Comparing your EA’s performance to others can lead to feelings of inadequacy, envy, or frustration, especially if you perceive that your system isn’t performing as well as someone else’s.

Social comparison is common among traders, but it can lead to unnecessary emotional strain unless checked. It’s important to remember that traders are often more vocal about their successes than their losses. Maintain a focus on your own progress and the unique journey of developing a system that works for you. 9.

Emotional Resilience The ability to stay emotionally resilient during drawdowns or periods of underperformance is critical. Fear, anger, frustration, and impatience can cloud your judgment and negatively impact decision-making, including premature withdrawal of an EA. With any strategy there will be periods of under and over performance.

Accepting this is critical for good long-term decision making. Obviously, time is a great “calmer” in terms of developing not only confidence but also this acceptance. Anecdotally, new automated trades are most at risk until there is a “record of achievement”.

This is one of the key reasons why trading any new EA at minimum volume as you discover how it performs under live market conditions is vital. In Summary Addressing these psychological challenges is essential for success in the world of automated trading. Taking these points on board and stepping back to review where you are as many of these may creep in insidiously over time would seem prudent.

Practical steps you can take may include: Developing a deep understanding of your EA’s logic and parameters, so you trust the system you’ve built. Setting clear performance expectations and avoiding comparisons with others. Developing self-awareness and emotional regulation to stay calm during turbulent times.

Regularly reviewing and updating their trading strategy on which the EA is based, including sighting charts of trades taken and refinement of risk management strategies are always worthwhile. Consistent monitoring is vital. Taking breaks to avoid burnout and maintaining a healthy work-life balance.

Trading EAs do create an interesting set of challenges but as stated previously, awareness that these challenges may exist is the first step to be able to take meaningful action and continue the work on yourself. Whether you ae a discretionary or automated trader, this rule is unquestionable and always the start point of long term improvement in trading decision making. If you are interested in the GO Markets automated trading platform and strategy tester, and the education we can provide relating to this topic, please feel free to connect at [email protected] at any time.

Achieving long-term success in trading requires more than just knowledge and technical skills. It depends on building a foundation of mindset, behaviours, and self-awareness. This foundation is built on three critical drivers: Trading Confidence and Reliability, Trading Self-Relevance, and Trading Locus of Control.

These drivers work together to create a framework for sustainable growth and success in the market. However, failing to implement these drivers can lead to frustration, inconsistency, stagnation, and trading outcomes that fall short of what may be possible for you. In this article we explore these drivers in detail, enriched with definitions, examples, and insights into the consequences of neglecting them. 1.

Trading Confidence and Discipline Definition: Confidence is the belief in your ability to succeed and overcome challenges, while reliability is about creating consistent, dependable outcomes through your actions and systems. Confidence is the psychological pillar that allows traders to operate with clarity and conviction, even in volatile markets. This IS the KEY ISSUE in trading discipline.

Confident traders invariably are disciplined traders. This attribute needs work, being cultivated through deliberate practice and the accumulation of small wins over time. Core Concepts: Confidence in Your Ability to Take Action: What it means: This is about trusting in your capability to take the necessary steps, no matter how small or challenging, to achieve positive outcomes.

It requires the ability to see yourself as an active participant in your success, rather than a passive observer. This confidence grows through persistence and a willingness to learn from setbacks. You need to believe that even if you don’t have all the answers today, you are equipped to figure things out over time.

Example: A trader analyses their losses to identify mistakes and refine their approach, developing resilience to re-enter the market with improved strategies. Consequences of Neglect: Without confidence, traders may hesitate to take action or abandon trades prematurely, missing out on potential gains and learning opportunities. Confidence in the Importance of Taking Action and then Testing: What it means: Recognizing the value of consistent effort and the power of experimentation is essential in trading.

Small, deliberate actions, such as testing new strategies or refining old ones, provide insights that build trust in your systems. Testing allows you to bridge the gap between theory and application, proving to yourself that what you do matters and can lead to improved results. Example: A trader refines a new risk management rule on a demo account, building trust in its reliability.

Consequences of Neglect: Neglecting testing can lead to impulsive decisions based on unverified strategies, increasing the likelihood of inconsistent or poor outcomes. Confidence in Your Trading Systems: What it means: Believing in your system means trusting the process you’ve developed, knowing it has been built on solid foundations, and understanding that, over time, it is capable of delivering reliable results. This confidence doesn’t mean blind faith—it’s about the discipline to stick to your system because you’ve put in the work to validate it.

Example: A trader follows a trend-following system backed by thorough back testing and evidence in live markets of positive outcomes. Consequences of Neglect: Without trust in your system, you may second-guess trades, frequently change strategies, or fail to commit to a plan, resulting in erratic performance. The link between this and the ability to be disciplined is undeniable.

Believing in the Impact of Learning and Action: What it means: Understanding that your effort to grow and take deliberate action is the engine that drives success. This belief empowers you to view setbacks as opportunities for growth, rather than roadblocks. It shifts your focus from outcomes solely to recognising the important processes, enabling you to learn and improve continually.

Example: A trader uses mindfulness techniques to reduce emotional errors, significantly improving decision-making. Consequences of Neglect: Failing to learn from mistakes or take deliberate action can result in repeated errors and a lack of meaningful progress. Key Takeaway: Confidence and, subsequently, discipline are essential for building consistency.

Without them, traders are likely to operate reactively, undermining their potential for long-term success. 2. Trading Self-Relevance Definition: Trading self-relevance is the alignment of your trading activities with your values, goals, and purpose. It ensures that trading is not just an activity, but a meaningful pursuit tied to your identity and aspirations.

Core Concepts: Purpose: What it means: Having a clear “why” behind your trading journey is about understanding the deeper motivation that drives your actions. Purpose provides the emotional anchor that keeps you steady, even when the market becomes unpredictable. It transforms trading from a task into a mission, connecting it to something personally significant.

Example: A trader pursuing financial independence views trading as a means to an end, which keeps them motivated. Consequences of Neglect: Without a strong purpose, trading can feel aimless, leading to a lack of discipline, motivation, and ultimately, poor results. Level of Importance: What it means: Treating trading as a priority requires committing the time, energy, and focus necessary for improvement.

It involves recognizing the importance of consistent effort and giving trading the same respect as any other profession or life goal. Example: A trader allocates specific hours for market analysis, reflecting their commitment. Consequences of Neglect: Treating trading as a low priority can lead to inconsistent effort, incomplete preparation, and missed opportunities.

Developmental Evidence: What it means: Monitoring your progress and recognizing improvement is key to maintaining motivation. Evidence of growth reinforces that your actions are effective, encouraging you to stay the course. It creates a feedback loop where success builds confidence and confidence drives further effort.

Example: A trader reviews their journal weekly to identify profitable patterns. Consequences of Neglect: Without tracking progress, traders may lose confidence, fail to learn from their experiences, and struggle to refine their approach. Key Takeaway: Self-relevance connects your trading to your identity and goals.

Neglecting this alignment can lead to a lack of direction and reduced motivation to improve. 3. Trading Locus of Control Definition: Locus of control refers to your belief about whether outcomes are determined by your own actions (internal) or by external factors (external). Core Concepts: Internal Locus of Control (ILOC): What it means: Believing that your outcomes are shaped by your decisions, behaviours, and preparation.

This mindset puts you in the driver’s seat, enabling you to take responsibility for your actions and their consequences. It empowers you to adapt, improve, and proactively address challenges. Example: A trader reviews losses to identify mistakes and improve, rather than blaming external factors.

Consequences of Neglect: Without an ILOC, traders may externalize blame, failing to take responsibility for their growth and repeating the same mistakes. External Locus of Control (ELOC): What it means: Attributing outcomes to luck, market conditions, or other external influences. This mindset often leads to feelings of helplessness, as you perceive success as being outside of your control.

Example: A trader blames sudden news events for losses without analysing their own decisions. Consequences of Neglect: An ELOC mindset often results in a lack of accountability, leaving traders feeling powerless and unmotivated. Take charge of what you can control!

Here are the actionable aspects within your control to make sure that your locus of control remains primarily internal: What You Learn: Continuously improving knowledge through deliberate effort. Your Systems: Refining strategies with evidence and adapting to market changes. Your Trading Time: Managing when and how much you trade.

Performance Measurement: Evaluating progress using clear metrics. Execution: Maintaining discipline in trade management. Permission Not to Trade: Knowing when to step back.

Consequences of Neglect: Failing to focus on what you can control leads to frustration, emotional decisions, and a reactive mindset. Key Takeaway: An internal locus of control empowers you to take responsibility for your outcomes, fostering resilience and proactive growth. Summary - Bringing It All Together Ultimately, these three drivers— Trading Confidence and Reliability, Trading Self-Relevance, and Trading Locus of Control —must work in harmony to achieve lasting success.

They create a foundation for continuous growth, adaptability, and resilience. Neglecting these principles often results in frustration, stagnation, and missed opportunities. By adopting these drivers, you align your trading journey with a mindset built for success.

One of the biggest indicators confounding markets, economists, and commentators over the past six months in particular, is the strength of the employment market. Not only are they stable, they are moving at rates outside historical ten year norms. Just have a look at Australia at the moment, unemployment at 4% averaging 35 to 40,000 jobs per month and participation in the employment market at or near record all-time highs.

This is not just an Australia story, have a look at the US where the non-farm payroll figures continue to run ahead of our expectations and forecasts. Yes it is eased from its peak in 2023/2024 but overall The US employment market is really solid. This is despite the fact that the cost of living crisis is entering its 28th month and according to all media factions is still ‘ending the world’.

The thing is - employment stability produces stronger than anticipated consumer spending. And we believe that this is what's being missed by traders and investors alike as the stability has directly supported stronger-than-anticipated consumer spending. Which in turn for western developed markets underscores why there has been resilience of the economy.

That's not to say a slowdown in economic growth is off the cards, more that the trajectory looks less steep and more delayed than previously forecasted. Retail sales data for December showed a solid 0.7% month-on-month (MoM) increase. Which suggests real consumption growth for the final quarter of 2024 was a year on year (YoY) 3%.

As long as the labour market remains resilient and equity prices avoid a sharp downturn, consumer spending should continue to hold up. Caveat is US savings rates, they are now at the lowest level in over 6 years so expect spending growth to moderate in the coming months. Something that was seen in 23/24 was weaker retail sales in Q1 of last year after a bumper December print - could repeat in 2025 following the strong December retail performance?

But you are probably thinking “who cares” what does this mean for my trades and what does this mean for my positioning? Well as explained in last week’s 5 thematics of 2025 - nationalism versus global trade supply is one area we need to look at. Because it will feed directly into the theme that has been going on now for 18 months which is the consumer price conundrum.

Why this matters markets have put so much money behind the rate cut trade impacts both positively and negatively to inflation will still be one of the biggest impactors to your trades. So looking to the US let's break down the December CPI data – there was a modest 0.23% MoM increase, for a YoY rate of 2.7%. Aligning with the 0.17% MoM rise in core Personal Consumption Expenditures (PCE), which and a YoY rate of 2.1%.

This effectively confirms the Fed’s inflation target has been hit. Think about that for one moment and the initial reactions in the market to start 2025. It was rift with bets that the Fed could be done, and that inflation would remain stubbornly high.

There is justification for this idea and more on that below. The December CPI suggests US core inflation to trend down to about 2% by mid-year. Secondly the trend is there as well - three-month core inflation has slowed to 2.2%, and six-month core inflation has eased to 2.3%.

These figures point to a clear and sustained moderation in price pressures. Going deeper – the biggest factor that is likely to drive US inflation lower is signs shelter costs have peaked and are beginning to ease. Owner’s Equivalent Rent rose just 0.23% in November and 0.31% in December.

These increases are much slower than the 0.4-0.5% monthly jumps seen in late 2023 and are more in line with pre-pandemic norms. Of course, there are caveats to this narrative. Residual seasonality in the data could skew the inflation readings.

For example, in both 2023 and 2024, softer inflation in the latter half of the year was followed by a sharp 0.5% MoM spike in core PCE inflation in January. But – if the November December trend in PCE inflation was to continue in February and March it would reinforce confidence among both the Fed and markets that inflation is on a sustainable path back to the central bank’s 2% target – and that should equal more rate cuts in the Federal Funds Rate. All things being equal - by the time the Federal Open Market Committee (FOMC) meets in May, there would likely be enough evidence to justify this move, especially to prevent real policy rates from rising unintentionally as nominal rates hold steady.

However – there are input costs coming from the newly installed Trump administration. Changes to immigration policy is likely to drive up wage and input cost on sectors such as agriculture and personal services. Then there are possible tariffs and other trade sanction issues that will also impact global supply and ultimately price.

If we look at the chatter from Fed officials, opinions vary on the implications of broader policy shifts. Hawkish members of the Fed expect these policies to exert upward pressure on inflation, while dovish officials, argue that any price increases stemming from these factors would likely be temporary and wouldn’t necessitate a monetary policy response. Either way – they are unknown knowns, and explains the flow of funds to the USD, CHF and gold.

It also probably explains further excitement in crypto. So – who is right and who is wrong? If we take the movement in the USD and bond markets as ‘right’ – inflation is going to move higher from here and the Fed is done.

Traders only now have moved from possible rate hike(s) – (yes higher) to a mild chance of a single rate cut in 2025. The Fed’s December dot plots – only has 50 basis points – so two cuts, which is not huge and explains the shifts. On the counter – if the current market trend is wrong we need to look at the economist forecast.

Most have 3 rate cuts in 2025 some have as much as 5 (so 125 basis points). If that was to be the case the speed and change in positioning will be rapid and the strength in the USD would need to be evaluated. That scenario, if it eventuates, would likely begin in May, there is plenty of time to reposition.

But risks remain, particularly around seasonality and policy uncertainties. In the interim, watch for fiscal policy around nationalism then look for changes in inflation and labour that lead to monetary policy changes in the coming months to maintain balance in the economy.

Welcome to 2025, a year that will be shaped by macro thematic events that were put in place at the end of 2024. Why we need to prioritise thematic analysis is that if we look at 2023 and 2024 indices and FX markets that were tied to the thematics of those two years outperformed peers and similar tools. Considering the S&P 500 returned a whopping 25 percent in 2024, starting the new year around the event that will shape the trading world is prudent.

So what will be the big thematics of 2025? Here are the five themes shaping the year ahead, each refined to align with evolving market dynamics: 1. The nationalisation of globalism Tricky title yes, but we are going to see a return to nationalistic policies from all walks of government.

This theme is likely to make a strong return in 2025 after pausing from about mid 2023. It will be driven by shifting global trade particularly the US and China and policy priorities of populist governments that are popping up all over the world. The push pull of nationalism versus globalism has rapidly swung back to nationalism since COVID.

Policymakers are consistently banging the drum that reducing reliance on globalised supply chains in favour of localised production and economic security. Just take a look at the policy ‘Future made in Australia’. This is a policy that is picking winners directly targeting manufacturing and a technology space that is already saturated with global supply.

The question we as traders and investors have to ask is will national policy supporting inefficient industry win out over global supply into the future? Theory would suggest not investment however follows the money and governments are piling money in. Again that's not to say it's right, it's just the flow.

With the return of a Trump administration to the White House not only is nationalistic policies going to be front and centre for investment tariffs and trade impacts will also be a major theme for 2025 and beyond. The playbook here is to review Trump 1.0 and look at the impacts on trade from 2017 to 2020. More on that below.

What is clear is the current populist shift to nationalism in global supply chains marks the biggest swing in trade systems since the 1960s. What we need to realise as investors is which multinationals and trading firms can adjust to the new reality and which will face the challenges that they are unable to survive. Identifying these changes will be key to investing going forward. 2.

China sandbagging One of the fastest developing thematics of 2025 is signs that Beijing it's starting to sandbag itself against future incoming tariffs from the West, specifically the US. Already we're seeing changes to liquidity ratios, policy and local government that haven't been in place since 2017 and 18. We're also starting to see policies around employment, aged care, and other social services that have not been enacted or tweaked in over half a decade.

Couple this with signs of increased infrastructure spending changes to manufacturing orders and a shift in direction to internal purchases. Shows Beijing really does mean business And is preparing to fight fire with fire. Most notably that ‘fire’ power is the tweaks that's happening to the renminbi.

The depreciation that has been allowed by the Peoples Bank of China (PBoC) shows very clearly that if tariffs are to be placed on Chinese exports the appearance at the import docks will be one of negligent, even better off positioning in price. It is a very, very savvy way of countering arbitrary cost increases from its biggest market, that of the US. How Washington responds to this change is likely to be just less dramatic.

Be prepared for a full blown currency trade war over the next four years as Beijing and Washington trade economic barbs. The winners and losers are already starting to present, case in point is the impact and slide in price of the Aussie dollar (AUD). Currently sitting at a 5 year low to start 2025 against the US dollar and having seen a 10 per cent decline against the JPY, and 8 per cent decline against the CHF, EUR and even a 5 per cent decline against the GBP.

The AUD’s China proxy thematic is well and truly kicking and the Aussie will be a key part of the China sandbagging thematic trade of 2025. 3. Meaningful living Do not underestimate the change in social structures around ‘meaningful living’. With aging populations across the developed world more and more societies are shifting to pursue healthier and more meaningful lives.

This is the rise of online and AI driven programming health treatments, new age drug consumption and a concentration on preventative medicine and health products. Meaningful living is moving the dial in policy, economies, and businesses. You only have to look at Apple's investment in its fitness app or the rise and rise of wearables.

Increase content on social media and the impact that AI is now having on medical and health related industries. On this point look to healthcare, particularly AI-driven advancements and obesity treatments to continue to be the stand out areas. Then there will be the changes to consumption behaviours, nutrition and affordable foods, ‘core value’ items over mass consumption as well as demand for more sustainable consumption practices.

The advantage of the meaningful living thematic is that it will likely be fairly isolated to the issues that will present from thematic 1 and 2. You will also be fairly insulated from changes of things like inflation, interest rates and politics. 4. Energy Thirst The thirst for energy supply coupled with decarbonisation is going to be a thematic not just of 2025 but over the next decade.

What will be different in 2025 is a short- and long-term supply change. Once again, nationalism will play a part here – the Trump administration has made it a cornerstone of its re-election pitch that oil will be front and centre in the US’s energy supply. However at the same time Elon Musk’s presence makes the outlook for battery storage and Electric Vehicles (EVs) also very interesting.

Longer term – energy will also face the ultimate question of 100 per cent renewables, a hybrid model that includes fossil fuels and/or a model that involves yellow cake. Uranium is facing an interesting period, the demand from China, France, the US and the like for nuclear energy is growing by the year. We are also now seeing nations that have never entertained nuclear having a debate on it as well (Australia is case in point).

Thus from a trade and investment point of view – we need to consider three points here: Supply - who are the suppliers that will benefit short term who benefits long term? And are there players that will benefit over the entire period? Demand – As stated in thematic 1,2 and 3 energy demand is only going to increase and if we include thematic 5 – not only will demand increase it could move almost exponentially.

Delivery – what form of apparatus is needed to deliver the energy nations need? That means everything from renewables to nuclear, micro units (household solar) to macro units (power plants). As well as energy storage, carbon capture and grid optimisation. 5.

AI the third digital revolution It’s been two years since ChatGPT’s debut – and in those 24 months more value has been created than in the 65 years from 1945 to 2010 and we are still early in AI’s widespread adoption. AI is being called the third digital revolution after the invention of the computer and the internet. The difference in 2025 from 23 and 24 is we are moving from “infrastructure” and “enablers” to applications.

Those programs that will drive efficiency and market leadership. Already the fight is on to be the “it” provider here as the likes of Alphabet, Meta, Microsoft and Amazon continue to redefine their individual offering. The trends here that will matter in 2025 are things like enterprise adoption of AI, which firms are adopting AI and its positive impacts?

Rapid increases in AI capabilities, surprising even the most optimistic expectations and how fast can it move? Expanded profit opportunities, reducing debates over AI’s return on investment. The faster we can understand the pace of these changes the more investors can capitalise on AI’s transformative potential.

In short, with these five thematics as our basis for 2025, it will be an exciting and transformative year.

For traders, the motivation to explore additional technical indicators often stems from a desire to enhance trading results and refine their existing system. With the abundance of information available about technical indicators, it can be tempting to incorporate new tools into your strategy. However, as the decision-maker in your trading journey, it is crucial to approach this process with a structured mindset.

The first step is to ask yourself a fundamental question: “Is it the right time to explore the use of another indicator?” This article outlines four critical questions you should consider before introducing new technical indicators into your trading system. 1) Am I Fully Actioning my Existing System? The primary motivation for adding a new indicator is often to improve the results of your current trading system. However, such improvements can only be measured if you have a well-defined system and are consistently trading it as designed.

A comprehensive system should at least include rules for entry, exit, and position sizing. Key Considerations: Are you faithfully following your current trading plan? Are you journaling your trades to track adherence and outcomes?

For many traders, the root issue lies in either an incomplete system or inconsistent execution. Honest self-assessment, backed by evidence from a trading journal, will help identify gaps in your current approach. Addressing these gaps should be your priority before adding another layer of complexity with a new indicator.

Action Steps: Review your trading journal to ensure you are consistently following your existing plan. Focus on refining your discipline and execution rather than prematurely seeking additional tools. 2) Is Adding Another Indicator the Most Impactful Change I Can Make Right Now to my trading? Improving your trading outcomes involves prioritizing actions that offer the highest potential for positive change.

While adding an indicator may seem appealing, there are other critical areas to address first: Trading Plan and Discipline: Ensure your existing plan is robust and that you are adhering to it consistently. Journaling: Regularly document your trades to provide a foundation for evaluating performance. Knowledge Development: Deepen your understanding of the indicators you already use.

Recognize what they reveal about market conditions and their limitations. Expanding your knowledge not only helps you maximize the effectiveness of your current tools but also enables you to make informed decisions about integrating new ones. In many cases, these priorities may outweigh the benefits of adding another indicator at this stage.

Action Steps: Evaluate whether enhancing your plan, discipline, or learning offers more immediate value than exploring new indicators. Commit time to mastering your existing tools before seeking additional complexity. 3) Do I Have Clarity on What any New Indicator Should Achieve? Before introducing a new indicator, you must clearly define its intended purpose.

Start by identifying whether your focus is on improving entries, exits, or another specific aspect of your trading system. Once you’ve pinpointed the objective, consider whether adjustments to your current indicators might achieve the same goal. Example: If you use a 10-period EMA as an exit signal but find it too sensitive to market noise, you could test a simple adjustment, such as switching to a 20-period EMA, before adding a new indicator.

Action Steps: Identify the specific gap in your system that a new indicator would address. Evaluate whether tweaking the parameters of your current tools could achieve the desired improvement. Test adjustments thoroughly before implementation. 4) Do I Have a Formal Testing Process in place for an evaluation of a New Indicator?

Introducing a new indicator requires a structured testing process to evaluate its impact on your trading outcomes. This process ensures that any changes to your system are based on evidence, not speculation. Testing Framework: Back-Test: Analyze past trades to determine how the new indicator would have influenced outcomes.

The goal is to justify the need for a forward test. Forward Test: Use a demo account to test the indicator in real-time market conditions. Maintain all other aspects of your trading plan to isolate the indicator’s impact.

Trading Plan Integration: If testing yields positive results, document how the indicator will be used within your trading plan. Be specific about its role and under what conditions it will be applied. Review Period: Set a timeline (e.g., three months) to assess the indicator’s performance and its contribution to your overall strategy.

Action Steps: Develop a clear and disciplined testing process. Specify the number of trades you consider sufficient for evaluating the indicator’s effectiveness. Regularly review and refine your approach based on test results.

Conclusion Adding new indicators to your trading system can undoubtedly enhance outcomes, but only when approached strategically. Before making changes, take the time to ask yourself these four critical questions: Am I fully utilizing my existing system? Is adding another indicator the most impactful change I can make right now?

Do I have clarity on what the new indicator should achieve? Do I have a formal testing process in place? By addressing these questions, you can ensure that any decision to incorporate a new indicator is well-informed and aligned with your broader trading goals.

Thoughtful preparation and disciplined execution will ultimately yield the best results for your trading journey.