Berita & analisis pasar

Tetap selangkah lebih maju di pasar dengan wawasan ahli, berita, dan analisis teknikal untuk memandu keputusan trading Anda.

Tiga bank sentral menentukan suku bunga secara bersamaan, minyak mentah Brent berayun liar di sekitar US $100 per barel, dan perang di Timur Tengah menulis ulang prospek inflasi secara real time. Apa pun yang terjadi minggu ini dapat mengatur nada pasar untuk sisa tahun 2026.

Fakta singkat

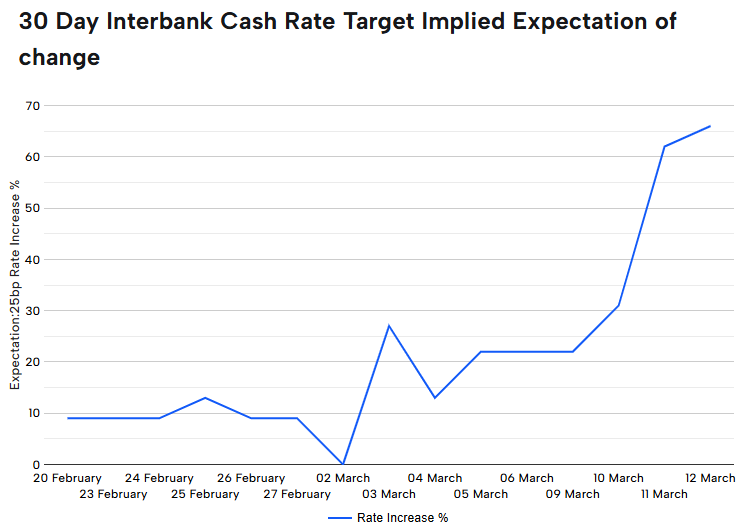

- Bank Cadangan Australia (RBA) mengumumkan keputusan suku bunga tunai berikutnya pada hari Selasa, dengan pasar sekarang menetapkan peluang 66% untuk kenaikan kedua menjadi 4,1%.

- Beberapa analis telah memperingatkan perang Iran dapat mendorong inflasi AS menjadi 3,5% pada akhir tahun dan menunda penurunan suku bunga Fed hingga September, menjadikan plot dot FOMC minggu ini yang paling diawasi ketat dalam beberapa tahun.

- Minyak mentah Brent menggoda US$100 per barel setelah Iran meluncurkan apa yang digambarkan media pemerintah sebagai “operasi paling intens sejak awal perang.”

RBA: Akankah Australia naik lagi?

RBA menaikkan suku bunga tunai untuk pertama kalinya dalam dua tahun menjadi 3,85% pada pertemuan Februari setelah inflasi meningkat secara material pada paruh kedua tahun 2025.

Pertanyaannya sekarang adalah apakah itu bergerak lagi bahkan sebelum melihat cetakan CPI kuartalan berikutnya, yang tidak akan jatuh tempo sampai 29 April.

Wakil Gubernur Andrew Hauser mengakui menjelang pertemuan bahwa pembuat kebijakan menghadapi keputusan yang benar-benar terpecah, dibentuk oleh sinyal ekonomi yang saling bertentangan di dalam negeri dan meningkatnya ketidakstabilan di luar negeri.

Pasar keuangan saat ini menetapkan sekitar 66% probabilitas untuk kenaikan lain, dengan kenaikan Mei dianggap hampir pasti terlepas dari apa yang terjadi pada hari Senin.

Tanggal utama

- Keputusan Suku Bunga RBA: Selasa, 17 Maret, 14:30 AEDT

- Konferensi pers Gubernur Bullock: Selasa, 17 Maret, 15:30 AEDT

Memantau

- Referensi apa pun dari Bullock untuk kenaikan lebih lanjut kemungkinan akan terjadi pada bulan Mei

- AUD/USD reaksi langsung.

- Bank ASX dan REIT.

FOMC: Kemungkinan besar, semua mata tertuju pada plot titik

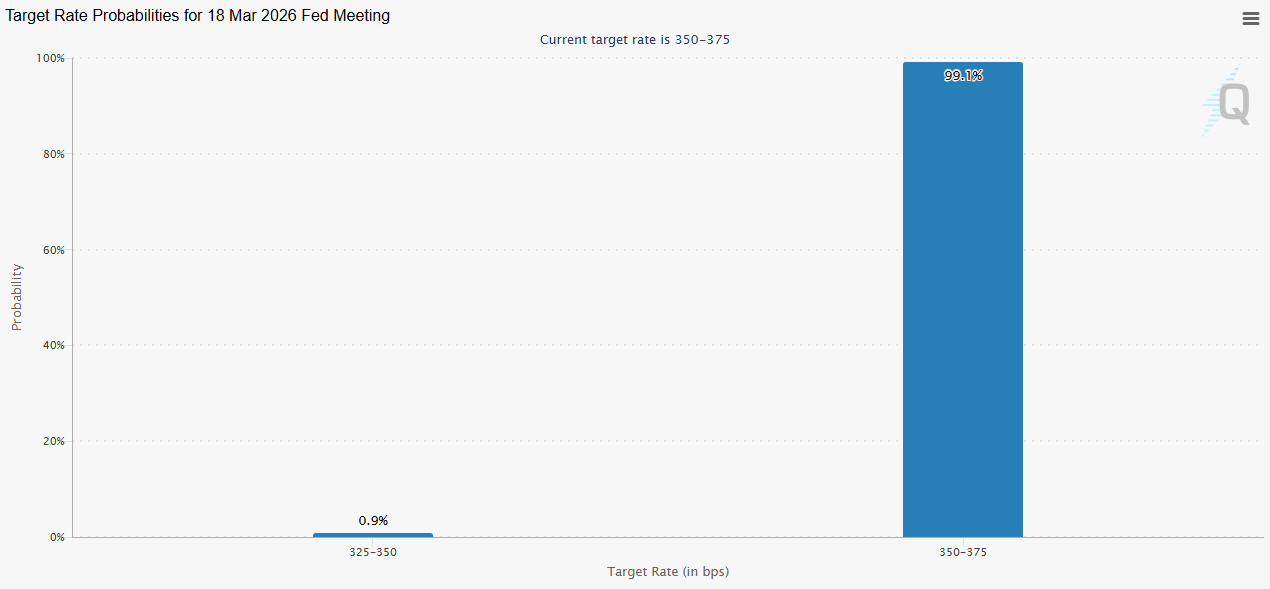

FOMC bertemu pada 17-18 Maret, dengan pernyataan kebijakan dijadwalkan pukul 14:00 ET pada 18 Maret dan konferensi pers Ketua Jerome Powell pada pukul 14:30. CME FedWatch menunjukkan probabilitas 99% bahwa Fed mempertahankan suku bunga pada 3,50% hingga 3,75%.

Tindakan sebenarnya ada di Ringkasan Proyeksi Ekonomi (SEP) dan plot titik. Titik median saat ini menunjukkan satu potongan 25-titik basis untuk 2026. Jika bergeser ke dua pemotongan, itu dovish dan bullish untuk aset berisiko. Jika bergeser ke nol pemotongan atau menambahkan kenaikan suku bunga ke dalam proyeksi, pasar dapat bereaksi ke arah lain.

Lebih lanjut memperumit masalah, masa jabatan Powell sebagai Ketua Federal Reserve berakhir pada 23 Mei 2026. Kevin Warsh adalah kandidat utama untuk menggantikannya, dipandang lebih hawkish dalam kebijakan moneter. Setiap komentar dari Powell tentang transisi ini dapat menggerakkan pasar secara independen dari keputusan suku bunga itu sendiri.

Tanggal Kunci

- Keputusan Suku Bunga FOMC+Plot Sep/DOT: Kamis 19 Maret, 4:00 pagi AEDT

- Konferensi pers Powell: Kamis 19 Maret, 4:30 pagi AEDT

Memantau

- Bahasa Powell tentang minyak dan inflasi tarif.

- Reaksi imbal hasil Treasury 2 tahun.

- Harga ulang CME FedWatch untuk setiap perubahan dalam probabilitas pemotongan September.

Bank of Japan: Pengetatan lebih lanjut bisa dilakukan

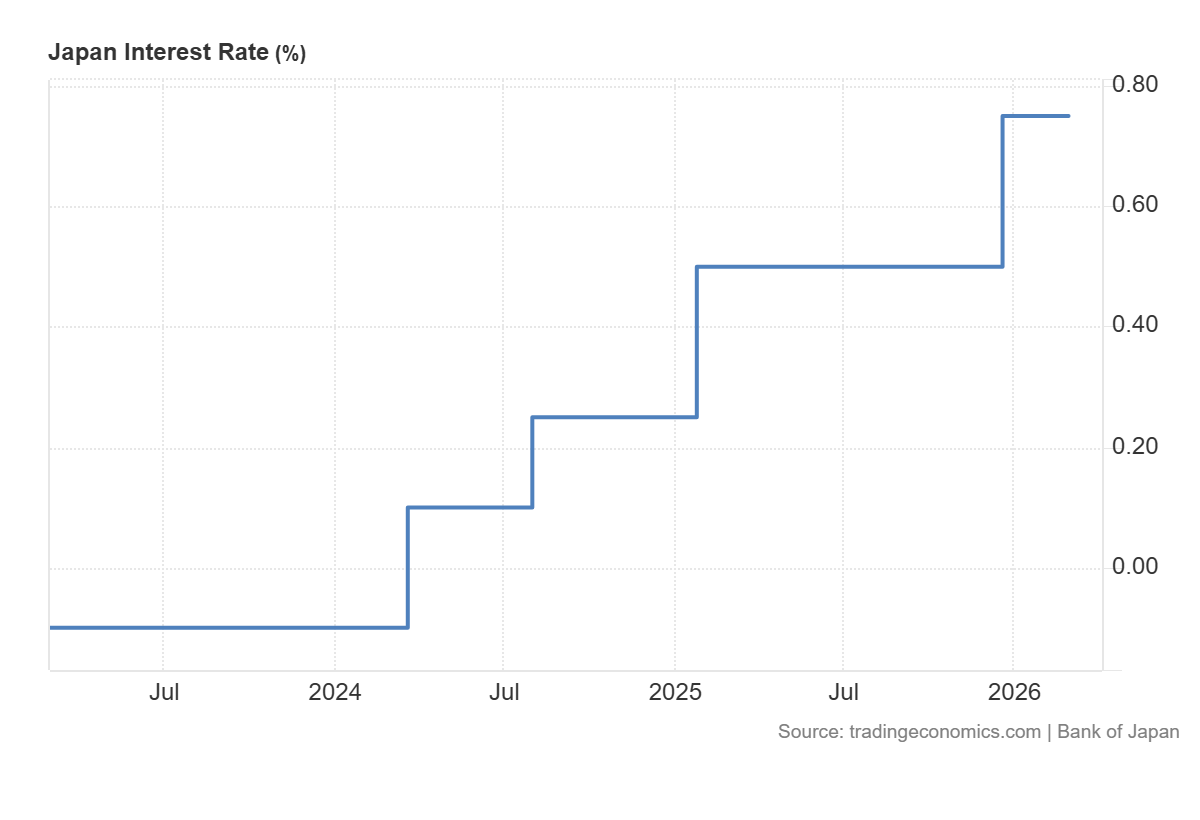

BOJ bertemu pada 18-19 Maret, dengan keputusan yang diharapkan Kamis pagi waktu Tokyo. Suku bunga kebijakan saat ini berada di 0.75% (tertinggi 30 tahun), dan pertemuan Januari 2026 menghasilkan penahanan dalam suara 8-1.

Gubernur Ueda telah mengkategorikan pertemuan Maret sebagai “langsung,” mencatat jadwal untuk pengetatan lebih lanjut dapat “dibawa ke depan” jika negosiasi upah musim semi Shunto menghasilkan hasil yang lebih kuat dari perkiraan.

Hasil-hasil tersebut akan mulai mengalir selama seminggu, menjadikannya masukan penting untuk keputusan BOJ. Nomura memperkirakan kenaikan upah Shunto pada 2026 akan mencapai sekitar 5,0%, termasuk senioritas, dengan pertumbuhan gaji pokok sekitar 3,4%. Jika hasil mengkonfirmasi lintasan itu, kasus untuk kenaikan bulan Maret menguat secara signifikan.

Komplikasinya adalah latar belakang global. Jepang mengimpor sekitar 90% dari kebutuhan energinya, dan minyak sekitar US $100 per barel mendorong kenaikan biaya impor dan mengancam akan menambah tekanan inflasi. Kenaikan BOJ ke guncangan minyak global akan menjadi langkah yang luar biasa berani.

Sebagian besar pelaku pasar masih condong ke arah penahanan pada pertemuan ini, dengan April atau Juli dipandang sebagai waktu yang lebih mungkin untuk langkah berikutnya.

Tanggal Kunci

- Keputusan Suku Bunga Kebijakan BOJ (saat ini 0,75%): Kamis 19 Maret, pagi AEDT

Memantau

- Hasil upah Shunto sebagai pemicu utama kenaikan bulan Maret.

- Bahasa konferensi pers Ueda dan panduan ke depan pada bulan April dan Juli.

- Reaksi USD/JPY.

Minyak: Volatilitas Berlanjut

Minyak mentah Brent sempat menyentuh US$119,50 per barel pada awal pekan sebelum turun 17% menjadi di bawah US $80, kemudian rebound menuju US $95 di tengah sinyal beragam dari Washington tentang Selat Hormuz.

Pada hari Kamis, Brent kembali lebih dari US $100 karena Iran melancarkan serangan baru terhadap pengiriman komersial dan rilis cadangan IEA gagal membawa bantuan yang berarti.

Dalam skenario di mana konflik yang lebih lama menyebabkan kerusakan pada infrastruktur energi, analis memperkirakan CPI dapat naik menjadi 3,5% pada akhir 2026, dengan harga bensin mendekati US $5 per galon pada kuartal kedua.

Untuk minggu ini, minyak bertindak sebagai meta-variabel makro. Setiap berita geopolitik, sinyal gencatan senjata, serangan tanker, pelepasan cadangan, dan komentar Trump dapat menggerakkan ekuitas, obligasi, dan mata uang secara real time.

Memantau

- Setiap aliran tanker Selat Hormuz yang dilanjutkan.

- Rilis cadangan darurat IEA.

- Pernyataan Trump tentang Iran.

- Ekuitas sektor energi.

7 saham komoditas global yang harus diperhatikan saat perang Iran membentuk kembali pasar

Intel, the US technology giant reported its Q1 earnings after the closing bell on Thursday. The company reported revenue of $18.57 billion, above analyst forecast of $17.90 billion. Earnings per share were at $1.39, also beating analyst expectations of $1.15 per share.

Intel’s data-centre group revenue fell by over 20% year-over-year to $5.56 billion, below analyst forecast of $5.89 billion. ''Intel delivered strong first-quarter results driven by exceptional demand for our leadership products and outstanding execution by our team. The response to our new IDM 2.0 strategy has been extraordinary, our product roadmap is gaining momentum, and we’re rapidly progressing our plans with a re-invigorated focus on innovation and execution,'' said Pat Gelsinger, Intel CEO. ''This is a pivotal year for Intel. We are setting our strategic foundation and investing to accelerate our trajectory and capitalize on the explosive growth in semiconductors that power our increasingly digital world.'' Despite the earnings beat, the share price of Intel was trading lower in post-market – down by 2.51%.

The stock is up by 25% year-to-date after ending the trading day on Thursday at $62.57 per share. Intel Source: TradingView Intel is the world's largest semiconductor chip maker by revenue. The company is headquartered in California, US and has over 110,000 employees worldwide.

It supplies microprocessors for computer manufacturers such as Dell and HP. You can trade Intel (INTC) and many other stocks from the NYSE, NASDAQ and the ASX with GO Markets as a Share CFD. Click here for more information.

Trading Derivatives carries a high level of risk.

Netflix reported their Q1 earnings after the closing bell on Tuesday. The online streaming service reported total revenue of $7.16 billion in Q1 beating analyst forecast of $5.77 billion. Earnings per share were reported at $3.75 vs. $2.98 estimate.

With both revenue and earnings per share higher than analysts' expectations, the new paid subscriber additions came in way below analysts' forecast of 6.29 million – at 3.98 million. The latest dip in new additions could be the beginning of a further slowdown in new subscribers as lockdown eases around the world and people return to normality. ''Revenue grew 24% year over year and was in line with our beginning of quarter forecast while operating profit and margin reached all-time highs. We finished Q1’21 with 208m paid memberships, up 14% year over year, but below our guidance forecast of 210m paid memberships.

We believe paid membership growth slowed due to the big Covid-19 pull forward in 2020 and a lighter content slate in the first half of this year, due to Covid-19 production delays. We continue to anticipate a strong second half with the return of new seasons of some of our biggest hits and an exciting film lineup. In the short-term, there is some uncertainty from Covid-19; in the long-term, the rise of streaming to replace linear TV around the world is the clear trend in entertainment,'' Netflix said in a letter to investors following the announcement.

Shares of Netflix was down by around 9% in post-market on Tuesday following the latest numbers, down at $495 per share after ending the trading day a $549.57 per share. Netflix Source: TradingView You can trade Netflix (NFLX) and many other stocks from the NYSE, NASDAQ and the ASX with GO Markets as a Share CFD. Click here for more information.

Trading Derivatives carries a high level of risk.

Last week marked a significant milestone for NIO when it produced its 100,000 th electric vehicle. The latest development also caught the eye of Tesla CEO Elon Musk, to which he responded: ''Congrats to NIO. That is a tough milestone.'' On Thursday, NIO officially confirmed its partnership with Sinopec – taking a major step forward in the company’s future.

Rumours about a potential partnership between the two companies first emerged back in February, when Sinopec Chairman Zhang Yuzhuo visited NIO’s battery swap station. About Sinopec Sinopec is the largest supplier of refined oil products and petrochemicals as well as the second-largest oil and gas producer in China. It was founded on 25 th February 2000 in Beijing, China and has over 240,000 employees globally.

The company has more than 30,000 gas stations – second highest in the world. The partnership NIO’s statement on the partnership: ''The partnership between Sinopec and NIO is an important milestone for further developing China's smart EV industry, a concrete measure to help achieve peak carbon emissions and achieve carbon neutrality, a key step in developing global, green, and innovative transportation initiatives and innovations.'' Following the announcement, NIO and Sinopec also unveiled the NIO Power Swap Station 2.0 at Sinopec's Chaoying Station in Beijing, China. The share price of NIO has taken a hit in recent months after reaching record highs back in February when it climbed above $60 per share.

It was down by around 5% on Thursday following the announcement, trading at around $34 per share. Worth noting that it was trading at $3.20 per share same time last year, a 995% increase at the current share price. NIO Source: TradingView You can trade NIO (NIO) and many other stocks from the ASX, NYSE, and the NASDAQ with GO Markets as a Share CFD.

Click here for more information. Trading Derivatives carries a high level of risk.

JPMorgan and Goldman Sachs reported their Q1 earnings before the opening bell on Wednesday – both beating analysts' forecasts. JP Morgan & Co JPMorgan reported a total revenue of $32.3 billion (up by 14.3% year-on-year) in Q1, above analysts' forecast of $30.52 billion. Earnings per share were reported at $4.50 vs. $3.05 estimate.

Jamie Dimon, Chairman and CEO, commented on Q1 results: ''JPMorgan Chase earned $14.3 billion in net income reflecting strong underlying performance across our businesses, partially driven by a rapidly improving economy. These results include a benefit from credit reserve releases of $5.2 billion that we do not consider core or recurring profits. We believe our credit reserves of $26 billion are appropriate and prudent, all things considered.'' ''With all of the stimulus spending, potential infrastructure spending, continued Quantitative Easing, strong consumer and business balance sheets and euphoria around the potential end of the pandemic, we believe that the economy has the potential to have extremely robust, multi-year growth.

This growth can benefit all Americans, particularly those who suffered the most during this pandemic. If all of the government programs are spent wisely and efficiently, focusing on actual outcomes, the benefits will be more widely shared, economic growth will be more sustainable and future problems, like inflation and too much debt, will be reduced.'' Shares of JPMorgan were down by around 1.19% in pre-market on Wednesday following the latest earnings numbers, trading at around $152.23. The share price is up by around 22% year-to-date.

JPMorgan Chase & Co Source: TradingView Goldman Sachs Goldman Sachs also reported strong numbers with revenue of $17.7 billion (up by 102.5% year-on-year) in Q1, way higher than analysts' estimate of $12.6 billion. Earnings per share at $18.60, above the forecast of $10.22 per share. ''We have been working hard alongside our clients in preparation for a world beyond the pandemic and a more stable economic environment,'' Goldman Sachs CEO, David Solomon said in the earnings release. ''Our businesses remain very well positioned to help our clients reposition for the recovery, and that strength is reflected in the record revenues and earnings achieved this quarter.'' Goldman Sachs The share price of Goldman Sachs trading higher after the Q1 results, up by around 4% at $343 per share. The stock is up by 30% year-to-date.

Source: TradingView You can trade JPMorgan Chase & Co (JPM), Goldman Sachs (GS) and many other stocks from the NYSE, NASDAQ and the ASX with GO Markets as a Share CFD. Click here for more information. Trading Derivatives carries a high level of risk.

Market response to any specific economic data release is far from standard even if actual numbers differ greatly from consensus expectations. Rather the market response is based on context of the current economic situation. This week’s non-farm payrolls, being one of the major data points in the month, is a great case in point.

There are many factors and of course the key one for you as an individual trader is your chosen vehicle you are trading (and of course direction i.e. long or short for open positions). The context of today’s impending non-farm payrolls from a market perspective is interest rate expectations going forward. This week the Fed gave the market the expected.25% cut that was already priced into currency, bond and equity market pricing.

The market response however, as this was already priced in, was as a result of the accompanying statement which was not as dovish as perhaps anticipated and a reduction in expectations of a further imminent cut. From an equity market point of view the result, despite the interest rate cut, was to sell off, whereas from the USD perspective this lessening expectation of further rate cuts was bullish. Perhaps this could be viewed as contrary to what the textbooks would suggest is a standard response.

So, onto todays non-farm payrolls (NFP) figure… Logic would suggest that a strong number is good news for the economy, and so should be positive for equities and perhaps bearish for USD. However, as this may be a critical number in the Feds decision making re. interest rate decisions, a strong NFP is likely to have the opposite effect. A weaker number is likely to be perceived as potentially contributory to thinking that another rate cut may be prudent sooner and so despite on the surface being “bad news”, it would not be surprising to see equities stronger and USD weaker.

It remains to be seen of course what the number is and the actual response but is perhaps a lesson in seeing new market information within the potential context of the current economic circumstances and of course incorporate this in your risk assessment and trading decision making.

It has been an eventful week over in the United States this week. Some of the major companies, including Microsoft, Apple, Facebook, and Tesla announced their latest earnings. The Federal Reserve kept their interest rates unchanged at 0.25%.

We also saw the US GDP expand by 4% in Q4 of 2020. However, these were not the most talked-about events this week. Major hedge-funds on Wall Street were left with huge losses after it bet against a struggling American gaming company GameStop by short-selling its shares.

What is short-selling? Short-selling is when an investor speculates that a stock or security will fall in price in the future. The investor borrows the stock or security from a broker and immediately sells it with the hope of buying it back at a lower price.

Gains from short selling are limited as a stock can only go to 0. The losses do not have a cap as there is no limit as to how high a stock’s price may jump. What happened?

The ''short'' bet did not pay off for the big players on Wall Street after amateur traders rallied together on social media sites to take on the hedge-funds and pump the price of gaming retailer GameStop to new levels. The share price of the GameStop has surged by over 1,550% this year alone after trading at $17 at the beginning of January. The stock ended the trading day at the $193 level on Thursday, rising up to the $261 level in post-market hours.

The White House said it was ''monitoring'' the latest price surge in GameStop and other stocks. Hedge-funds and others that bet against GameStop have collectively lost more than $5bn, according to data analytics company S3. Source: TradingView It is an interesting time on Wall Street and it is definitely worth keeping an eye on the future developments moving forward.